Grievance hand Mechanism for Processing of GST Registration

Table of Contents

Summary of Grievance Redressal Mechanism for processing of application for GST registration

- GSTN Dept is issue Trade Notice No. 01/2025 Date of Issue is 2nd May 2025 issued by the Office of the Principal Chief Commissioner, CGST and CEX, Delhi Zone, regarding the Grievance Redressal Mechanism for processing GST registration applications and Applicability on All Principal Chief Commissioners / Chief Commissioners of Central Tax across India.

- Focuses on grievances relating to GST registration applications assigned to Central jurisdiction. Aims to provide a structured, efficient, and time-bound grievance redressal system for applicants facing delays, rejections, or queries. This Circulated is issued to RAC, Trade Associations, and Chambers of Commerce in Delhi. Officers and staff across CGST Delhi zones and Website, notice boards, and relevant internal files

Key Highlights of Grievance Redressal Mechanism for processing of application for GST registration

Who Can Use This Grievance Redressal Mechanism?

- Applicants whose Application Reference Number (ARN) is assigned to Central jurisdiction. Specifically applies to grievances such as:

- Rejection of GST registration applications.

- Unjustified or unresolved system-generated queries.

- Delays or errors during application processing.

Procedure for Grievance Submission under GST registration

Step 1: Each Zonal Principal Chief Commissioner / Chief Commissioner is mandated to publicize a dedicated official email ID for grievance submission.

Step-2: The applicant may submit the grievance by email, containing the following details:

- ARN (Application Reference Number)

- Name and PAN of the applicant

- Description of the grievance

- Supporting documents/screenshots, if any

Handling of Grievances Jurisdiction Check: On receiving a grievance, the Zonal Office will first verify whether the grievance pertains to Central jurisdiction. Resolution and Communication: The grievance is assessed and, if valid, resolved within a reasonable timeframe. Applicants are informed via email regarding the outcome or any additional steps required.

Monitoring and Reporting of GST registration application

- Monthly Reporting: Each Zonal Principal Chief Commissioner / Chief Commissioner must compile a monthly grievance redressal report. This report includes the number and nature of grievances received, resolved, and pending.

- Submission to DGGST: The monthly report is submitted to the Directorate General of Goods and Services Tax (DGGST). The DGGST consolidates zone-wise reports into a national summary.

- Review by CBIC: The Central Board of Indirect Taxes and Customs (CBIC) reviews the summary and provides further directions or policy inputs, if required.

Role of Supporting Authorities in GST registration

- Director General of Taxpayer Services: To create awareness and ensure dissemination of this redressal mechanism to taxpayers.

- GST Council Secretariat: May provide coordination and oversight as needed, especially where policy-level interventions are required.

- Resolution of Difficulties : Any implementation-related challenges or practical difficulties should be promptly escalated to the CBIC for immediate attention and resolution.

- Reference to CBIC Instruction No. 04/2025-GST dated 02.05.2025: Applicants whose Application Reference Number (ARN) has been assigned to Central Jurisdiction and have grievances regarding rejection or query raised in contravention of instructions, may approach the Zonal Principal Chief Commissioner/Chief Commissioner.

- Grievance Redressal Cell (GRC): A GRC has been set up in PCCO, CGST & CX, Delhi Zone. Taxpayers are advised to send grievances related to new GST registration to the dedicated email: grievance.cgstdelhi@gov.in

- Approval and Signatory: : The notice is issued with the approval of the Principal Chief Commissioner, CGST & CX, Delhi Zone. Digitally signed by Manish Kumar Jha, Additional Commissioner.

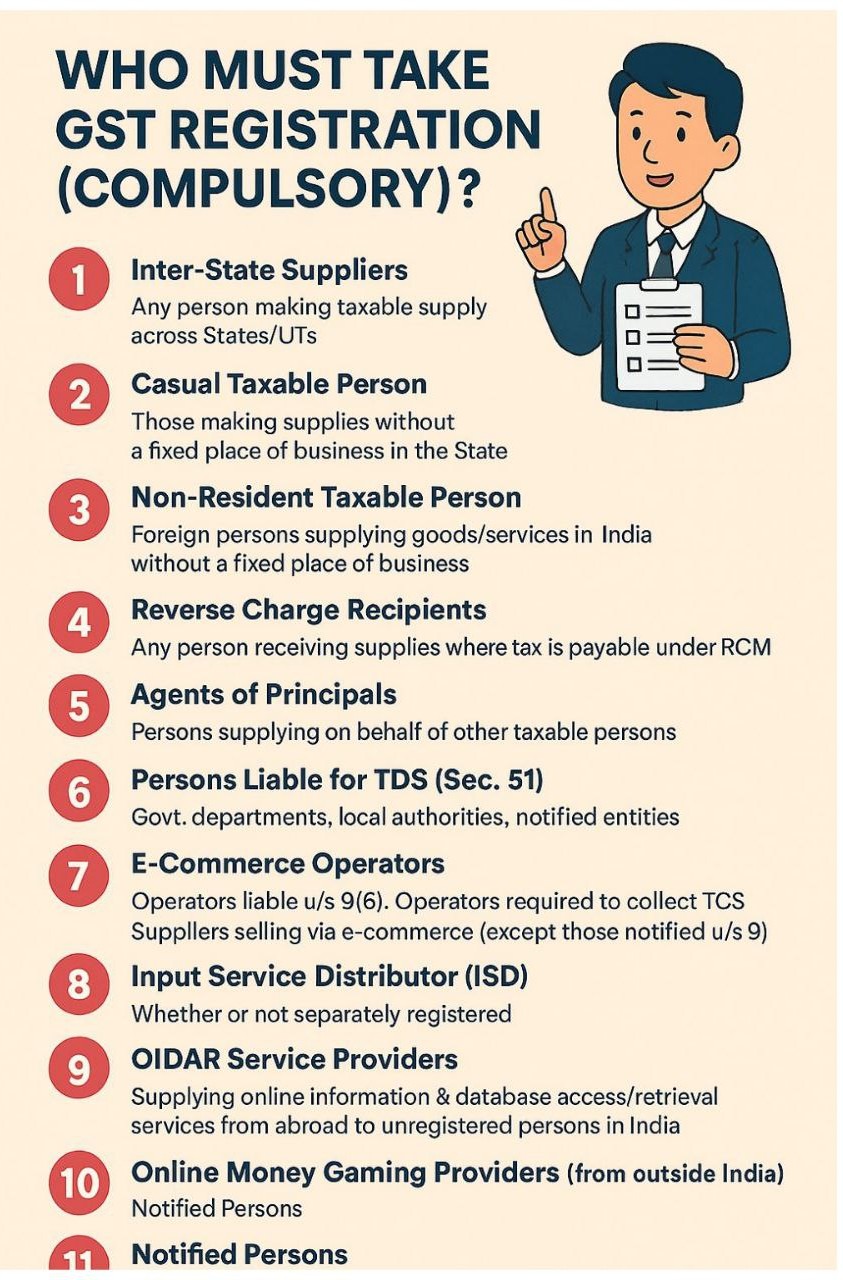

WHO MUST TAKE GST REGISTRATION (COMPULSORY)

Mandatory GST Registration Required For following person

- Inter-State Suppliers : Any person making taxable supply across different States or Union Territories.

- Casual Taxable Person : Those making supplies without a fixed place of business in the State.

- Non-Resident Taxable Person : Foreign entities supplying goods/services in India without a fixed business location.

- Reverse Charge Recipients : Any person receiving supplies where tax is payable under Reverse Charge Mechanism (RCM).

- Agents of Principals : Persons supplying goods/services on behalf of other taxable persons.

- Persons Liable for TDS (Section 51) : Includes government departments, local authorities, and other notified entities.

- E-Commerce Operators : Operators liable under Section 9(5) or required to collect TCS. & Suppliers selling via e-commerce platforms (except those notified under Section 9).

- Input Service Distributors (ISD) : Whether or not separately registered.

- OIDAR Service Providers : Providers of Online Information and Database Access or Retrieval services from abroad to unregistered persons in India.

- Online Money Gaming Providers (from outside India) : As notified by the government.

- Other Notified Persons : As per specific government notifications.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.