IT dept issuing notices to who claim the Fake HRA?

Table of Contents

Income Tax dept issuing notices to who claim the Fake HRA?

Tax Dept. is taking action against lot of individuals who have claimed House Rent Allowance via delivery Income Tax dept notices. People make fake rent receipt to claim HRA for less than a lakh. Assessee are also punished with big penalties. Tax Dept has starting begun implementing its action plan. The Govt of India offered various tax-saving measures as per old income tax regime.

Currently under the new Income tax Regime, Home renting is also a good option for Income Tax saving. Income tax Assessee shall provide your company with a house rent receipt for this in Feb or March. Additionally, those who are employed also produce additional documentation.

Normally Individual make fake receipts of house rent on their own & mention them to their employer rather than requesting a receipt from the landlord. But, Assessee cleverness is about to get Assessee into a lot of issues or trouble. Thereafter Assessees are being asked for documentation.

Income Tax Notices:

In the safeguard of Revenue, above kind of Income Tax fraud, Tax dept. uses specified customized software & AI Technogym. With the use of above AI Technogym, They identify all the fraudulent documents filed by taxpayers. Currently Few people are getting Income Tax Dept notices. They are needed to give documentation related to income Tax Exemption claims by the , Assessee. All received information & documents records are being securitized by the Income Tax dept in the detail manner.

Measures are being taken by the Tax dept. against forged documents.

As per Income tax act, Assessee shall present the landlord’s Permanent account number card if the rent for Assessee home is higher than INR 1,00,000/- per year to Assessee employer.

These notices pertain to the AY 2022-2023 and are being sent in compliance with Section 133(6) of the Income Tax Act. The assessing officer is authorised by law to request particular information regarding transactions made during a designated time period.

According to Income Tax Law Section 10(13A), the Tax Dept provides tax benefits on housing expenses to people of the salaried class.

The Central Board of Direct Taxes’s Central Action Plan states that field officers are leveraging technology to broaden the tax base.

The greatest justification for rent-related fraud is the opportunity to significantly decrease the tax liabilities. If Assessee have listed your residence for rent for INR 20,000 per month, or INR 2,40,000/- annually, you won’t pay direct tax on this sum. Also, provided that the employer is paying you a housing rent allowance of at least INR 2,40,000/-.

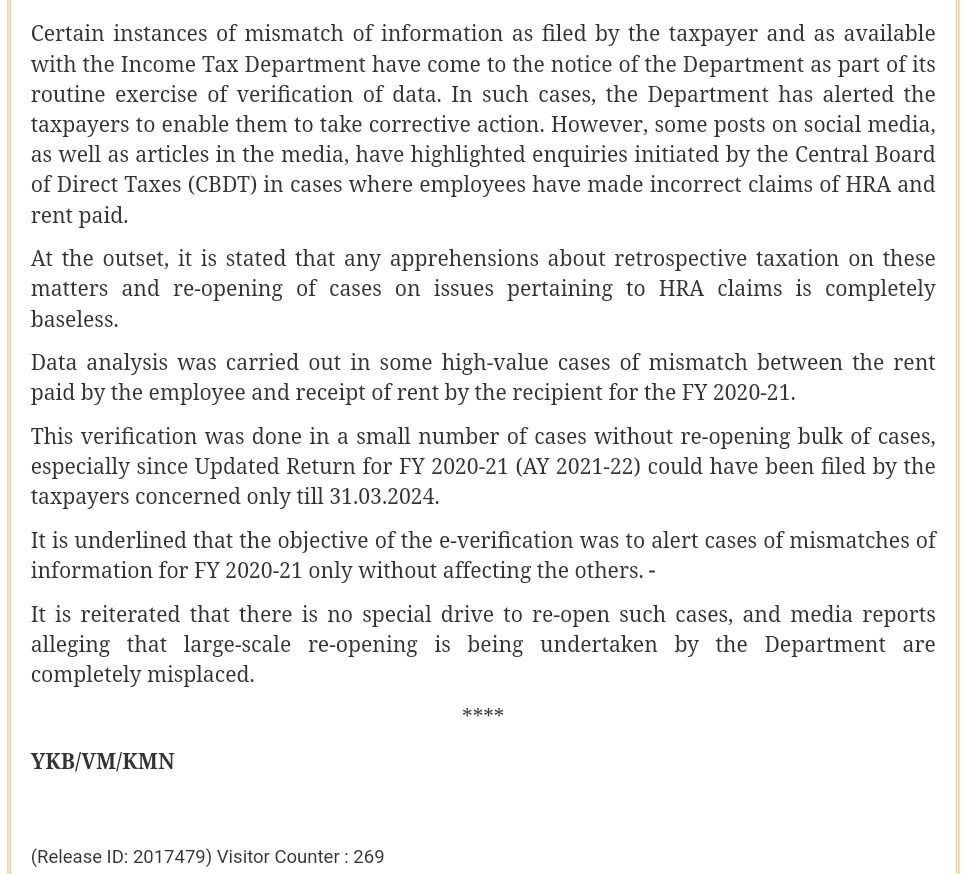

CBDT clarification on Special Drive to reopen mismatch HRA claims

Relief against House Rent Allowance claims: The Central Board of Direct Taxes has made it clear that there isn’t a particular initiative to reconsider cases involving HRA claims. According to the income tax authorities, there isn’t a continuous initiative to examine mismatch circumstances.

The Central Board of Direct Taxes clarifies on media reports claiming special specific effort to revisit cases with reference to House Rent Allowance allegations.

There isn’t a specific drive/ initiative to reopen mismatch cases & media reports alleging that big media claims re-opening is being undertaken by the Central Board of Direct Taxes are entirely misplaced.

Concerns regarding are about retrospective taxation in this matter & re-opening of cases on instances involving to House Rent Allowance claims is entirely baseless

What’s the penalty in case of Fake House Rent Allowance?

If an employee provides fake reimbursement bills to reduce their tax liabilities, that is considered income concealing. In this case, the A.O. might open an investigation. The taxpayer then has to provide proof that the bills are legitimate.

A person who knowingly filing fake bills and gives misleading information about their income may face a fine of up to INR 200/-. in case If fraudulent bills are found, penalties will be imposed. Underreporting income is punishable by up to a 50% fine U/s 270A (1).

Rent Receipt Format- Rent Receipts are useful when you claim HRA deduction

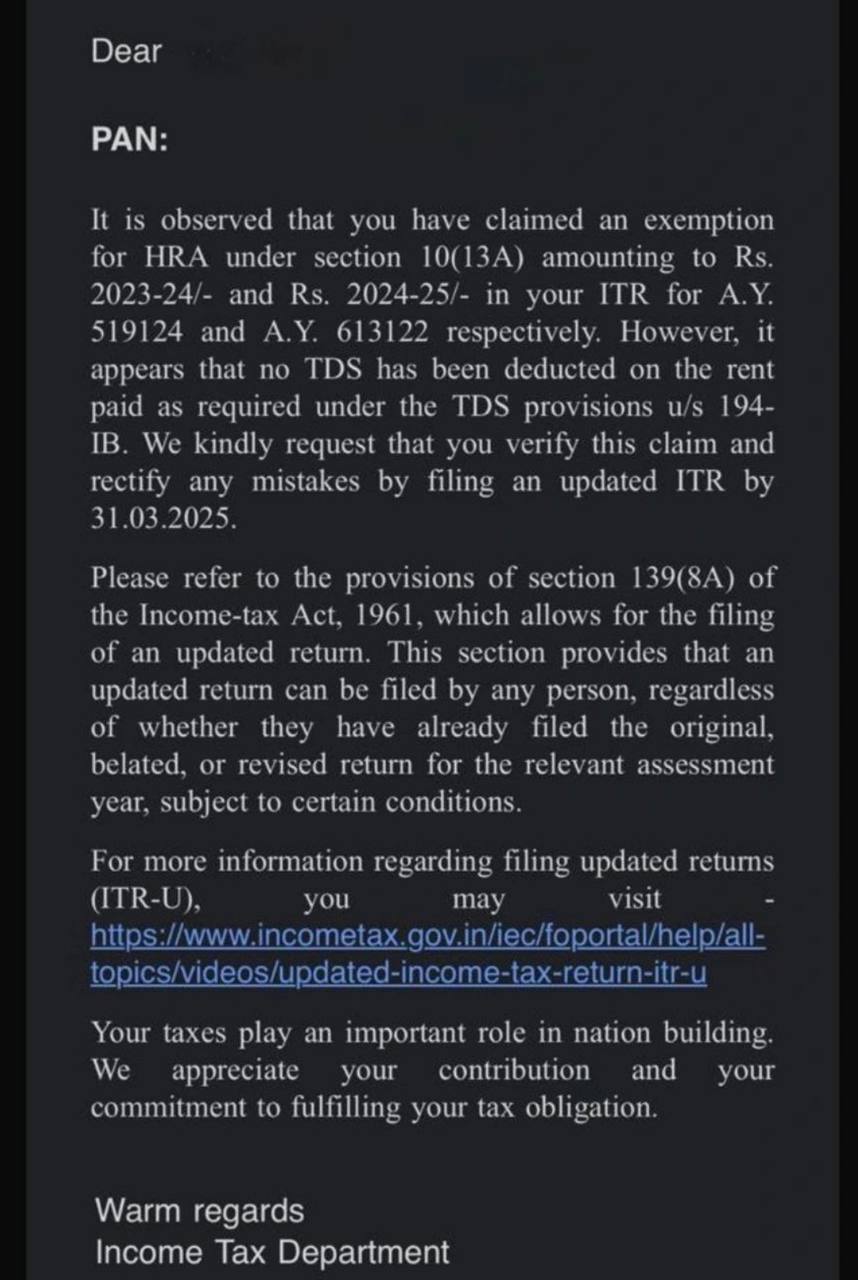

HRA Exemption Claimed Without TDS Deduction? You May Get a Notice!

Scenario: In case the taxpayer claimed HRA exemption without deducting TDS?

You’ve claimed HRA exemption u/s 10(13A) in your ITR, but your monthly rent exceeds INR 50,000 and you didn’t deduct TDS u/s 194-IB as required? Tax Department is now using data analytics to match HRA claims with TDS records. If no TDS is deducted on rent exceeding Rs. 50,000/month, the exemption may be disallowed!

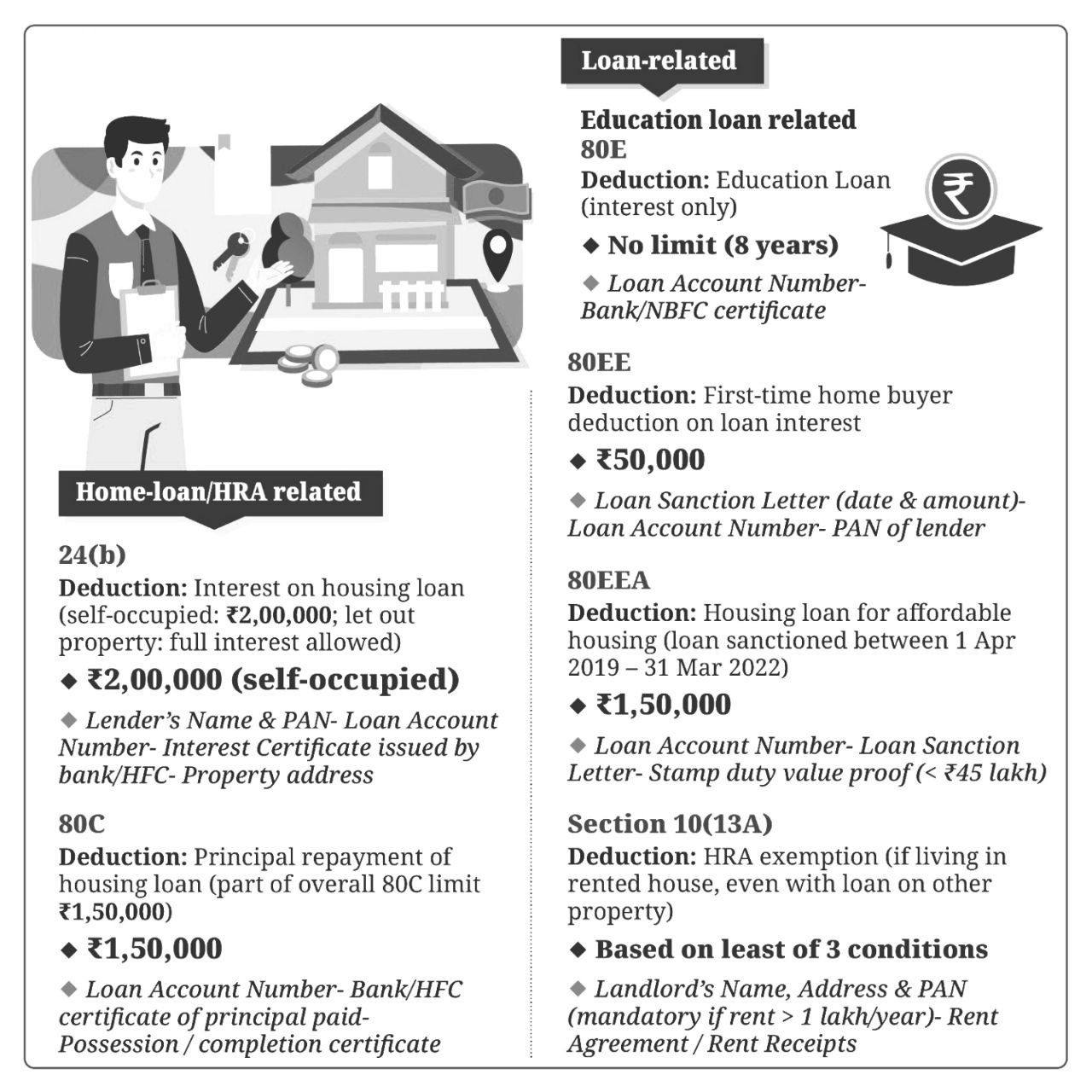

Home Loan & HRA Related Deductions

- Section 24(b) – Interest on Housing Loan

- Limit: INR 2,00,000 (self-occupied); full interest allowed for let-out property

- Required:

- Lender’s Name & PAN

- Loan Account Number

- Interest Certificate from Bank/HFC

- Property Address

- Section 80C – Principal Repayment of Housing Loan

- Limit: INR 1,50,000 (part of overall 80C limit)

- Required:

- Loan Account Number

- Bank/HFC Certificate of Principal Paid

- Possession/Completion Certificate

- Section 10(13A) – HRA Exemption

- Limit: Least of three conditions (as per Income Tax rules)

- Required:

- Landlord’s Name, Address & PAN (mandatory if rent > ₹1 lakh/year)

- Rent Agreement/Rent Receipts

Loan-related Deductions

- Section 80E – Education Loan (Interest Only)

- Limit: No cap; available for 8 years

- Required:

- Loan Account Number

- Bank/NBFC Certificate

- Section 80EE – First-Time Home Buyer (Interest)

- Limit: INR 50,000

- Required:

- Loan Sanction Letter (Date & Amount)

- Loan Account Number

- PAN of Lender

- Section 80EEA – Affordable Housing Loan (Sanctioned between 1 Apr 2019 – 31 Mar 2022)

- Limit: INR 1,50,000

- Required:

- Loan Account Number

- Loan Sanction Letter

- Stamp Duty Value Proof (< INR 45 lakh)

What Is Section 194-IB?

-

Applies to individuals/HUFs (not liable for audit) who pay monthly rent > ₹50,000 and taxpayer must deduct TDS @ 5% of annual rent once in a financial year, and TDS must be deposited and Form 26QC should be filed, and Form 16C issued to the landlord.

What Happens If You Don’t Deduct TDS?

-

Your HRA exemption may be disallowed

-

You may get a notice of mismatch

-

Penalty and interest could apply

-

You might need to revise or update your ITR

What Should You Do Now?

- Verify: Check if your rent was over ₹50,000/month and Confirm whether TDS under 194-IB was deducted and reported via 26QC

- Correct: If TDS was not deducted and rent was over ₹50K/month, consider filing an Updated Return (ITR-U) under Section 139(8A)

- Deadline: For AY 2023-24, the ITR-U must be filed by 31st March 2025

- Pay Additional Tax: 25% of additional tax + interest (if you file within 12 months from end of AY)

Key Notes : Sec 139(8A) allows taxpayer to voluntarily correct errors via an ITR U Return — even if Taxpayer original ITR is filed already! and If you’re paying rent to your parents or a relative, make sure:

-

Rent agreement exists

-

Actual rent is paid via bank

-

Your landlord reports the rent income in their ITR

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.