Difference CA vs MBA Professional Examinations & pattern

Table of Contents

Difference CA vs MBA Professional Examinations & pattern

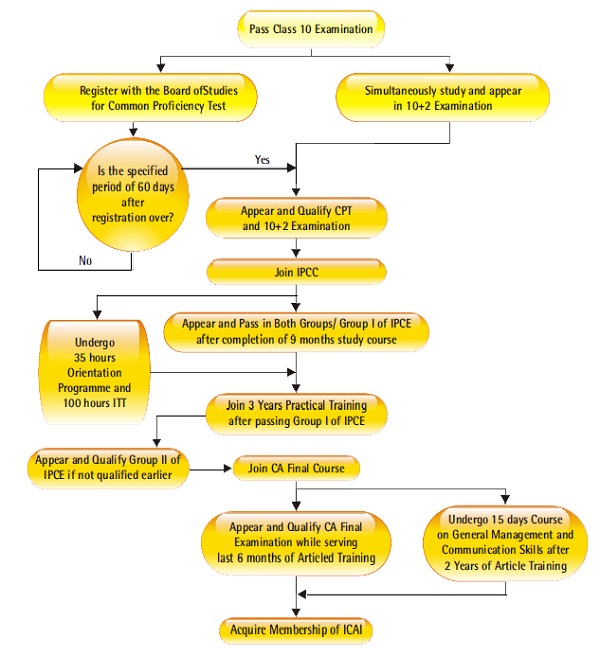

Introduction – This is part of a discussion a fellow Chartered Accountant is having with regard to the changes our community (read Chartered Accountants and Chartered Accountants students) wants from the new Central Council and Regional Council for the betterment of the Chartered Accountants course. I put forward here my views regarding the changes required in the syllabus.Changes required – The first and foremost change that needs to be done, a thing which was necessary for the last two decades, is a proper change in the syllabus. That has never been done. Unfortunately. Not just a change for the heck of it.

- Abolish the MCQ pattern of exams – Not MCQ. Abolish the MCQ pattern of questions at every stage of the Chartered Accountants exams right from Foundation, IPCC to the Final exams and they may or may not be in touch the subject.

- Case studies. Adopt the case study method of learning. Introduce the case study method of teaching. Something which qualified Chartered Accountants don’t know. but now a days ca course has been incorporated case studies in there patterns?

- Make case studies a compulsory 20-mark question in all papers. In every exam. You want quality. All of us want quality among Chartered Accountants who qualify. And we will get quality.

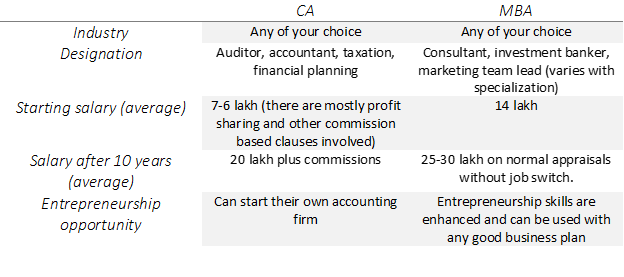

- Many of us in our community refer to the highly paid MBAs. we knon few a full time MBA faculty at some very good b-schools for a decade at Mumbai and Delhi NCR. And we are telling this from there experience & placements.

- In a recent MCS class of mine someone was asking. why do the MBAs earn more than CA? A very important question for us. And time to sit down and find the answers.

- Industry pattern on salary packages of CA & MBA are mention here under :

- We still believe the Chartered Accountants final examination to be the most difficult exam I ever had.

Examinations & pattern Chartered Accountants (CA) vs MBA

| Particulars | MBA | Chartered Accountants |

| Investment | It is Highly expensive if you are planning to do it from Top Business-Schools like IIMs, XLRI etc., | No so expensive, Overall amount invested in a Chartered Accountants certification is less as compared to an MBA degree. |

| Pass % | Easy & 90-95% of student who opt for MBA end up getting good jobs. | only 3-5% of candidates are able to qualify and get certified as Chartered Accountants Out of 100, |

| Career options | Wider options are available. | Nero options, For a qualified Chartered Accountants, ample options are not available. Only few options available. |

| Exposure | Only internship ranging from 3-6 months required | Three years Articleship required + other training |

| Difficulty Level | (80% of candidates crack the exam and pass) Moderate to Difficult | Tough |

- It’s entirely up to you and the field you want to work in. A CA’s scope of work is mostly in the areas of finance and accounting, but MBAs have a wider range of options. There have been CAs and MBAs who have risen up the ranks to higher positions, albeit in some fields, like as investment banking, financial consulting, or mergers and acquisitions, an MBA would be preferred above a CA.

- There have been cases where CAs have picked up new abilities on the job and handled more responsibility than someone with an MBA. CA professionals may also apply to overseas MBA programmes in the hopes of pursuing a global career. we can conclusion up that a lot depends on the related responsibilities, the nature of your job, and learning involved.

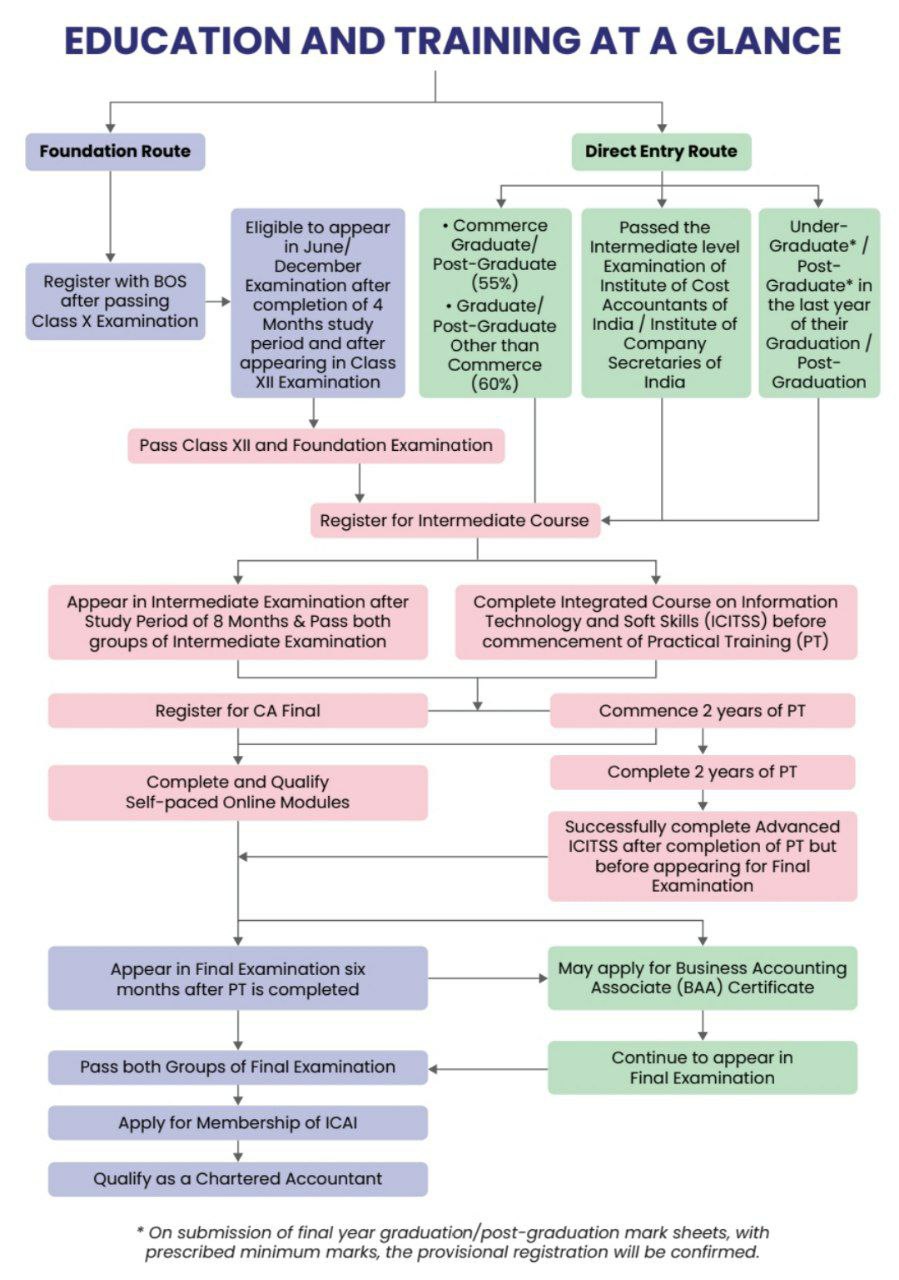

New Training Guide for student of ICAI

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.