Complete overview on Gold Bonds

Complete overview on Gold Bonds

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold aimed at bringing down gold imports and providing an alternative to physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The bond is issued by the Reserve Bank of India on behalf of the Central Government.

Here are some important facts that one should know about SGB:

PROTECTION:

The quantity of gold for which the investor pays is protected since he receives the ongoing market price at the time of redemption/ premature redemption. The bond offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated.

Investors are assured of the market value of gold at the time of maturity and periodical interest. Gold bonds are free from issues like making changes and purity in the case of gold in jewellery form. The bonds, to be sold by banks and designated post offices either directly or through their agents, can be also be held in the demat form eliminating risk of loss of scrip.

PRICE/ INTEREST:

The bonds bear interest at the rate of 2.75 per cent (fixed rate) per annum on the amount of initial investment. The bonds are issued in denominations of one gram of gold and in multiples thereof. Minimum investment in the bond will be two grams with a maximum buying limit of 500 grams per person per fiscal year. The RBI has fixed the issue price of first tranche of gold bonds at Rs 2,684 per gram which will be open for subscription from November 5 to 20. The price of the bonds will be fixed by the RBI on the basis of the previous week’s (Monday – Friday) simple average price for gold of 999 purity published by the India Bullion and Jewellers Association (IBJA). Resident Indians including individuals, HUFs, trusts, universities and charitable institutions can hold these bonds.

REDEMPTION:

On maturity, the redemption proceeds will be equivalent to the prevailing market value of grams of gold originally invested in Indian Rupees. The redemption price will be based on simple average of previous week’s (Monday-Friday) price of closing gold price for 999 purity published by the IBJA.

Both interest and redemption proceeds will be credited to the bank account furnished by the customer at the time of buying the bond.

WHY IT’S GOOD:

As investors will get returns that are linked to the market price of gold, the scheme is expected to offer the same benefits as physical gold. The big advantage is 2.75 per cent interest on bonds.

They can be used as collateral for loans and can be sold or traded on stock exchanges. Bonds can be sold or transferred to other persons. Parents can buy bonds in the name of minor children.

Investment in Gold’s Option

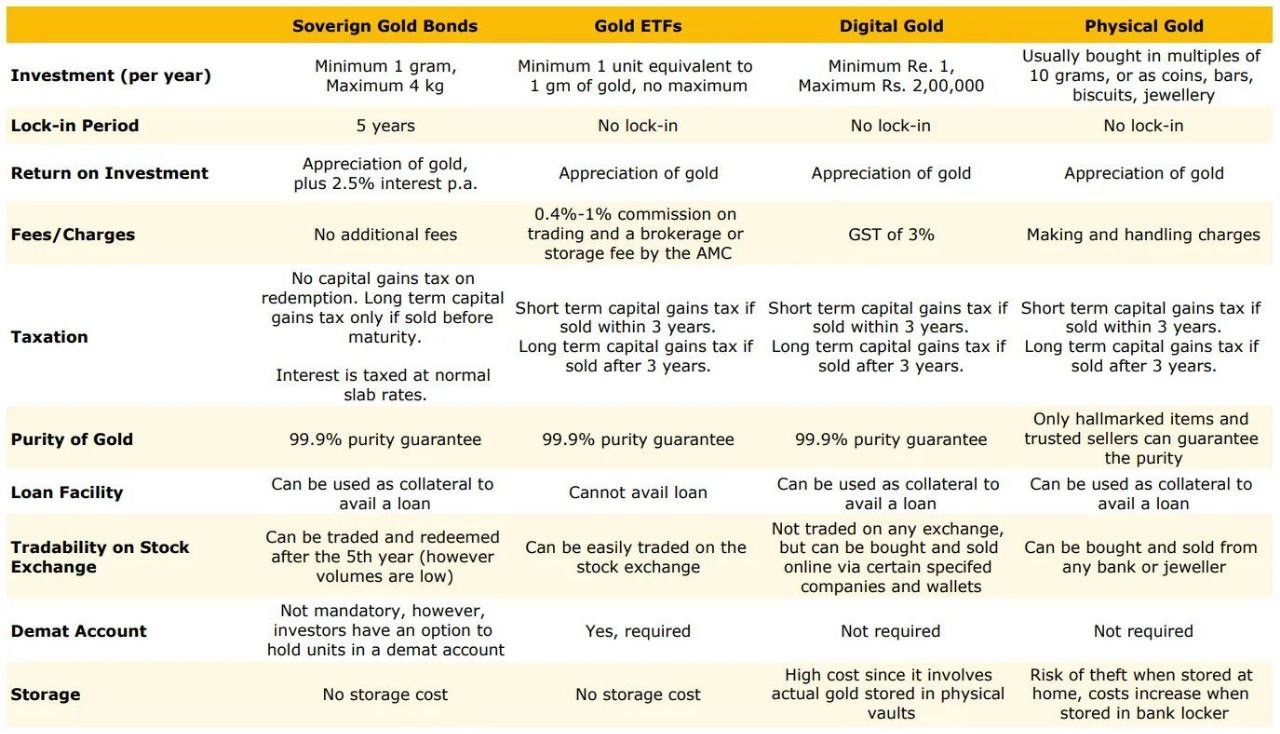

Investors have a plethora of options when it comes to investing in gold, each with its own advantages and considerations. Let’s briefly explore some of the popular avenues:

- Physical Gold: This includes buying gold jewelry, coins, or bars. While physical gold offers the advantage of ownership, it also comes with concerns such as purity verification, storage, and potential resale issues.

- Gold Exchange-Traded Funds (ETFs): These are open-ended mutual fund schemes that invest in standard gold bullion of 99.5% purity. Gold ETFs provide investors with an opportunity to invest in gold without the hassles of physical ownership. They are traded on stock exchanges, offering liquidity and transparency.

- Gold Funds: Similar to Gold ETFs, gold funds also invest in various forms of gold, such as bullion, stocks of gold mining companies, and gold ETFs. They offer the advantage of professional management and diversification.

- Sovereign Gold Bond Scheme: Issued by the Government of India, sovereign gold bonds are denominated in grams of gold and offer a fixed interest rate. They provide investors with an opportunity to earn interest along with capital appreciation linked to gold prices. Moreover, they come with the benefit of capital gains tax exemption upon maturity.

- Gold Saving Schemes: Some banks and financial institutions offer gold saving schemes where investors can regularly invest a fixed amount towards purchasing gold, which is accumulated over a period. These schemes often come with added benefits like discounts or bonus gold.

Investors should carefully assess their investment goals, risk tolerance, and preferences before choosing a gold investment avenue. Additionally, staying informed about market trends, geopolitical developments, and macroeconomic indicators can help make informed investment decisions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances; Hope the information will assist you in your Professional endeavors. For query or help, contact:info@caindelhiindia.com or call at 9555 555 480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.