FAQ’s on GST Annual Return Form GSTR-9 & GSTR-9C

Table of Contents

GSTR-9 & GSTR-9C for FY 2024-25 Made Simple

The GSTN has released updated FAQs and enhanced system features for filing GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) for Fiancial Year 2024-25. This year introduces major improvements in auto-population, ITC reporting logic, import treatment, and reconciliation formats, making compliance more data-driven and tightly linked to GSTR-2B.

Below is a simplified Key Highlights GST taxpayer must Know, practitioner-friendly summary of all major changes in Filing Enabled Only After GSTR-1 & GSTR-3B.

- GSTR-9/9C will become available only after filing all GSTR-1 and GSTR-3B for FY 2024-25. No partial filing or system override is possible.

- Table 8A Completely Overhauled : Table 8A will now include all ITC invoices of FY 2024-25 appearing in GSTR-2B from April 2024 to October 2025, including late-reported invoices. This reduces disputes where suppliers filed late, but ITC reflected correctly in 2B of the extended period.

- New Table 6A1 Introduced : A new reporting requirement under Table 6A1 – ITC of Fiancial Year 2023-24 claimed in Fiancial Year 2024-25 This helps the system segregate prior-year ITC from current-year ITC, improving accuracy in 2B-based validations.

- Clear Rules for Reclaimed ITC (Rule 37 & Rule 37A) : Any ITC reversed earlier and reclaimed in Fiancial Year 2024-25 must be reported. Always in Table 6H which is Regardless of the original year of reversal. This applies to Rule 37 reversals (non-payment to vendors) & Rule 37A reversals (supplier not filing GSTR-3B) also Payment-based reversals that are reclaimed later

- GSTR-1A Impact Auto-Captured : Invoices/amendments added via GSTR-1A will now auto-populate in Table 4 (Outward Supplies) & Table 5 (Zero-rated/Exempted/Non-GST). Reduces manual adjustments and mismatch errors.

- New Table for Import ITC Claimed Next Year : Table 8H1 – Import ITC of FY 2024-25 claimed in Fiancial Year 2025-26. This captures late-claimed import IGST credit and corrects earlier disclosure inconsistencies.

- Table 8B Now Linked Only to Table 6B : Table 8B will now be matched only with Table 6B (ITC on inward supplies). Earlier it matched 6B + 6H, creating confusion. This change simplifies validation and prevents mismatches involving reclaimed ITC.

- Table 8C Applies Only to Current-Year Missed ITC : Table 8C will include only Fiancial Year 2024-25 ITC missed earlier and claimed first time in Fiancial Year 2025-26. This resolves past issues where reclaim entries were incorrectly captured.

- Late Fee Under Section 47(2) for BOTH GSTR-9 & 9C : For the first time Late fee applies to GSTR-9, Late fee applies to GSTR-9C, System will auto-compute late fee based on actual filing date. This makes timely filing essential for avoiding penalties.

- HSN Reporting Simplified : GSTN will provide downloadable HSN summary sheets, reducing manual errors and easing reconciliation between outward and inward HSN data.

What This Means for Your FY 2024-25 Annual Return

- The direction is clear More automation, more 2B-dependence, stricter reclaimed-ITC rules, and fewer manual overrides. For taxpayers and consultants, this means Start monthly 2B vs books reconciliation early, Track Rule 37 / 37A reversals and reclaims carefully, Ensure vendors file GSTR-1 and 3B on time, Maintain accurate import IGST documentation, Update internal checklists and workflows for the new tables.

- FY 2024-25 is the most structured, system-integrated year of annual return filing so far. A proactive approach to ITC tracking and supplier compliance will ensure a smooth, mismatch-free GSTR-9 and 9C filing season.

Frequently Asked Questions about Form GSTR-9C by Taxpayers

What are the system requirements for GSTR-9C filing?

- The following are the system requirements for submitting Form GSTR-9C:

- The Windows Operating System must be version 7 or higher.

- Microsoft Excel should be version 2007 or higher.

- Internet Explorer must be version 10 or higher.

- Java should be version 1.6 or higher.

- Use the Form’s most recent offline functionality.

Is there a deadline for filing GSTR-9C, and should Forms GSTR-9 and GSTR-9C be filed separately?

- GSTR-9C must be filed with the Annual Return GSTR-9, according to Section 44(2). In addition, according to Section 44(1), the Annual Return must be filed on or before the 31st December after the end of the financial year for which it is prepared.

- As a result, the GSTR-9C filing deadline is on or before December 31st following the end of the financial year for which the return is prepared.

What papers must be attached to Form GSTR-9C?

- Along with Form GSTR-9C, the following documents must be enclosed: A copy of the financial accounts that have been audited in accordance with Section 35 (5) If the entity’s audit is conducted under a statute other than the GST Act, a copy of the audit report is required.

How do I make a JSON file for Form GSTR-9C?

- Here’s a step-by-step guide to utilising the offline tool to prepare Form GSTR-9C and generate the JSON file.

Is it possible to amend GSTR-9C?

- There is currently no way to modify Form GSTR-9C. As a result, taxpayers are urged to use extreme caution when filling out Form GSTR-9C and filing it.

Can an entity’s internal auditor certify Form GSTR-9C?

- No, according to the ICAI’s instructions, an internal auditor cannot certify Form GSTR-9C.

Should Form GSTR-9C be filed for each registration under the same PAN, state by state?

- Yes, Form GSTR-9C must be filed for each state’s registration. Every registered GSTIN with the same PAN is required to have its accounts audited and file Form GSTR-9C once the PAN-based aggregate turnover exceeds Rs.2 crore.

Is it necessary for a CA to be registered as a GST practitioner in order to certify Form GSTR-9C?

- A GST practitioner does not have the authority to audit under section 35 of the GST Act (5). It can only be obtained by Chartered Accountants or Cost Accountants.

- As a result, a CA does not need to be a GST Practitioner to certify Form GSTR-9C.

What is the best way for an auditor to provide his or her Membership No?

- Auditors should avoid using the prefix “0” in their membership numbers. If the membership number is ‘020,’ the auditor should put ‘20′ in the membership number field rather than ‘020.’

Can GSTR-9C is to be filed without filing Annual GST Return (GSTR-9)?

- No, the GSTR-9C can be filed only after filing of GSTR-9.

Which fields are auto-populated from GSTR-9 in Form GSTR-9C?

- Given Below are the fields which will be auto-populated:

- The turnover details as per GSTR-9

- Liability as per GSTR-9

- Total tax paid as mentioned GSTR-9

- Input Tax Credit availed in GSTR-9

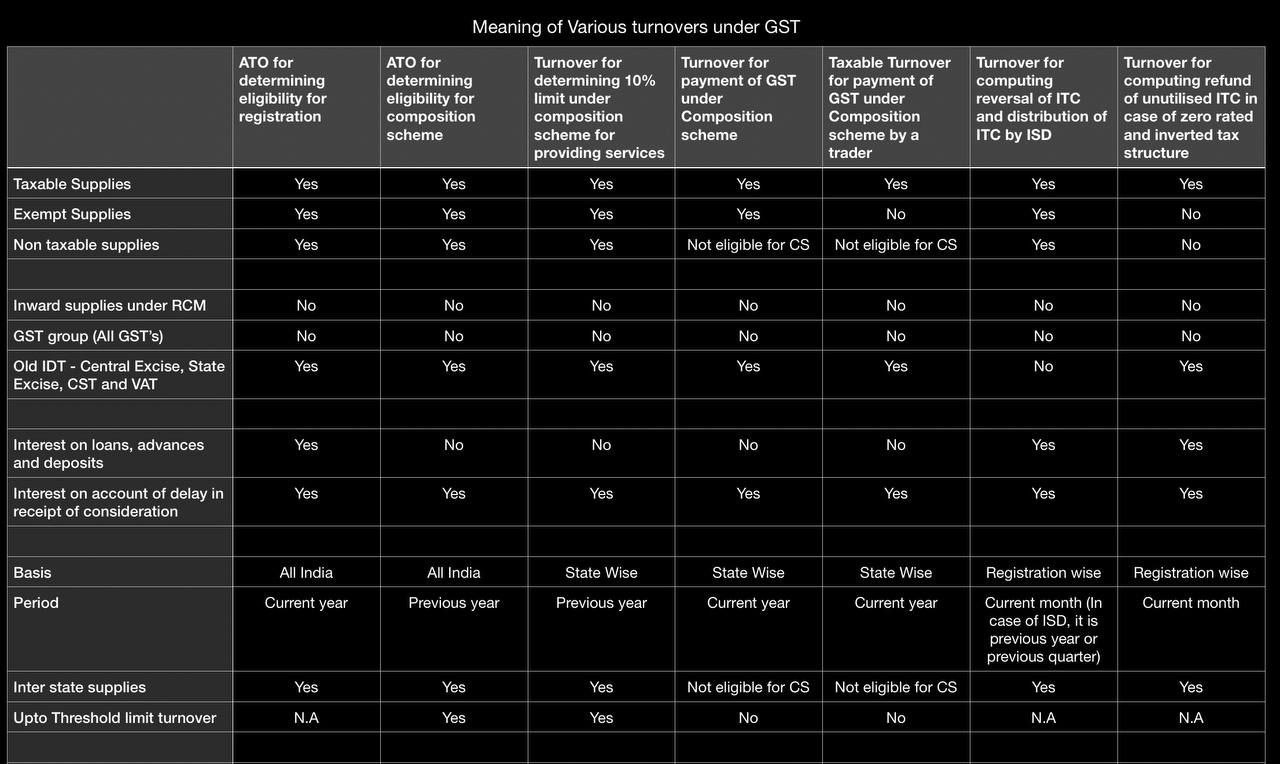

Is stock transfers/cross charges between branches in different states included in total turnover?

- The phrase aggregate turnover, as defined in Section 2(6) of the CGST/SGST Act, includes inter-state supplies of persons with the same PAN.

- As a result, a stock transfer from one state’s branch to another state’s branch will be included in the turnover of the branch delivering goods/services.

When determining the threshold limits, does aggregate turnover include stock transfers/cross charges between branches in the same state?

- Stock transfers not included in aggregate turnover for determining the threshold limit if both branches have the same GSTIN: If both branches have the same GSTIN, such stock transfers will not be included in the aggregate turnover for ascertaining the threshold limit.

- Branches with different GSTINs: If the GSTINs of both branches differ, stock transfers will be included in the aggregate turnover for computing the threshold limit.

Is the supply of alcohol for human use considered while determining a registered person’s threshold limit of Rs. 2 crores?

- Exempt turnover is included in aggregate turnover. Exempt turnover, as defined by the CGST Act, is any supply of goods or services, or both, that attracts a zero-rate of tax or is fully exempt from tax under section 11 or section 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supplies.

- A non-taxable supply is one that is not subject to tax under either the CGST Act or the IGST Act. Alcoholic liquor for human consumption is specifically exempt from the levy/charge of GST under Section 9(1) of the CGST/SGST Act and Sections 7(1) and 5(1) of the UTGST and IGST Act.

- As a result of a combined reading of all the sections, it may be deduced that alcoholic liquor for human use is exempt turnover, and because exempt turnover is part of the aggregate turnover, it should be included in computing the Rs.2 crores threshold limit.

Is a registered person who only deals in exempted supply worth more than Rs.2 crore obliged to submit GSTR-9C?

- Yes, because exempted supply are included in the definition of aggregate turnover.

What are the penalties for failing to file an annual return and having your accounts audited?

- If a taxpayer unable to file both the Annual Return and Form GSTR-9C, he will be charged a fee of Rs.200/- per day that the default continues (Rs. 100 under the CGST law + Rs. 100 under the State / Union Territory GST law)*.50 percent (0.25 percent under the CGST Law + 0.25 percent under the SGST / UTGST Law) of turnover in the State/UT.

- These restrictions apply to the filing of GSTR-9; however, there are no explicit provisions for GSTR-9C, therefore the submission of GSTR-9 and non-filing of GSTR-9C could result in a Rs 25,000 general penalty.

Can the late fee be waived in exceptional circumstances?

- The government could do so by issuing a notification that details the circumstances, but no such notification has yet been made.

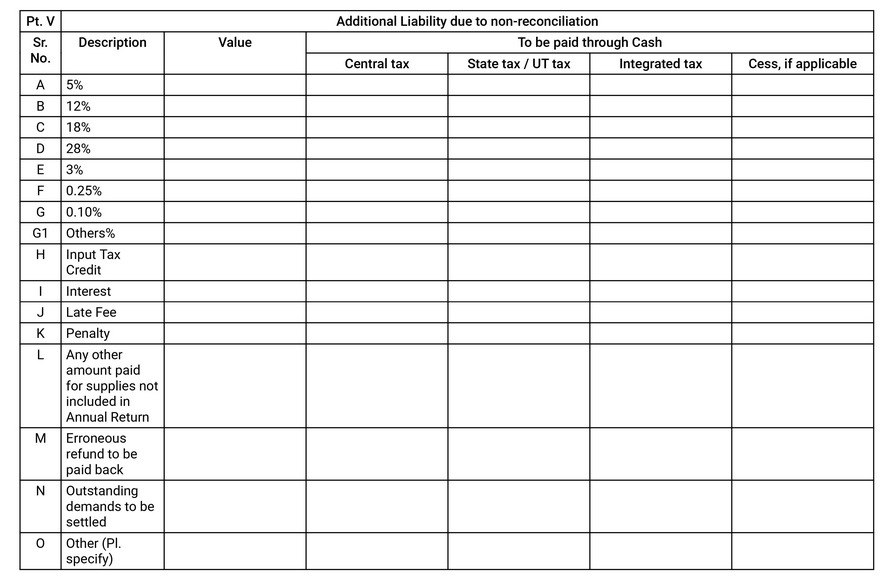

- GST liability arising from GSTR-9 and paid through DRC-03 should be reported in. This part of the form is designed to capture any additional tax liability that arises due to discrepancies between the audited financial statements and the annual return (GSTR-9).

Which adjustments should be included/excluded from Form GSTR-9C’s Table 5C?

- Advances can be used for a variety of reasons. As a result, only those that are subject to GST should be considered for the adjustment. Include:

| Particulars | Reasons |

| Advances received on services for which the supply has not been made as on 31st March 2021 | Revenue is not recognized in the books but offered to tax for GST. |

| Any Advances is received for Goods before 15th Nov 2020 and the supply of goods not complete as on 31st March 2021 | Revenue is not recognized in the books but offered to tax for GST. |

Exclusions:

| Particulars | Reasons |

| Advance received for exempted services as on 31st March 2021 | GST is not applicable |

| Advance received for Goods after 15th Nov 2020 | GST is not applicable |

| Financial Advances received which are not adjustable against any services | NOT a GST Transaction |

What information should be included in table 5B of Form GSTR-9C?

- Table 5B requires that additions to unbilled revenue be reported at the start of the financial year. In basic terms, this clause mandates the reporting of any unbilled revenue that was recorded in the previous financial year’s books but was invoiced in the current fiscal year under the GST statute.

Should a taxable person provide information in GSTR-9C about notice pay recoveries from employees? If so, where should you report it?

- If the notice pay recovered from employees is considered a taxable supply but not declared as income in the Profit and Loss account, it should be reported under GSTR-9C Sl.No.5O.

Where should the auditor-identified ineligible ITCs that the dealer claimed as eligible in GSTR 3B and Form GSTR 9 be submitted in Form GSTR 9C?

- The total ITC claimed by the merchant is reported in column 3 Part IV of Form GSTR 9C’s Sl.14. The auditor’s determination of eligible ITC is given in column 4 Part IV of Sl.14 of Form GSTR 9C.

- As a result, the distinction between the two is ineligible ITC. The auditor has to be any ineligible ITC in the Certificate issued by him.

Is it understood that by submitting Form GSTR 9C, the Commissioner or any official authorised by him will not conduct an audit under Section 65 of the CGST Act?

- No, the Departmental Audit and the CA Audit are two independent provisions. Section 65 pertains to departmental audits, whereas section 35(5) pertains to CA audits. When the total turnover exceeds Rs.2 crores, an audit under section 35(5) is required;

- however, there is no such requirement for audits under section 65. As a result, submitting Form GSTR 9C does not limit the department’s ability to undertake an audit.

Turnover Meaning as per GST Law

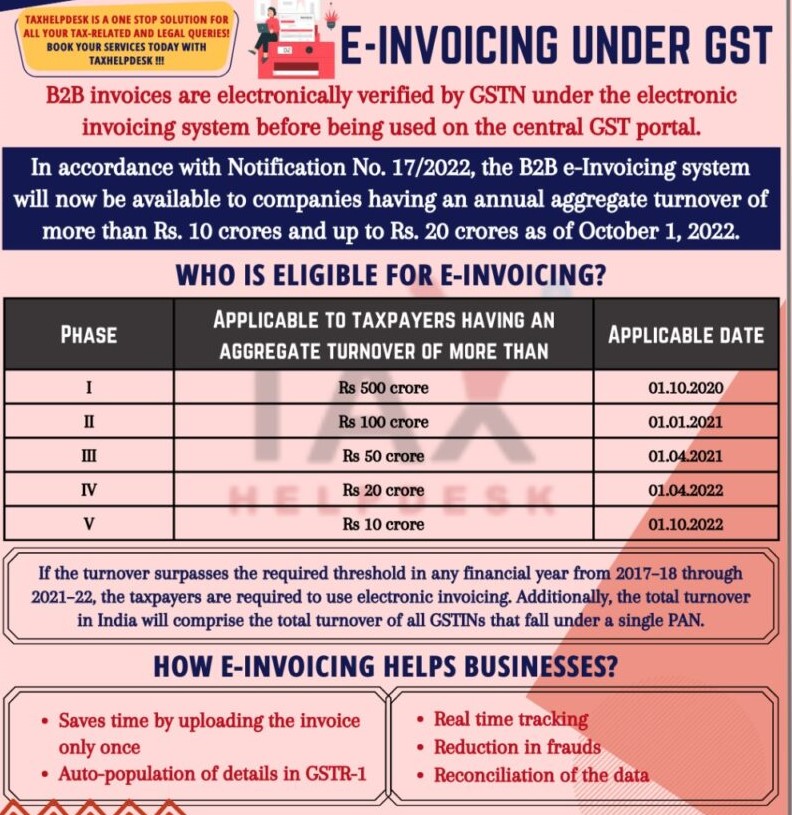

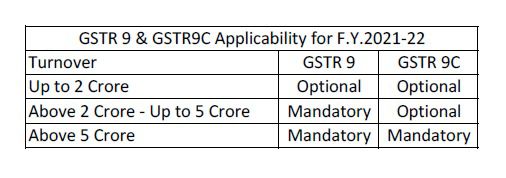

GSTR 9 and GSTR -9C applicability for FY 2021-22.

- GSTR-9 and GSTR-9C for the FY 2021-22 are available on the GST Portal for filing

- GSTR-9C & GSTR-9 Applicability for F.Y.2021-22 given below

- Due Date to File GSTR-9 & GSTR-9C is 31/12/2022

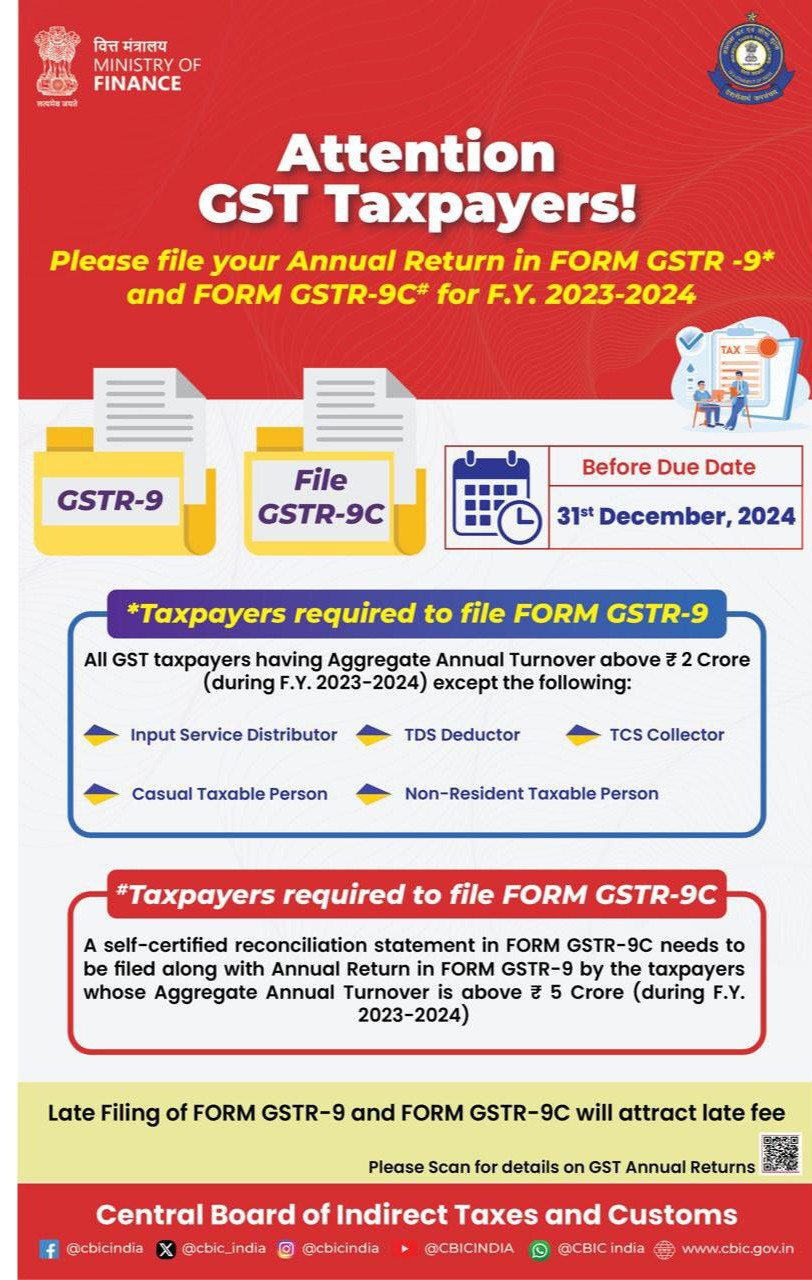

File your annual return in Form GSTR-9 and Form GSTR-9C for the FY 2023-24 before the due date.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.