How indexation affects LTCG & Aet-off post Budget 2024

Table of Contents

How indexation affects LTCG & Aet-offs post Budget 2024

comprehensive explanation of how indexation affects capital gains tax and set-offs—especially in light of the Budget 2024 changes.

Key Capital Gains Tax Changes in Budget 2024 Explained

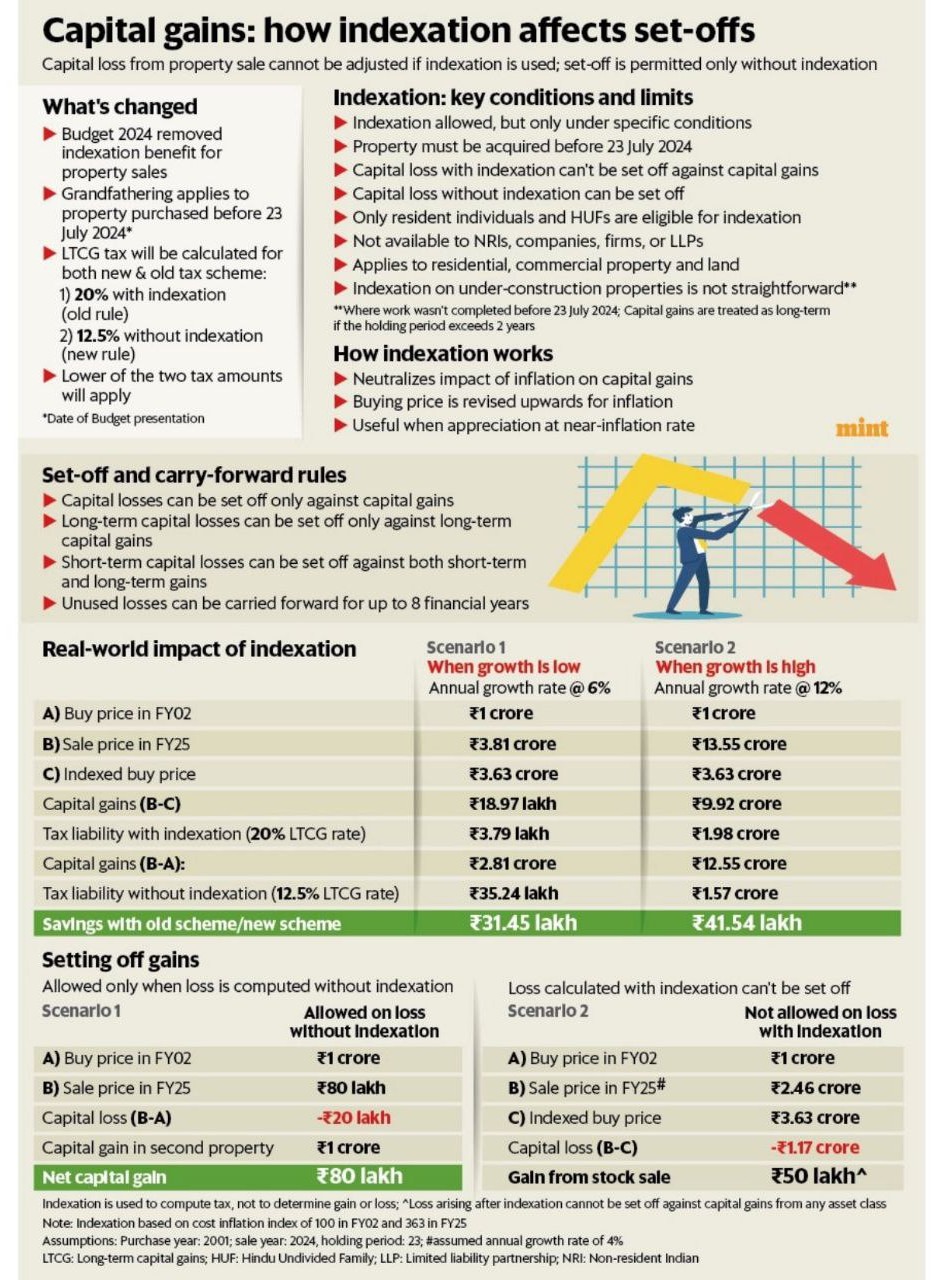

Indexation removed for property sales after 23 July 2024. Grandfathering applies to properties purchased before 23 July 2024. LTCG (Long-Term Capital Gains) tax will be calculated using:

- 20% with indexation (old rule)

- 5% without indexation (new rule) Lower of the two tax amounts will apply.

Who Can Avail This Benefit?

Eligible:

-

- Individuals and Hindu Undivided Families (HUFs)

- For both residential and commercial property

- Only for assets acquired before July 23, 2024

Not Eligible:

-

- Companies, LLPs, partnerships, trusts, etc.

- Assets like gold, securities, or leasehold rights (case-dependent)

Indexation: Conditions & Limits

- Income tax Indexation Allowed only if Property was acquired before 23 July 2024 and Taxpayer is a resident individual or HUF

- Indexation Not available for NRIs, companies, firms, or LLPs & Losses calculated with indexation

Only loss without indexation can be adjusted Indexation Applies to Residential, commercial property, and land and For under-construction properties is also eligibility depends on completion date

Uniform Long-Term Capital Gains (LTCG) Tax Rate

- Old Regime:

- Listed equity: 10% LTCG (no indexation)

- Real estate/unlisted assets: 20% LTCG (with indexation)

- New Regime:

- Flat 12.5% LTCG tax across all financial and non-financial assets

- Indexation benefit removed for real estate acquired after 23 July 2024

Short-Term Capital Gains (STCG) Tax Rate Increased

- Old Rate: 15% on listed equities and equity mutual funds

- New Rate: 20% STCG tax for listed equities & equity-oriented mutual funds

Holding Period Adjustments

- Listed Assets: 12 months = Long-term

- Unlisted Assets (financial & non-financial): 24 months = Long-term

- Includes:

- Stocks, bonds, ETFs (gold, bond, equity)

- REITs, InvITs

- Includes:

Share Buybacks Treated as Dividends

- Entire buyback proceeds now taxed as dividends in shareholder’s hands

- Capital loss (cost of acquisition) will be available for set-off/carry-forward

How Indexation Helps

- Indexation Adjusts the purchase price for inflation and Indexation Reduces taxable capital gains and also Indexation Most useful when growth is closer to inflation rate

Set-Off & Carry Forward Rules

- Losses can be adjusted only against capital gains

- LTCL (Long-Term Capital Loss) ↔ Only against LTCG

- STCL (Short-Term Capital Loss) ↔ Against STCG or LTCG

- Losses can be carried forward for 8 years

- Losses with indexation cannot be set off

Which Option Is Better? – Example-Based Insight

| Scenario | Annual Growth Rate | Better Option |

| Bought in 2001, Sold in 2024 at 4% growth | Old (indexation more helpful) | 20% with indexation |

| Bought in 2001, Sold at 12% growth | New (high appreciation benefits) | 12.5% without indexation |

| Bought in 2010, Sold in 2024 | New | 12.5% without indexation |

| Bought in 2019, Sold in 2024 | Old (low appreciation, indexation wins) | 20% with indexation |

Rule of Thumb:

- Low appreciation rate (below ~8%) → Old regime (indexation) is more beneficial

- High appreciation (above ~8–10%) or short holding → New regime (12.5% without indexation) is better

- You must calculate both methods to decide – no automatic switch

- Indexation cannot be used to create a loss (losses can’t be carried forward if only due to indexation)

- Section 54/54F/54EC exemptions are unaffected — can still invest gains to avoid tax

- Leasehold properties: Tax treatment unclear; depends on judicial interpretation

Before selling property:

- Check acquisition date (must be before July 23, 2024)

- Calculate LTCG both ways (with and without indexation)

- Choose the option with lower tax

Tools like capital gains calculators or help from a tax consultant/CA are strongly recommended.

Implications for Investors: Indexation affects LTCG & Aet-offs post Budget 2024

Positive Impacts

| Benefit | Impact |

| Simplification | One LTCG rate for all assets removes complexity |

| Tax Cut | Real estate & unlisted equity LTCG drops from 20% to 12.5% |

| Boost to long-term investing | STCG hike discourages short-termism; LTCG exemption raised from ₹1L to ₹1.25L for listed equity & equity MFs |

| Level playing field | Uniform tax treatment between listed & unlisted assets, and across investor classes |

Negative Impacts: Indexation affects LTCG & Aet-offs post Budget 2024

| Concern | Effect |

| Higher tax on short-term trades | Traders and short-term investors will bear more tax (20% STCG) |

| Loss of indexation | Real estate sellers lose inflation-adjusted benefits, increasing tax outgo |

| Discourages buyback participation | Dividend tax on buybacks may reduce investor interest |

No Impact on Fixed Deposits (FDs)

- FD interest remains taxed as per slab

- No change to taxation or structure of Tax Saver FDs

- Still viable for safe, low-risk, tax-saving investment

Summary & Key Takeaway

- Flat 12.5% LTCG tax creates parity and simplicity

- STCG rate hike could reshape short-term trading behavior

- Real estate investments need recalibrating due to loss of indexation

- Diversified, long-term investment strategy remains critical under the new tax regime

- Indexation helps only in low appreciation scenarios.

- Losses with indexation are disallowed for set-off → affects tax planning.

- For tax-saving Consider not opting for indexation if loss set-off is a goal and File capital gains and losses carefully with correct method. Always check eligibility — NRIs, LLPs, companies can’t use indexation

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.