IBBI: IP to Seek Restitution of ED-Attach Asset under PMLA

Table of Contents

IBBI Directs Insolvency Professionals to Seek Restitution of ED-Attached Assets under PMLA

Insolvency and Bankruptcy Board of India Issued Direction on 4th November 2025 Applies to all Insolvency Professionals, IP Entities, & IP Agencies. Deals with cases where corporate debtor’s assets are attached by the Enforcement Directorate (ED) under Prevention of Money Laundering Act, 2002 during insolvency proceedings.

The Insolvency and Bankruptcy Board of India has issued a directive requiring Insolvency Professionals (IPs) to approach Special Courts under the Prevention of Money Laundering Act to seek restitution of assets belonging to corporate debtors attached by the ED. According to the circular, Insolvency Professionals may file applications u/s 8(7) or 8(8) of the Prevention of Money Laundering Act for the release or restitution of such assets. The IBBI stated that this measure aims to enhance the value of the corporate debtor’s estate, thereby enabling better recovery and higher realisation for creditors under the IBC process.

A prescribed undertaking must accompany the application & undertaking directions

This directive is part of the regulator’s continued effort to ensure that assets critical to resolution are effectively recovered and brought within the insolvency process. A prescribed undertaking must accompany the application & undertaking directions is mention here under :

- Application for Restitution: IPs should file an application before the Special Court under PMLA (Sections 8(7) or 8(8)) for restitution of attached assets.

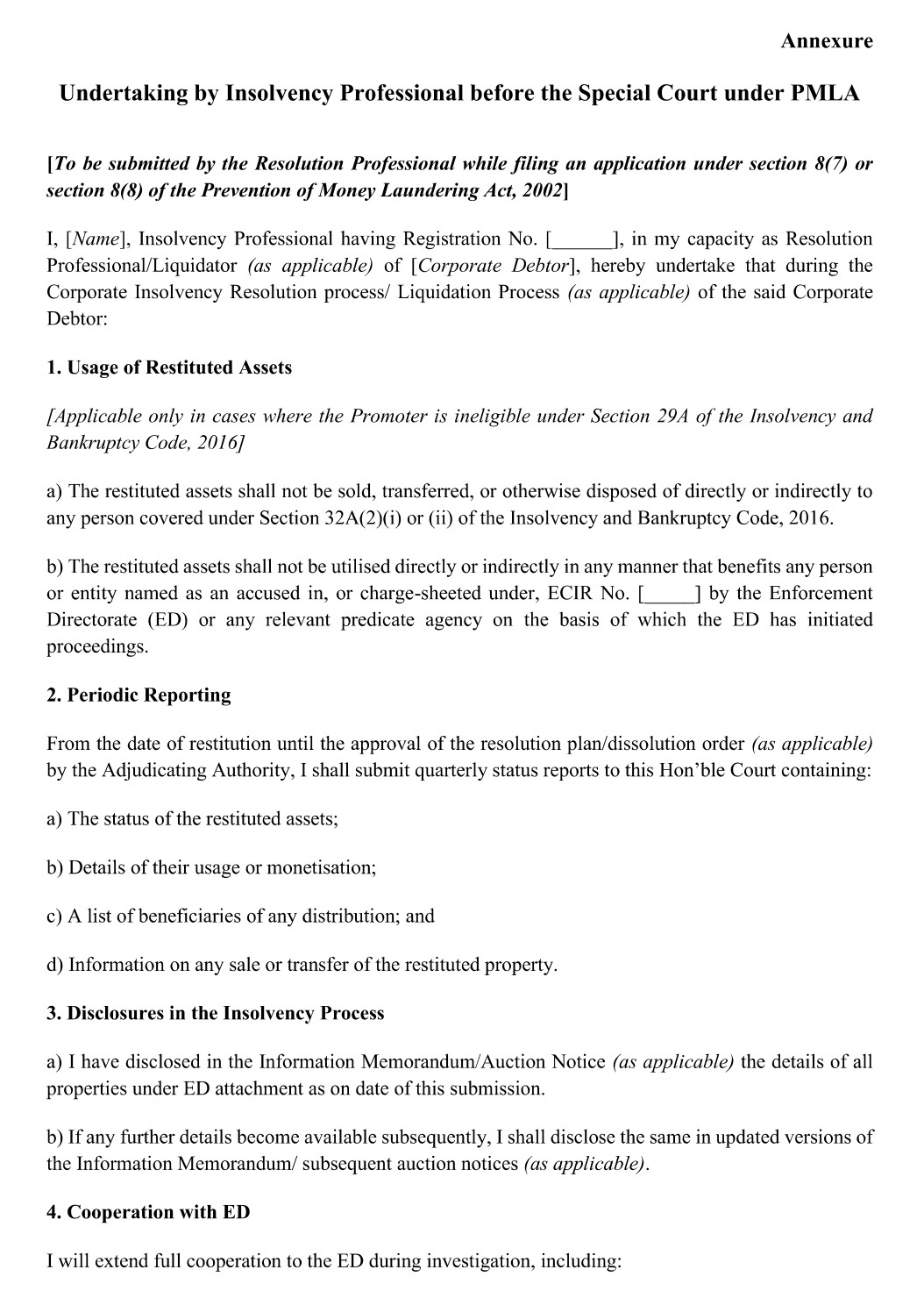

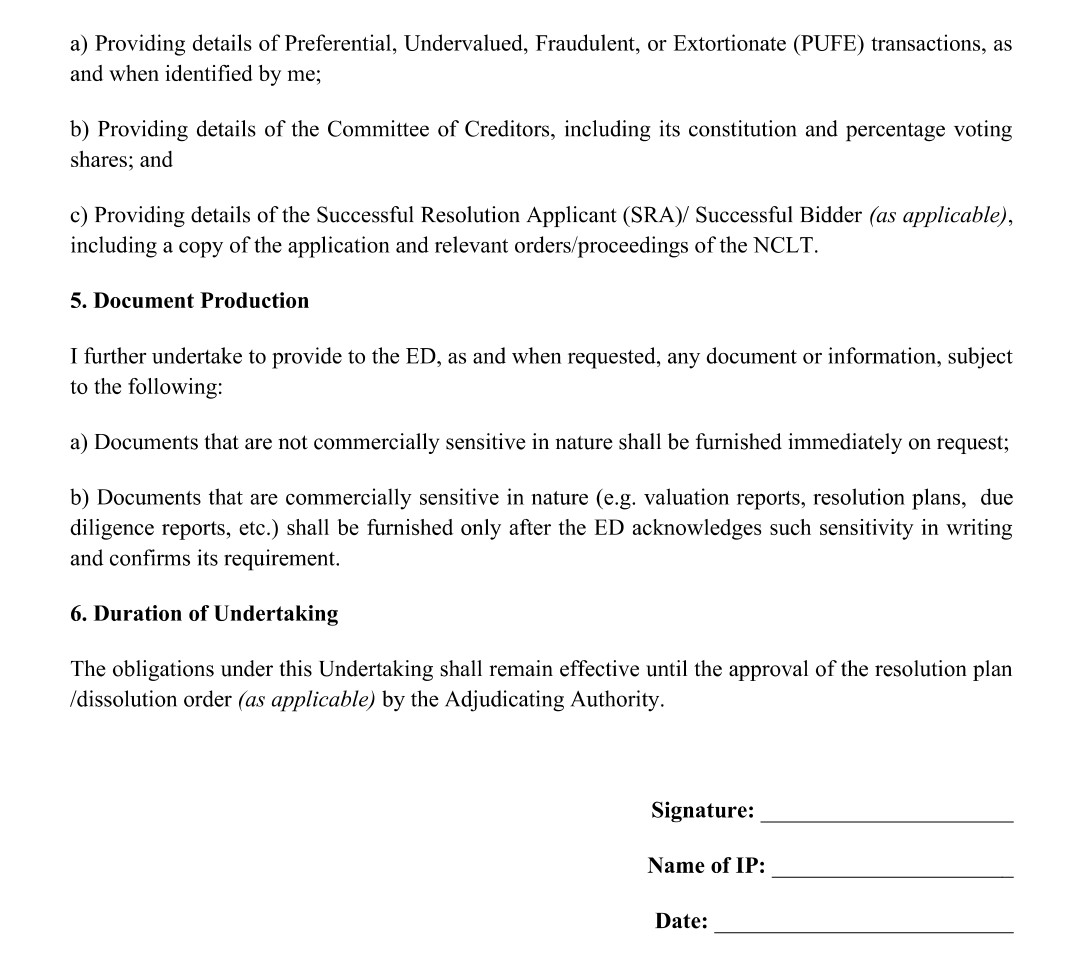

- Insolvency and Bankruptcy Board of India issue an Standard Undertaking under Prevention of Money Laundering Act (Sections 8(7) or 8(8)) for restitution of attached assets: A prescribed undertaking must accompany the application. Key obligations include:

- Usage Restrictions: Restituted assets cannot benefit promoters ineligible under Section 29A or any accused in ED cases.

- Periodic Reporting: Quarterly reports to the Special Court on asset status, usage, and beneficiaries.

- Disclosure: Details of ED-attached properties in Information Memorandum/Auction Notices.

- Cooperation with ED: Share details of PUFE transactions, CoC composition, and Successful Resolution Applicant.

- Document Production: Provide requested documents, with safeguards for commercially sensitive information.

- Duration: Undertaking remains effective until resolution plan approval or dissolution order.

IBBI the prescribed undertaking must accompany the application.

You may also review the other article

- Four Pillars of the Insolvency & Bankruptcy Code

- Category: Insolvency and Bankruptcy Code

- checklist of compliance requirements for RPs under IBC

- Overview on Initiation of Liquidation under the IBC

- Penalty Insolvency Professional under IBC regulations.

- Overview on Mandatory Requirement of AFA under IBC Code

- Do’s & Don’ts for IPs During Moratorium under IBC

- IBC Regulation

- IBC Help Homebuyers

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.