CORPORATE AND PROFESSIONAL UPDATES JULY 7, 2016

Today updates:

DIRECT TAX:

Income Tax : Deduction u/s 80HH of the Act in respect of profit and gains from newly established industrial undertaking in backward areas would be given subject to fulfillment of certain conditions as provided in sub section (2) of the said provision. Indian Railway Const. Co. Ltd. Vs. IAC (A) -ITAT Delhi

Income Tax : Bangalore ITAT upholds capital gains addition in respect of sale of various lands held by assessee, engaged in buying / selling of immovable properties, during AY 2007-08, rejects assessee’s claim of exemption on the ground that land was agricultural land and falls under exclusion clause (iii) to Sec 2(14). [TS-360-ITAT-2016(Bang)]

Income Tax: ITAT in the given case held that the ‘upfront fee’ paid to Central Bank of India on loan taken from it is allowable as a deduction from the assessee’s income. ( DCIT, Mumbai Vs. M/s Videocon Industries Ltd.)

Income Tax: Income Computation and Disclosure Standards (ICDS) are to be applicable from 1.4.2016 i.e. previous year 2016-17 (AY 2017-18), postponed by one year.

Payment made to agencies for services of Toll collection would attract sec. 194C TDS and not sec. 194H TDS Deputy Commissioner of Income-tax, Circle-3(1), (TDS), Vijayawada v. Project Director, NHAI [2016] 71 taxmann.com 7 (Visakhapatnam – Trib.)

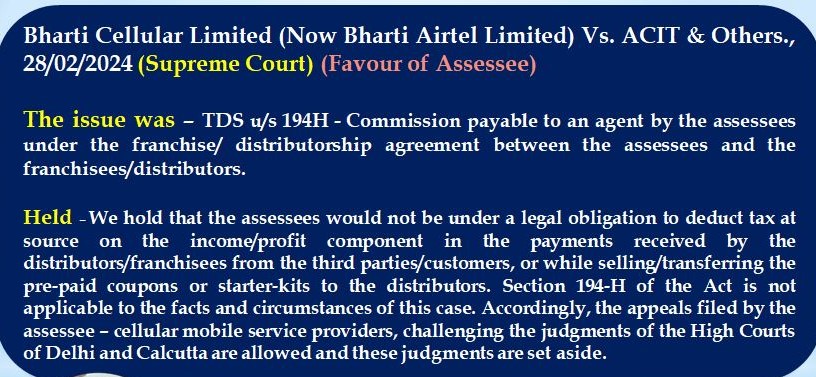

Commission payable to franchise/ distributionship is not require to deduct TDS u/s 194H -SC

INDIRECT TAX:

Vat & sales tax: Joint Commissioner has to decide VAT proceedings without any interference of other authority Tanuj Agency (P.) Ltd. v. State of Gujarat [2016] 71 taxmann.com 4 (Gujarat)

CENVAT : CENVAT Credit on Canteen Services and House Keeping/Cleaning Services availed in office building are admissible to Assessee when same was situated within licensed factory premises of Assessee.( M/S. Tata Steel Ltd. Vs. Commissioner Of Central Excise & Service Tax, Jamshedpur (Cestat Kolkata)

OTHER UPDATES:

COMPAT quashes CCI’s penalty order of Rs. 6.75 crores on India Trade Promotion Organisation India Trade Promotion Organisation v. Competition Commission of India , New Delhi [2016] 71 taxmann.com 71 (CAT – New Delhi)

Time period u/s 139 to comply with provisions of rotation, changed to 1st AGM held after 3yrs from commencement of Companies Act, 2013. Removal of Difficulties 3rd Order, 2016.

KEY DATES :

Submission of form 27C (TCS) received in the month of June: 07/07/2016

Payment of TDS for the month of June: 07/07/2016\

“The key to happiness is not that you never get angry, upset, frustrated, irritated or depressed it is actually, how fast you get out of it”

FOR FURTHER QUERIES CONTACT US:

E: info@caindelhiindia.com T:011-233-4-3333 , 9-555-555-480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.