CORPORATE AND PROFESSIONAL UPDATE 8 JUNE , 2016

TODAY UPDATES:

DIRECT TAX:

Income Tax : Fresh claim of deduction u/s 80G in respect of donations allowed by CIT (A) – the restriction laid down in the decision in the case of Goetze (India) Ltd. is applicable only to making claim before AO and not before the appellate authorities under the Act – Deduction allowed – Allahabad Bank Vs. CIT (ITAT Kolkata)

Income Tax : Disallowance / addition u/s 40A (3) – cash expenditure – business expediency – Amount was directly deposited the cash in the account of the companies – there is no evasion of tax by claiming the bogus expenditure in cash – No additions – Prabir Kumar Mullick Vs. ITO (ITAT Kolkata)No TDS for provident fund withdrawals of up to Rs 50,000 (increased from Rs.30,000/-).

Income Tax : No reassessment to check creditworthiness of investor if all details were already furnished at assessment stage [2016] 69 taxmann.com 444 (Delhi) Allied Strips Ltd. v. Assistant Commissioner of Income-tax Section 68, read with section 147, of the Income-tax Act, 1961 – Cash credits (Share application money) – Assessment year 2007-08 – During original assessment proceedings, assessee, in response to specific queries raised by Assessing Officer regarding share application money, furnished complete details of shareholders, their addresses, PANs, acknowledgment of e-returns and their confirmation letters – After considering said details, Assessing Officer framed assessment making no addition on account of share application money – After four years, Assessing Officer reopened assessment on ground that creditworthiness of investors remained unverified – Whether on facts, issuing notice under section 148 would amount to change of opinion which is not permissible – Held, yes

ICAI’s income from coaching is exempt as its main purpose is to train future CAs [2016] 70 taxmann.com 54 (Delhi – Trib.) Deputy Director of Income-tax (E), Trust Circle-IV v. Institute of Chartered Accountants of India

Income Tax : Setting up of business – For a new business or for a new source of income which has come into existence, previous year would start from date of setting up of new business or from date when new source of income has come into existence – [2016] 69 taxmann 380 (Lucknow – Trib.)

Income Tax : Section 14A was inserted by the Finance Act, 2001 with retrospective effect from 1-4-1962. The section provided for a disallowance of all expenditure incurred to earn exempt income, that is, income not includible in the total income of a tax payer. Rule 8-D of the Income Tax Rules’ 1962 (inserted w.e.f 24-03-2008) read with Section 14A of the Income Tax Act’1961 provides for the mechanism to quantify the amount of disallowance. Before this notification, the amount to be disallowed shall be the aggregate of (i) expenditure directly incurred to earn exempt income, (ii) interest expense worked out on the basis of a prescribed formula even though the interest is not directly attributable to any income or receipt and (iii) ½% of the average value of the investment the income from which is exempt from tax. There has been high end litigation on the application of the section. Around 15% of the tax litigation is attributed to the determination of expenditure relating to exempt income. There was an imperative need to clarify and simplify some of the provisions of the section and the rule so far as to quantify the amount of expenditure attributable to exempt income. Under the existing provisions before this notification, the application of Rule 8-D sometimes results in an unintended outcome whereby the amount of such expenditure exceeds the total amount otherwise claimed as expenditure; obviously, the disallowance cannot exceed the amount claimed. Sometimes the disallowance under the Rule also results in the disallowance exceeding the exempt income which resulted in unnecessary high pitched assessments, high demands leading to high end litigation.

INDIRECT TAX:

Service Tax: Levy of penalty – appellant has already been spared from non-imposition of penalty u/s 78 by the adjudicating authority – What is not alleged in the show cause notice cannot be traversed at a later point of time in any proceedings – No penalty –GRR Logistics Pvt. Ltd. Vs. CST (CESTAT Chennai)

Service Tax: Audit is a special function which has to be carried out by duly qualified persons like a Cost Accountant or a CA. It cannot possibly be undertaken by any officer of the Service Tax Department. There is a distinction between auditing the accounts of an Assessee and verifying the records of an Assessee. Therefore, without assigning any reasons and giving opportunity of being heard, conducting special audit by departmental officers is ultra-vires.

VAT and Sales : In the absence of any rules being framed u/s 102(2)(z) read with Section 59(2) of the DVAT Act the power of the Commissioner U/s 59(2) of the DVAT Act to call upon a person to produce the books of accounts and other documents cannot be exercised – Vayam Technologies Ltd. Vs. CTT (Delhi High Court).

CENTRAL EXCISE : APPEALS – BINDING NATURE OF PRECEDENTS – HIGH COURT- Officers must withdraw orders/actions contrary to binding judicial orders reserving right to challenge them in legal proceedings; and in case of any violation, concerned officials would be liable to individual penalties, including forfeiture of their salaries until they take a corrective action – [2016] 70 taxman 29 (Bombay)

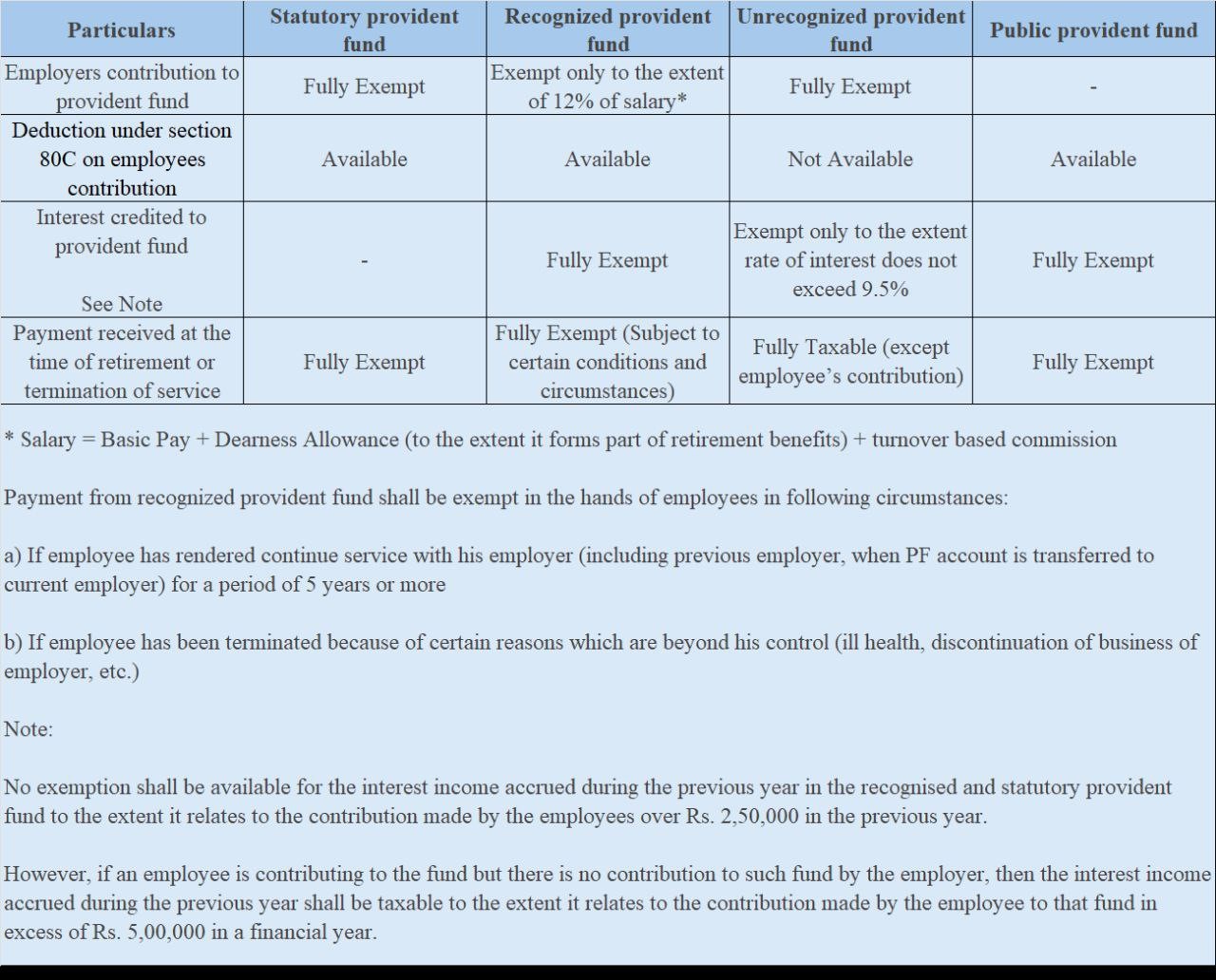

Employees Provident Fund

Tax treatment in respect of contributions made to and payment from various provident funds are summarized in the table given below :

“Laziness may appear attractive, but work gives satisfaction.”

We look forward for your valuable comments. www.caindelhiindia.com

REGARDS

INDIAN FINANCIAL CONSULTANCY PRIVATE LIMITED

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.