Changes in ITC Reporting for GSTR-9 & GSTR-9C for FY 2024–25

Table of Contents

Key Changes in ITC Reporting for GSTR-9 & GSTR-9C for FY 2024–25

Changes in ITC Presentation in GSTR-9/9C for FY 2024-25

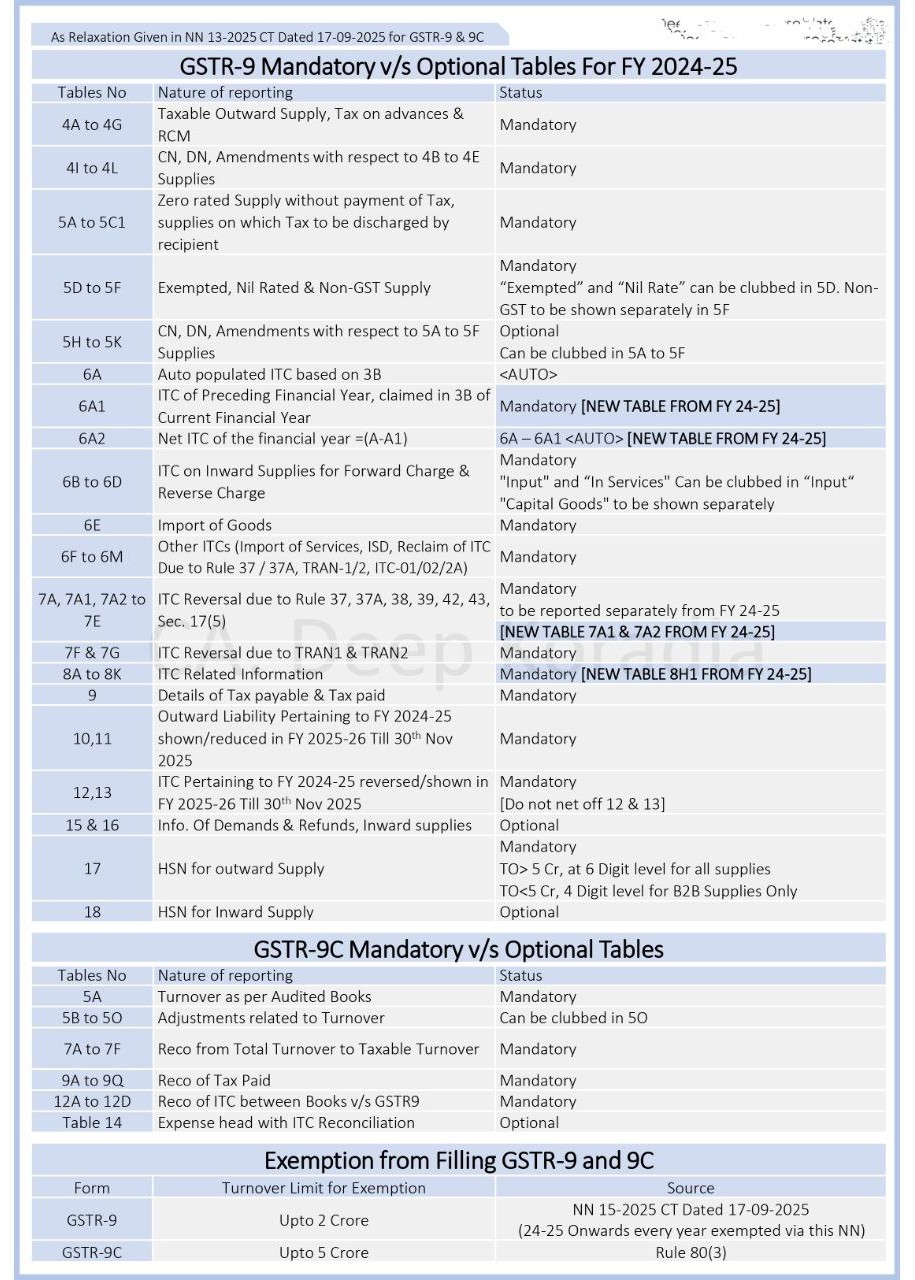

The revised GSTR-9/9C formats for FY 2024-25 have introduced structural and computational changes to ensure accurate demarcation of Input Tax Credit (ITC) pertaining to different financial years and eliminate artificial mismatches in reconciliation tables (particularly Table 8D). (As per Notification No. 13/2025 – Central Tax dated 17.09.2025 and FAQ on GSTR-9/9C dated 09.12.2024)

GSTR-9 & GSTR-9C Applicability under GST

| Return Type | Applicability for FY 2024-25 | Turnover Threshold | Remarks |

|---|---|---|---|

| GSTR-9 | Mandatory | > INR 2 crore | Exemption continues for taxpayers with turnover ≤ INR 2 crore as per Notification No. 15/2025–Central Tax |

| GSTR-9C | Mandatory | > INR 5 crore (PAN-wise, all-India basis) | Audit certification and reconciliation statement required |

Key Changes in ITC Reporting for GSTR-9 (FY 2024–25)

New Segregation of ITC (Tables 6A(1) & 6A(2))

-

6A(1): To now include ITC of the preceding financial year availed in the current financial year.

This figure should match with Table 13 of the previous year’s return.

Earlier, no such disclosure existed, causing negative figures in Table 8D. -

6A(2): Reflects balance ITC for the current financial year after excluding ITC reported in 6A(1).

Revised Comparison Logic

-

6J (difference between ITC as per GSTR-3B and as per 6B-6H) will now compare totals with 6A(2) instead of the earlier 6A, because of the new segregation.

-

Ideally, 6J = 0, ensuring internal consistency of ITC claims within the year.

E-commerce Supplies (Sec. 9(5)) : New rows 4G1 / 5C1 introduced for reporting supplies made through e-commerce operators. Ensures reconciliation between GSTR-1, GSTR-3B, and GSTR-9.

ITC Reporting Overhaul : Auto-population now sourced from GSTR-2B (Table 3.I) instead of GSTR-2A. Table 6A split into:

-

-

6A(1): ITC of preceding FY (e.g., FY 2023-24) claimed in FY 2024-25. 6A(1) will include ITC reclaimed (other than R.37/37A) reversed in preceding FY and claimed in current FY. However, reclaimed ITC due to R.37/37A of preceding FY will not be shown in 6A(1).

-

6A(2): ITC pertaining to current FY 2024-25

-

Linkage Adjustments

-

6B (ITC from forward charge) now excludes ITC of earlier years and corresponds to 6A(2). This change eliminates artificial differences in Table 8D previously caused by carry-forward ITC.

-

6H (ITC reclaimed) is excluded from Table 8B; 8B is now auto-populated from 6B.

-

Reclaimed ITC to be separately disclosed in Table 6H.

Treatment of Reclaimed ITC (6H)

| Case | Disclosure Requirement |

|---|---|

| (i) ITC reclaimed (other than due to R.37/37A) in the same year | Include in 6H |

| (ii) ITC reclaimed (other than due to R.37/37A) of preceding FY | Exclude from 6H |

| (iii) ITC reclaimed due to R.37/37A (current or prior FY) | Include in 6H |

3. Unclaimed / Deferred ITC : ITC claimed up to 30 Nov 2025 (statutory limit) to be shown in Table 13 and 8C for cross-year allocation.

4. Simplified ITC Classification : In Table 6, only Inputs and Capital Goods bifurcation needed. Input Services not separately required. Table 7H now allows a consolidated reversal (excluding TRAN).

5. HSN Code Reporting : 6-digit HSN mandatory for taxpayers with turnover > ₹5 crore. & 4-digit HSN sufficient for others. The GST Annual Return (GSTR-9) for FY 2024–25 introduces major revisions to the Input Tax Credit (ITC) reporting structure — particularly in Table 6 and Table 8. These changes are designed to improve year-wise reconciliation and align ITC disclosure with the static GSTR-2B statement.

Changes in Table 6 – ITC Availed During the Financial Year

The structure of Table 6 has been expanded to distinguish ITC based on when it was availed.

New Sub-Tables Introduced

-

Table 6A1: Captures ITC of the preceding financial year (FY 2023–24) that was claimed during FY 2024–25.

-

Table 6A2: The total ITC auto-populated in Table 6A (Total ITC Availed) is now split into:

-

6A1: ITC of the preceding year, and

-

6A2: ITC pertaining to the current year (FY 2024–25).

-

Reclaiming ITC : If ITC was reversed earlier and reclaimed within the same year, it must be shown in Table 6H. However, the treatment differs based on the timing and rule under which the reclaim is made requiring careful classification.

Changes in Table 8 – Other ITC-Related Information

Table 8 has been refined to strengthen reconciliation between GSTR-2B and actual ITC availed.

Auto-Population Logic (Table 8A)

-

Source of data: Auto-populated from GSTR-2B (static statement), replacing the earlier dynamic GSTR-2A.

-

Scope of data: Includes invoices relating to FY 2024–25 appearing in GSTR-2B up to October 2025, consistent with the statutory ITC time limit.

-

Exclusions: Invoices pertaining to earlier years that appear in FY 2024–25’s GSTR-2B will not be considered in Table 8A.

Refined Reporting in Table 8C :

Revision in Table 8C : 8C will exclude ITC of the preceding FY that was claimed and reversed earlier a shift from the prior FAQ interpretation.

Delinking of ITC Tables :

The auto-population of Table 8B is now based only on Table 6B (regular ITC availed) — excluding any ITC reclaimed under Table 6H. This aims to eliminate mismatches in Table 8D.

New Table 8H1 : Introduced for IGST on imports of goods relating to FY 2024–25, where ITC is claimed in the next FY (2025–26).

GSTR-9C – Relevance Issue in Table 12B :

- No change made to Table 12B of GSTR-9C, which still compares ITC as per books with total ITC as per GSTR-9 Table 7J. Since 7J now excludes earlier-year ITC (reported in 6A1), this table may generate unwarranted differences—an anomaly yet unaddressed.

- Structural mismatches in Table 8D due to earlier-year ITC are now eliminated. Differences in 8D, if any, will now reflect genuine ITC availment or reconciliation gaps. This invalidates the 2019 clarification (Press Release dated 04-06-2019) that asked taxpayers to ignore 8D differences arising due to timing issues.

- Frequent annual modifications in GSTR-9/9C continue to erode consistency in reporting and reconciliation. Even the latest FAQ (page 12) hints at further changes expected for FY 2025-26, indicating that stability in return structure remains elusive.

Key Changes in GSTR-9C (FY 2024-25)

- ITC Disclosure (Tables 12B & 12C) : Mandatory reporting of ITC as per books vs. ITC claimed, along with reconciliation variances.

- Rate-wise Tax Segregation : Inclusion of 6% slab for brick manufacturers (and other notified supplies).

- Turnover Adjustments : Line-wise adjustment reporting from Table 5B to 5O — clubbing not allowed.

- Optional Cost-Center ITC Mapping (Table 14) : Remains optional but recommended for large entities to improve traceability of ITC utilization..

- Enhanced ITC Reconciliation: Greater granularity means taxpayers must reconcile ITC year-wise and source-wise.

- Maintain Separate ITC Records: Track ITC claimed, reversed, and reclaimed distinctly — based on timing and applicable rule.

- GSTR-2B Becomes the Primary Reference: Since GSTR-2B is now the only data source for ITC auto-population in GSTR-9, regular monthly reconciliation is essential to avoid mismatches and loss of credit.

Practical Implications in Reporting for GSTR-9 (FY 2024–25)

-

GSTR-2B Reconciliation becomes the backbone for ITC validation — monthly reconciliation is crucial.

-

Maintain year-wise ITC trail (claimed, reversed, reclaimed) for audit readiness.

-

Cross-verify e-commerce and Section 9(5) supplies to avoid duplication or omission.

-

Ensure PAN-wise turnover aggregation before determining GSTR-9C applicability.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.