Main High Value Transactions monitors by Tax Dept.

Main High Value Transactions monitors by Tax Dept.

We should require to be cautious because, in last few years, Income tax Authorities have brought into the radar and have been monitoring a large number of high-value and cash transactions. The Income Tax Department continually monitors high-value transactions that exceed a certain threshold. Failure to include such transactions in Income Tax Returns (ITR) filing may result in a tax notice. The Income Tax Department has established a data flow by enlisting the help of numerous investment platforms such as banks, mutual fund institutions, broker platforms, and others such as property registering authorities.

Main High Value Transactions are mention here under:

- Deposit of cash in the Current and Savings Accounts held with Nationalized or Private Banks: All Nationalized or Private Banks with Co-operative banks have to report transactions wherein cash deposits aggregating to INR 10,00,000/- or more is made in a savings account, in a FY. In the current A/c is capped limit at INR 50,00,000/-.

- Property sale or purchase: In case property Registering authorities have to report to the Tax Dept., all such kind of transactions, where amount is INR 30,00,000/- or more either by way of purchase or sales.

- Investment in Different financial instruments like, debentures, shares, mutual funds & bonds: financial institutions or Companies issuing debentures or bonds are compulsory required to report receipt from any person an amount aggregating to INR 10,00,000/- or more in a FY for purchase bonds or debentures. A similar limit is set for reporting purchase of mutual funds & shares.

- Deposit in Fixed deposit : All Nationalized or Private Banks with Co-operative banks are required to report to the Tax Dept. Transactions, where a person deposits cash in one or more-time deposits or Fixed deposit of an amount Total to INR 10,00,000/- or more in a FY.

- Foreign Exchange Transactions: Any receipt from a person for sale of foreign currency or expenses paid in any such foreign currency using banking cards, by draft, travellers’ cheque, or any other financial instrument with value INR 10,00,000/- or more, will have to be reported to the Tax Dept.

- Credit Card bill payment: Any payment of INR 1,00,000/- or more in cash against credit card Exp. has to be reported to the tax department. Apart from this payment of INR 10,00,000/- or more in a FY is also covered under the reporting need.

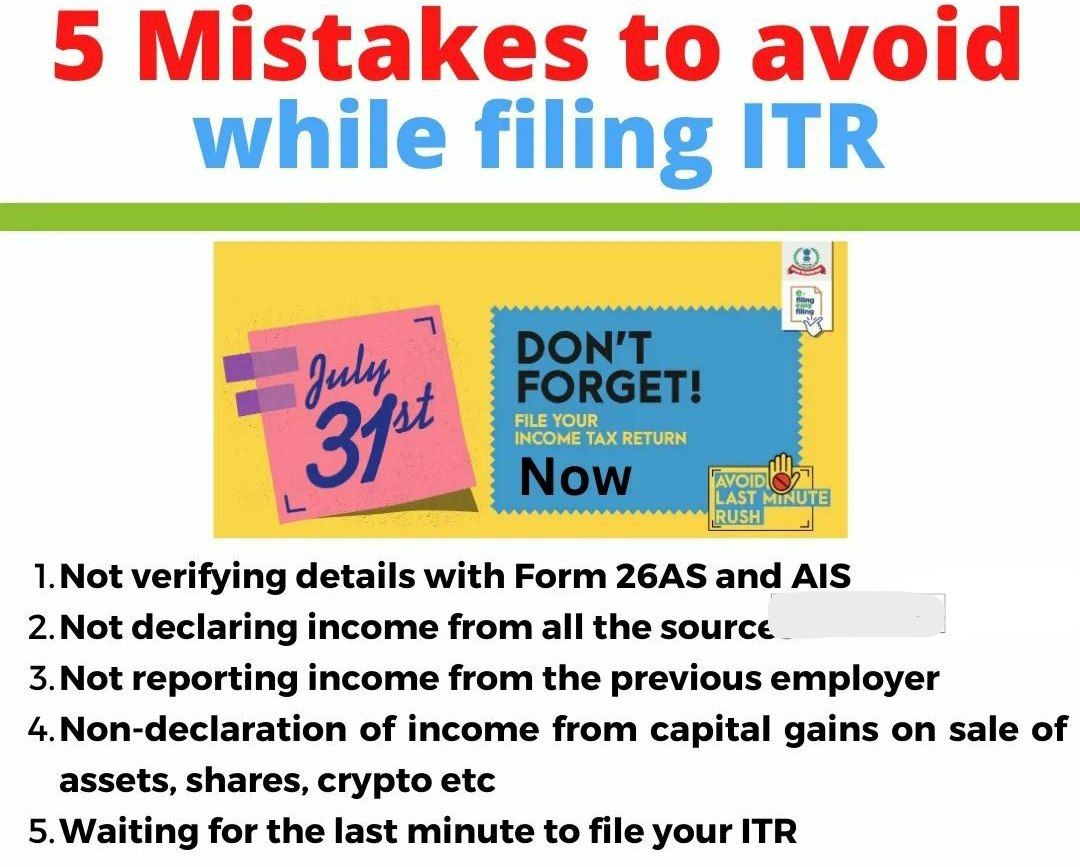

As a consequence, while finishing the ITR, a taxpayer must ensure that high-value transactions are correctly reported, and that the tax burden is correctly analysed. An Income Tax notice may be issued if there is an error or discrepancies in reporting such transactions. The income tax department employs a variety of data analytic techniques to track down non-filers of income tax returns or those who underreport their income.

Contact us at India Financial Consultancy Corporation Pvt Ltd, a team of professionals and expert CA CS in Delhi.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.