CBDT Extends Due Date for Tax Audit & ITR Filing -AY 2025-26

Table of Contents

CBDT Extends Due Dates for Tax Audit & ITR Filing (AY 2025-26)

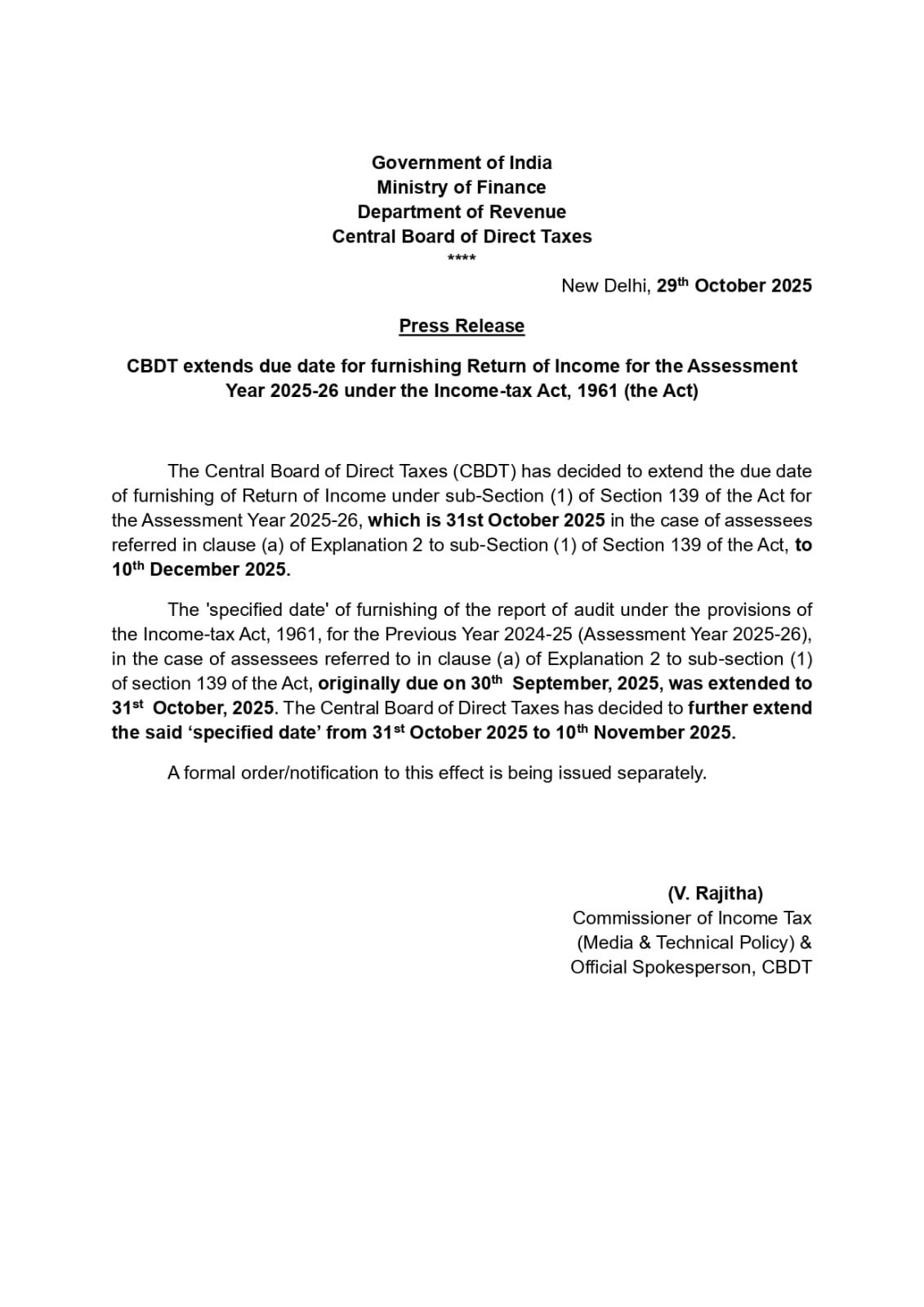

Official Press Release issue by V. Rajitha, Commissioner of Income Tax (Media & Technical Policy) & Official Spokesperson, from the Government of India, Ministry of Finance, Department of Revenue, Central Board of Direct Taxes (CBDT) dated 29th October 2025. Here are the key points related to CBDT Extends Due Dates for Audit & ITR Filing (AY 2025-26)

- CBDT extends the due date for furnishing Return of Income for Assessment Year 2025-26 under the Income-tax Act, 1961.

- Original due date: 31st October 2025

- Extended due date: 10th December 2025 (Applicable for assessees referred in clause (a) of Explanation 2 to sub-Section (1) of Section 139 of the Act.)

- Tax Audit Report Due Date: For assessees under audit provisions for AY 2025-26 Original due date: 30th September 2025, First extension: 31st October 2025 & Further extended to: 10th November 2025

In summary, the Central Board of Direct Taxes has officially extended key due dates under the Income-tax Act, 1961:

-

- Tax Audit Report (u/s 44AB): Extended from 31st October 2025 : 10th November 2025

- Return of Income for Audit Cases (u/s 139(1)) : Extended from 31st October 2025 : 10th December 2025

A formal notification will be issued shortly. Please find attached a copy of the CBDT press release for your reference.

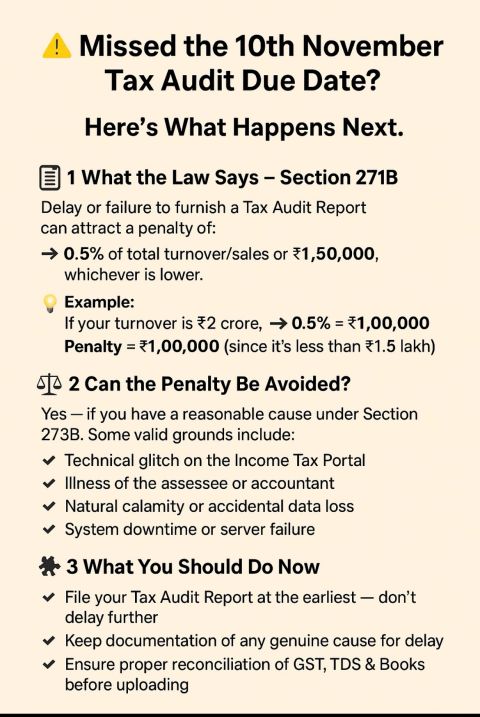

In case you missed the 10th November Tax Audit Due Date?

- The Income Tax Audit Report filing deadline for AY 2024–25 was 10th November 2025. If you missed it — don’t panic, but do understand the implications and the corrective steps you can take.

- Section 271B : Failure or delay in furnishing the Tax Audit Report (Form 3CA/3CB & 3CD) can attract a penalty under Section 271B of the Income Tax Act: Penalty = 0.5% of total turnover/sales or INR 1,50,000, whichever is lower For Example: If your turnover is ₹2 crore then 0.5% = INR 1,00,000

- Penalty = INR 1,00,000 (since it’s less than INR 1.5 lakh)

If the Income Tax Audit Report filing deadline is missed, can the penalty be avoided?

Yes; if you can justify a reasonable cause under Section 273B. The following reasons are generally accepted by tax authorities as valid grounds for waiver:

- Technical glitch or downtime on the Income Tax Portal

- Illness of the assessee, auditor, or accountant

- Data loss due to system crash or hardware failure

- Natural calamity, accident, or force majeure event

- Delay in finalization of accounts due to genuine reconciliation issues

If such a cause can be substantiated with evidence, the penalty may be waived.

What You Should Do Now after 10 Nov 2025

- File your Tax Audit Report immediately & don’t delay further.

- Maintain documentation explaining the reason for delay (emails, screenshots, CA communication, etc.).

- Ensure reconciliations between GST, TDS, and financial statements are complete before filing.

- Coordinate with your tax auditor to avoid additional compliance lapses.

A missed deadline isn’t the end but inaction can be costly. Timely filing and a well-documented explanation can help you avoid penalties and scrutiny

Bulk Notices Issued for Common Non-Compliance Issues

India’s Income Tax Department has issued bulk notices in 2025 targeting common non-compliance issues like mismatches in returns and unreported high-value transactions, driven by AI-powered scrutiny. These notices, often u/s 143(1), aim to enforce voluntary compliance ahead of deadlines like December 31, 2025, for revised ITRs in AY 2025-26. Over 1.65 lakh cases have been flagged for scrutiny, a sharp rise from prior years

Foreign Investments & Income

- Investment in foreign shares/securities not disclosed in ITR

- Dividend income from foreign investments not reported

- Non-disclosure of foreign assets (bank accounts, shares, ESOPs, etc.)

Incorrect Deductions & Donations

- Wrong claim under Section 80G vs 80GGC

- False or ineligible claims under Sections 80G / 80GGC

- Donations to unrecognised or non-eligible trusts claimed for deduction

Return Filing & Reporting Errors

- Non-filing of ITR despite high turnover or substantial transactions

- Income reported under incorrect head

- Filing an incorrect ITR form

- Significant transactions in AIS/TIS not properly reported

- Mismatch between AIS, TIS, Form 26AS and filed ITR

Result?

- Even honest and compliant taxpayers are compelled to spend time in collating explanations, money on professional responses, and mental energy dealing with automated scrutiny. Often, these notices arise not from tax evasion but from technical mismatches, interpretation issues, incomplete third-party data, and reporting differences rather than real income leakage.

- Compliance should build trust, not fear. Data analytics should assist, not harass. A taxpayer-friendly regime is not about fewer notices but about meaningful notices. Automation is powerful, but context matters. Bulk analytics without human calibration risk converting compliance into coercion.

- Better pre-filing validation and warnings, Clearer distinction between mismatch vs evasion, Reduced duplication between AIS, TIS, and return utilities, Risk-based notices instead of blanket triggers

- A mature tax system is judged not by how many notices it issues, but by how fairly and intelligently it enforces compliance. Honest taxpayers spend time, money, and mental energy responding to system-generated notices.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.