All about the Nidhi Company Registration

Table of Contents

How to Start a Nidhi Company Registration

Definition:

Nidhi Company is now a well-known lending mechanism for obtaining secured loans. These businesses are most prevalent in India’s southern regions. Furthermore, the operations and affairs of this company are very similar to those of a Co-operative Society. Section 406 of the Companies Act, 2013, also addresses the process of Nidhi Company Registration.

Furthermore, the primary reason for establishing this business structure is to encourage and motivate its members to save, so that they can smoothly and easily meet their financial needs as they arise. As a result, this company is based on the concept of Mutual Benefits.

What is a Nidhi Company?

The Nidhi Company refers to a specific form of NBFC (Non-Banking Financial Corporation) that is governed and controlled by the Companies Act of 2013. The sole essential aspect that defines this company apart from others is that it only accepts deposits from and makes loans to its members, i.e., shareholders, and it only works for the mutual benefit of its members.

Moreover, the activities of this business structure are within the scope of RBI (Reserve Bank of India) as it is similar to that of an NBFC. It should be taken into account. However, because these companies only deal with the money of their shareholders or members, the RBI has exempted them from the core provisions of the RBI Act of 1934 and other regulations that apply to NBFCs.

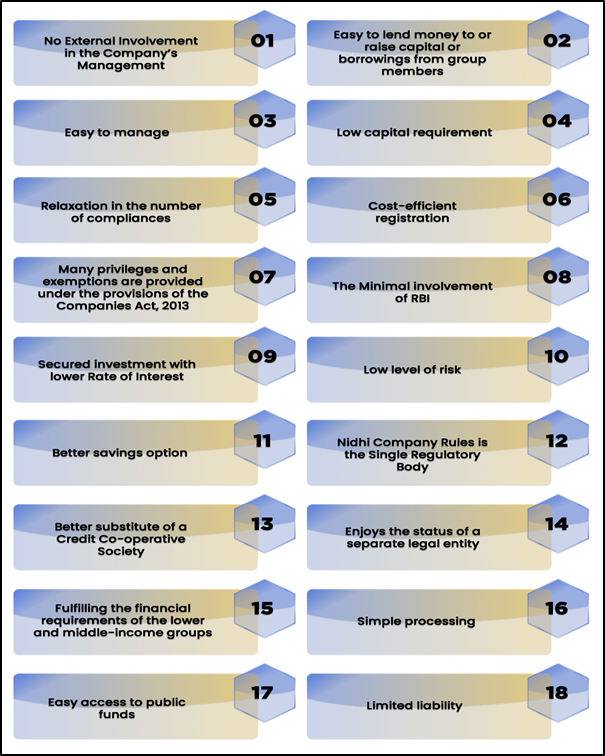

The Benefits of Nidhi Company Registration:

The advantages of forming a Nidhi Company in India can be summarised as follows:

- There is no outside involvement in the company’s management.

- It is simple to lend money to or borrow money from group members.

- It’s easy to manage.

- There is a low capital requirement.

- There has been a reduction in the number of compliance requirements.

- Registration is affordable.

- The Single Regulatory Body is Nidhi Company Rules.

- A Credit Co-operative Society is a better substitute.

- It has the legal status of a separate legal entity.

- Providing for the financial needs of low- and middle-income people.

- Easy access to government funds.

- The Companies Act of 2013 grants numerous privileges and exemptions.

- RBI’s involvement is minimal.

- Secured investment with a lower interest rate.

- There is little danger.

- A better way to save money.

- Processing is straightforward.

- Liability is limited.

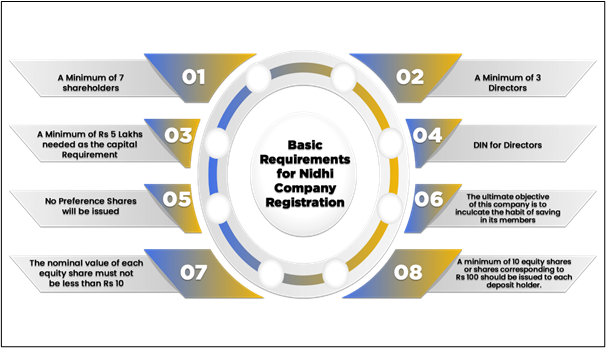

Basic Requirements for Nidhi Company Registration

The following are the essential conditions for forming a Nidhi company:

- There must be a minimum of 7 shareholders or members.

- There must be a minimum of three directors.

- The capital requirement is a minimum of Rs 5 lakhs.

- DIN (Director Identification Number) is a number assigned to directors.

- There will be no Preference Shares issued.

- The company’s ultimate goal is to instil the habit of saving in its members or shareholders by accepting deposits from them and lending to them solely for mutual gain.

- Each equity share issued must have a nominal value of at least Rs 10 per share.

- Each deposit holder should receive a minimum of 10 equity shares, or shares worth Rs 100.

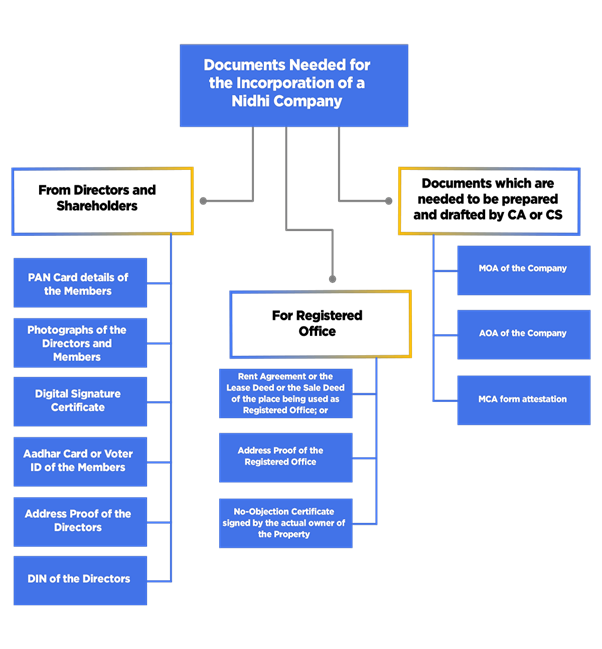

Required Document for Registration of Nidhi Company:

The documents required for obtaining nidhi company registration are as follows:

For the Board of Directors and the Shareholders

-

- Members’ PAN Card details

- Photographs of the Directors and Members

- Certificate of Digital Signature

- Members’ Aadhar Card or Voter ID

- Address Verification for the Directors

- The Directors’ DIN (Director Identification Number)

For use as a registered office:

-

- The Rent Agreement, Lease Deed, or Sale Deed of the location being used as the Registered Office.

- Proof of Registered Office Address

- No-Objection Certificate (NOC) signed by the property’s actual owner.

Documents required for preparation and preparation by CA or CS.

-

- The Company’s MOA (Memorandum of Association).

- The company’s AOA (Article of Association).

- Attestation from the Ministry of Corporate Affairs (MCA).

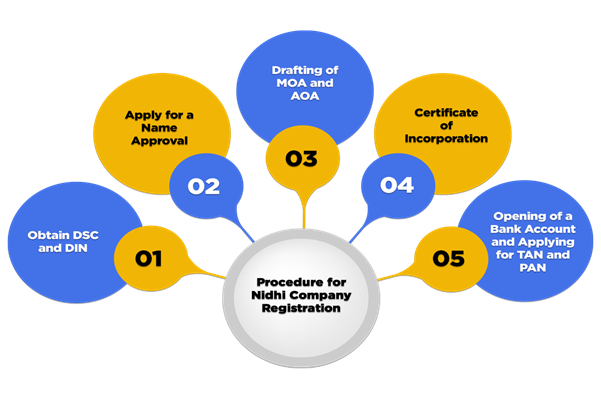

Procedure for Nidhi Company Registration

The following are the procedures needed in acquiring a nidhi company registration:

-

- Obtain the DSC and DIN codes.

The first and most important step for all Directors is to obtain a DIN (Director Identification Number) and a DSC (Director Status Code) (Digital Signature Certificate).

-

- Request a Name Approval.

The shareholders or directors must now apply for a name permission by submitting three names to the MCA in the second phase (Ministry of Corporate Affairs).

Furthermore, the MCA will select one of the suggested names for the aforementioned company. Moreover, any suggested names must have a distinct personality and must not be confusingly similar to the name of an existing company. Additionally, under Rule 8 of the Companies Act of 2013, the approved name will only be valid for 20 days.

-

- MOA and AOA drafting:

After completing the name approval process, the directors must submit the Application for Registration in the form INC- 32, along with the Articles of Association (AOA) and Memorandum of Association (MOA). It is also important to note that the documents must state the aim behind the incorporation of a Nidhi company.

-

- Incorporation Certificate.

Normally, the certification of Incorporation takes approximately 15 to 25 days. In addition, this certificate provides proof of the incorporation of the said company. This certificate also refers to the CIN of the company (Company Identification Number).

-

- Bank account opening and TAN and PAN application.

Finally, managers must apply for PAN (Permanent Account Number) and TAN (Tax Deduction Account Number). Furthermore, shareholders or members of the company must open a bank account by submitting the Certificate of Incorporation, copies of the MoA and AoA, and the allotted PAN details to the bank.

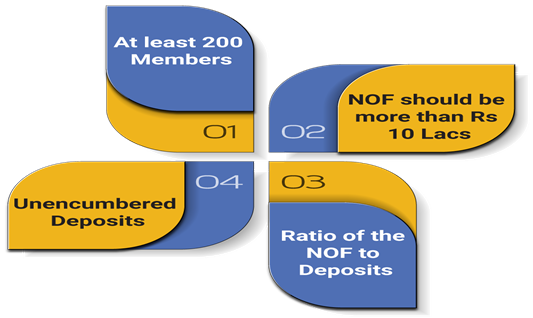

Post Requirements of Nidhi Company Registration

The Post-Nidhi Company Registration requirements are as follows:

- At least 200 people:

The company must have at least 200 members or shareholders by the end of the first year, in accordance with its first requirement. Furthermore, the list of all members must be submitted in this Form within 90 days of the end of each financial year.

In the event the Company cannot compose at least 200 members, it is then obliged to report NDH-2 to the regional director by the shareholders or members of the Company. If the company files a new financial year within the 30-day period beginning at the end of the first financial year after the beginning, the company may use this form. This extension is also possible.

Moreover, if the company does not comply with the prescribed requirements after its 2nd financial year, the same company will not be eligible for deposits until such time as such provisions are observed and, in addition, can also have penal consequences.

- More than Rs 10 lakes should be NOF:

The second post-requirement describes NOF (Net Owned Funds). The company’s NOF must exceed the lakhs of Rs 10. The term Net Owned Funds refers to the total of payments of equity and free reserves, which are reduced by intangible assets and accumulated losses which appear in the last balance sheet audited.

- Deposits ratio of the NOF:

The Net Owned Deposit Funds ratio must be over 1:20.

- Deposits not charged.

Deposits uncharged must be greater than 10% of the remaining deposits.

This business structure must also file a Half-Yearly Return in Form NDH-3 (again, appropriately certified by a Practicing CA/ CS/ CWA) with the ROC (Registrar of Companies) along with the required payments. In addition, such a form must be submitted within 30 days, beginning at the end of each half year.

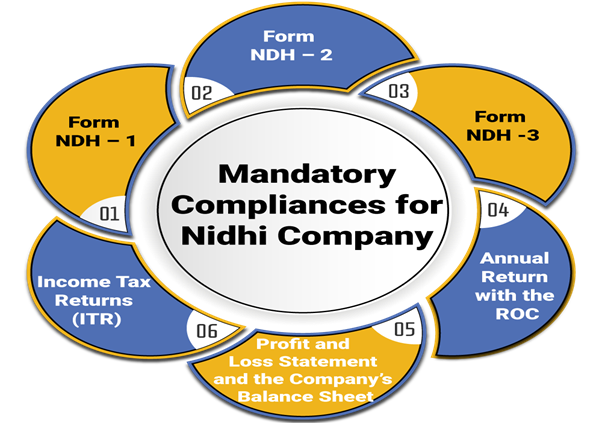

Mandatory Compliance for the Registration of Nidhi Company.

Compliance with registration requirements for a Nidhi Company is the following.

- NDH – 1. Form

It must submit the membership list in this particular form within a period of 90 days from the end of each financial year.

- Forms of NDH – 2.

If a company in the first financial year is unable to meet the 200 member goal, it can request an extension in this form from the MCA (Ministry of Corporate Affairs).

- NDH -3 form.

A half-yearly return is also required to be completed in Form NDH-3, in addition to the above-mentioned NDH-1 Form.

- Annual Return with the ROC:

It must file its annual returns via form MGT-7 with the MCA.

- P & L Statement and Balance Sheet of the Company

Annual submission in AOC-4 is necessary for the financial statements and other relevant documents.

- Income Tax Returns (ITR)

It must file Annual Income Tax Returns (ITR) by September 30th of the following financial year.

Loans provided by a Nidhi Company are subject to a ceiling limit.

If the entire amount of deposit is less than Rs 2 crore, the ceiling limit for Nidhi Companies’ loans can be described as follows:

| Amount of Deposits | Permissible Loan limits |

| If the total amount of deposit is less than Rs 2 Crore. | Rs 2 Lacs |

| If the entire deposit amount falls between Rs 2 crore and Rs 20 crore. | Rs 7.50 Lacs |

| If the entire deposit amount falls between Rs 20 crore and Rs 50 crore. | Rs 12 Lacs |

| If the total deposit amount exceeds Rs 50 crore. | Rs 15 Lacs |

Is it legal for Nidhi Company to have branches?

Yes, a Nidhi Company may have branches, but only under the following conditions:

- The company must have earned Net Profits after Deducting Tax for the previous three financial years in a row.

- This business structure is only allowed to open three branches. Furthermore, it is important to note that all of these branches must have opened in the same district.

- If it wants to open more than three branches, it must first seek and obtain authorization from the RD (Regional Director). Furthermore, these branches can be opened within the same district’s territorial limits or in a separate district.

- The Registrar of Companies (ROC) must be notified within 30 days of the opening of its branches.

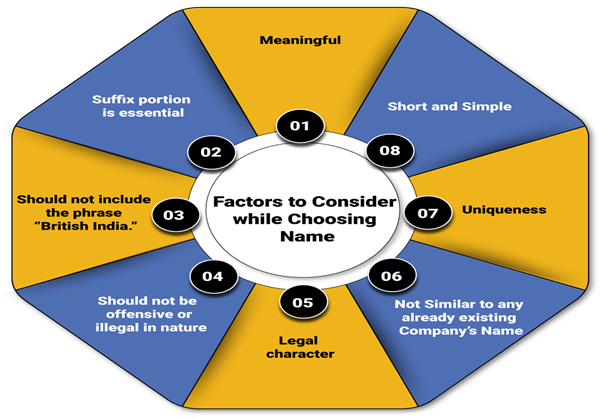

Factors to Consider When Choosing a Name for Nidhi Company

In India, the following factors must be considered when naming a company:

- Meaningful

- Short and Simple;

- Uniqueness;

- Not Similar to Any Existing Company’s Name;

- Legal Character; Should not be offensive or illegal in nature;

- Should not include the phrase “British India.”

- The suffix portion is essential.

Restrictions on Nidhi Company Registration

In India, the following restrictions apply to Nidhi companies in terms of their activities:

- Insurance

- chit funds,

- Finance through leasing,

- They advertise themselves in order to obtain deposits.

- Lotteries, Hire-Purchase funds

- Sell, mortgage, or both Pledge the assets it has on hand as collateral for a loan.

- forming joint ventures to engage out lending and borrowing activities,

- Accepting deposits from or lending money to anyone other than its shareholders

- Issuing preference shares, debentures, or other debt instruments

- The issuance of equity shares with a nominal value of more than Rs. 10/- per,

- Offer equity shares to its depositors, preferably more than ten shares or shares valued more than Rs. 100/-.

- Open a current account with the rest of the group (although it is permitted to open a Account).

- Make a loan to or accept a deposit from a corporation.

- Pay a commission, incentive, or fee for the mobilization of deposits.

- Carry out any other business than lending or borrowing from its members,

- Hire a Purchase Financer.

- Pay any brokerage fees for granting a loan to its members.

Deposit Acceptance Regulations

The deposit acceptance rules are summarised as follows:

- Nidhi Companies are not permitted to accept deposits in excess of twenty times their NOF (Net Owned Funds).

- They can accept Fixed Deposits (FD) for as little as six months and as much as sixty months.

- Similarly, these businesses are authorised to accept Recurring Deposits (RD) for a minimum of twelve months and a maximum of sixty months.

Rajput Jain & Associates Associate will understand your business requirements and help you in Nidhi Company related issues. Also we will help to obtain the necessary registrations to open a bank account in the name of your business, thereby proving an identity for the business.

Nidhi Company Registration is a completely online process. It is a sort of NBFC, and the applicant company must be registered with the MCA in order to incorporate it. The company structure in Nidhi is best suited for young entrepreneurs wishing to enter the world of finance.

Included in the package:

- There is no prior experience required.

- 500,000 is the required minimum capital.

- Get ready in 15 days for start-up.

- Generate higher software access.

- It is simple to obtain a deposit from the general public.

- Dedicated CA/CS team .

- Participate in the Business Training Program.

For any information/queries, you can contact us. Our team of experts can provide all the assistance. For Contact:

Website- Click here

Email id- info@caindelhiindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.