How to Build a Strong CIBIL Score – Guide for New Customers

Table of Contents

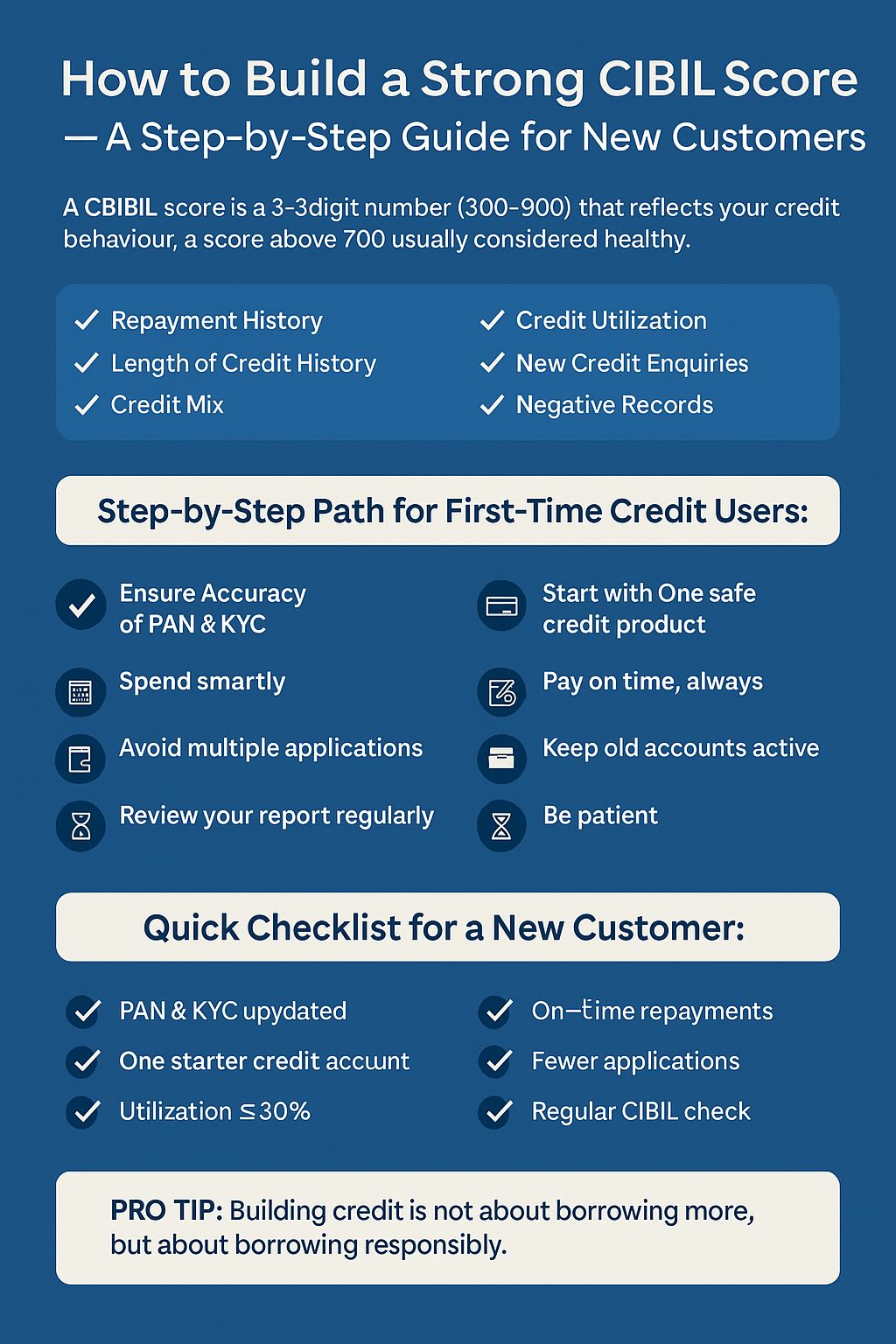

How to Build a Strong CIBIL Score – Step-by-Step Guide for New Customers

Your CIBIL score is a 3-digit number (300–900) that reflects your credit behaviour. A good credit score improves your chances of getting home loans, personal loans, and credit cards often with lower interest rates. In India, the CIBIL score ranges from 300–900, and a score of 700+ is considered healthy. It plays a critical role in loan approvals, credit cards, and interest rates. A score above 700 is usually considered healthy.

What Shapes Your CIBIL Score?

-

Pay Your Bills on Time : Timely repayment is the most important factor. Lenders primarily check your last 12 months’ payment history.

-

-

Set up auto-debits or reminders to avoid missed payments.

-

Late or missed payments significantly lower your score.

-

- Start Building Credit History Early : Credit history takes 6–12 months to establish.

-

Begin with a small loan or secured credit card.

-

Paying in instalments responsibly helps lenders trust you with larger loans.

-

- Lower Your Debt-to-Credit Ratio : Keep your credit utilisation ratio around 30% of your limit.

-

High utilisation signals financial stress to lenders.

-

Strategies: increase credit limit, make multiple payments in a month, or set alerts.

-

- Avoid Too Many Credit Applications : Multiple applications in a short period trigger hard inquiries and reduce your score.

-

Opt for quotation searches when comparing rates—they don’t impact your credit profile.

-

Only apply when you meet eligibility criteria.

-

- Check Your Credit Reports Regularly : Mistakes on your report can hurt your score.

-

India’s main credit bureaus: CIBIL, Equifax, Experian, CRIF Highmark.

-

Dispute errors promptly; resolution may take 30+ days.

-

- Clear Credit Card Dues On Time : Always pay your full balance by the due date.

-

If unable, pay at least the minimum due to avoid defaults.

-

Missed payments reflect in the Days Past Due (DPD) section of your report.

-

-

Clear Existing Debt : Outstanding debt lowers your credit score.

-

-

Repay loans on schedule or make prepayments to reduce the burden.

-

Responsible use of credit improves your score over time.

-

-

Repayment History : Timely EMI and credit card payments

-

Credit Utilisation : How much of your limit you actually use

-

Length of Credit History : Older, active accounts strengthen your profile

-

Credit Mix : Balance of secured (home/auto loans) and unsecured (credit cards/personal loans)

-

New Credit Enquiries : Multiple applications lower lender trust

-

Negative Records : Defaults, delays, or legal actions damage your score

Step-by-Step Path for First-Time Credit Users

- Ensure PAN & KYC Accuracy : All details must match across banks and documents.

- Start with One Safe Credit Product : A secured credit card or small EMI loan that reports to CIBIL is ideal.

- Spend Smartly : Keep credit utilisation below 30% of your limit each month.

- Pay on Time, Always : Automate payments or set reminders to avoid missed EMIs.

- Avoid Multiple Applications : Too many hard enquiries reduce your score.

- Keep Old Accounts Active : Longer credit history strengthens your profile.

- Review Your Report Regularly : Download your CIBIL report at least once a year and dispute errors if any.

- Be Patient : Credit history builds gradually; consistency is the key.

Quick Checklist for New Customers

-

PAN & KYC updated

-

One starter credit account

-

Utilisation ≤ 30%

-

On-time repayments

-

Fewer credit applications

-

Regular CIBIL check

How Long to Rebuild Credit?

-

Negative items can stay on your report for 7–10 years. Recovery from serious events like bankruptcy, foreclosure, or loan default takes longer. Consistent repayment and responsible credit use can show significant improvement within a few years.

-

Start small, pay on time, manage utilisation, and check your report regularly : a strong credit score is built gradually, not overnight.

Strategic Advice

- Build Slowly, Think Long-Term : A strong CIBIL is a marathon, not a sprint.

- Link Score to Benefits : Better score = lower interest rates, faster approvals, higher credit limits.

- Check All 4 Bureaus : CIBIL, Experian, Equifax, CRIF Highmark; lenders may check any of them.

- Avoid Co-applicant Risks : Defaults by co-borrowers or guarantors can impact your score.

- Start small, pay on time, and maintain consistency : your credit score will grow steadily and open doors to better financial opportunities.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.