GSTN issued advisory on New Bank A/c Validation

Table of Contents

Goods and Services Tax Network issued advisory on New Bank Account Validation

- GSTN has issued Advisory dated April 24, 2023 on Bank Account Validation. It is recommended that the Goods and Services Tax System now includes capabilities for bank account validation. This feature was added to make sure that the bank information provided by GST payers is integrated with Goods and Services Tax System

- Bank A/c validation status can be seen under the GST Dashboard→My Profile→Bank A/c Status tab in the FO portal.

- Goods and Services Taxpayers will also receive the bank account status detail on registered email and mobile No immediately after validation is performed for his declared bank A/c.

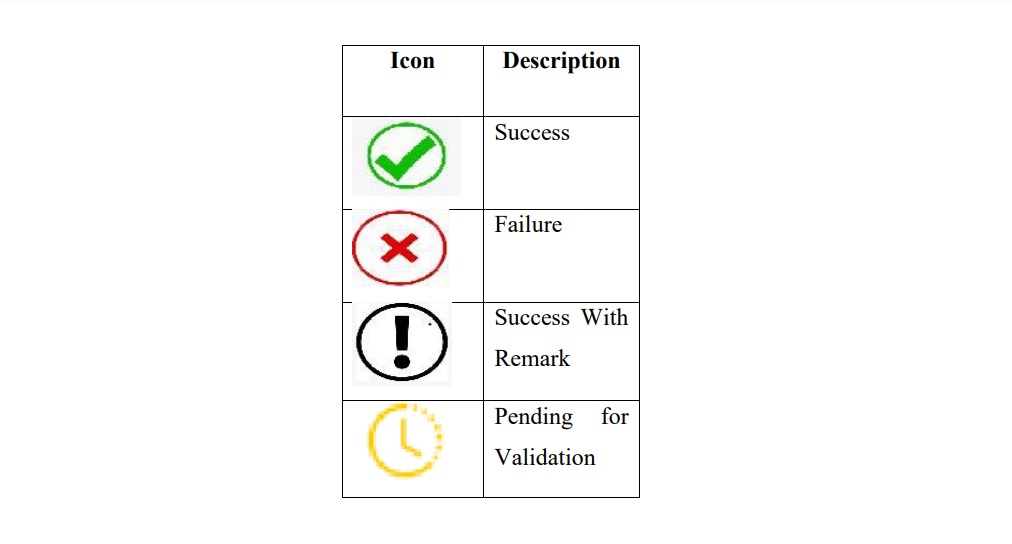

- Post Bank Accounts validation, any bank A/c No in database would have one status out of the four status types. The exact details of the Bank Accounts can be seen by hovering mouse over these icons in the Goods and Services Tax Payers’ dashboard in FO Portal.

- Whenever, the Goods and Services Taxpayer is shown ‘Failure’ icon, it with have further details such as

🔘 Entered Permanent Account Number is invalid.

🔘 Permanent Account Number not available in the concerned bank account.

🔘 PAN Registered under Goods and Services Tax Network, and the Permanent Account Number maintained in the Bank Account are not same.

🔘 Bank IFSC code entered for the bank A/c details is invalid.

- In such circumstances, Goods and Services Taxpayer is liable for making sure that he has supplied accurate bank information & that the bank has completed the Know Your Customer form for his bank account.

- The GST Tax Payer should provide an alternate bank account number so that it can be revalidated in order to speed up subsequent online processes whenever the status of his bank account is displayed as “Success With Remark” icon with the information “The account cannot be validated since the bank is not integrated with National Payments Corporations of India for online bank account validation”,

- If the account status is shown as “Pending for Validation” then wait since the account will be validated by National Payments Corporations of India.

- The Goods and Services Taxpayer at any time can delete or add the bank account details & new Bank Account details will be validated.

- GSTN has issued Advisory can be accessed at: https://www.gst.gov.in/newsandupdates/read/579

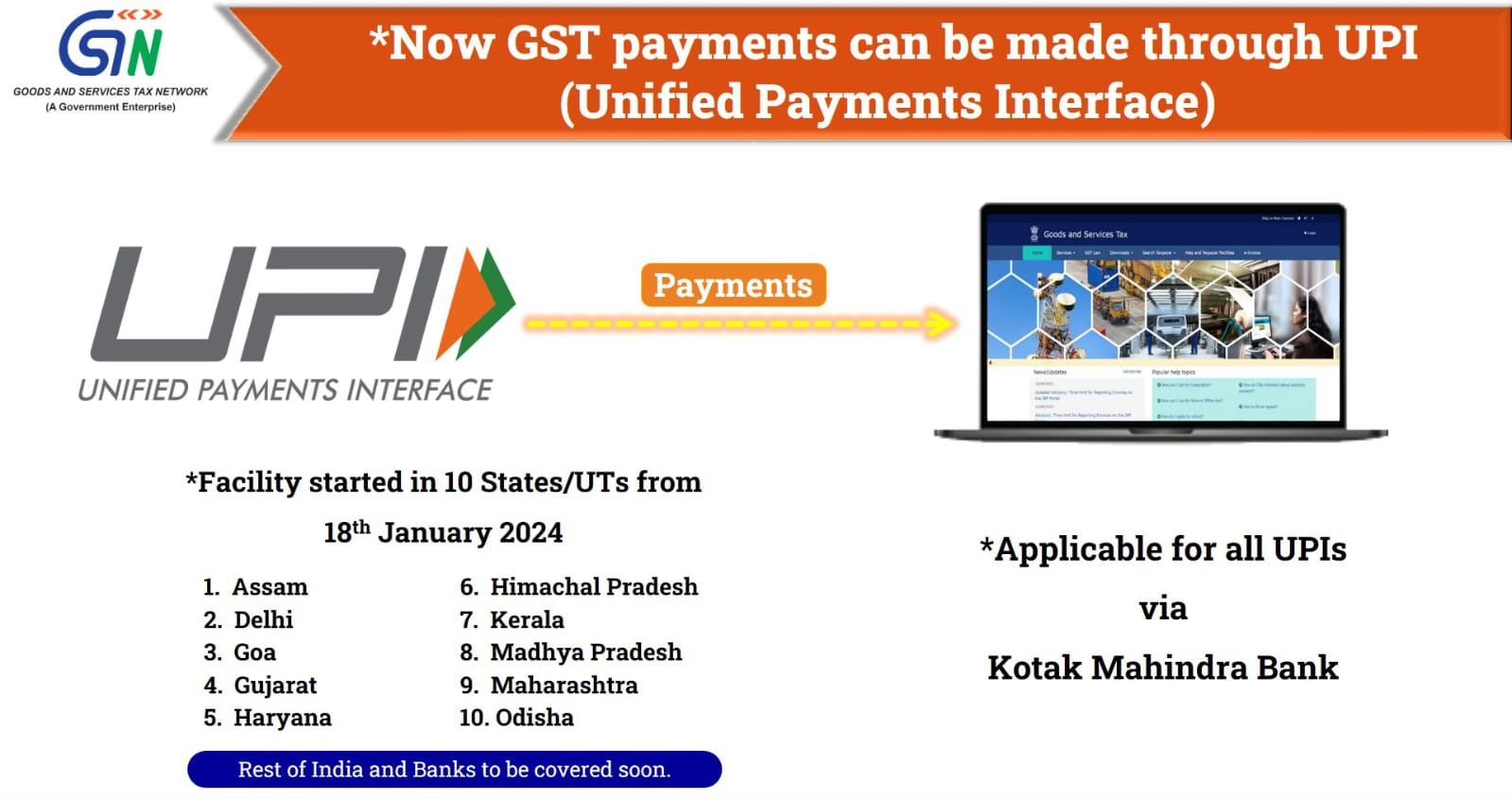

Now Goods and Services Tax Payments can also be made through UPI via @KotakBankLtd

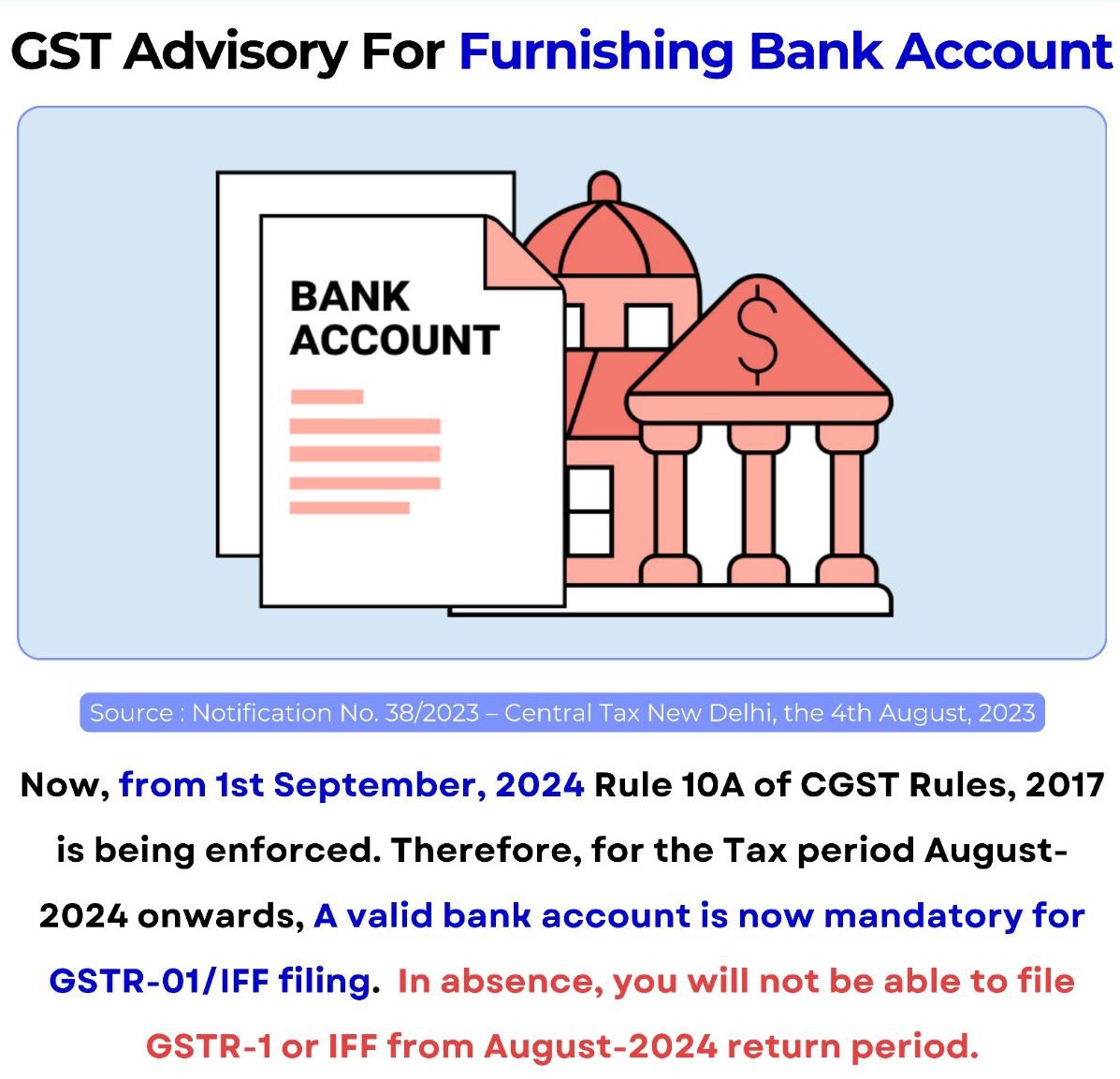

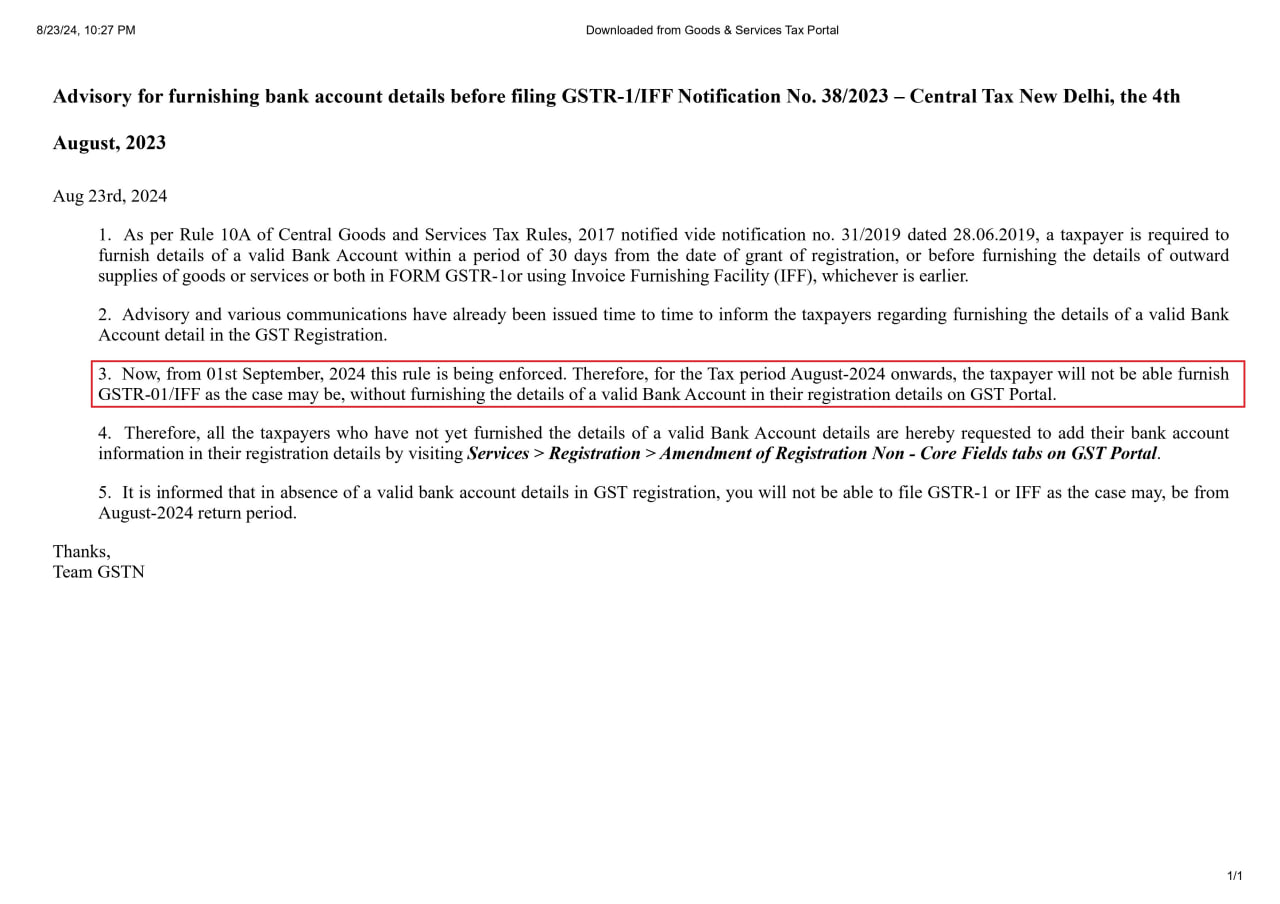

Goods and Services Tax add their valid bank account information in GST Registration

- From Tax period August-2024 onwards, the taxpayer will not be able furnish GSTR-01/IFF as the case may be, without furnishing the details of a valid Bank Account in their registration details on GST Portal.

- We kindly ask all taxpayers who have yet to provide the data of a genuine bank account to do so by visiting the Goods and Services Tax portal and adding the bank account information to their registration details.

- It is recommended that starting with the August 2024 GST Return period, you will not be allowed to file GSTR-1 or IFF, depending on the situation, In case GST Taxpayer do not have a valid bank account information for your Goods and Services Tax Registration.

- Allow us to assist you with GST compliance!

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.