FEMA Compliance Requirements for LLPs related to FDI & ODI

Table of Contents

FEMA Compliance Requirements for LLPs related to FDI & ODI

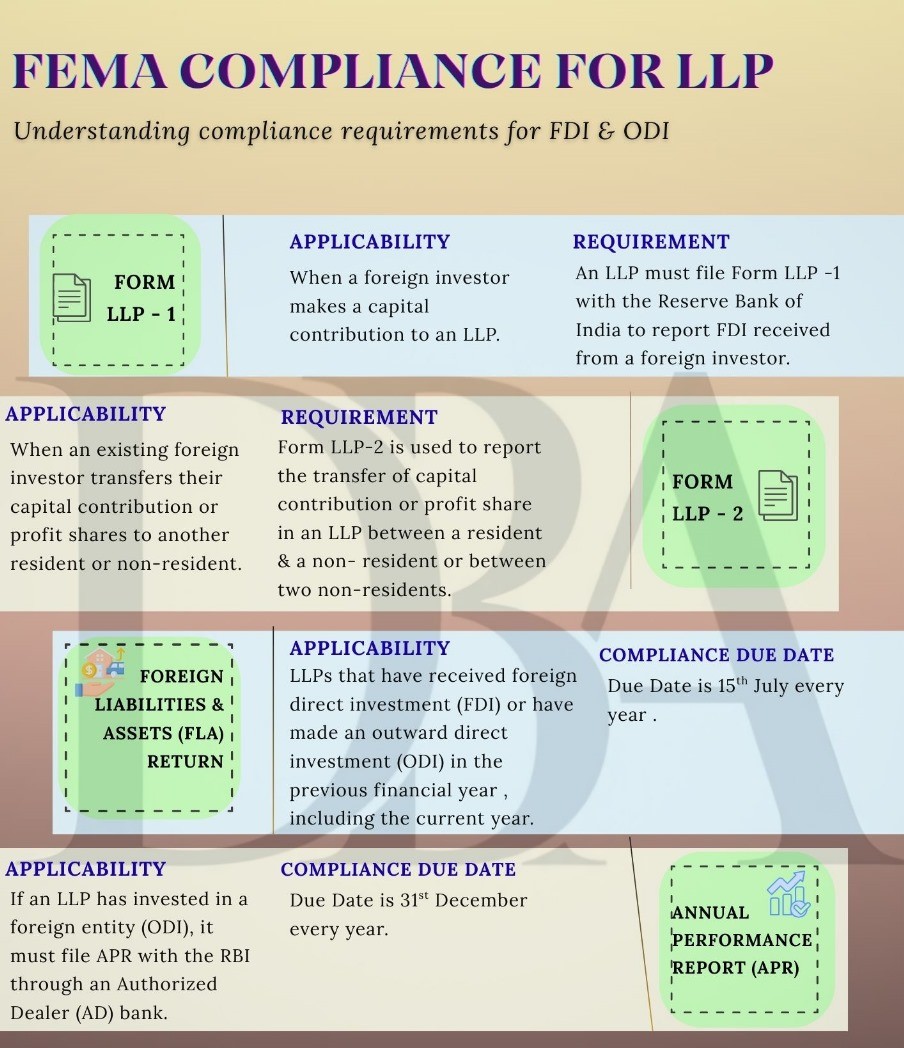

FEMA Compliance for LLPs

- Form LLP-1

- Applicability: When a foreign investor makes a capital contribution to an LLP.

- Requirement: Must be filed with RBI to report FDI received.

- Form LLP-2

- Applicability: When a foreign investor transfers capital contribution or profit share to another resident or non-resident.

- Requirement: Used to report such transfers to RBI.

- Foreign Liabilities & Assets (FLA) Return

- Applicability: LLPs that have received FDI or made ODI in the previous or current financial year.

- Due Date: 15 July every year.

- Annual Performance Report (APR)

- Applicability: LLPs that have made ODI (investment in foreign entities).

- Requirement: Must be filed with RBI through an Authorized Dealer (AD) Bank.

- Due Date: 31 December every year.

FEMA Compliance Calendar for LLPs

| Form / Return | Applicability | Due Date | Responsible Action |

| LLP-1 | When a foreign investor makes capital contribution to an LLP | Within 30 days of receipt | File with RBI to report FDI received |

| LLP-2 | Transfer of capital contribution/profit share between resident & non-resident | Within 60 days of transfer | File with RBI to report transfer |

| FLA Return | LLPs with FDI or ODI in previous/current financial year | 15 July every year | File online on RBI portal |

| Annual Performance Report (APR) | LLPs that have made ODI (investment in foreign entities) | 31 December every year | File through Authorized Dealer (AD) Bank |

Checklist for FEMA Compliance (LLPs)

🔹 Before Receiving FDI

- Ensure sectoral caps and entry routes are permitted under FEMA.

- Open a designated bank account for capital contribution.

- Maintain proper documentation of investor details and valuation.

🔹 After Receiving FDI

- File Form LLP-1 with RBI within 30 days.

- Update LLP agreement if required.

🔹 On Transfer of Contribution

- File Form LLP-2 within 60 days of transfer.

- Ensure valuation and pricing guidelines are followed.

🔹 Annual Filings

- File FLA Return by 15 July.

- File APR by 31 December (if ODI exists).

- Maintain records of foreign assets, liabilities, and performance.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.