GST Tax Evasion instances observed during GST law

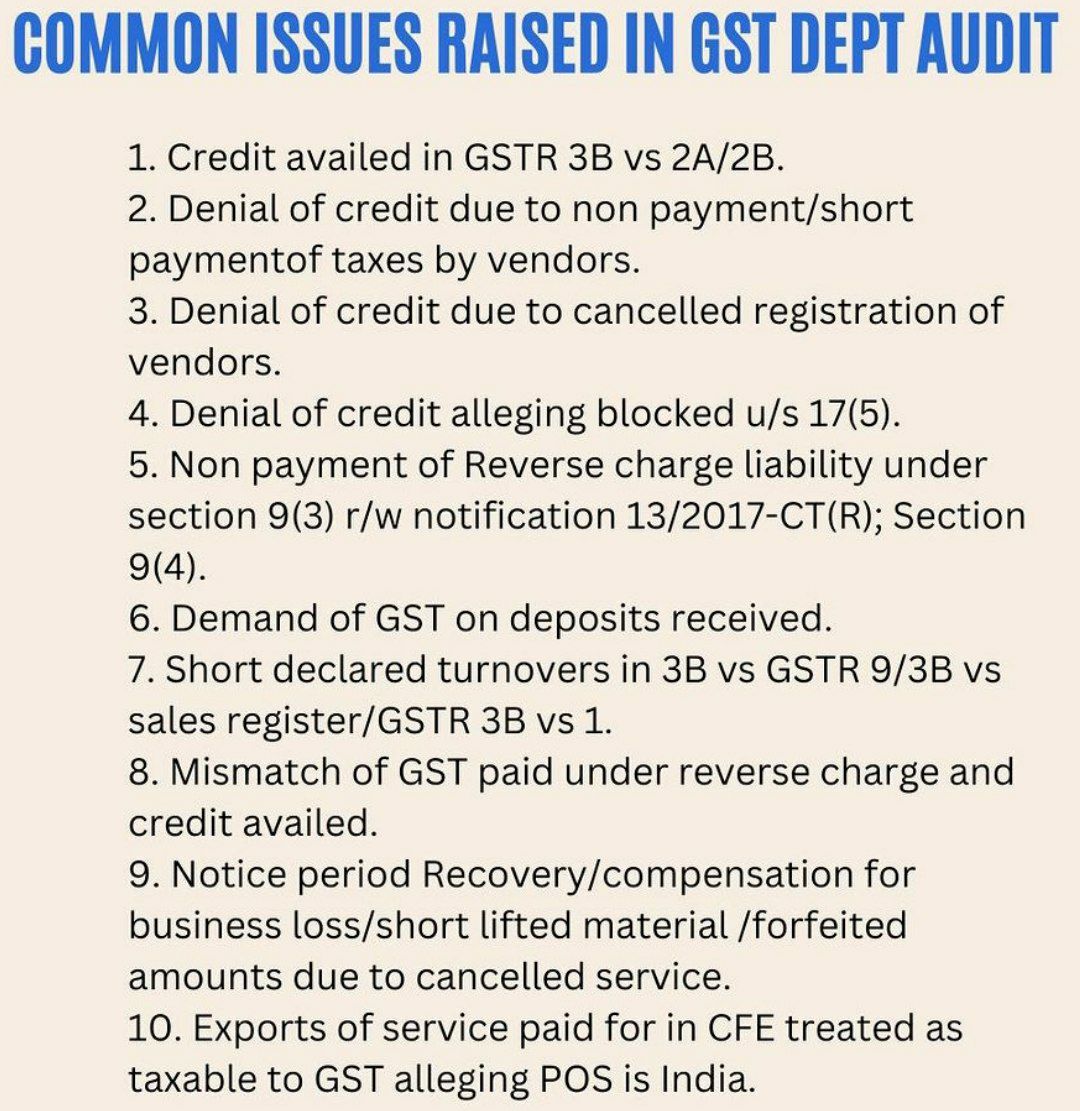

Normal GST Tax Evasion instances observed during the GST law

- Fake invoices with fake GST number raised to collect Goods and services tax, but not deposited with government.

- Making sales of services to GST registered persons not in line of same business, and thereby transfer the balance/unutilized Input tax credit and receive cash against the same.

- Initially, Input tax credit claimed on assumption basis, and in the last months of the financial year, the said ITC is reversed, without payment of interest liability.

- Amount of Taxable Supply, as prefilled based on filing of GSTR -1 can be manually changes in GSTR-3B, without stating the changes to particular invoices.

- Bills manipulation, wherein Goods and services tax rate differ on account of bill amount, and accordingly lower GST rate is applied even though the sale value is more. – Apparel under 1000 rate us 5%, exceed 1000, rate is 12%.

- Same trader takes 2-3 Goods and services tax registrations and transfer the whole turnover of 1 business to 3 business, thereby avoiding Goods and services tax registration and liability thereon.

- Businesses are purchasing branded goods, but are selling them in open as unbranded goods, thereby evading from Goods and services tax liability.

- Claiming Input tax credit paid on capital goods, which is required to be capitalized in the books and not to be claimed under Goods and services tax.

- In order to evade from the compliance of E-way Bill, goods are transported using Railways, since the same is a proper mode to evade E-way bill requirement and thus facilitate evasion of GST.

- Personal expenses incurred are booked under business expenses and thus, Goods and services tax input is transferred to business Goods and services tax number and ITC is accordingly claimed.

- Businesses are knowingly making mistake in Goods and services tax liability, i.e. charging taxable supplies to exempt supplies, or charging lower GST rate, and thereby claiming unutilized ITC as refund.

- Traders, local confectioneries and grocery stores donot issue bill to customers, and thereby suppress GST turnover.

- GST evasion of Rs 23,000 cr by gaming companies in April 2019-Nov 2022 period being investigated.

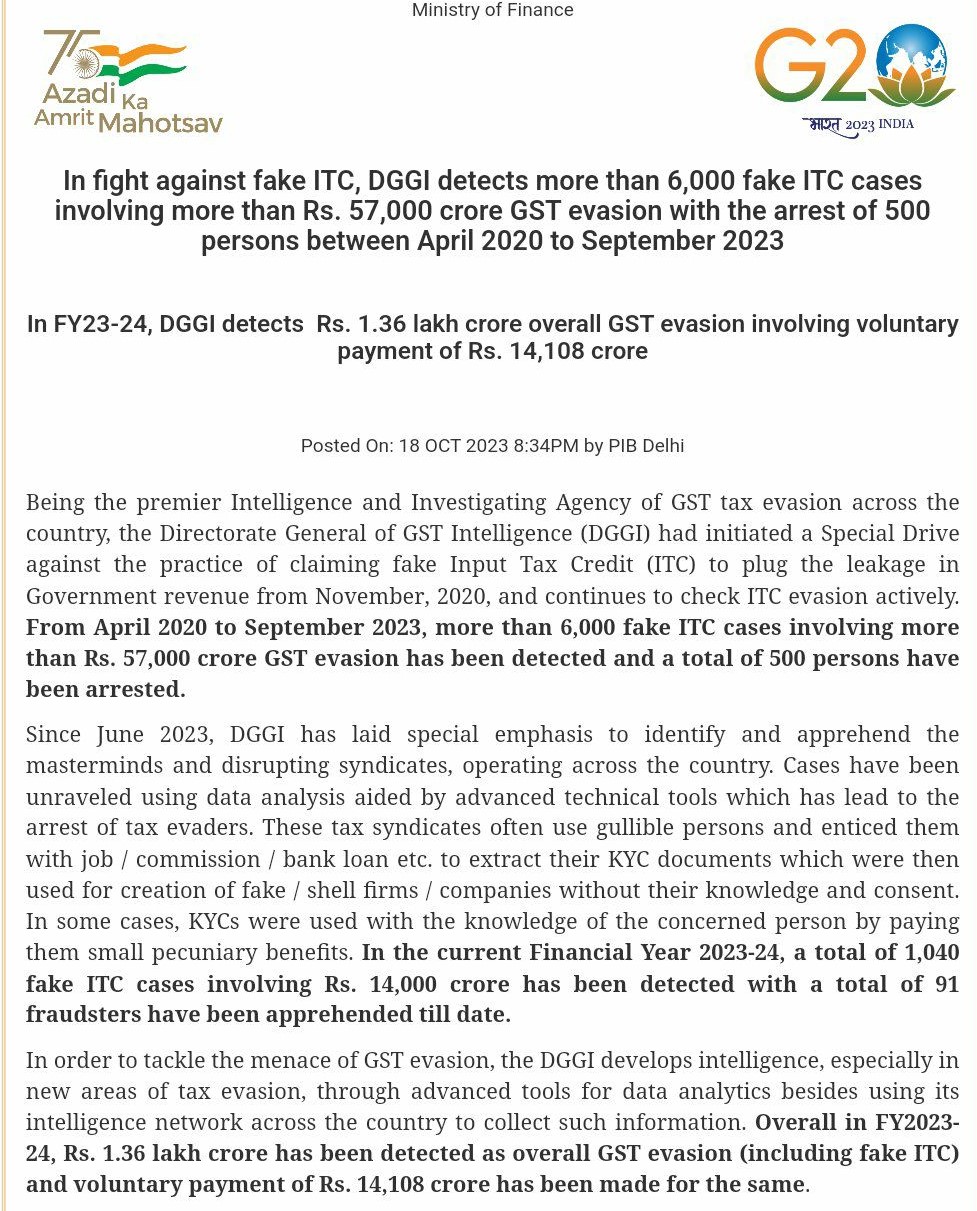

Directorate General of Goods and Service Tax Intelligence detects more than 6k fake Input Tax credit

- Directorate General of Goods and Service Tax Intelligence detects more than 6k fake Input Tax credit cases involving more than Rs. 57,000 crore Goods and Service Tax evasion with the arrest of 500 persons From April 2020 to Sept 2023.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.