How differentiates PAN, TAN, & TIN?

Table of Contents

How differentiates PAN, TAN, and TIN?

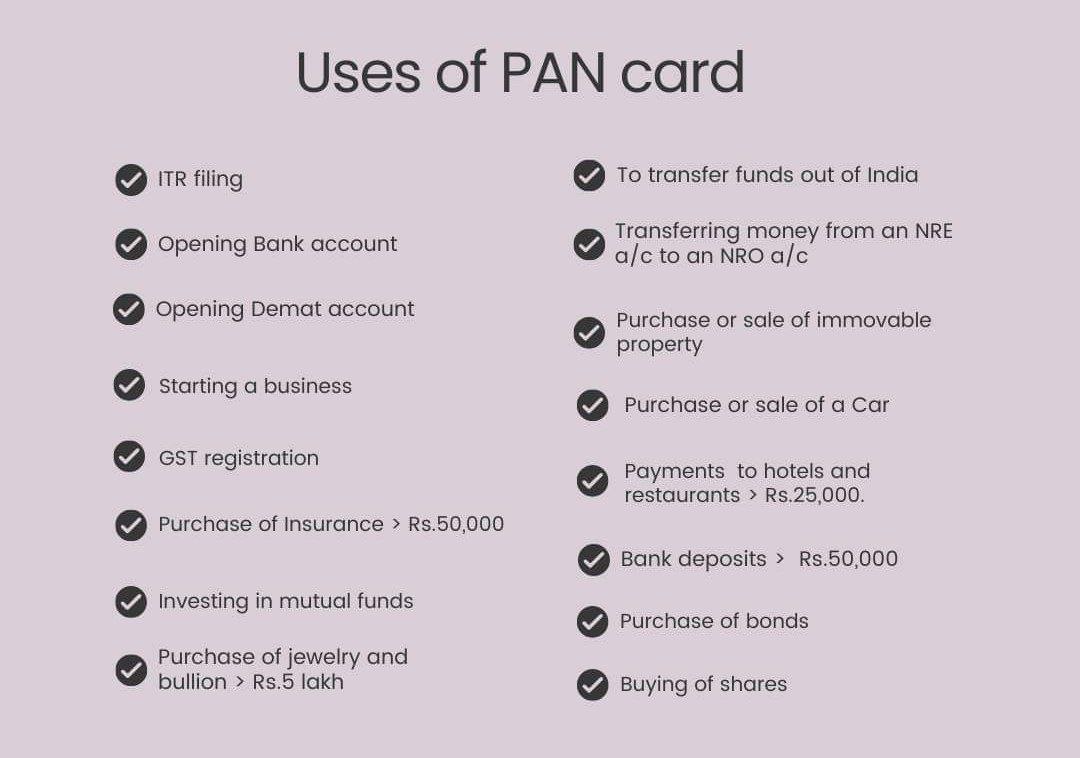

PAN, TAN, and TIN are all documents with various purposes. PAN, TAN, and TIN are acronyms for Permanent Account Number, Tax Deduction and Collection Account Number, and Taxpayer Identification Number, respectively.

PAN, TAN, & TIN are all documents that serve various different functions.

- PAN stands for Permanent Account Number,

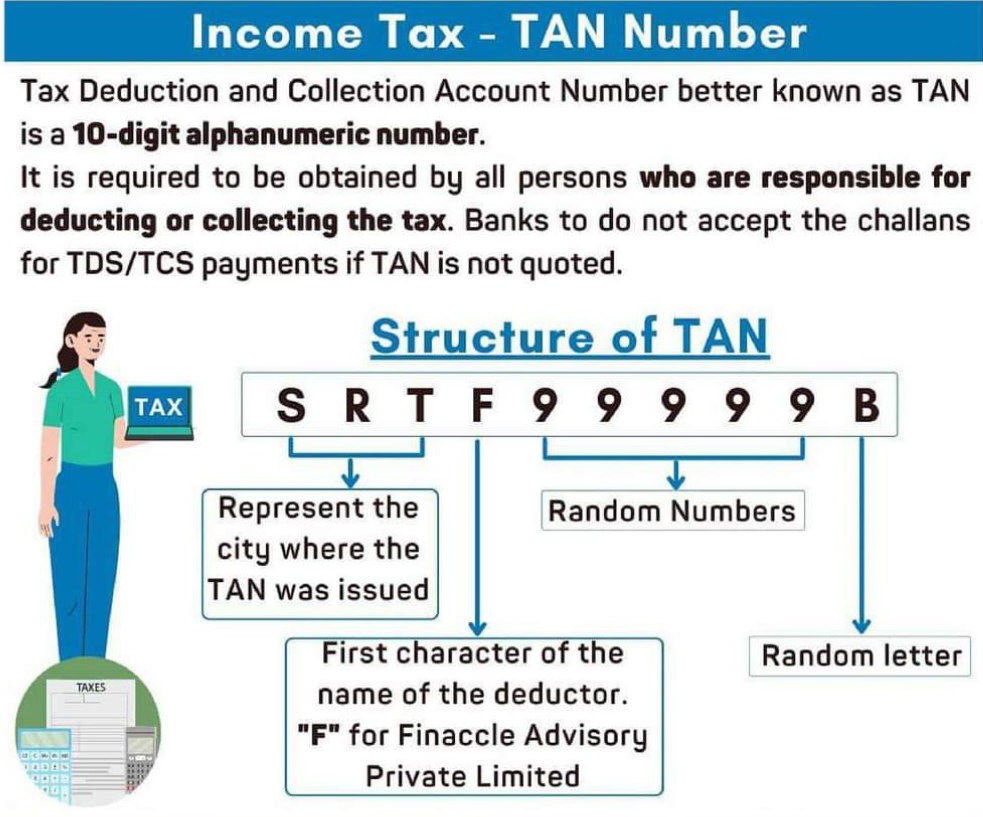

- TAN stands for Tax Deduction and Collection Account Number, and

- TIN stands for Taxpayer Identification Number.

Important documents like PAN, TAN, and TIN must be supplied for a number of activities like submitting income tax returns, withholding or collecting taxes, trading, and so on. A person is subject to punishment if they don’t apply for a PAN, TAN, or TIN or don’t follow the card-based rules.

Additionally, wherever they are required, these documents—PAN, TAN, and TIN—should be explicitly quoted. Furthermore, it’s essential to know that they are mutually exclusive.

In-depth discussions on PAN, TAN, and TIN, as well as the differences between them, will be covered in this blog.

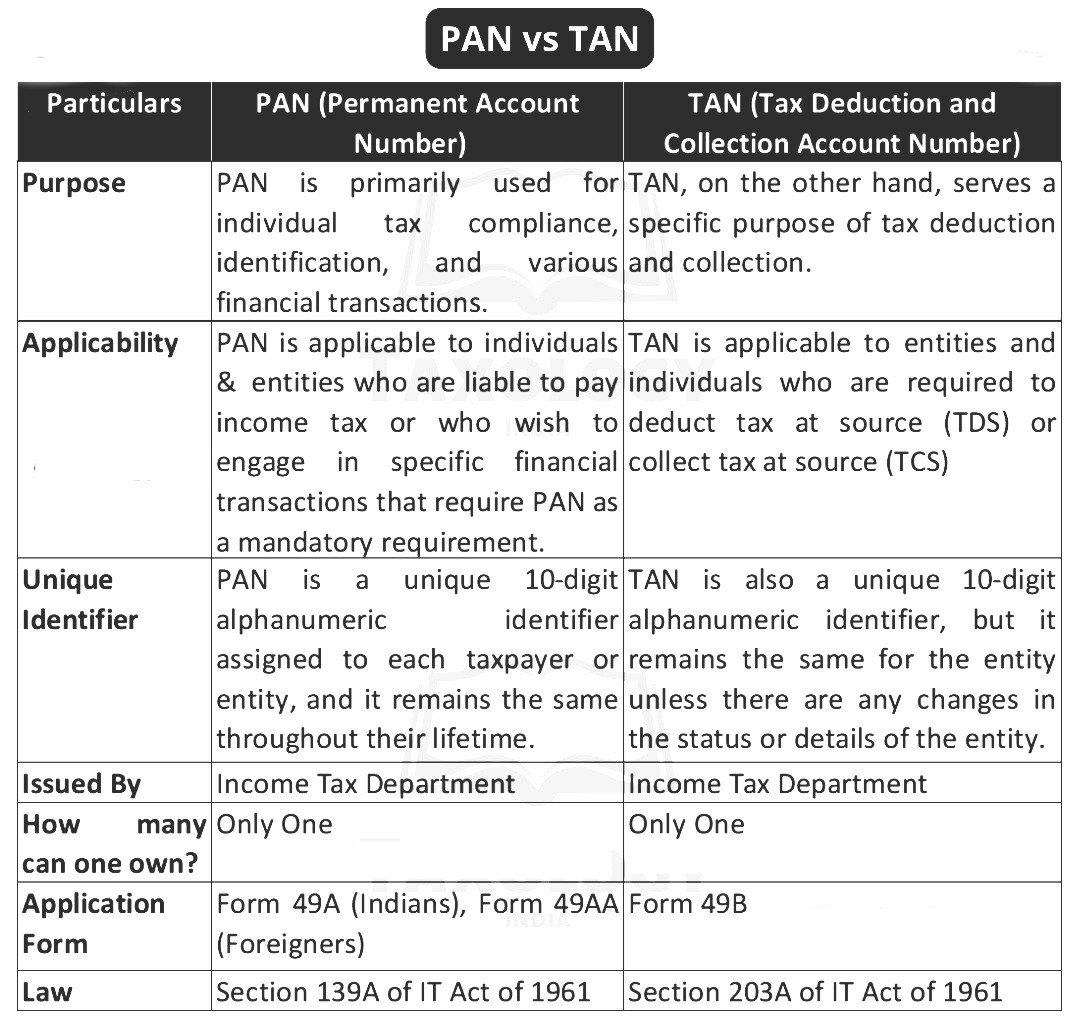

Difference Between PAN (Permanent Account Number), TAN (Tax Deduction and Collection Account Number), TIN (Taxpayer Identification Number)

| Parameters | Taxpayer Identification Number | Tax Deduction and Collection Account Number | Permanent Account Number |

| Issuing Agency | Commercial Tax Department of Respective State | Income Tax Department | Income Tax Department |

| Code | 11-digit code | 10-digit Alphanumeric number | 10-digit Alphanumeric number |

| Purpose | Track VAT-related activities | Used for deduction and collection of Tax | Used for financial transactions Acts as a proof of identity Used for buying/selling or property, car etc |

| Who should have it | Dealers, exporters, traders | People who deduct or collects tax under section 203 A | Taxpayers/ Non-Taxpayers Foreign nationals Foreign Entities |

| Laws | Different States have Different Laws | Section 203A of the Income Tax Act of 1961 | Section 139A of the Income Tax Act of 1961 |

| Penalty | Penalty differs as per the states | INR 10,000 | INR 10,000 |

| Forms to fill | Forms vary as per the States | Form 49B | Form 49A for Indian Citizens Form 49AA for Foreign Nationals |

| Number of Cards | 1 | One | 1 |

What are the Documents Required for a Taxpayer Identification Number (TIN)?

The given below documents might vary from state to state-

- Permanent Account Number Capy

- 6 passport size photographs

- Address proof

- Address proof of the business premises

- ID proof

- Purchase invoice,

- copy of GR & Payment/LR, collection proof with bank statement

Who Need a Taxpayer Identification Number (TIN)?

Below is the list of persons who require a Taxpayer Identification Number-

- Traders

- Manufacturers

- Exporters

- Dealers

Who Requires a Tax Deduction and Collection Account Number (TAN Number)?

A Tax Deduction and Collection Account Number (TAN number) is NEEDED by below mentions person

- Company

- Individual/HUFs

- Branch/Division of a Company

- Firm /Association of Persons/Trusts

- Central/State Government/Local Authorities

- Individual business’s branches

Who required to Apply Permanent Account Number Card?

Below mentions person can apply for a Permanent Account Number (PAN) card:

- Foreign nationals

- Individuals with a taxable income

- Students, non-taxpayers

- Foreign entities

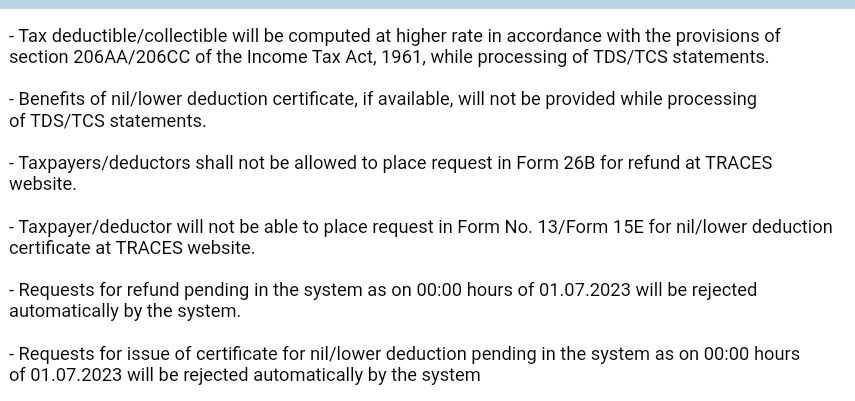

Consequences of Inoperative of PAN card due to Non Linking of PAN-Aadhaar

Our comprehensive range of services includes:

1) GST Compliance and Advisory :

· Registration and Filling of GST Returns

· GST Audit and Assessment Supports

· GST Planning and Optimization

2) Income Tax Services :

· Income Tax Return Preparation and Filling

· Tax Planning and Advisory

· Income Tax Assessment Assistance

· Tax Audit

· TDS Return

3) Accounting Services :

· Bookkeeping Services

4) Accounting Audit :

· Financial Statement Audit

· Internal Audit

· Compliance Audit

To know more kindly contact us on: +91 9555-555-480 or singh@caindelhiindia.com , India Financial Consultancy Corporation Pvt Ltd provide experienced CFO Service & Corporate advisory, affordable business & financial solution to Companies, SMEs, business owners and Entrepreneurs to address their all business needs without the expense and challenges of having a full time CFO on your company’s payroll.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.