Inverted Duty Structure is applicable under the GST

Table of Contents

Inverted Duty Structure is applicable under the GST

Understanding of Inverted Duty Structure

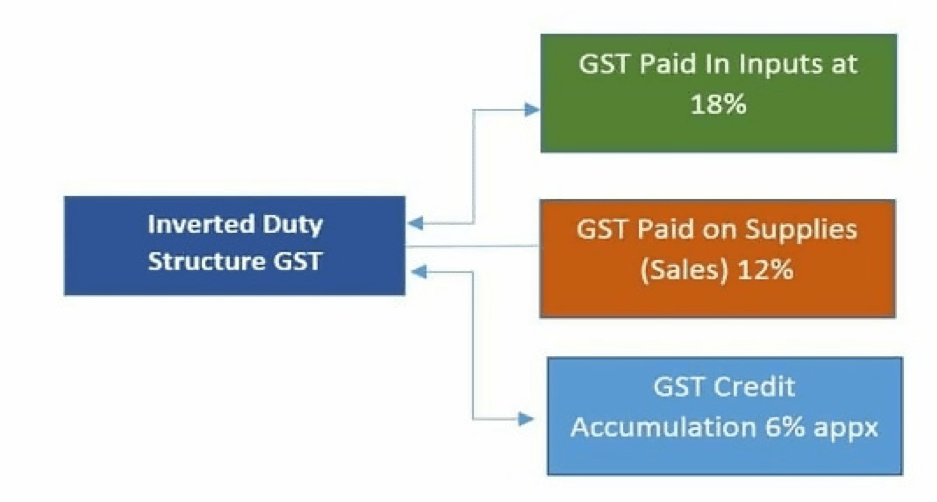

- Inverted duty structures arise when the tax rate on input credits used surpasses the tax rate on output supplies. Simple terms, the GST paid on inputs purchased exceeds the GST due on sales.

- As a result, the registered person’s electronic credit ledger begins to accumulate Input Tax Credit.

- A registered person may, in accordance with GST Law, request a refund of unused ITC upon meeting certain requirements, which we shall go through in this post.

Circumstances Inverted Duty Structure is applicable.

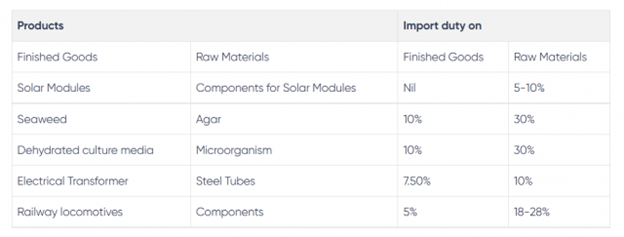

Below are some of the Circumstances in which tax paid on ITC is higher than the GST tax paid on outward supplies made.

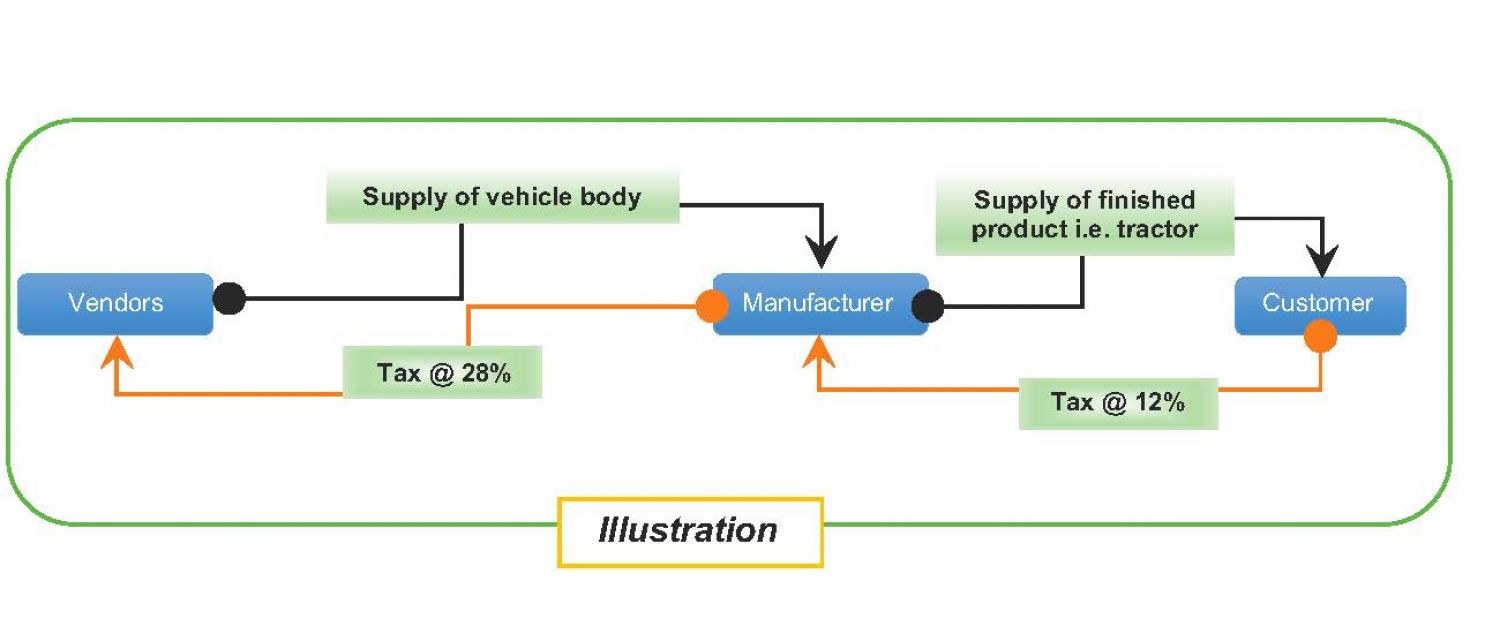

As seen above, raw materials are imported from other nations and used in the production or manufacturing of finished goods. Inverted duty structures place a higher tax on raw materials than on finished items.

Documentation needed for GST Refund if the Inverted Duty Structure

Application filed for GST refund has to be attached by documentary or other evidence in order to establish that the amount of tax and interest, if any, paid on such tax or any other amount paid in relation to which refund is claimed was collected from, or paid by, him and incidence of such tax and interest had not been passed on to any other person.

The amount of GST tax & interest, if any, paid on that tax or any other amount paid in relation to which a refund is claimed must be supported by documentary or other evidence in order to show that the money was taken from or paid by the applicant and that the incidence of that tax and interest had not been passed on to another person.

List of documents required for inverse Duty Structure

- Undertaking in relation to U/s 16(2) (c) & Section 42 under GST

- GSTR-2A copy of the relevant period

- Statement of invoices (Annexures-B)

- Declaration under 2nd & 3rd Proviso to section 54(3)

- Statement 1A under rule 89(2)(h)

- Invoices Self-certified copies entered in Annexures-B whose details are not found in GSTR-2A or 2B of the relevant period

- Statement 1 under rule 89(5)

- Declaration U/s 54(3)(ii) (not used for Nil or exempt supply)

- Self-declaration under rule 89(2)(I), if the amount claimed, does not exceed two lakh rupees, certification under rule 89(2)(m) otherwise

Procedure to submission of GST Refund application in case Inverted Duty Structure

GST Refund in case of Inverted Duty Structure: a GST taxpayer is required to follow the following steps:

- We needed to submit GST Form RFD-01 along with the List of documentary & supporting details required as explain above.

- After the GST Refund application is filled by the GST taxpayer, the acknowledgment & details will be auto-populated in GST Form RFD-02. The application will be forwarded though email & SMS for future references to the GST applicant.

- After submission of documents with the GST dept.

- If there are any mistakes, omissions, or shortages in the GST refund application, the applicant must submit Form RFD-03, which will be sent to them so they can make any changes in accordance with the application.

- The proper officer must issue a provisional refund order when tax is sought for exports of goods or services. 90% of the refund claim must be filed in Form RFD-04 with the this order.

- Authorised officer issues a final instruction to the taxpayer when they receive a “go” signal from them following a thorough review of all their documentation to guarantee compliance with the law.

- When the taxpayer gets their refund, GST Form RFD-06 is filed.

- If the refund application is denied, an RFD-07 is issued for complete rejection.

What to do after filing GST refund under inverted duty structure.

After the submission of a request for a GST refund, the GST taxpayer may follow up with the GST authority. In order to get the refund, the officer must give any documents or explanations that are required by the officer. You can always get in contact with the GST Refund consultant at IFCCL if you are having difficulty obtaining your GST refund. Our “No Success, No Fee” policy is applied to GST Refund claims.

Common mistakes Goods and Services tax

Time Limit for Inverted Duty Structure refunds u/s 54(1) of the CGST Act, 2017

Explanation of Time Limit under Section 54(1) of the CGST Act, 2017: As per Section 54(1), the refund application must be filed within two years from the “relevant date.” For inverted duty structure refunds, the relevant date is the due date of filing the return (GSTR-3B) for that particular month.

Application of Time Limit in Your Case: If you file the refund application on 04/03/2025, the refund will be available only for tax periods from March 2023 onwards. GST refunds for April 2022 to February 2023 will be time-barred, as more than two years would have elapsed from their respective due dates.

Example Breakdown for FY 2022-23:

| Tax Period | GSTR-3B Due Date | Last Date to Apply for Refund | Eligible for a GST Refund if filed on 04/03/2025? |

| April 2022 | 20/05/2022 | 20/05/2024 | ❌ Time-barred |

| May 2022 | 20/06/2022 | 20/06/2024 | ❌ Time-barred |

| … | … | … | … |

| Feb 2023 | 20/03/2023 | 20/03/2025 | ✅ Eligible |

| March 2023 | 20/04/2023 | 20/04/2025 | ✅ Eligible |

Conclusion: The two-year time limit for claiming a refund under the Inverted Duty Structure in GST is calculated month-wise, not for the full financial year. Always apply for the Inverted Duty Refund monthly or quarterly to avoid missing out due to time limits so only February 2023 and March 2023 will be eligible for a refund if you apply on 04/03/2025. And April 2022 to January 2023 will be time-barred.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.