Decide whether New-Tax Regime vs Old Tax Regime beneficial

Table of Contents

Tax Saving under Old vs New Tax Regime

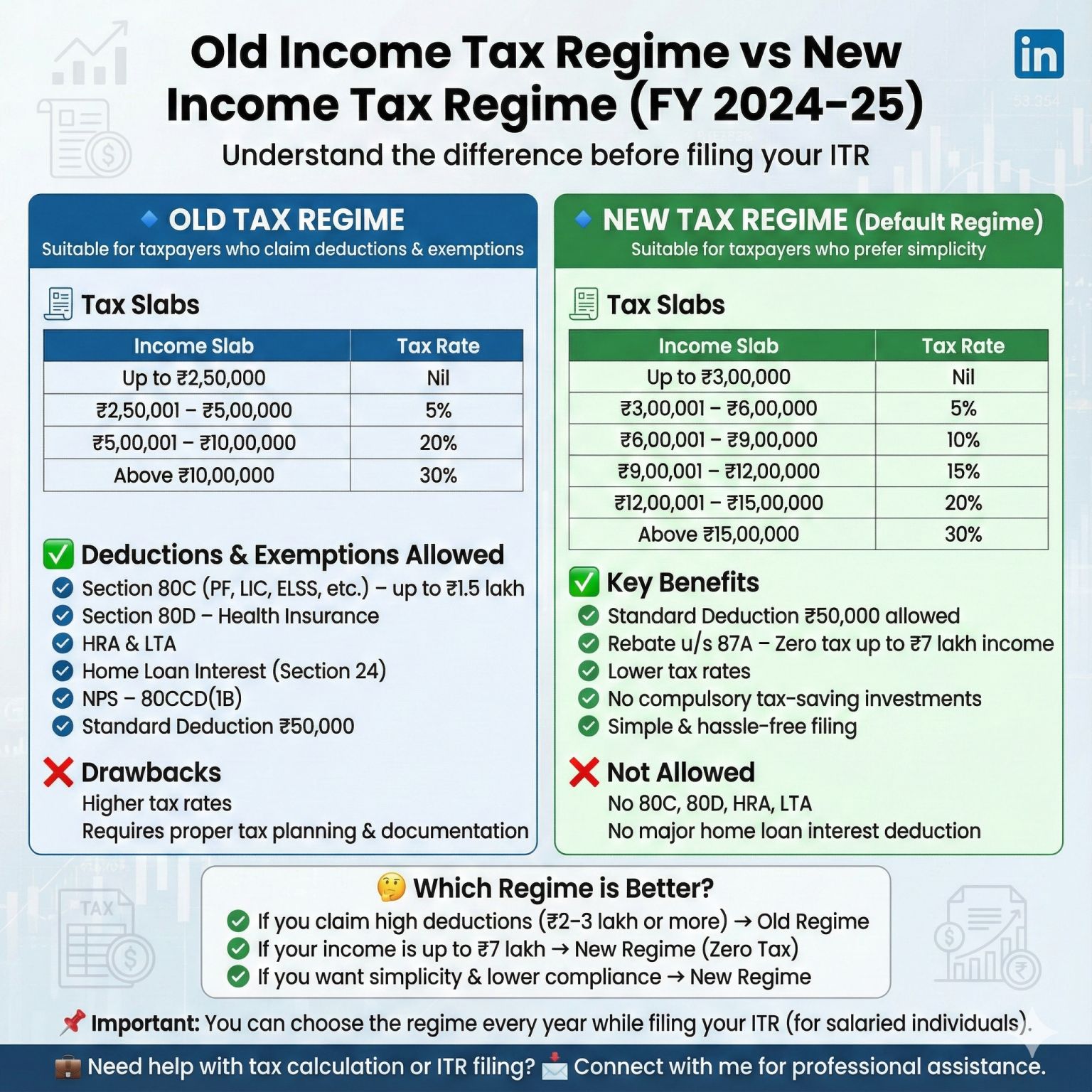

Deciding between new & old tax regimes is based on a comparison of total benefits of different tax slab rates & deductions available to you under both tax regimes. To make things easier, we’ve compared old & new tax systems based on a variety of criteria in sections below.

Old Tax Regime: Offers a wide range of deductions & exemptions, including Section 80C (investments), 80D (medical insurance), & others, making it beneficial for those who can utilize these deductions.

Advantages: Allows for deductions under various sections like 80C, 80D, 24(b), etc., which can significantly reduce taxable income. Promotes long-term wealth growth through tax-saving investments.

Disadvantages: Requires managing and documenting multiple deductions and exemptions. The tax-free limit is Rs. 5 lakhs, which is lower than in the new regime.

New Tax Regime: Simpler with fewer deductions, but offers a higher rebate limit u/s 87A & includes standard deductions for salaried individuals, making it attractive for those who prefer simplicity or do not have significant deductions. This comparative summary should help in deciding which tax regime suits an individual’s financial situation better for the Assessment Year 2024-25 (FY 2023-24).

Advantages: No need to manage multiple deductions and exemptions. Increased from Rs. 5 lakhs to Rs. 7 lakhs. Reduced rates for various income slabs.

Disadvantages: Most deductions under sections like 80C, 10(10D), HRA, LTA, etc., are not available. For incomes above Rs. 15 lakhs, the tax liability might be higher compared to the old regime.

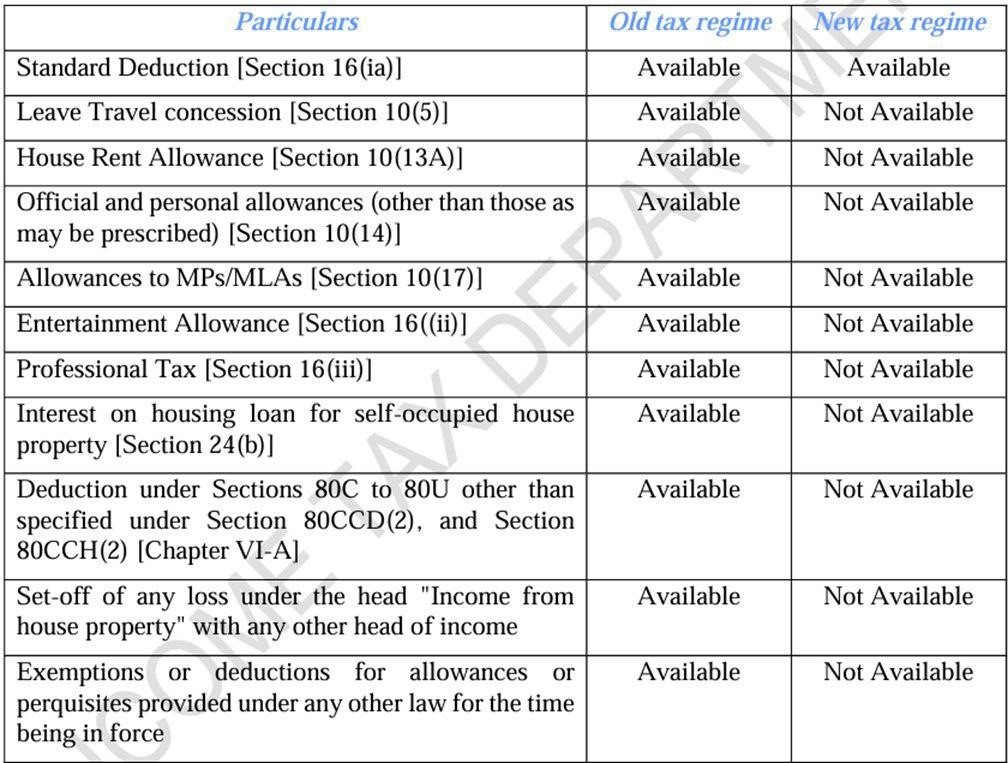

Comparison of Income Tax Deductions/Exemptions

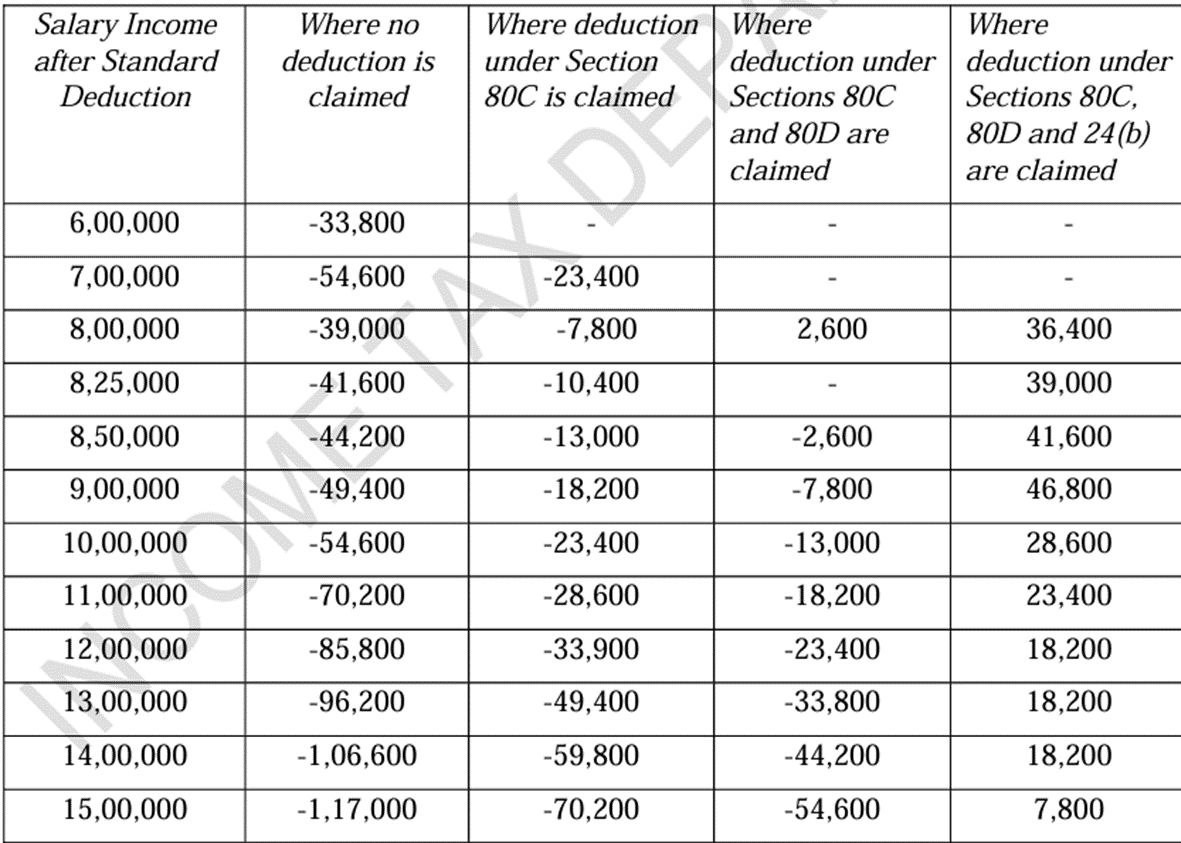

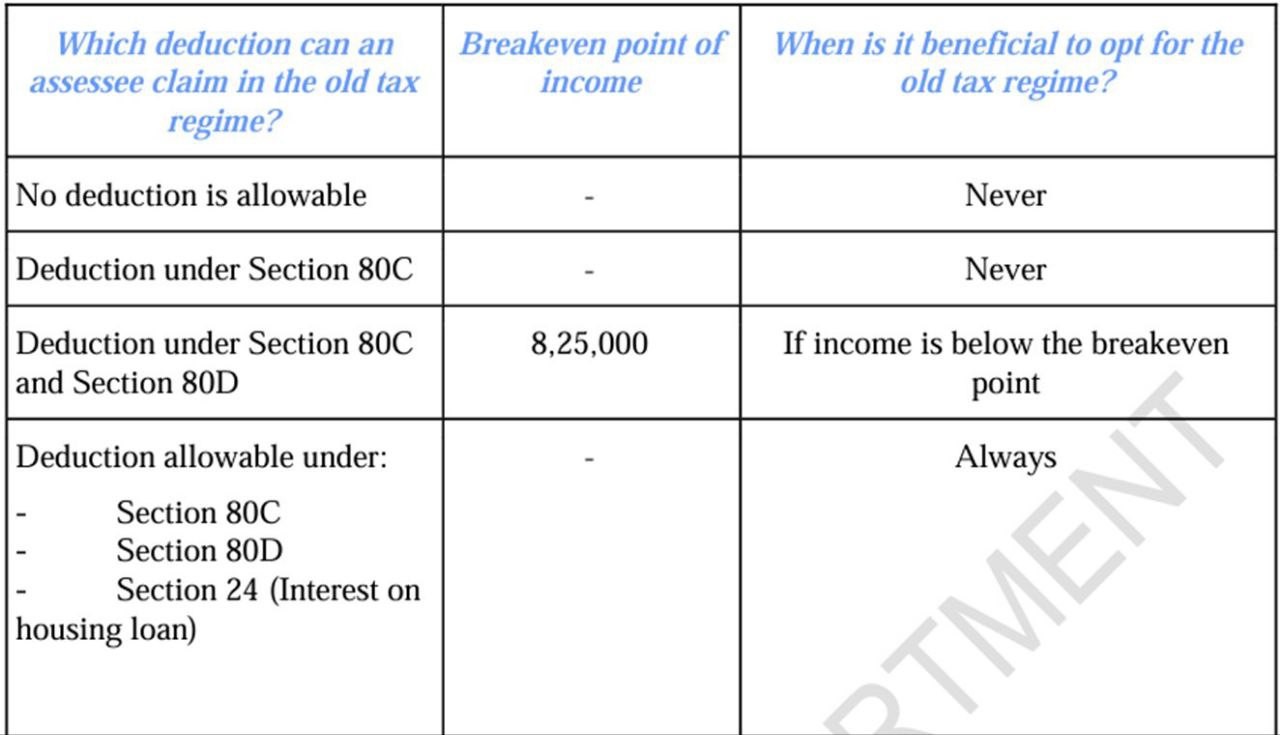

How to Decide whether New Tax Regime or Old Tax Regime is beneficial.

The decision between the old and new tax regimes for FY 2023-24 is nuanced and highly dependent on individual circumstances. Here are some key considerations and detailed analysis to help in making an informed choice:

- The new tax regime offers lower tax rates for most income brackets but removes many exemptions and deductions. It’s simpler but may not always be financially advantageous.

- Old tax regime provides multiple deductions and exemptions, which can significantly reduce taxable income for those who make use of these provisions.

- The new tax regime offers a higher tax-free limit of Rs. 7 lakhs compared to Rs. 5 lakhs in the old regime.

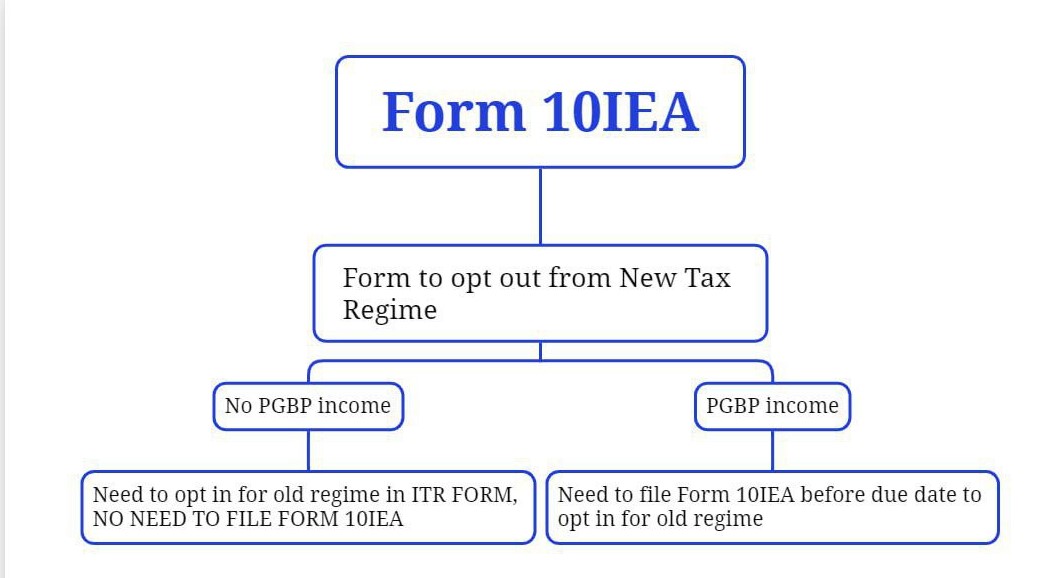

Form 10-IEA: Option to Choose Old Tax Regime

Conclusion:

Neither tax regime is universally better. The ideal choice depends on your specific financial situation, including income level, investment habits, and ability to claim deductions. Use online tax calculators to compare tax liabilities under both regimes. Assess the value of deductions you are eligible for and how they impact your taxable income. Factor in how each regime aligns with your long-term financial goals, including savings and investments.

By thoroughly evaluating these aspects, you can make a well-informed decision that maximizes your tax savings and aligns with your financial objectives. Always calculate tax under both regimes before filing your ITR and choose the one with lower tax liability. Need help with tax calculation or ITR filing?

Feel free to connect with us.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.