Current Account Rules & Transactions to Avoid Scrutiny

Table of Contents

Current Account Rules & Transactions to Avoid Scrutiny

Applicability of Current Accounts : Current accounts are generally used by businesses, professionals, and entities for frequent and high-value transactions & No interest is paid on balances (unlike savings accounts). Subject to stricter Income Tax and RBI compliance checks because of large inflows/outflows. Following are the basic Key Income Tax & Regulatory Rules

- Cash Deposit/Withdrawal Limits : Cash deposits above ₹10 lakh in a FY across all current accounts of an entity are reported to the Income Tax Department through SFT (Specified Financial Transactions). & Large cash withdrawals may also be monitored, especially if exceeding ₹1 crore in a FY (TDS u/s 194N @2% applicable beyond this limit).

- PAN & KYC Requirement : Mandatory PAN quoting for transactions ≥ ₹50,000 (deposit/withdrawal) & Ensure proper KYC compliance with the bank.

- GST-Linked Transactions : If you are registered under GST, payments and receipts must match GST returns (GSTR-1, 3B) to avoid mismatch notices. Frequent high-value transactions without GST filing may invite scrutiny.

- Reporting Requirements : Banks report suspicious or unusual transactions to FIU (Financial Intelligence Unit). Frequent round-tripping (large deposits & withdrawals without business rationale) can trigger inquiry.

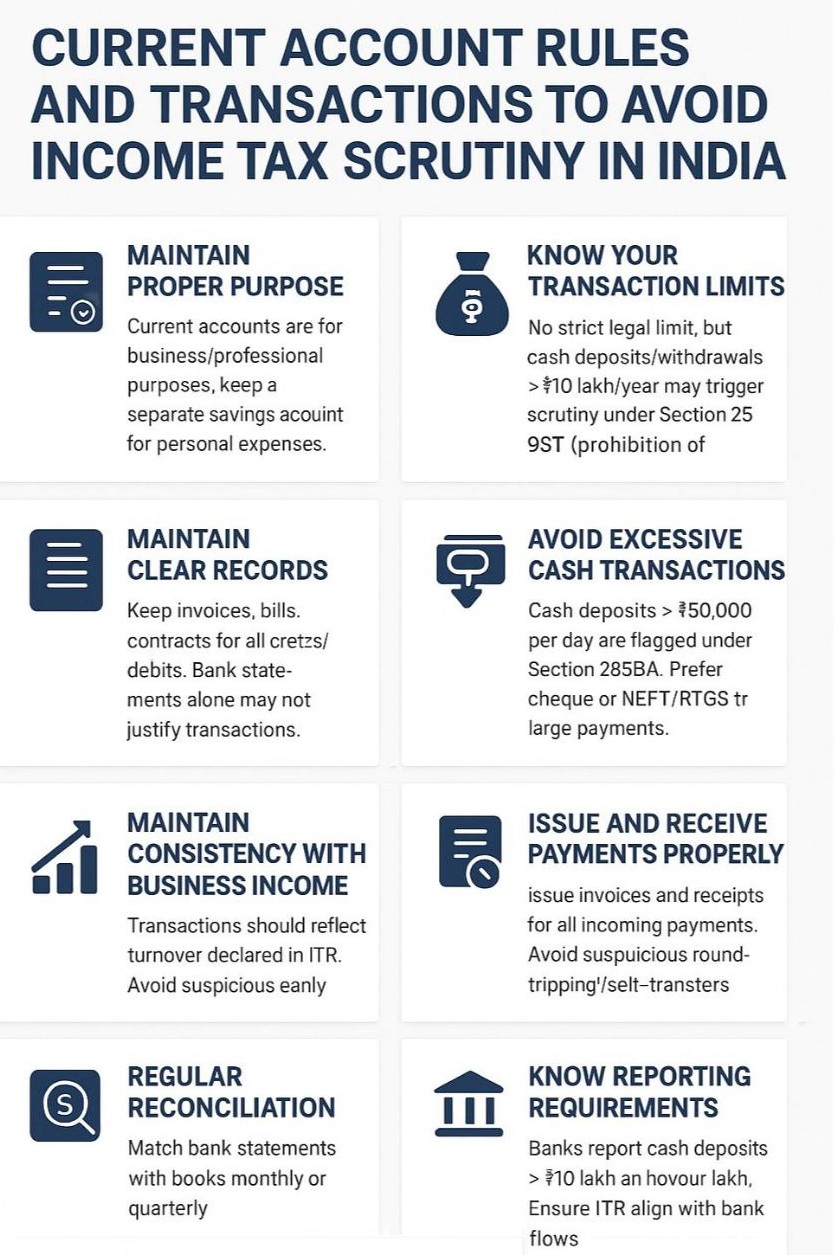

Current Account Rules & Transactions to Avoid Income Tax Scrutiny in India

- Maintain Proper Purpose: Taxpayer must Use current accounts strictly for business/professional use & Keep personal expenses in a separate savings account.

- Know Your Transaction Limits : No fixed legal limit, but Cash deposits/withdrawals > ₹10 lakh/year may trigger scrutiny under Section 269ST.

- Maintain Clear Records : Taxpayer must Keep invoices, bills, contracts for all credits/debits & Bank statements alone are not sufficient for justification.

- Avoid Excessive Cash Transactions : Cash deposits > ₹50,000/day are flagged under Section 285BA & Prefer cheques, NEFT, RTGS for large payments.

- Maintain Consistency with Business Income : Taxpayer must Ensure transactions match turnover declared in ITR & Avoid suspiciously early or large inflows without justification.

- Issue and Receive Payments Properly : Taxpayer must Always issue invoices and receipts for incoming payments & Avoid round-tripping or self-transfers that appear suspicious.

- Regular Reconciliation : Reconcile bank statements with books monthly or quarterly.

- Know Reporting Requirements :Banks report Cash deposits > ₹10 lakh/year. Taxpayer must ensure your ITR aligns with bank flows to avoid mismatches.

Transactions to Avoid to Stay Tax-Compliant

- Cash-Heavy Transactions: Taxpayer should Avoid depositing or withdrawing large amounts of cash without proper documentation & Keep invoices, bills, or contracts ready to explain the source/use.

- Benami Transactions: Don’t use the account to park money for third parties (relatives, friends, clients) & Benami Act violations can lead to severe penalties.

- Unexplained High-Value Credits : Sudden large deposits (especially from unrelated parties) without invoices/contracts may attract scrutiny under Section 68 (unexplained cash credit).

- Splitting Transactions: Artificially splitting transactions to stay below reporting thresholds (e.g., multiple ₹9.9 lakh deposits) can still be flagged by banks.

- Mismatch with ITR & GST : Ensure turnover in the current account matches income declared in ITR and sales declared in GST. Any mismatch is a red flag.

- Cash Payments Beyond Limits: Don’t make business cash payments > ₹10,000 to a single person in a day (Sec 40A(3)) — such expenses are disallowed in income tax.

Best Practices related to Current Account Rules & Transactions:

- Route all business transactions through the current account.

- Keep proper invoice trail for every large credit or debit.

- Use digital modes (NEFT/RTGS/UPI/IMPS/cheques) instead of cash.

- Reconcile current account statements with Books of Accounts regularly.

- File accurate ITR & GST on time to ensure figures match.

In Summary Rules related to Current Account Rules & Transactions

- Cash transactions, unexplained deposits, and mismatch with tax returns are the top triggers for scrutiny.

- Always maintain proper documentation & reconciliation for current account activities.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.