Financial Action Task Force adopts Mutual Evaluation Report

Table of Contents

Financial Action Task Force adopts Mutual Evaluation Report of India

India’s success in Mutual Evaluation conducted by the FATF is indeed significant. The FATF (Financial Action Task Force) is in charge of global efforts to combat money laundering, terrorism, and proliferation financing. India’s placement in the ‘regular follow-up category’ in the Financial Action Task Force – Mutual Evaluation Report reflects its significant progress in strengthening its financial system against money laundering and terrorist financing. Details is here under :

- The report was adopted during the Financial Action Task Force plenary held from June 26th to 28th, 2024, in Singapore. Being placed in the ‘regular follow-up’ category by FATF indicates that India has robust anti-money laundering & counter-terrorist financing measures in place. This status is noteworthy, as only a few G20 countries share this distinction.

- India’s proactive measures in combating money laundering and terrorist financing have been recognized. This includes the transition from a cash-based to a digital economy, which helps in making financial transactions more traceable and reducing associated risks.

- Financial Action Task Force, established in 1989, is an intergovernmental organization focused on combating money laundering, terrorist financing, and other threats to the integrity of the international financial system. India has been a member since 2010.

- The Jan Dhan, Aadhaar, Mobile has been instrumental in increasing financial inclusion and promoting digital transactions. These efforts have contributed significantly to mitigating risks associated with money laundering and terrorist financing.

- According to the Finance Ministry, this distinction is shared by only four other G20 countries, highlighting India’s efforts in mitigating money laundering and terrorist financing risks, transitioning to a digital economy, and implementing the Jan Dhan, Aadhaar, Mobile.

- The positive evaluation by Financial Action Task Force is expected to enhance India’s access to global financial markets, boost investor confidence, and support the international expansion of the UPI. India’s strong performance in the FATF evaluation is expected to yield significant economic benefits, such as improved access to global financial markets and increased investor confidence. Additionally, it will aid in the global expansion of the UPI.

- India’s commitment to international AML/CTF standards sets a benchmark for other countries in the region, highlighting its leadership role in ensuring the stability and integrity of the global financial system.

- The success in the mutual evaluation process is attributed to the collaborative efforts of various Indian ministries, regulatory bodies, and financial institutions. This underscores the importance of coordinated actions in achieving significant milestones in financial regulation and security.

RBI Updates Limits for Small Value Digital Payments in Offline Mode!

The Reserve Bank of India has made significant amendments to the framework for facilitating small-value digital payments in offline mode, including UPI Lite transactions. Here’s what you need to know:

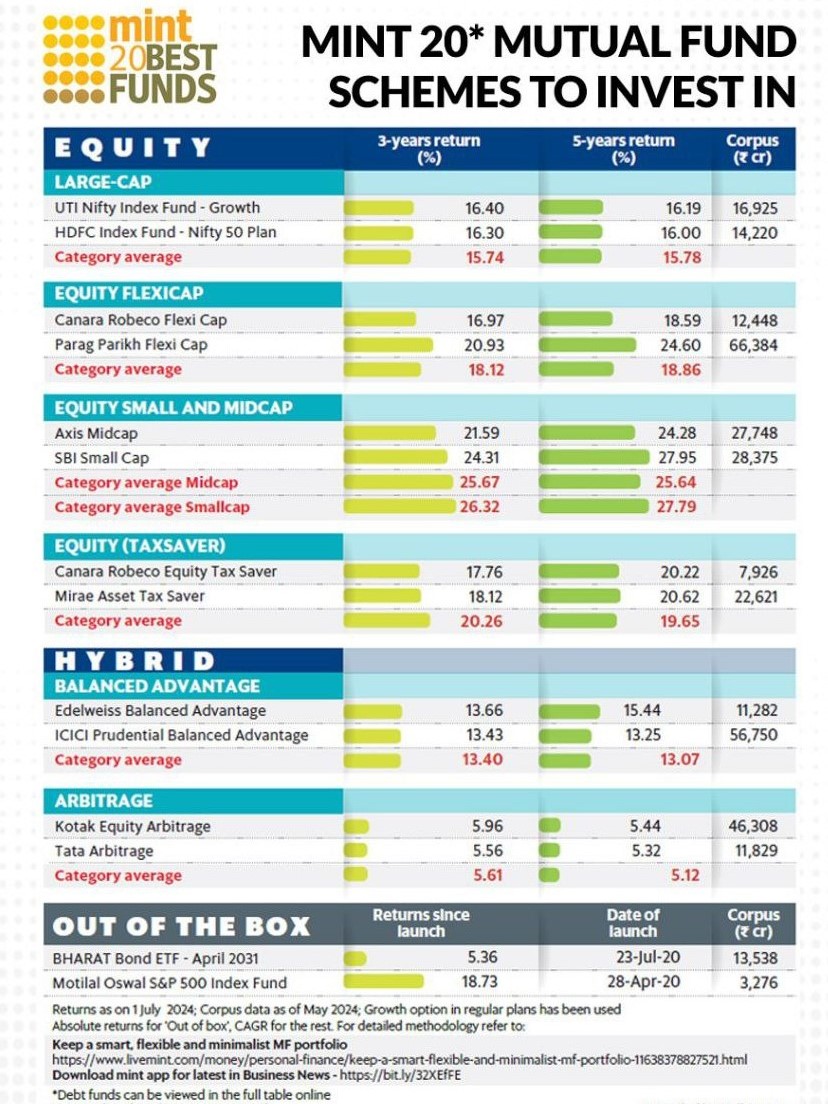

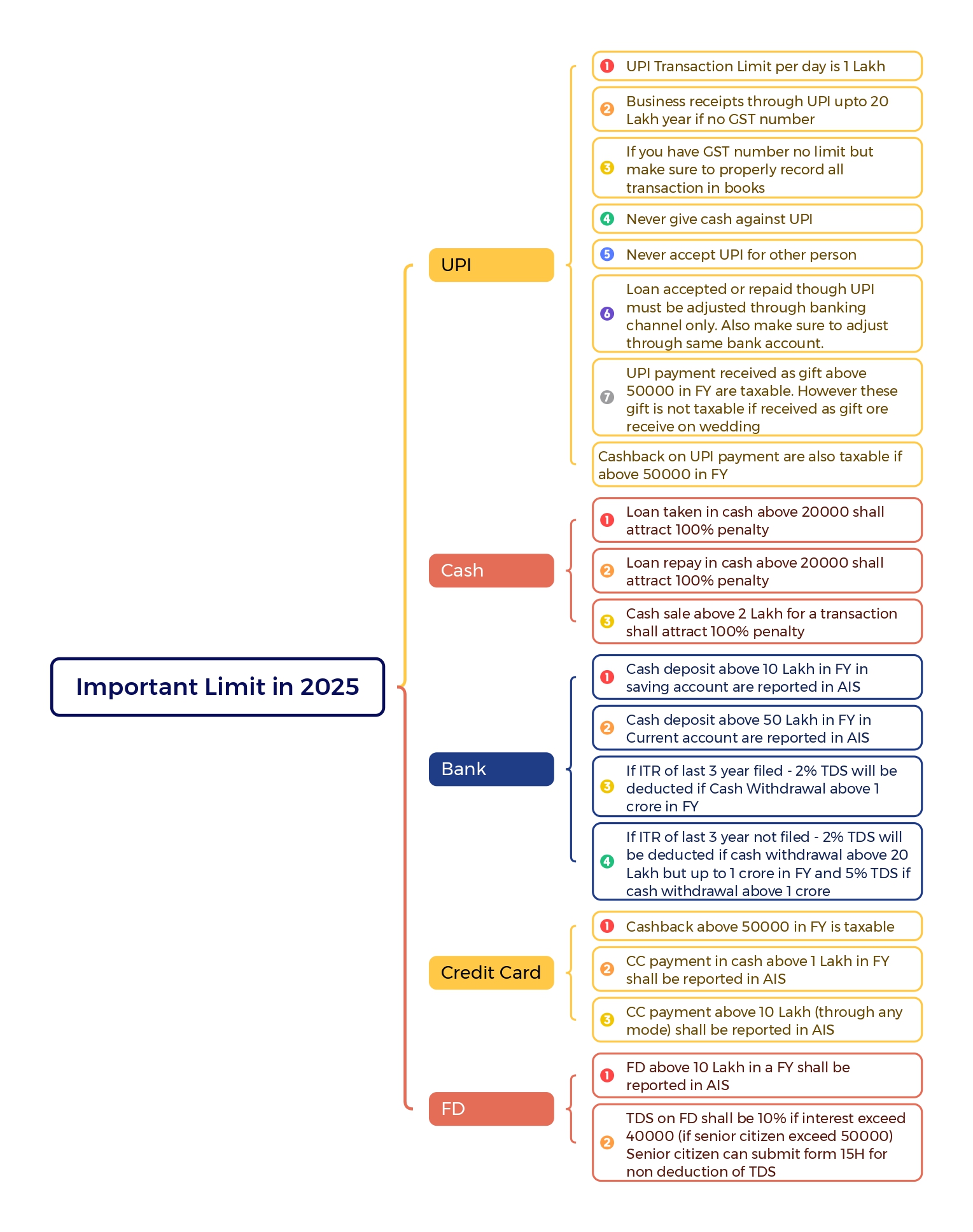

Important Financial Limit in 2025 for UPI and other transactions

New Transaction Limits:

• INR 1,000 per transaction (previously INR 500).

• INR 5,000 total limit at any point in time (up from INR 2,000).

- Why This Matters: These changes aim to enhance the adoption of UPI Lite and offline digital payments, offering more convenience for users even in areas with limited internet connectivity.

- Immediate Effect: The updated limits are effective immediately as per the Payment and Settlement Systems Act, 2007. This is another step by the RBI to boost digital financial inclusion across India!

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.