FORM 15CA AND FORM 15CB CERTIFICATE

Table of Contents

REPATRIATION

An NRI, OCI and a Foreign Citizen residing in India, are often into the transaction of remitting the money from Indian Bank accounts to foreign or NRI accounts.

To undertake such type of transactions, the banks are authorized to ask for certain documents namely –

- Application form duly filed and supported with required documents for outward remittance from NRO Account

- A2 Form as required to be filed under the regulation of RBI.

- Form 15CB, a certificate issued by a Chartered Accountant, practicing in India.

- The source or way the said income was earned.

- Form 15CA, a declaration to the IT department.

- Passport of the NRI.

The following documents require to confirm the rate of withholding tax on overseas consultancy.

- Tax residency certificate for the current year.

- PAN card copy of consultant

- Digital Form 10F

- NO PE declaration

- Agreement copy

FORM 15 CA, CB REGULATION AND PURPOSE

- Form 15 CA and 15CB are the Income Tax forms as required to be filed by the NRIs under section 195 of the Income Tax Act,1961.

- These forms are required to be filed by a NRI while making any remittance outside India. Such forms are regulated by Income Tax Authorities.

- Form 15CB is a declaration which is required to be certified by a Chartered Accountant practising in India and Form 15CA is a declaration by the NRI.

- TDS provisions are also triggered while making these remittances. It is to be noted that section 195 is not applicable on remittances made from the NRO account to NRE account by the NRI.

- Both these forms can be downloaded and filed on the Income Tax portal and the certification of the Chartered Accountant can also be done using their Digital Signature.

CERTIFICATION BY CHARTERED ACCOUNTANT

There are certain steps to be followed in order to obtain certification in Form 15 CB –

- The NRI is required to approach a certified Chartered Accountant and submit his/her bank statement for the last 1-2 years.

- Chartered Accountants will verify their source of income.

- Once the source is identified, the Chartered Accountants will calculate the taxable income of the NRI and estimate the tax liability on the said income.

- after NRI makes the payment of the requisite tax amount, the CA will file a return for the same.

- After filing of return, the CA will keep a record of the same and certify the Form 15 CB.

STEP BY STEP PROCEDURE FOR FILING FORM 15CA

- First the NRI needs to login to the Income Tax Web Portal.

- Create a new user account with the help of a PAN card and other proofs.

- Then visit the E-File option and select Form 15CA.

- Form 15CA will have certain steps to be followed.

- Fill in the required details in all the Parts from A to D.

- On completing the information, submit the form by clicking on the submit button.

- After Successful filing, the NRI is required to submit a copy of the filed form with their bank.

- The bank official will sign on the same and thereby complete the procedure.

Talking about the time required for such a procedure, usually a CA or tax consultant requires at least 1-3 days, to verify the documents and submitting Form 15CA and 15CB. After successful submitting,

The NRI is required to submit the copy of the form to the respective Bank and remit the funds immediately thereafter. Thus, on an average, it takes 2-4 days’ time in order to initiate the whole process of remittance.

DOCUMENTATION

- NRI is required to have the bank receipts for earlier remittances.

- Tax residency certificate of receiver of such remittance, duly issued by their home country.

- self-attested Form 10F, duly authorized by the remittee.

- Certification by the NRI, that he/she is not having any fixed place of business in India. In such a case, the NRI would be required to obtain a No PE Certificate from the authority.

FORM 15CA PROVISIONS

- Amount can be remitted to any other non-resident or foreign company

- Such remittance be made by any resident /non-resident/ domestic company/foreign company from India.

- Income from which such remittance will be made, shall accrue/ arise/ received or deemed to accrue/ arise/ received in India (Section 5 & 9 of Income Tax Act).

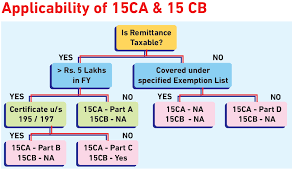

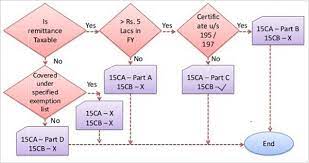

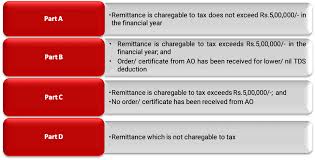

- The whole form is divided into 4 parts and the required part be filled by the NRI, while providing declaration.

FORM 15CB PROVISIONS

- This form is certified and issued by a Chartered Accountant in India.

- Remittance be made to a non-resident or foreign company.

- Certification by CA is required, if the amount subject to tax exceeds Rs. 5,00,000.

- Also, where the certificate u/s 195(2)/195(3)/197 of the Act has not been received from the Assessing Officer, such certification is required

- It is basically a Tax Determination Certificate wherein the details pertaining to the remittance is examined by the CA and the taxation aspect is also taken care of.

IMPORTANT POINTS TO BE CONSIDERED

- COUNTRY TO WHERE REMITTANCE IS MADE –

- Name of remittee’s country is important to know, because, there are certain instances where the invoice is generated in some other country, but the payment is made to another.

- There is an option to choose country as India in the Form 15CA & Form 15CB, thereby permitting the filing of Form to a Non-resident whether made out of foreign bank account or Indian bank account.

- AMOUNT OF REMITTANCE – The amount of remittance should reconcile/match the amount stated in the invoice provided at the time of documentation for Form 15CA.

- RATE OF EXCHANGE – Another important aspect is rate of exchange. Generally, remittances are made outside India, and the same be required to be exchanged in the foreign currency. In such a scenario, the rate of exchange shall be the SBI’s TT Buying rate, determined at the time of TDS deduction.

- RATE OF TAX – The rate of tax and provisions prescribed under Section 195, 192, 194LC, 194LD, 115A, are needed to be complied with.

- DTAA – The NRI is also required to look into the DTAA agreement between India and the remittee’s country.

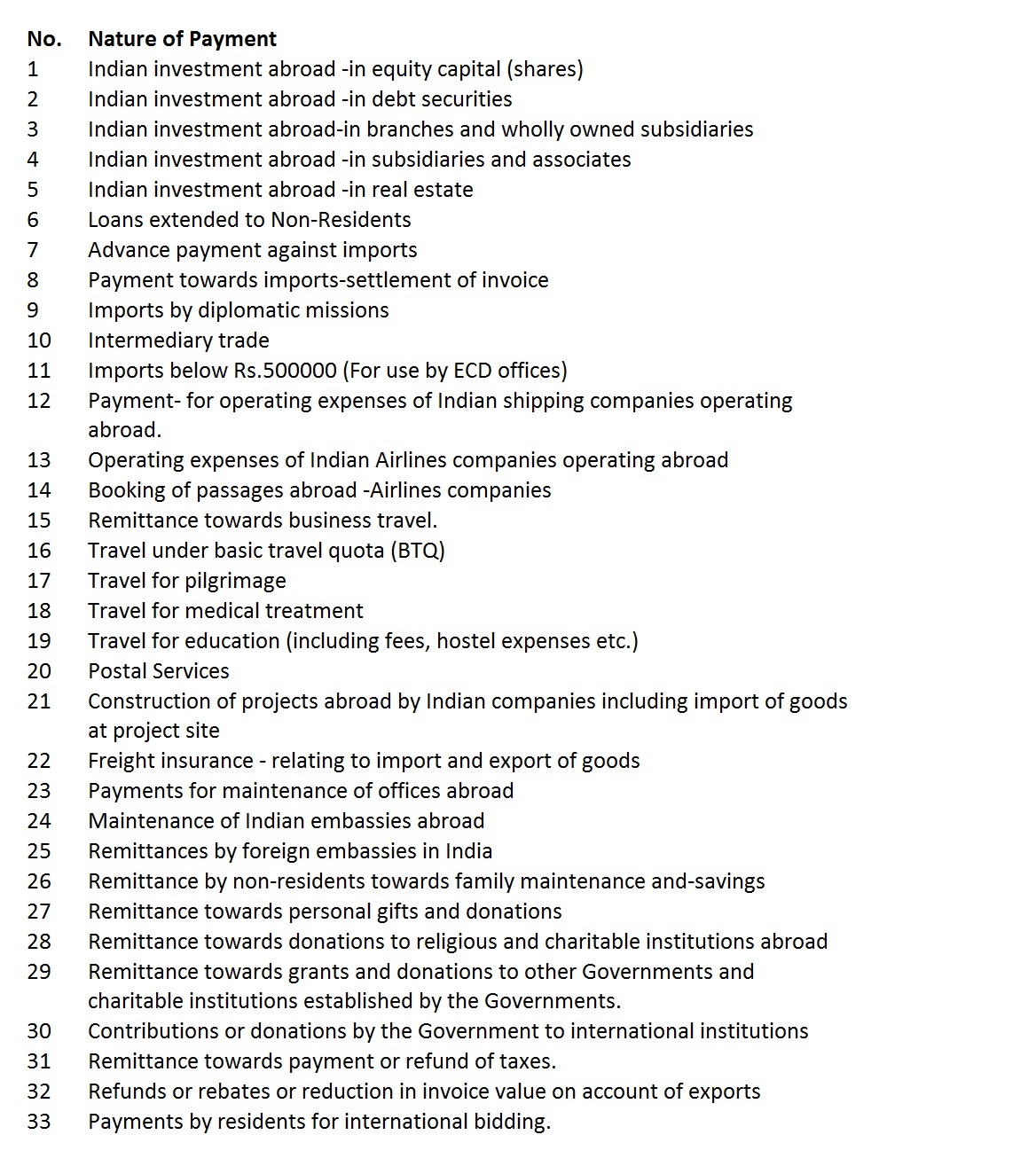

- PURPOSE FOR REMITTANCE – The NRI should also ensure that the purpose of their remittance, falls within the prescribed purposes by the authority.

- EFFECTIVE DATE OF REMITTANCE – The effective date shall be the date on which taxpayer is proposed to make remittance to Non-resident, as prescribed in the invoice presented.

- DETAILS OF CA ON ITR PORTAL – Since a chartered accountant certification is required to file form 15CB, the NRI is required to add the name of such CA in its E-filing portal.

- SEQUENCE OF FILING – It is to be noted that Form 15CB should be filed prior to filing of Form 15CA, as in order to prefill the details in Part C of form 15CA, the Acknowledgement Number generated by filing Form 15CB would be required and an e- verification procedure is initiated for the verification of same.

Form 15ca and 15cb not required for below Kind of payments

You can also review all about the withdraw of 15CA and 15CB

PENALTY FOR NON-COMPLIANCE

Where the NRI fails to comply with any of the provisions relating to the remittance to be made outside India, such a person shall be punishable with a monetary penalty of Rs. 1 Lakhs, under section 271-I of the Income Tax Act, 1961.

NO PE CERTIFICATE

SELF DECLARATION REGARDING NON-RECEIPT OF FIXED ESTABLISHMENT IN INDIA

To,

……………………..

……………………..

……………………..

I ________________________(Name), _____________(Designation) of M/s.__________________________________having it’s national office at

__________________________________________________________________________________________________________________________________________

Hereby state that:

I/We am/are a resident in [ ……………………………………………………………. Insert name of country of which the payee is tax resident]. I am a Non-Resident of India as per Indian Tax Laws.

I/We are in no receipt of any office or other fixed place of business in India as envisaged in Tax Treaty.

I/We undertake the responsibility to intimate …………………………… [Name of the Payer] immediately in case of any alteration in the aforesaid declaration including change in tax residential status, etc.

I/We do not have any dependent agent performing activities in India as envisaged in the Tax Treaty.

I, [ ………………………………………………………………….], hereby declare that the information provided above is correct, complete and truly, to the best of my knowledge.

__________________________________

(Name, designation & signature of non-resident Payee)

Company Seal (if applicable)

Date:

Place:

Address:

Email and Telephone:

Popular blog:-

- Basic Provision of Form 15CB & 15CA

- Complete Understanding about Form 15CA, Form 15CB

- New Form 15CA & 15CB Submission Process redesigned

- Certificate Form 15CA CB for making payments abroad

- Form 15cb To Be Issued For Payment To NRI

- How to file e-form 15ca & 15cb-process

- New rules for form 15ca/cb under rule 37bb

- Form-15cb-to-be-issued-for-payment-to-non-resident-for-using-immovable-property-situated-in-india

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.