CORPORATE AND PROFESSIONAL UPDATE OCT 26, 2016

CORPORATE AND PROFESSIONAL UPDATE OCT 26, 2016Direct Tax:-

- Bombay High Court in the below citied case held that Loss suffered u/s 37(1)/43(5) in foreign exchange transactions entered into for hedging business transactions cannot be disallowed as being “notional” or “speculative” in nature. [CIT vs. M/s. D. Chetan & Co]

- CBDT issued press release regarding draft Rules for prescribing the method of valuation of fair market value in respect of the trust or the institution-Chapter XII-EB of the Income-tax Act, 1961-

- No addition on basis of 26AS if payee claimed that there was wrong entry in TDS return: ITAT P.K. Rajasekar v. Income-tax Officer, Chennai[2016] 74 taxmann.com 151 (Chennai – Trib.)

- As many as 2.5 crore salaried tax payers will now receive SMS alerts from the income tax department regarding their quarterly TDS deductions.

- Acquisition of right to use trademark for 3 years is a depreciable asset: Bangalore ITAT Bosch Ltd. v. Assistant Commissioner of Income-tax, LTU,Bangalore [2016] 74 taxmann.com 161 (Bangalore – Trib.)

Indirect Tax:-

- CESTAT denies concessional CVD benefit under Notification No. 6/2006-CE on imported ‘external hard disks’, holding them classifiable as “removable or exchangeable disc drives” under CETH 84717030 and not “hard disc drives” under CETH 84717020 of Central Excise Tariff. [TS-422-CESTAT-2016-CUST]

- Penultimate sale – export consignment – When the revisional authority noticed discrepancies in the different documents supplied by the assessee he was within his rights to deny the benefit of tax exemption to such extent. – HC – VAT and Sales Tax- Commissioner of Commercial Tax Versus Shakti Containers – 2016 (9) TMI 827 – GUJARAT HIGH COURT

MCA UPDATE

- MCA has invited application regarding empanelment of professionals for at least fifteen years of continuous practice as a Chartered Accountant with as mediator or conciliator u/s 442 of the Companies Act, 2013.

- MCA has requested all stakeholders who had filed Form MGT-07/20B but the same had not been taken on records due to non-submission/ non-uploading of CD to complete the filing by uploading the data in excel sheet by 07th November 2016.

FAQ ON GST

INPUT SERVICE DISTRIBUTOR

1.How to distribute common credit among all the units of an ISD?

Ans. The common credit used by all the units can be distributed by ISD on a pro-rata basis i.e. based on the turnover of each unit to the aggregate turnover of all the units to which credit is distributed.

1. The ISD may distribute the CGST and IGST credit to recipients outside the State.

(a) IGST

(b) CGST

(c) SGST

Ans. (a) IGST.

2. The ISD may distribute the CGST credit within the State as____

(a)IGST

(b) CGST

(c) SGST

(d) Any of the above.

Ans. (b) CGST.

- The credit of tax paid on input service used by more than one supplier is ________

- a) Distributed among the suppliers who used such input service on the pro-rata basis of turnover in such State.

- b) Distributed equally among all the suppliers.

- c) Distributed only to one supplier.

- d) Cannot be distributed.

Ans. a) Distributed among the suppliers who used such input service on the pro-rata basis of turnover in such State.

2. Whether the excess credit distributed could be recovered by the department?

Ans. Yes, excess credit distributed could be recovered along with interest from an ISD by the department.

3. What are the consequences of credit distributed in contravention of the provisions of the Act?

Ans. The credit distributed in contravention of provisions of the Act could be recovered from the unit to which it is distributed along with interest.

Key Dates:

- Advance information for 1st fortnight of Nov of function with booking cost more than Rs. 1 Lakh in Banquet halls, hotels, etc in Delhi-27.10.2016

- Filling of DVAT Return verification form for quarter ended September where return not signed with digital signature:- 28.10.2016

- Return of TDS for September quarter in DVAT-48 -28.10.2016

- Return by scheduled bank branches in Delhi engaged in sale of silver, gold, repossessed vehicle for quarter ended September:-28.10.2016

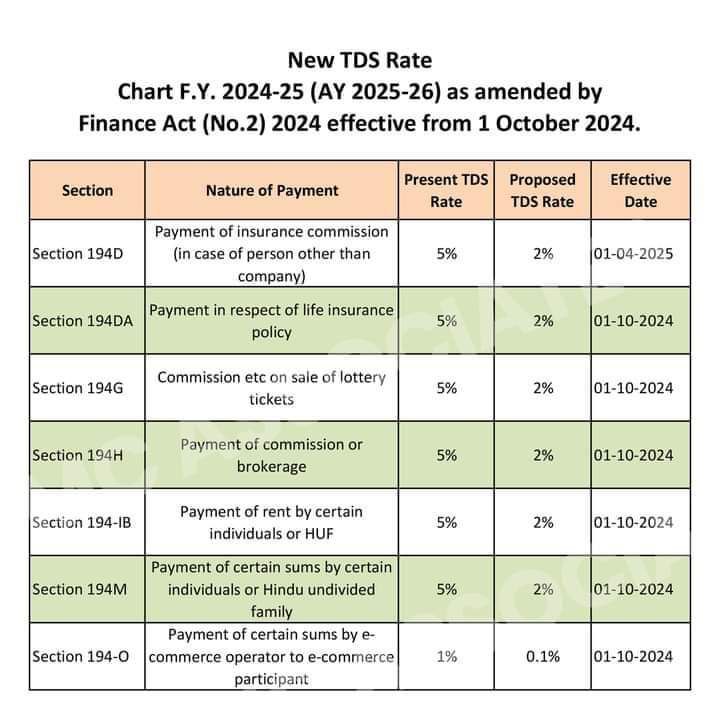

TDS Rate chart for the FY 2024-25 (AY2025-26). Budget 2024

We look forward for your valuable comments. www.caindelhiindia.com

FOR FURTHER QUERIES CONTACT US:

W: www.caindelhiindia.com E: info@caindelhiindia.com T: 9-555-555-480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.