India–UK FTA recently signed by PM Modi

Table of Contents

India–UK FTA recently signed by PM Modi

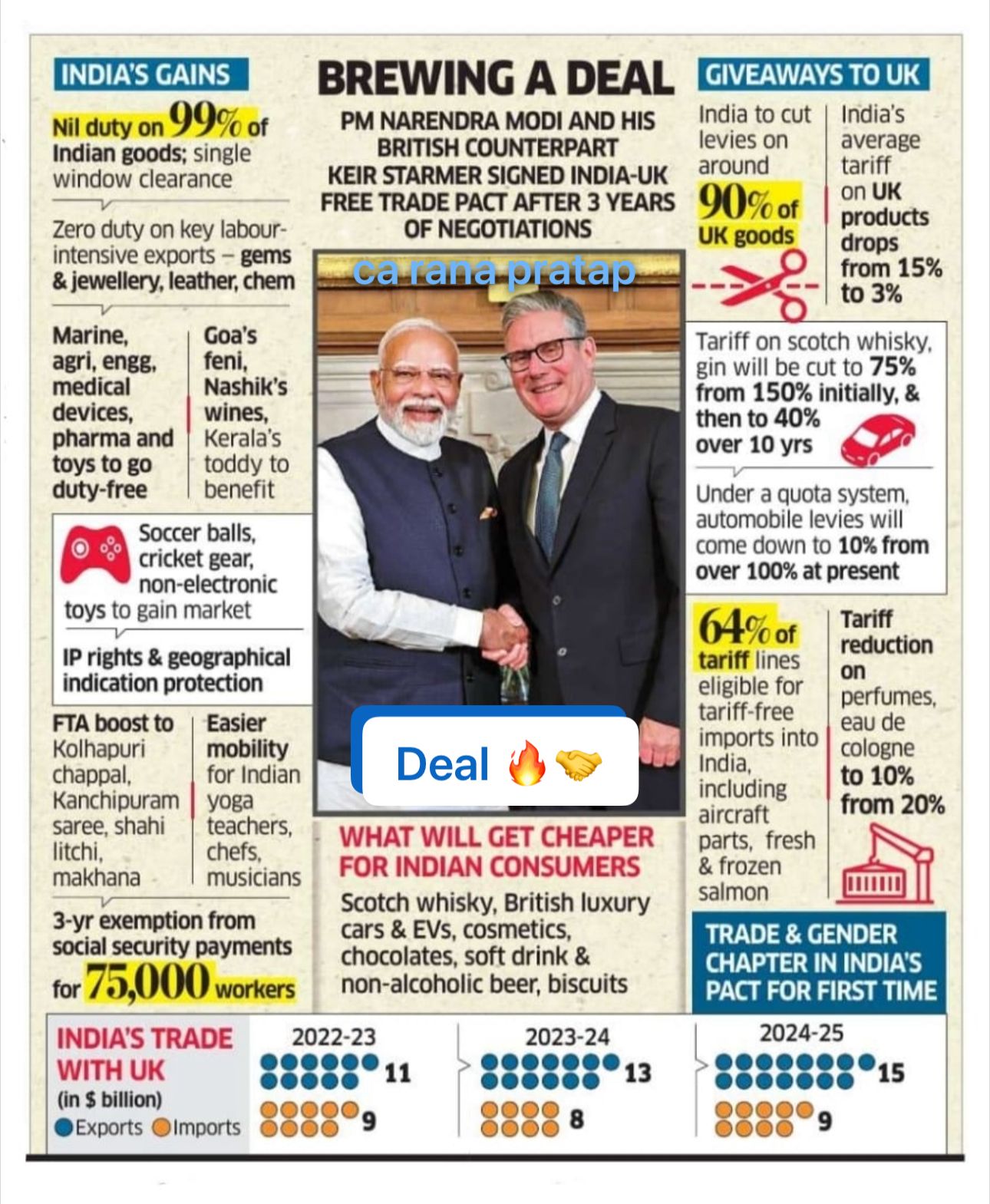

India–UK Free Trade Agreement recently signed by PM Narendra Modi and UK PM Keir Starmer after 3 years of negotiations. Here’s a clear breakdown of its implications:

As per Shri Piyush Goyal:“This CETA marks a milestone in the trade relations between two major economies… It unlocks tariff-free access on 99% of Indian exports, enhances mobility, and strengthens the ‘Make in India’ vision. It will benefit artisans, workers, MSMEs, startups, and innovators—safeguarding India’s core interests while accelerating inclusive growth.”

Historic Agreement Sealed

In a landmark achievement, India and the UK signed the Comprehensive Economic and Trade Agreement (CETA), heralding a new era of economic cooperation under the visionary leadership of Prime Minister Shri Narendra Modi and UK Prime Minister Sir Keir Starmer. Key Features of the India–UK CETA

India’s Gains:

- Nil duty on 99% of Indian goods exported to the UK. Zero duty on key labor-intensive exports like: Gems & Jewellery, Leather, Chemicals and Major export categories to benefit MarineAgricultureEngineering goodsMedical devicesPharmaToys, Geographical Indication (GI) & IP protection boost. FTA boost for local goods like Kolhapuri chappalsKanchipuram sareesShahi litchi, makhana,

- 3-year exemption from UK social security payments for 75,000 Indian workers.

- Easier mobility for yoga teachers, chefs, musicians.

Giveaways to UK:

- India to cut levies on 90% of UK goods. Average tariff on UK products drops from 15% to 3%.

- Tariff on scotch whisky & gin: Cut from 150% → 75% and Then down to 40% over 10 years

- Auto imports (like British luxury cars & EVs): Tariffs down to 10% from 100%+ under quota system. 64% of UK tariff lines eligible for tariff-free imports (e.g. aircraft parts, fresh/frozen salmon), Tariff on perfumes & cologne cut from 20% → 10%

What Gets Cheaper for Indian Consumers: Scotch whisky, British luxury cars & EVs, Cosmetics, Chocolates, soft drinks, non-alcoholic beer, Biscuits

India–UK Trade Snapshot:

| Year | Exports ($B) | Imports ($B) |

| 2022–23 | 11 | 9 |

| 2023–24 | 13 | 8 |

| 2024–25 | 15 (projected) | 9 (projected) |

Other Notable Highlights:

First inclusion of Trade & Gender chapter in an Indian FTA. FTA benefits extended to Goa’s feni, Nashik wines, and Kerala toddy. Boost to sports gear exports like soccer balls, cricket gear, non-electronic toys

Unprecedented Market Access : Zero-duty access on 99% of tariff lines for Indian exports to the UK. Covers nearly 100% of total trade value, unlocking significant export potential.

Boost for Labour-Intensive Sectors : Major benefits for sectors including Textiles, Leather & Footwear, Gems & Jewellery, Marine Products, Toys & Sports Goods, Engineering Goods, Auto Components, Organic Chemicals

Ambitious Services Commitments : First-of-its-kind UK commitment covering IT & ITeS, Financial, Legal & Professional Services, Education, Telecom, Consulting, Architecture & Engineering, Supports job creation, innovation, and higher-value service exports.

Enhanced Global Mobility for Indian Professionals : Streamlined visa and entry pathways for Contractual Service Suppliers, Intra-Corporate Transferees, Business Visitors, Independent Professionals (e.g., yoga instructors, chefs, musicians)

Double Contribution Convention – Major Breakthrough is Exemption from UK social security contributions for Indian workers and their employers for up to 3 years. Boosts take-home pay and cost efficiency for Indian companies deploying talent to the UK.

Inclusive and Sustainable Growth : Provisions to empower Women & youth entrepreneurs, Startups & MSMEs, Farmers & fishermen & Promotes access to global value chains, reduces non-tariff barriers, and supports innovation & sustainability.

Trade Impact & Outlook : Bilateral trade currently stands at USD 56 billion., Joint target: Double trade volume by 2030., Expected to significantly boost job creation, exports, and economic resilience.

In summary : Tarrif on Indian Exports after UK FTA

Marine Products: 20% ➝ 0%

Arms/Ammunition: 2% ➝ 0%

Electrical Machinery: 14% ➝ 0%

Gems & Jewellery: 4% ➝ 0%

Leather/Footwear: 16% ➝ 0%

Processed Food: 70% ➝ 0%

Textiles: 12% ➝ 0%

Auto/Transport: 18% ➝ 0%

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.