Introduction for Types of Non Banking Financial Institutions

Table of Contents

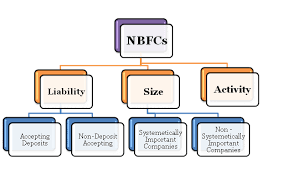

Introduction to Types of NBFC

Nowadays NBFC has become an integral part of the financial sector in India. RBI has mandated various types of NBFC carrying of different types of businesses based on their principal object.

For carrying on different types of financial lending activities, the NBFC must fulfill the required criteria as provided by RBI.

NBFC Based on Liabilities

-

Deposit Taking NBFC (NBFC – D)

These include NBFC’s which are licensed to accept deposits from the depositors apart from doing the lending business activities.

-

Non – Deposit Taking NBFC (NBFC – ND)

These are the NBFC’s which are not licensed to accept any deposit. These kinds of NBFC can only do the lending business and they are not allowed to accept any deposit. Furthermore, these kinds of NBFC mandatorily need to pass a Board resolution at the first Board meeting of every financial year that the NBFC Neither holds any Public deposit nor it will accept any deposit in the future.

Activity-Based NBFC

-

NBFC – Investment and credit Company(ICC)

These are the NBFC which has the principal business activities of the Acquisition of securities or making lending by way of loans to its customers. This category has emerged after RBU has merged Loan Company and investment company into one category called NBFC – Investment and credit Company(ICC).

-

NBFC – Infrastructure Finance Company (IFC)

An NBFC is called an Infrastructure Finance Company if it fulfills the following criteria

- At least 75% of total assets are deployed in infrastructure loan

- It has a minimum NOF of INR 300 Cr

- The credit rating of A or equivalent minimum

- CRAR of Minimum 15%

-

NBFC – Asset Finance Company (AFC)

An Asset Finance Company (AFC) is an NBFC whose principal business is to make financing for financing Physical assets like machinery, tractor, etc.

An NBFC is called an AFC if it’s financing the physical assets and income generated therefrom is not less than 60% of its total asset and income respectively.

-

NBFC – Infrastructure Debt Fund (IDF)

IDF-NBFC facilitates the long term debt flow into infrastructure projects. They are allowed to raise resources through the issue of Rupee or Dollar denominated bonds having a minimum maturity of 5 years. These can only be sponsored by IDF-NBFC.

-

NBFC – Factors

These are the Non-Deposit taking NBFC which is engaged in the business of factoring.

NBFC factors generate at least 50% of its income of total income from financing in Factor activities and it holds at least 50% of financial assets from total assets in the factoring business.

-

NBFC – Mortgage Guarantee Companies (MGC)

This kind of NBFC must have a minimum NOF of 100 Cr. An NBFC is fulfilling the criteria of Mortgage Guarantee Company if

- At least 90% of business turnover is from Mortgage guarantee business or

- At least 90% of business income is from the Mortgage guarantee business.

-

NBFC – Non-Operating Holding Finance Company (NOHFC)

This kind of NBFC is set up to allow the promoter/promoter group to set up a new bank.

This entity as setting up will hold the bank as well as other financial services comp[anise as required by RBI.

Non-Deposit taking NBFC has been divided into the following

-

NBFC – ND Systematically Important

Non-deposit taking NBFC having asset size of more than 500 Cr. As per the last audited balance sheet of the NBFC are considered as Systematically important NBFC-ND.

-

NBFC – ND Non – Systematically important

Non-deposit taking NBFC having an asset size of less than 500 Cr. As per the last audited balance sheet of the NBFC are considered as Non Systematically important NBFC-ND.

Frequently Ask Question-FAQ’s

Q 1 Is there any difference in criteria for applying for COR of different kinds of NBFC?

Ans. Yes, the criteria relating to NOF and other limits must be fulfilled in case of different kinds of NBFC License.

Q 2 Is there any additional compliances required to be done by systematically important NBFC?

Ans. Yes, Systematically important NBFC must comply with the additional reporting requirement as prescribed by RBI.

Q 3 Can Deposit-taking NBFC accept demand deposits?

Ans. Deposit-taking NBFC Can accept deposit other than demand deposit.

Q 4 Can mortgage guarantee company (MGC) can give other types of loans or guarantees?

Ans. Yes, but that should not exceed 10% of its total asset or income generated from those loans cannot exceed 10% of total income.

CS Akshay Gupta is a diligent and innovative qualified Company Secretary, striving in matters related to Corporate Law. Akshay takes a deep interest in corporate, NBFC and FDI matters and his specialization includes corporate Compliance, FEMA Compliances, and NBFC Registration. As a Company Secretary, Akshay is passionate about matters relating to corporate funding, NBFC, and its compliances.

Regards

India Finacial Consultancy Private Limited

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.