Form 10-IEA filing requirements & switching restrictions

Table of Contents

Form 10-IEA filing requirements & switching restrictions

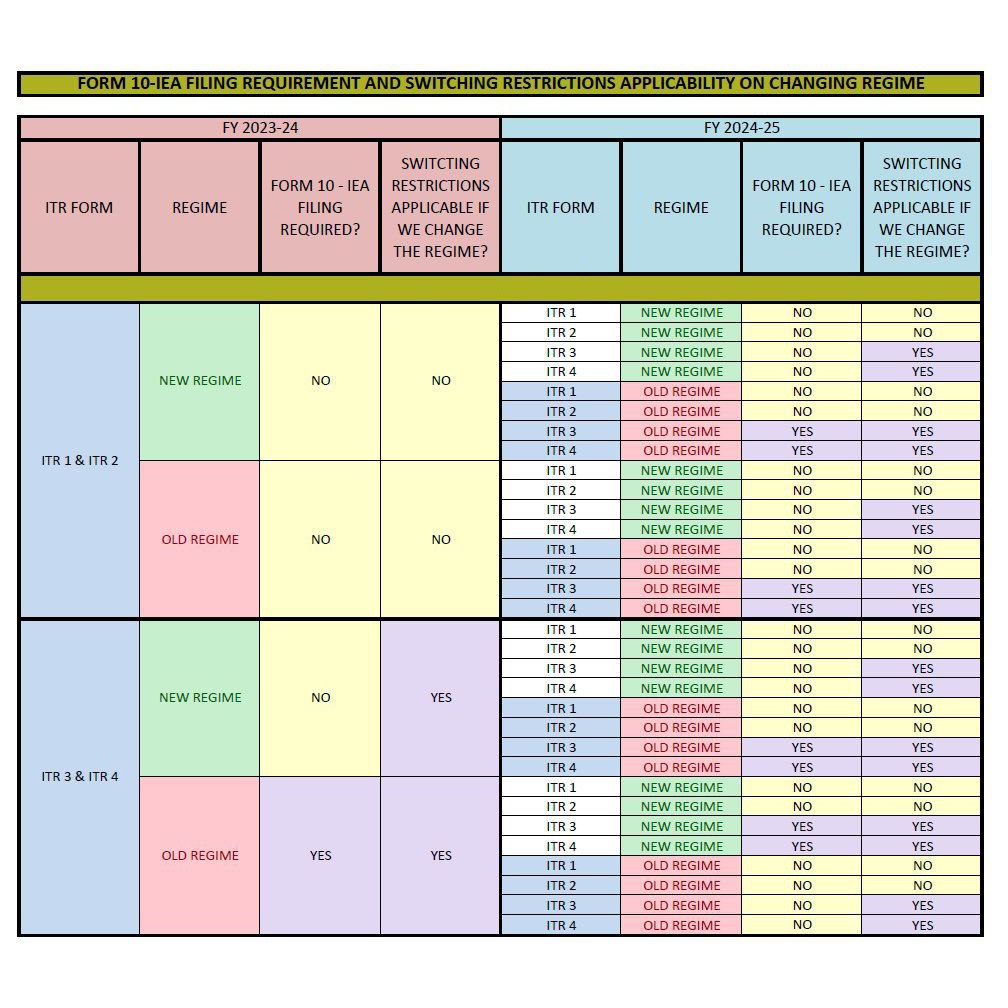

Under this blog where summaries Form 10-IEA filing requirements & switching restrictions when changing between new & old tax regimes for FY 2023–24 & FY 2024–25. Form 10-IEA filing is only required for ITR 3 & 4 taxpayers who choose the Old Regime. Taxpayer Switching Restrictions apply only to ITR 3 & 4 filers, no matter which regime they pick. ITR 1 & 2 filers have no form requirement and no switching restrictions in either regime.

What is Form 10-IEA?

Purpose: To opt for the Old Tax Regime (since the New Regime is now default). Who needs it Mandatory for individuals/HUFs with business or professional income (ITR-3 or ITR-4) who wish to choose the Old Regime. & Not required for salaried individuals (ITR-1 or ITR-2).

When to file: On or before the due date for filing ITR (AY 2025-26 due date: 15 September 2025 for audit cases; 31 July 2025 for non-audit).

Old vs New Regime :

- Old Regime: Higher tax rates but allows deductions & exemptions (e.g., 80C, 80D, HRA, housing loan interest).

- New Regime: Lower tax rates, minimal deductions, simpler compliance.

Following Breakdown of Form 10-IEA filing requirements & Switching restrictions & applicability on changing regime are mention here under:

Switching Rules :

For Salaried Individuals (ITR-1 & ITR-2) : Can switch every year between regimes. No Form 10-IEA needed. Choice can be made at ITR filing, even if you told your employer differently.

For Business/Professional Income (ITR-3 & ITR-4) : Can switch from New → Old Regime only once in a lifetime (via Form 10-IEA). Once you go back to the New Regime, you cannot return to Old Regime again.

FY 2023–24 :

ITR 1 & ITR 2

- New Regime : Form 10-IEA not required, no switching restrictions.

- Old Regime: Form 10-IEA not required, no switching restrictions.

ITR 3 & ITR 4

- New Regime : Form 10-IEA not required, but switching restrictions apply.

- Old Regime: Form 10-IEA required, switching restrictions apply.

| ITR Form | Regime | Form 10-IEA Required? | Switching Restrictions? |

| ITR 1 / ITR 2 | New | No | No |

| ITR-1 / ITR 2 | Old | No | No |

| ITR 3 / ITR 4 | New | No | Yes |

| ITR-3 / ITR 4 | Old | Yes | Yes |

FY 2024–25 :

ITR 1 & ITR 2 :

- Switching from new regime to new regime : No form, no restriction.

- Taxpayer is Switching from new to old : No form, no restriction.

- Switching from old to new: No form, no restriction.

- Taxpayer is Switching from old to old: No form, no restriction.

- Only ITR 3 & 4 under old regime: Form 10-IEA required if opting old regime.

ITR 3 & ITR 4

- New regime to new regime: No form, but switching restrictions apply.

- Old regime to new regime: No form, switching restrictions apply.

- New regime to old regime : Form 10-IEA required, switching restrictions apply.

- Old regime to old regime: Form 10-IEA required, switching restrictions apply.

| ITR Form | Regime | Form 10-IEA Required? | Switching Restrictions? |

| ITR 1 | New | No | No |

| ITR 1 | Old | No | No |

| ITR 2 | New | No | No |

| ITR 2 | Old | No | No |

| ITR 3 | New | No | Yes |

| ITR 3 | Old | Yes | Yes |

| ITR 4 | New | No | Yes |

| ITR 4 | Old | Yes | Yes |

Quick Rules : Form 10-IE vs Form 10-IEA

Form 10-IEA is generally not needed for ITR 1 & ITR 2, regardless of regime. For ITR 3 & ITR 4, Form 10-IEA is required whenever opting for the old regime. Form 10-IEA: Only needed for ITR 3 & 4 when opting Old Regime.

Form 10-IE vs Form 10-IEA

| Form | Purpose | AY 2025-26 Status |

| Form 10-IE | Opt for New Regime | Obsolete (New Regime is default) |

| Form 10-IEA | Opt for Old Regime | Required for ITR-3 & ITR-4 filers choosing Old Regime |

Switching Restrictions: Always apply for ITR 3 & 4, regardless of regime, but not for ITR 1 & 2. Switching restrictions mainly apply for ITR 3 & ITR 4 cases, and for some ITR 1/2 cases when moving to ITR 3/4. FY 2024–25 rules seem tighter on switching for higher ITR forms compared to 2023–24.

In short:

- ITR 1 & 2 : No Form 10-IEA, no switching restriction.

- ITR 3 & 4: Form 10-IEA needed to opt Old Regime, strict switching limits.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.