Compare GSTR-3B & GSTR-1 & significance GST regime

Table of Contents

Compare GSTR-3B & GSTR-1 and understand their significance in the GST regime:

GSTR-3B (Summary Return):

- GSTR-3B is a monthly summary return that contains details of both inward and outward supplies, tax liability, and input tax credit (ITC) claimed by the taxpayer.

- Unlike GSTR-1, GSTR-3B does not require invoice-level details. Instead, it provides a summarized view of the taxpayer’s tax liabilities and ITC for a given tax period.

- GSTR-3B is used by taxpayers to self-assess their tax liabilities and claim input tax credit on eligible purchases.

- It is an interim return introduced to facilitate compliance and revenue collection under the GST regime.

- While GSTR-3B provides a simplified mechanism for tax filing, it’s important to reconcile the figures reported in GSTR-3B with those in GSTR-1 to ensure accuracy and compliance.

GSTR-1 (Outward Supplies Return):

- GSTR-1 is a monthly or quarterly return that contains details of all outward supplies made by the taxpayer.

- It includes information such as invoice-wise details of sales, interstate sales, exports, credit notes, and debit notes.

- GSTR-1 is used by the tax authorities to verify the sales made by the taxpayer and to reconcile them with the purchases reported by the recipients in their GSTR-3B returns.

- It serves as the basis for the recipient’s input tax credit (ITC) claims.

- Timely and accurate filing of GSTR-1 is crucial for ensuring compliance and avoiding penalties.

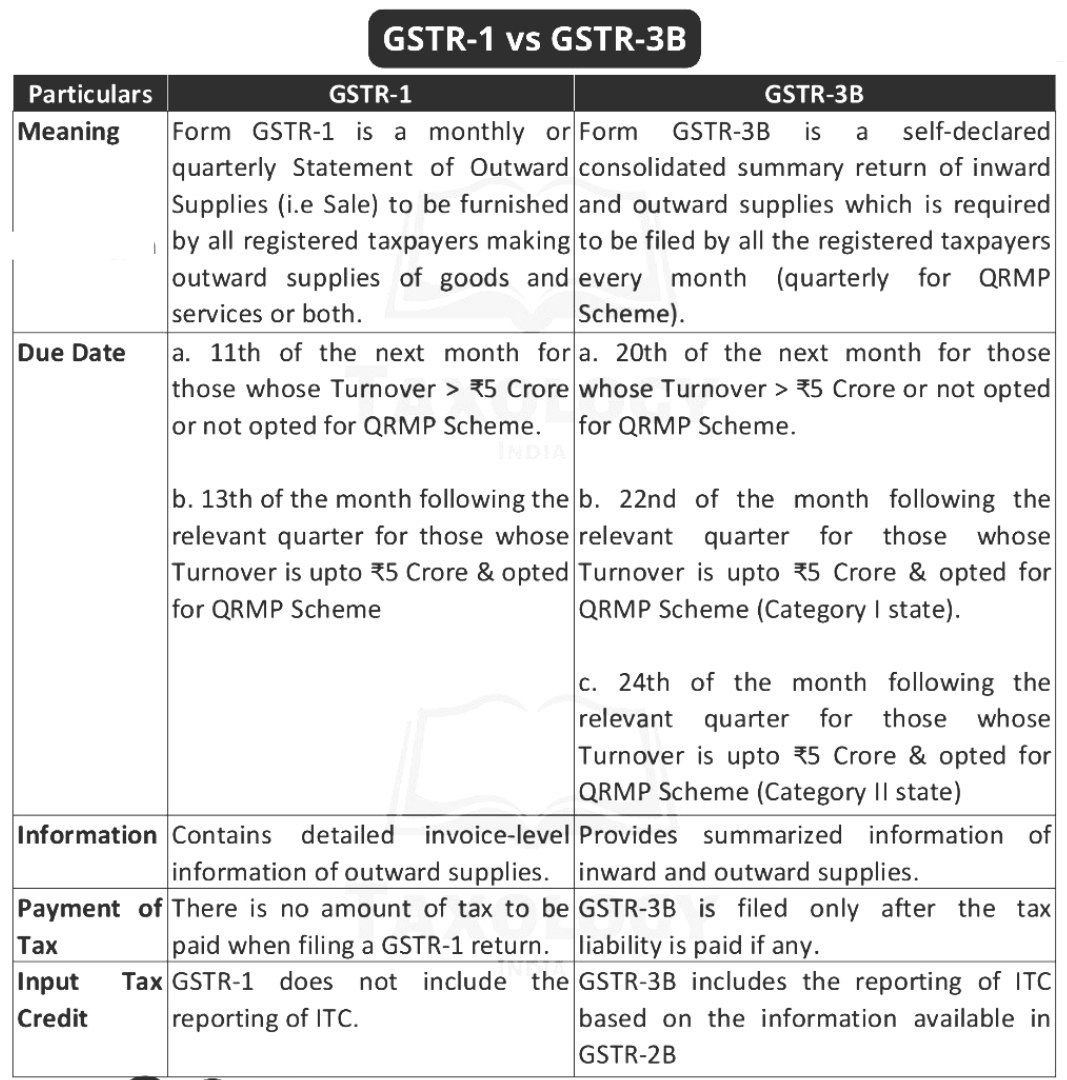

Differences between GSTR-3B and GSTR-1:

- GSTR-1 provides detailed information about outward supplies, while GSTR-3B provides a summary of both inward and outward supplies.

- GSTR-1 requires invoice-level details, whereas GSTR-3B does not.

- GSTR-1 is filed monthly or quarterly, depending on the taxpayer’s turnover, while GSTR-3B is filed monthly.

- GSTR-1 serves as the basis for input tax credit (ITC) claims by recipients, while GSTR-3B is used for self-assessment of tax liabilities and ITC claims by the taxpayer.

Significance of Filing Accurately and Timely:

- Timely and accurate filing of both GSTR-1 and GSTR-3B is essential for compliance with GST regulations.

- Filing errors or delays can lead to penalties, interest charges, and loss of input tax credit.

- Accurate reporting helps in proper reconciliation of tax liabilities and input tax credit, reducing the risk of tax disputes or audits.

Both GSTR-1 and GSTR-3B play pivotal roles in the GST regime, serving as key components of tax compliance for businesses.

- GSTR-1 captures the intricate details of outward supplies, ensuring transparency and accuracy in reporting sales transactions. On the other hand, GSTR-3B provides a consolidated view of tax liabilities and input tax credit, simplifying the tax filing process for businesses. Together, they offer comprehensive insights for decision-making and analysis, benefiting both businesses and the government.

- Understanding the variances between these returns is crucial for businesses to fulfill their GST obligations accurately. Timely and precise filing is paramount to avoid penalties and maintain compliance. By adhering to GST regulations, businesses not only uphold their credibility but also contribute to a transparent and efficient tax ecosystem, fostering trust and stability in the market.

- In summary, while GSTR-1 provides detailed information about outward supplies, GSTR-3B offers a summarized view of tax liabilities and input tax credit. Both returns are crucial for GST compliance, and businesses must ensure timely and accurate filing to avoid penalties and maintain good tax standing.

Levy and collection of CGST/IGST

Also Read : A requirement of liability under GST Registration

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.