Filling ITR Return for a deceased person as deadline coming

Table of Contents

How to file an Tax Return for a deceased person as the deadline draws near

- According to Section 159 of the Income Tax Act of 1961, a person’s legal executor is responsible for paying any debts that the deceased would have been required to pay if they had lived, in the same way and to the same extent as the deceased. This act makes it crystal clear that the legal representative of the deceased person is in charge of paying the deceased person’s Income tax return.

- Death puts everything to rest. Well, not when it comes to paying taxes. The person’s tax debt endures even after death. If the income received by the family on behalf of the deceased individual is greater than the basic exemption level, tax must be paid on that amount. The exemption threshold at this time is Rs 5 lakh annually.

- The tax due as well as any furthermore there, such as penalties, fines, or interest, for which the decedent would have been liable if he had lived, must be paid by the legal heir.

Concept of a legal heir in the eyes of law

The deceased person’s assets are represented by the legal heir. He or she is acknowledged as a legitimate successor by the Will as it is recorded or by a court. On the portal of the income tax department (Income tax dept), registration can be completed.

The following records are recognised as legitimate heir certificates:

- Legal heirship certificate from the local revenue officer.

- A legal court’s certification.

- Will Registered in law.

- A certificate of the surviving family members provided by the neighbourhood council (Nagar Palika), municipality, or local government.

- Letter from the banks confirming that the individual is the legal nominee of the dead, issued on their letterhead.

Who is responsible for filling Tax return of the deceased person?

- You can file a return on the of the deceased person’s behalf as a legal heir once your request to register as their legal heir has been approved. ITRs can be filed in the same manner according the same rules that an increasing accuracy while submitting his own tax return.

- Legal heir or representative/of the deceased person is require to file the income tax return on his/her behalf. In most cases, spouse or eldest son/daughter assumes the status of legal representative or heir unless will mention another person to be executor or administrator of the estate.

Who is responsible Tax liability of the legal heir?

- Tax liabilities on the of the deceased person’s income tax return must be paid by the legal heir. He isn’t responsible for the taxes owed, though. The legal heir’s liability is only as great as the extent to which the assets he received can cover the debt.

What are documents needed to file deceased’s Income Tax Return?

For the purpose of register as a legal heir below documents are to be uploaded on the ITR E-filing portal:

- PAN Copy of the of the deceased person,

- Death Certificate copy of the deceased person

- PAN of the Legal Heir Copy

- Any one of the legal heir proof from the below list as mentioned above

- Indemnity Letter Copy, This Indemnity Letter guarantees that payment of all income tax claims made with the income tax dept would be indemnified by legal heir/s filing the income tax return. In normal person terms, Legal heir/s are providing guarantee for payment of the tax dues of deceased to the income tax dept by way of this indemnity letter.

- Order copy which is passed in the deceased name. (Compulsory if the reason for registration is ‘Filing of an appeal against an order passed by Income tax dept deceased name ‘)

- Copy of Order/notice copy (Compulsory only if the reason for registration is ‘Filing of ITR/form for period in which deceased was alive via condonation request’ /A notice/order received from Tax Dept in name of the applicant for compliance on behalf of a deceased’)

What is Process of registration as a legal heir on Income tax Dept website portal?

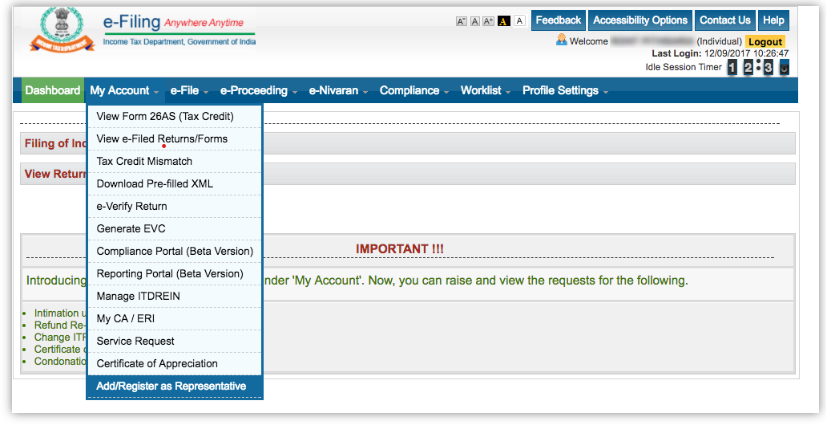

- First Step : We needed to Go to the official Income tax Dept website portal & make the income tax Login to e-Filing Portal- of income tax Dept, we needed to Log in using legal heir credentials at Income tax site.

- Second Step : Go to ‘My Account’ option menu & chose on to register to act on behalf of another person’ i.e of the deceased person’s. Next move to ‘Authorised partners’, then to ‘Register as Representative’ & click on ‘Let’s get started’ option at income tax site.

- Third Step –Next step is Enter your personal information & details. Enter the required details in the appropriate fields and attach required documents based on applicable category on the assesse i,e of the deceased person. For example the legal heir certificate, death certificate, Permanent account number Card of the deceased person.

- Fourth Step – Next the choose the option Click on ‘Proceed’ & then ‘Verify the request’ as available option.

- Fifth Step – Finally you needed to Click on ‘Submit’ for filling, then You will receive an income tax acknowledgement receipt from the dept.

Note: Request for registering shared to e-Filing Admin for approval. After complete checking proper authenticity of request details & May be Reject /Approve request & Upon Rejection/Approval intimation received via E-mail and SMS which will be shared to Income tax user who raised the income tax request.

What are the income tax Services Available to Legal Heir?

Below mention services are available to the legal heir according to respective status (permanent or temporary):-

| S.N | Option of Services available on behalf of deceased person | Permanent The Legal Heir | Temporary The Legal Heir |

| 1 | Upload Income tax return Return | Available | Available |

| 2 | Submit Income tax return online | Available | Available |

| 3 | Option of Defective Income tax return Returns | Available | Available |

| 4 | Submit Form online (self/ Legal Heir) | Available | Available |

| 5 | My Income tax return Returns/Forms | Available | Available |

| 6 | Rectification request/status of Income tax return | Available | No |

| 7 | Refund Re-issue | Available | No |

| 8 | Filling of request for Intimation | Available | No |

| 9 | Response to Outstanding Tax Demand | Available | No |

| 10 | Income Tax Credit Mismatch | Available | No |

| 11 | Add Chartered Accountants | Available | Available |

| 12 | List Chartered Accountants | Available | Available |

| 13 | Dis-engage Chartered Accountants | Available | No |

| 14 | Dis-engage E filing intermediary | Available | No |

| 15 | Option of Helpdesk Request | Available | No |

| 16 | To be Work list | Available | No |

| 17 | Compliance pending | Available | Available |

| 18 | View Form 26AS (Tax Credit) | Available | Available |

After the above request is approved by income tax portal. The legal heir can submit the Income tax Return with the help of a expert CA in income tax filling or by themselves.

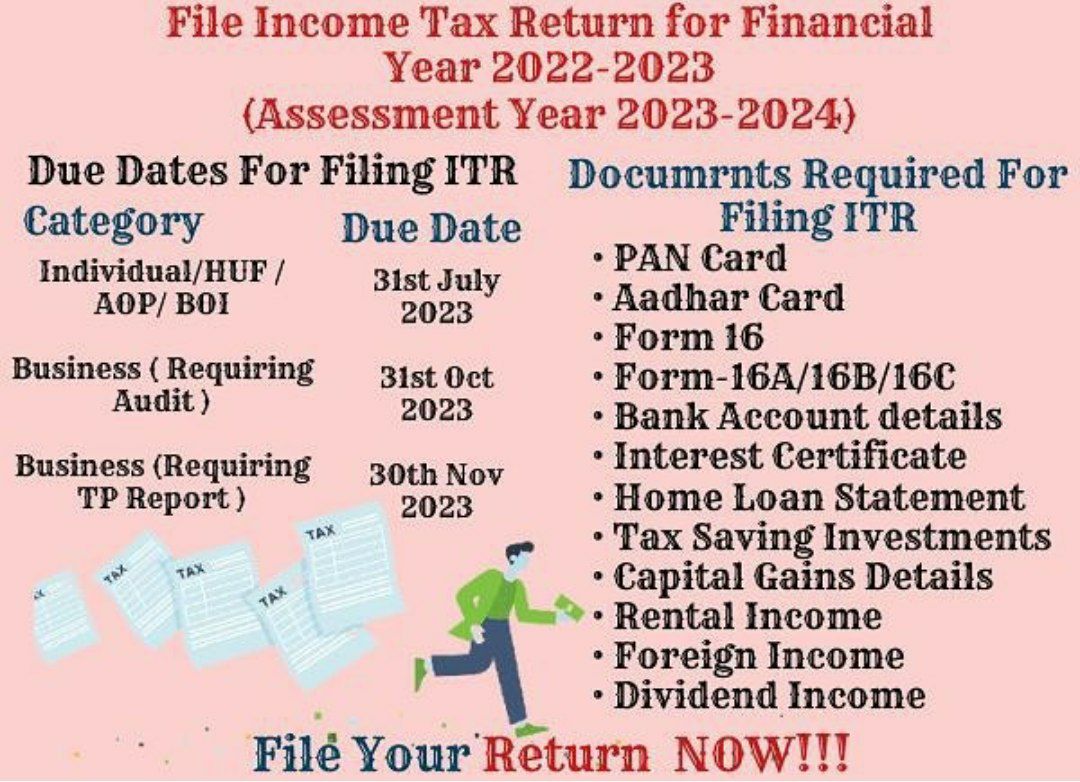

What is timeline date of filing Income tax return for deceased’s taxpayers Income Tax Return?

| Status of taxpayer | Due date |

| Taxpayers/Assessee/ Individuals whose accounts are not needed to be audited. | July 31 of relevant Assessment Year |

| Assessee/Taxpayers whose accounts are required to be audited | October 31 of relevant Assessment Year |

| Individuals/ Taxpayers who is required to furnish report U/s 92E | Nov 30 of relevant Assessment Year |

Who is responsible in the event of a penalty or demand for deceased taxpayer ?

- The successor is responsible for paying any penalties or fines levied to file the dead person’s ITR. It could also result in some extortionate penalties.

- Legal heir is responsible for paying the fines or penalties if the Income tax return is not submitted. They could also experience legal consequences. However, they are only required to cover the taxes or fines up to the amount of the inheritance.

- It indicates that the legal heir may also be the subject of penalty proceedings for a default by the deceased. However, the degree of his liability would be restricted by the assets he would inherit from the deceased.

- The penalty that the deceased person must pay is based on the deceased individual tax obligations. The heir may wind up paying their whole portion of the inheritance if the deceased’s tax burden is in a higher tax rate.

- For better understanding let’s take a look for an example, if a person is going to get Five lakh rupees from the deceased persons belongings, The dead is responsible for paying Rs 15 lakh in taxes. Legally, the successor is only required to pay up to Rs 5 lakh in tax or penalties on behalf of the deceased. The heir’s own assets and funds cannot be utilised to reduce the decedent’s unpaid debts.

- Over 1,55,000/- updated income tax returns (ITR-U) have been filed up to September 2022

File income tax return and Tax audit report as earlier avoid last minute anxiety. For any issues – send mail to dtc@icai.in – DTC of ICAI.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.