CBDT Extends Due Dates for Tax Audit & ITR Filing (AY 2025-26)

CBDT Extends Due Dates for Tax Audit & ITR Filing (AY 2025-26)

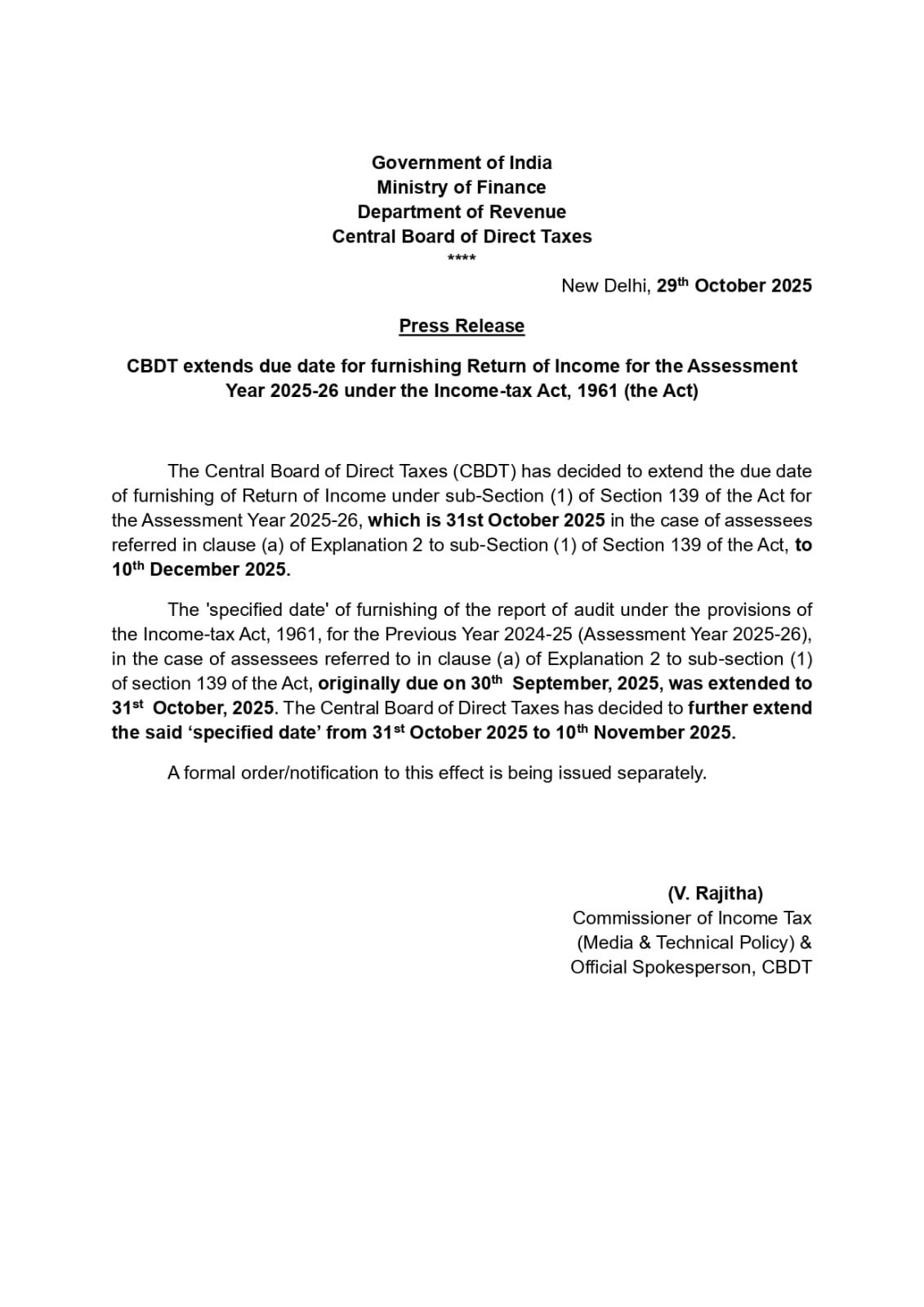

Official Press Release issue by V. Rajitha, Commissioner of Income Tax (Media & Technical Policy) & Official Spokesperson, from the Government of India, Ministry of Finance, Department of Revenue, Central Board of Direct Taxes (CBDT) dated 29th October 2025. Here are the key points related to CBDT Extends Due Dates for Audit & ITR Filing (AY 2025-26)

- CBDT extends the due date for furnishing Return of Income for Assessment Year 2025-26 under the Income-tax Act, 1961.

- Original due date: 31st October 2025

- Extended due date: 10th December 2025 (Applicable for assessees referred in clause (a) of Explanation 2 to sub-Section (1) of Section 139 of the Act.)

- Tax Audit Report Due Date: For assessees under audit provisions for AY 2025-26 Original due date: 30th September 2025, First extension: 31st October 2025 & Further extended to: 10th November 2025

In summary, the Central Board of Direct Taxes has officially extended key due dates under the Income-tax Act, 1961:

-

- Tax Audit Report (u/s 44AB): Extended from 31st October 2025 : 10th November 2025

- Return of Income for Audit Cases (u/s 139(1)) : Extended from 31st October 2025 : 10th December 2025

A formal notification will be issued shortly. Please find attached a copy of the CBDT press release for your reference.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.