DUBAI TAXATION SYSTEM 2025 -Business Must Understand

Table of Contents

UAE Corporate Tax Reform 2025: What Every Business Must Understand

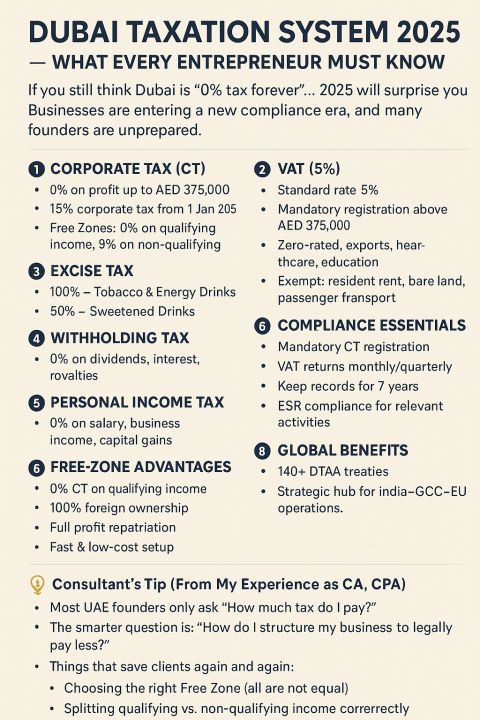

If you still think Dubai is “0% tax forever” 2025 will surprise you. The UAE has officially moved into a new compliance era, and many founders are still unprepared. Here’s the crystal-clear breakdown every CA, CFO, consultant, and global entrepreneur must understand:

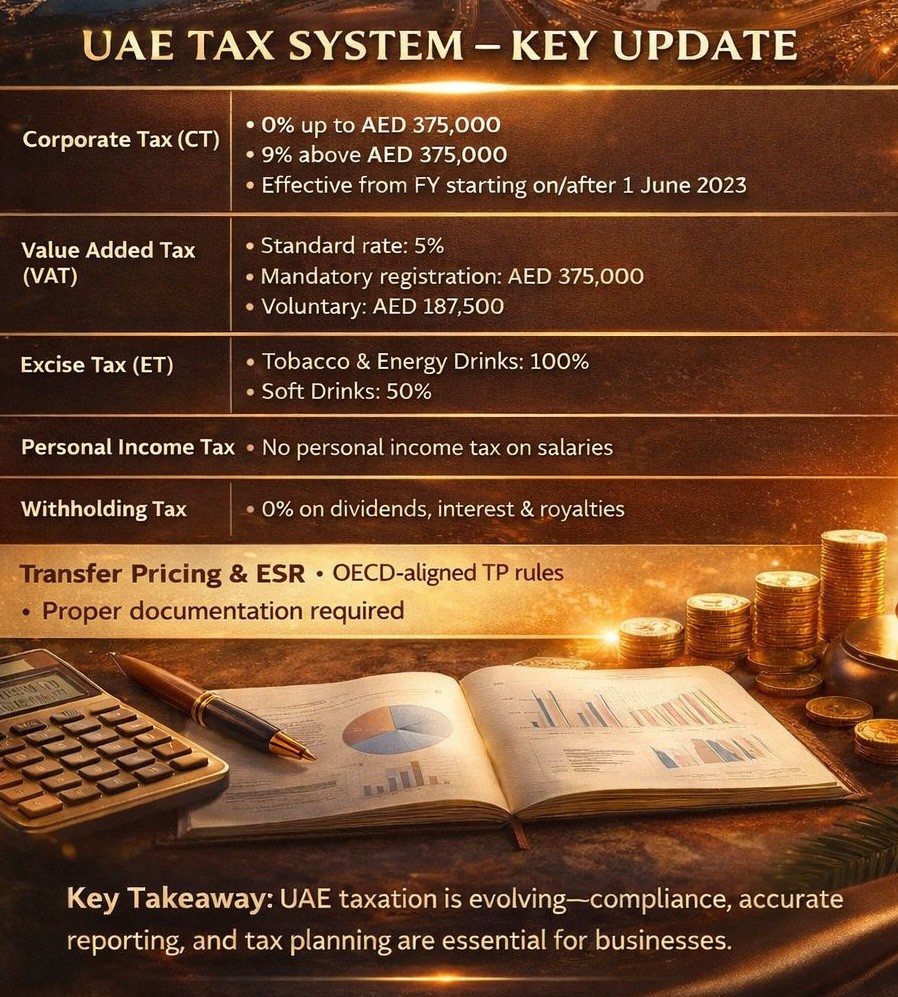

CORPORATE TAX (CT)

- 0% on profit up to AED 375,000

- 15% Corporate Tax applicable from 1 Jan 2025

- Free Zones:

- 0% on qualifying income

- 15% on non-qualifying income

VAT (5%)

- Standard VAT rate: 5%

- Mandatory registration above AED 375,000 turnover

- Zero-rated: exports, healthcare, education

- Exempt: residential rent, bare land, local passenger transport

EXCISE TAX

- 100% – Tobacco, vaping products & energy drinks

- 50% – Sweetened beverages

WITHHOLDING TAX

- 0% on dividends, interest, royalties, management fees

- No withholding on cross-border payments (subject to anti-abuse rules)

PERSONAL INCOME TAX

- 0% on salary income

- 0% on business profits

- 0% on capital gains, interest, dividends

- UAE remains a tax-free jurisdiction for individuals

FREE-ZONE ADVANTAGES

- 0% CT on “Qualifying Income”

- 100% foreign ownership

- Full repatriation of profits

- Fast, low-cost setup and simplified regulations

- Ideal for holding companies, service companies & international trading

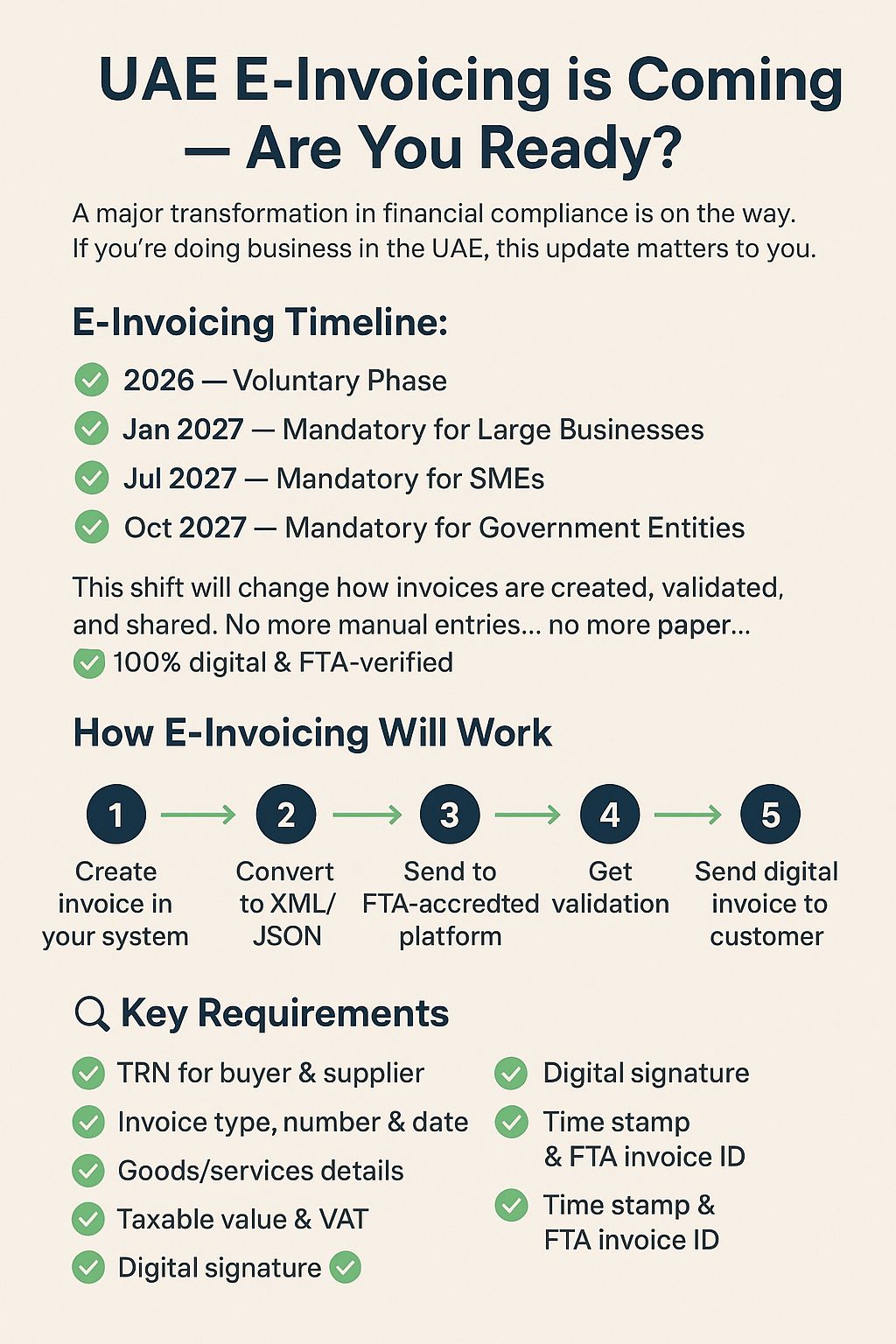

UAE E-Invoicing Is Coming

The UAE is entering a new era of digital tax compliance. If you operate in the UAE, this is one of the biggest regulatory shifts you must prepare for E-Invoicing Rollout Timeline

| Phase | Date | Applicability |

|---|---|---|

| Voluntary Phase | 2026 | All businesses (optional) |

| Mandatory Phase 1 | Jan 2027 | Large Businesses (threshold to be announced) |

| Mandatory Phase 2 | Jul 2027 | SMEs |

| Mandatory Phase 3 | Oct 2027 | Government & Public Sector Entities |

By the end of 2027, every taxable business in the UAE will be required to issue fully digital, FTA-validated e-invoices.

How UAE E-Invoicing Will Work

A fully automated, real-time, FTA-verified process: Generate the invoice in your ERP/accounting software, then convert into structured data (XML / JSON), then transmit it to an FTA-accredited e-invoicing platform. After that, the platform sends the invoice to the FTA for validation. The taxpayer completes FTA return, receives a validated invoice with a unique invoice code & Deliver the final digital invoice to the customer. Paper or PDF invoices will no longer be compliant on their own.

- Mandatory E-Invoice Fields : To be accepted by the FTA, each invoice must include:

- Business Identifiers : TRN of supplier, & TRN of buyer (if registered)

- Document Information like Invoice type (standard, simplified, credit/debit note), Invoice number & date, & Currency, VAT rate, and VAT amount

- Transaction Details like Description of goods/services, Quantity, unit price, discounts & Taxable value & VAT breakdown

- FTA Validation Data : FTA-generated invoice ID, Time-stamp (verified), Digital signature (mandatory)

These requirements ensure auditability, authenticity, and end-to-end traceability.

What Does This Mean for Your Business?

You will need to Upgrade ERP/accounting systems for e-invoicing and ensure API integrations with FTA-accredited platforms , Digitally sign all invoices, Train finance, accounts, and billing teams & maintain secure storage for e-invoice archives. Businesses that act early will avoid disruption, penalties, and compliance risks.

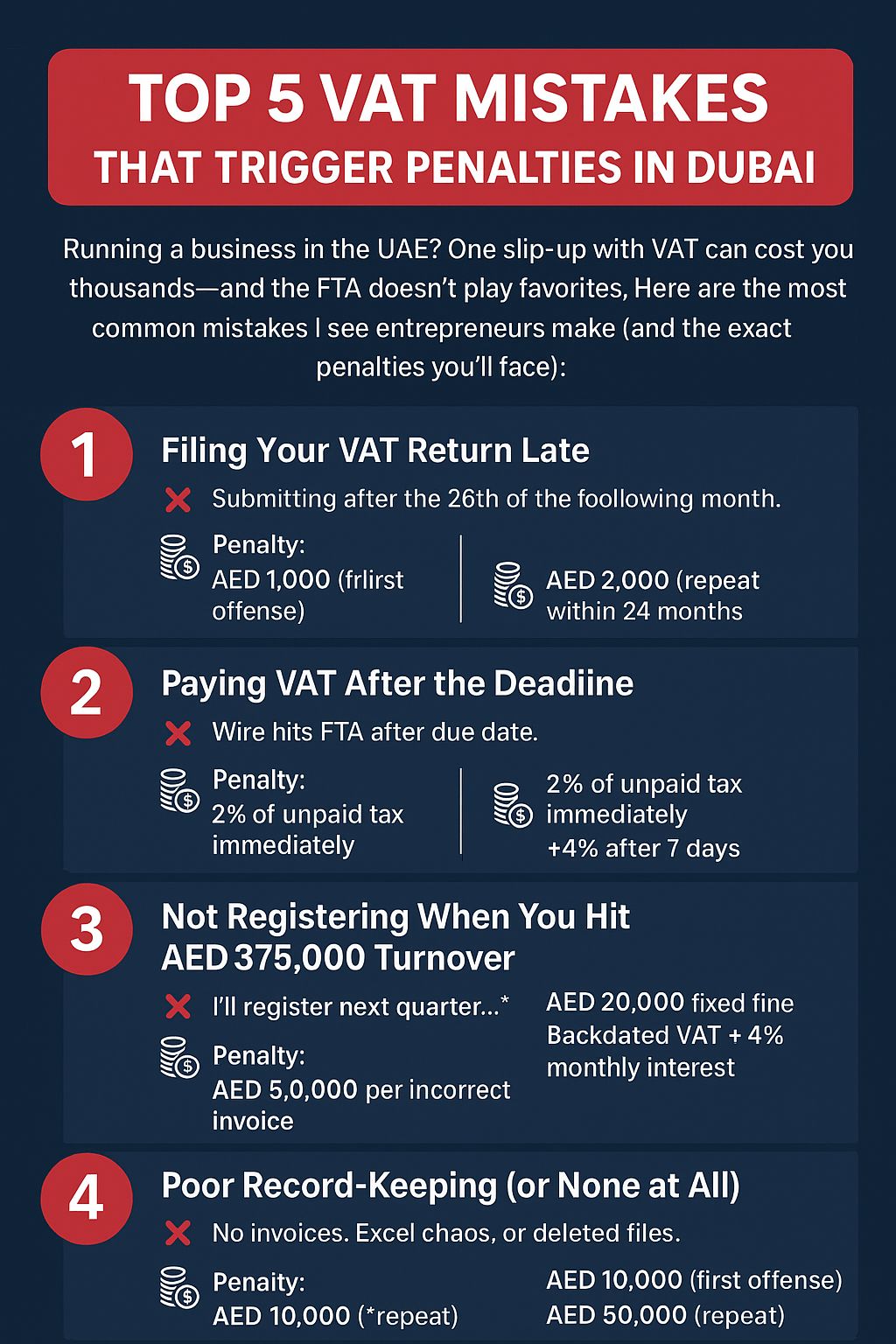

Top 5 VAT Mistakes That Trigger Heavy Penalties in Dubai

Running a business in the UAE? VAT compliance is non-negotiable. Even a small slip can cost you thousands of dirhams—and the Federal Tax Authority (FTA) enforces penalties strictly. Here are the top mistakes entrepreneurs keep making in 2025 and the exact fines you’ll face:

Filing VAT Returns Late

Mistake: Missing the filing deadline (usually the 28th of the following tax period). Penalty:

-

AED 1,000 for the first delay

-

AED 2,000 if repeated within 24 months

Paying VAT After the Deadline

Mistake: VAT return filed but payment reaches FTA late. Penalty:

-

2% of unpaid tax immediately

-

+4% after 7 days

-

Up to 300% for prolonged non-payment

Late VAT Registration (Crossing AED 375,000 Threshold)

Mistake: “We’ll register next quarter…” even after exceeding the mandatory limit. Penalty:

-

AED 20,000 fixed fine

-

Backdated VAT + 4% monthly interest

Incorrect or Non-Compliant Tax Invoices

Mistake: Missing TRN, wrong VAT rate, fake supplier details, or incorrect formatting. Penalty:

-

AED 5,000 per incorrect invoice

-

Up to AED 50,000 maximum per audit cycle

Poor VAT Record-Keeping

Mistake: Missing invoices, messy Excel files, or deleting/losing records. Penalty:

-

AED 10,000 (first offense)

-

AED 50,000 (repeat offense)

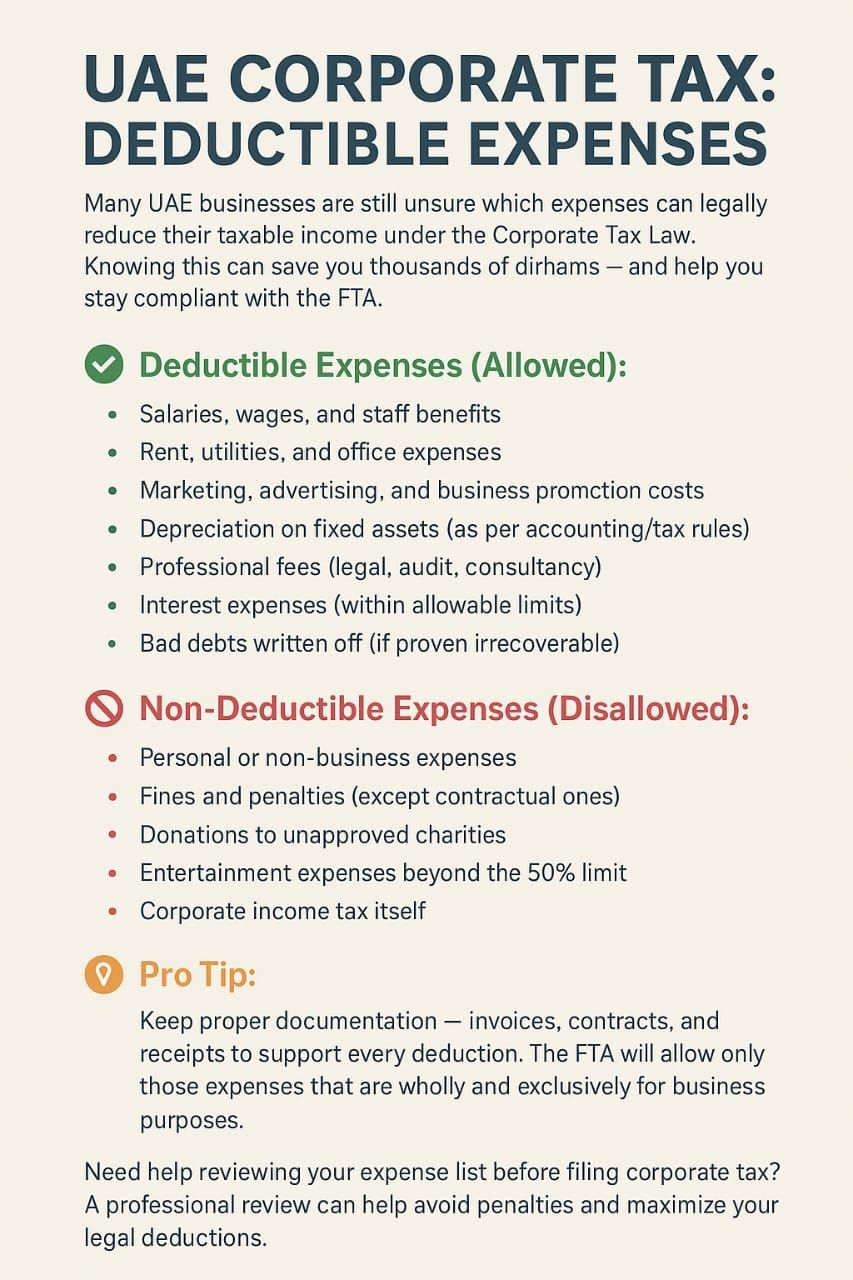

UAE Corporate Tax: Deductible vs. Non-Deductible Expenses

Many UAE businesses are still unsure about which expenses can be legally claimed to reduce taxable income under the Corporate Tax Law. Understanding this can help you save thousands of dirhams and ensure full compliance with the FTA.

Deductible Expenses (Allowed) :

These expenses are generally allowed if they are wholly and exclusively for business purposes:

- Salaries, wages, and employee benefits

- Rent, utilities, and office operating expenses

- Marketing, advertising & promotional costs

- Depreciation/amortization on fixed assets (as per accounting/tax rules)

- Professional and consultancy fees (legal, audit, advisory, etc.)

- Interest expenses (within the thin capitalization/interest deduction limits)

- Bad debts written off, if recovery efforts are documented and reasonable

Non-Deductible Expenses (Not Allowed) :

These expenses cannot be claimed as deductions:

- Personal or non-business expenses

- Fines and penalties, except those arising from contractual breaches

- Donations to entities not approved by the UAE MoF/FTA

- Entertainment expenses exceeding the 50% allowable limit

- Corporate Income Tax paid or payable

- Capital expenditure that is not depreciated/amortized as per rules

Bad Debt Relief Under UAE VAT – What Every Business Must Know

Cash flow challenges are common in every business. When customers delay payments or fail to settle invoices entirely, the VAT you already paid to the FTA becomes an added burden. The good news: UAE VAT law allows Bad Debt Relief, enabling you to recover VAT paid on supplies that remain unpaid — but only if specific conditions are met. following are Conditions to claim bad debt relief (Article 64, UAE VAT Law). You can recover VAT on bad debts if all of the following are satisfied:

1. VAT was charged and paid to the FTA

You must have already included the output VAT in your VAT return and paid it.

2. The debt is written off in your accounting records

The invoice must be recorded as irrecoverable (fully or partially) in your books.

3. At least 6 months have passed since the date of supply

The debt must be overdue for a minimum of 6 months.

4. The customer is notified of the write-off

You must formally inform your customer that the amount has been written off. Only when these four conditions are met can you adjust your output VAT and claim the relief.

Keep a bad debt tracker within your accounting system to monitor overdue invoices, notification dates, and eligibility timelines. This makes audits easier and ensures you never miss a legitimate VAT recovery.

UAE taxation is changing fast.

Understanding corporate tax, VAT, and compliance rules is no longer optional—it’s essential for businesses to avoid risks and plan better. Right knowledge + right timing = smarter decisions.

GLOBAL BENEFITS OF UAE STRUCTURING

- 140+ Double Tax Avoidance Treaties (DTAA)

- Strategic hub linking India–GCC–EU–Africa

- World-class banking, logistics & corporate ecosystem

COMPLIANCE ESSENTIALS (Non-Negligible in 2025)

- Corporate Tax registration is mandatory for all businesses

- VAT returns: monthly or quarterly

- Maintain accounting records for 7 years

- ESR compliance for relevant activities

- Transfer Pricing documentation required for many businesses

- Annual Audited Financial Statements now compulsory for Free Zone CT benefits

- Maintain proper documentation—invoices, agreements, receipts, board approvals, and proof of business purpose. The FTA allows deductions only when expenses are clearly supported and linked to taxable business activities.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.