Applicable GST Rates for Restaurants Services

Table of Contents

Applicable GST Rates for Restaurants Services

All Kinds of Restaurants do have not the right to charge GST on their services provided. In case the Restaurant is registered under the GST, then that restaurant will be eligible to charge GST as per the GST law and can issue an invoice & collect GST in their invoice.

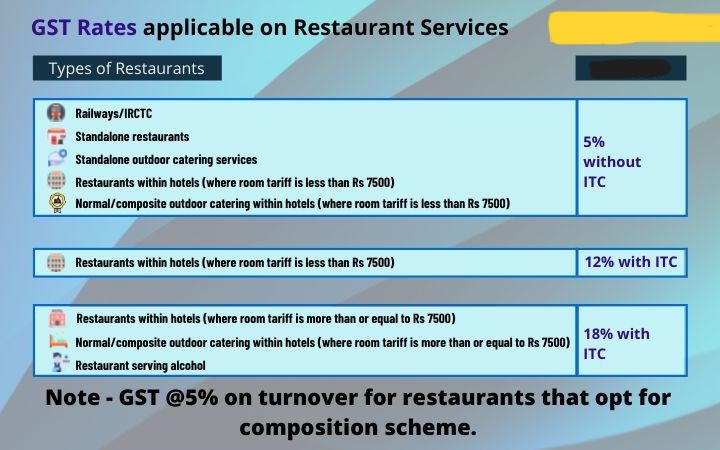

Different GST rates are applicable for different kinds of restaurant services under the GST Act 2017, and the same is summarized here under –

-

GST at 5% Rate (They cannot claim GST Input Tax credit)

According to a provision in the GST law, the expression “restaurant services” refers to all services and goods, including food and other items intended for human consumption, as well as any location where the said food is made available for consumption. These premises can include eating businesses, canteens, or mess halls.

As per Goods and services Tax circular dated 06.10.2021, No 164/20/2021, clarified that the It was made apparent that services provided by restaurants also include those provided by cafes, restaurants, and any other restaurants that provide a similar level of service. Therefore, it means that delivery and takeaway services are considered as well as restaurant services.

-

18% GST rate (can claim Input Tax credit)

The rate can differ according to the location of the restaurants. Other than this, a higher GST rate would be applicable for restaurants which are located in hotels, where the room tariff exceeds the specified amount.

GSTN Council left no doubt in making a clear that if any restaurant is in the hotel premises, guest houses, clubs, inn, or any other places defined as commercial for residents or their purposes with a regular tariff of INR 7,500/- per day/unit or above then the tax can be 18%.

So, 18% of the Goods and Services Tax amount includes services of food delivery. All the outdoor services of catering also come in the category of 18% Goods and Services Tax.

For Example, we have bifurcated the Goods and services tax rates for restaurant services based on the below parameters –

- Normal outdoor catering within hotels(with room tariff >=INR 7,500):-18% (with Input Tax credit )

- Standalone restaurants (including takeaway):- 5% (without Input Tax credit)

- Restaurants within hotels (with room tariff >= INR 7,500):- 18% (with Input Tax credit)

- food delivery service or standalone outdoor catering:- 5% (without Input Tax credit)

- Food supplied or catering services by IRCTC or Indian Railways:- 5% (without Input Tax credit)

- Normal outdoor catering within hotels(with room tariff less than INR 7,500):- 5% (without Input Tax credit)

- Restaurants within hotels (with room tariff less than INR 7,500):- 5% (without Input Tax credit)

Notes :

- Operators in the tourism industry are not eligible for the GST composition system. The composition system is only available to manufacturers, traders, and restaurants with annual sales of up to Rs. 1.5 crores.

- According to the Authority for Advance Ruling (AAAR) – Supply of readily available cakes & not accepting immediate orders by bakery can’t be treated as restaurant services.

- According to the Authority for Advance Ruling (AAAR) MAHARASHTRA AUTHORITY: Goods and services Tax Rate of 18% applicable on Services of restaurant located in hotel having tariff of INR 7500 & above.

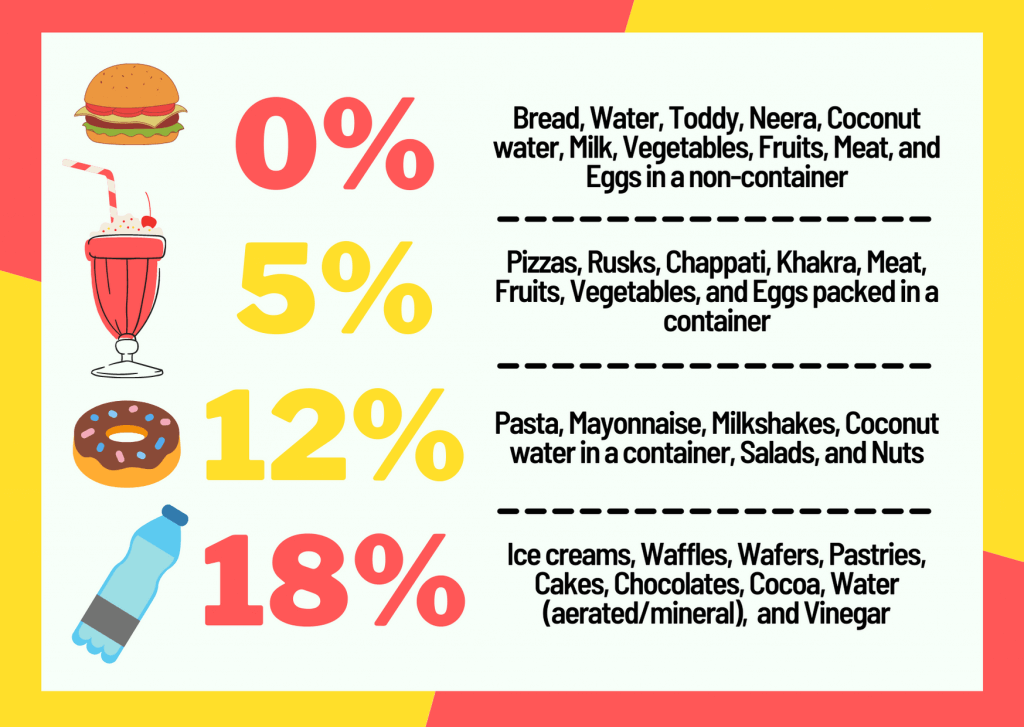

Details of food items with their interest rates:-

- Food items with an 18% interest rate: –

- vegetables (like. Tomatoes, mushrooms, etc.)

- Fruit jam, jellies, pastes, or nut puree Fruits

- Nuts and other plants preserved by vinegar or acetic acid or sugar.

- Food items with 0% interest rate: –

- Fresh vegetables & fruits meat & fish

- Coconut tea leaves, jaggery.

- Coffee beans, milk, turmeric, etc.

- Food items with a 5% interest rate: –

- Dried areca nuts (whether shelled or peeled

- Frozen or dried vegetables,

- Dried areca nuts whether shelled or peeled.

GST Rate on Sweets & Food Items – India (HSN-based Summary)

Branded & Packaged Ladoos

- HSN Code: 2106 – Food Preparations Not Elsewhere Specified or Included (Sweetmeats)

- GST Rate: 5%

- Applies when the sweets are branded, packaged, or sold with a registered trademark.

Unbranded / Loose Ladoos

- Typically sold by small halwais or sweet shops.

- GST Rate: 5%, when the seller is registered under GST.

- Exempt: When the seller’s aggregate turnover is below the GST registration threshold (₹40 lakh for goods, unless lower in certain special category states).

Other Sweet Items—Different GST Rates

| Item Category | HSN Code | Description | GST Rate |

|---|---|---|---|

| Traditional Indian Sweets | 2106 | Ladoo, Barfi, Rasgulla, Gulab Jamun, etc. | 5% |

| Sugar Confectionery | 1704 | Candies, Toffees, Sugar Drops | 18% |

| Chocolates & Cocoa-based Products | 1806 | Chocolate bars, cocoa preparations | 18% |

Sweet shops often classify themselves as restaurant + sweet shop, allowing mixed GST rates. Many items under HSN 2106 remain at 5%, making it a safe classification for most Indian sweets. For composite supplies (e.g., serving sweets with food), GST classification depends on the principal supply.

GST rates of AC & NON-AC Restaurants: –

According to Goods and Service Tax Network Council Norms

- In case Restaurants with no AC charge 5% GST, where 2.5% is CGST and 2.5% is SGST.

- And Restaurants AC charges 5% GST, but the restaurants which are located within the hotel premises and have a tariff of Rs 7,500 or more than this will charge a rate of 18%.

- If restaurants provided pre-cooked food or pre-packed food then the Goods and services tax rate will be 12%.

- Meanwhile, there is no GST Tax applicable on customers availing services from restaurants running on composition scheme.

- 5% GST without Input tax Credit for supply of food inside restaurant situated in zoological garden

Clarification on GST on Ice-Cream Parlor : Retro or Prosp

- Companies that are manufacturing ice cream have urged for clarification on the applicability of GST at the rate of 18% on parlour.

- The Goods and Services Tax Council is likely to take up the issue related to the levy of the GST mechanism on ice cream parlors in this month.

- Ice cream is supplied as a good, not a service, even though it contains some elements of a service. Ice cream parlors sell fully created ice cream rather than cooking or preparing it for consumption like a restaurant.

- The absence of references to the prosp and retrosp effects has been clarified.

- There have been numerous requests for clarification; however, the ice cream shops have been forced (by notice) to pay the GST at 18% for prior purchases as of July 1st, 2017, in which case most of them would file for insolvency and have to close down.

GST Rate Structure Impact on Restaurant Bills

- The GST rate structure is good news for eateries since it removes several taxes, which result the cost saving. Lower prices on bills undoubtedly draw customers and boost business overall.

- The restaurant industry has been subject to expensive and numerous taxes. NRAI has been promoting the same reduction/simplification. We applaud the Centre for taking action to bring about this long-awaited reform.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.