ITC Best Practices under GST – Conditions, Documentation etc

Table of Contents

ITC Best Practices under Goods and Services Tax – Conditions, Documentation Eligibility, and Restrictions etc

Input Tax Credit is one of the most significant features of India’s Goods and Services Tax framework. It allows registered taxpayers to reduce their tax liability by claiming credit for the GST paid on purchases or business-related expenses. But, to claim Input Tax Credit lawfully and avoid disputes, strict conditions must be satisfied and accurate documentation maintained. In short, disciplined documentation and timely compliance are the keys to maximizing Input Tax Credit benefits while staying Goods and Services Tax compliant. Following are the Key Conditions for Claiming Input Tax Credit

Who can claim Input Tax Credit ?

Only a person registered under GST can claim Input Tax Credit, provided all prescribed conditions are satisfied. Input Tax Credit can be claimed only for business purposes and only on eligible goods and services. A registered person, including an Input Service Distributor, can claim Input Tax Credit only if the following conditions are met:

- Possession of Tax Invoice/Debit Note – Issued by a registered supplier.

- Receipt of Goods/Services – ITC is claimable only after actual receipt.

- If goods are received in installments, ITC can be claimed only when the last lot is received.

- Filing of Returns – The recipient has filed GSTR-3B.

- Invoice Reflection in GSTR-2B – The supplier must file GSTR-1 correctly, ensuring the invoice/debit note appears in the recipient’s GSTR-2B.

- Tax Payment by Supplier – The supplier has deposited the tax with the government.

- Timely Payment to Supplier – The recipient must pay the invoice value (including GST) within 180 days from the invoice date.

- Taxable Supplies Only – Goods/services must be used in the course or furtherance of business.

- No Depreciation Claim on Tax Component – If depreciation is claimed on the GST portion of a capital good, ITC is not allowed.

- Time Limit for ITC Claim – ITC must be claimed by the earlier of:

- 30th November of the year following the financial year in which the invoice/debit note is issued, or

- The date of filing annual return (GSTR-9).

- Matching with GSTR-2B – As per CGST Rule 36(4), ITC claimed in GSTR-3B must match the details auto-populated in GSTR-2B.

- Not a Composition Dealer – Persons under the Composition Scheme cannot claim ITC.

- No Blocked Credits – Input Tax Credit should not fall under ineligible categories listed in Section 17(5) of the Central Goods And Services Tax Act, 2017.

- Filing of GST Returns – The taxpayer must have filed the relevant Goods and Services Tax returns (including GSTR-3B).

What Can Be Claimed as Input Tax Credit?

Input Tax Credit is available only for goods and services used for business purposes. Input Tax Credit cannot be claimed if goods/services are used for Personal use, Exempt supplies, Items specifically disallowed under Section 17(5) of the CGST Act

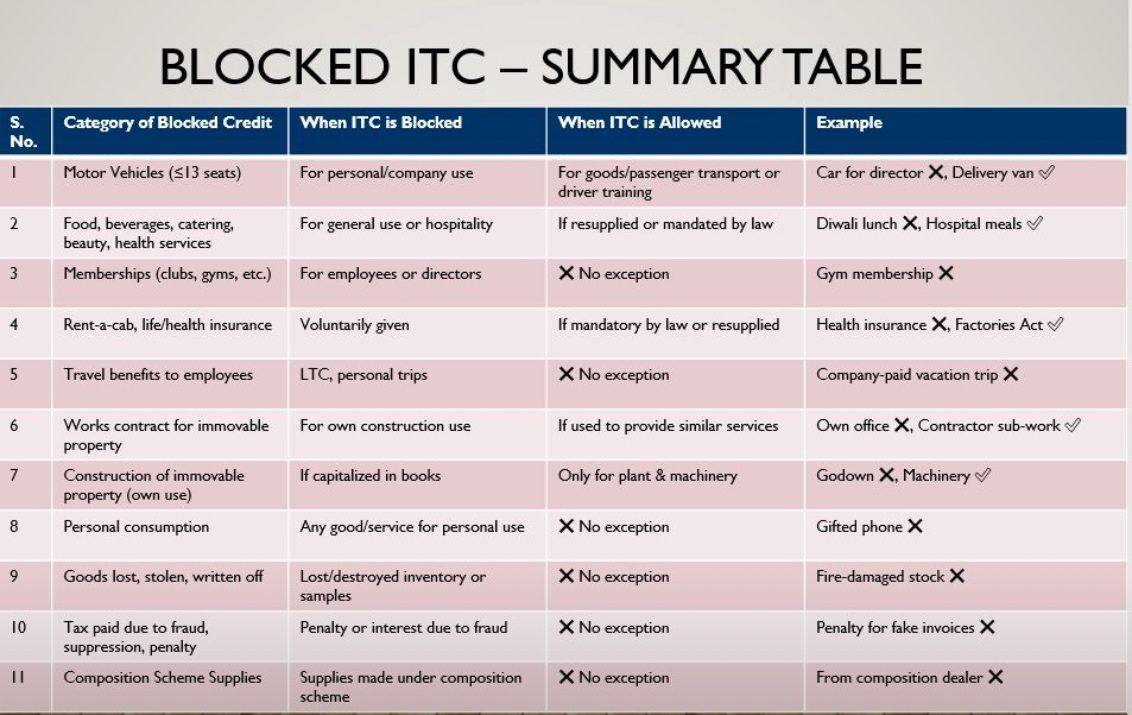

What are the Ineligible Input Tax Credit (Section 17(5))

Some common cases where Input Tax Credit is blocked:

- Motor Vehicles – If used for personal purposes.

- Exceptions: resale, commercial use (e.g., transport business, driving schools), or where usage is mandated.

- Food & Beverages, Catering, Health Services – Unless used for further supply of the same or required under law.

- Membership Fees – Club, gym, and health club memberships.

- Insurance Services – Life insurance and health insurance, except when required by law or provided as part of employment contracts.

- Construction of Immovable Property – ITC not allowed for construction (except plant and machinery).

- Lost, Stolen, Destroyed, or Gifted Goods – ITC not available for goods lost, destroyed, written off, or given away as gifts/free samples.

Documentation Requirements for Input Tax Credit – Valid Tax Invoice or Debit Note

A taxpayer must hold a valid tax invoice/debit note with the following particulars as per Central Goods And Services Tax Act, 2017 & related rules:

- Name, address, and GSTIN of supplier

- Invoice number and date

- Name, address, and GSTIN (if registered) of recipient

- HSN/SAC code of goods/services

- Description, quantity, and value of goods/services

- Place of supply

- Amount of tax charged (CGST, SGST/UTGST, IGST)

Accepted Documents for Input Tax Credit Claims

The following documents are recognized for availing Input Tax Credit :

- Tax Invoice issued by a supplier under Section 31

- Debit Note issued by the supplier

- Invoice issued by an Input Service Distributor

- Bill of Entry or similar document for imports under the Customs Act

- Invoice or self-invoice/credit note issued by a recipient in case of reverse charge transactions

Maintaining Goods And Services Tax Input Tax Register with Reconciliation

To ensure smooth Goods and Services Tax compliance and strengthen ITC claims, businesses should maintain a detailed record of all purchase invoices on which ITC has been availed in the GSTR-3B return. This record, commonly known as the Purchase Register or ITC Register, acts as a ready reference for tracking ITC claims, performing reconciliations, and ensuring documentation completeness for compliance and audit purposes. The basic primary objective of an ITC Register is to:

- Ensure accuracy in ITC claims

- Identify mismatches or delays in reflection of ITC

- Provide a complete audit trail for future reference

Importance of Accurate ITC Documentation

Maintaining a robust ITC Register is not only a compliance requirement but also a strategic control measure. Some of the key benefits include:

- Accurate Filing of Annual Returns – Supports preparation of GSTR-9 and GSTR-9C.

- Ease of Audit & Reconciliation – Facilitates smooth explanation during internal, statutory, or Goods and Services Tax dept audits.

- Regulatory Preparedness – Ensures readiness for Goods and Services Tax scrutiny or assessments.

- Risk Mitigation – Helps prevent disallowance or reversal of ITC due to incomplete/missing documentation.

- Financial Accuracy – Minimises the risk of interest and penalties from incorrect ITC claims.

A disciplined approach to maintaining an ITC Register with regular reconciliations is the cornerstone of effective Goods and Services Tax compliance. It not only safeguards ITC claims but also provides businesses with confidence in facing departmental scrutiny while ensuring accurate tax reporting.

Essential Details in an ITC Register

A well-maintained ITC Register should capture at least the following details for each invoice:

- Supplier Details – Name, Address, GSTIN

- Invoice Details – Invoice Number & Date

- Transaction Value – Taxable Value, Goods and Services Tax Rate, and Goods and Services Tax Amount (CGST/SGST/IGST)

- Reverse Charge – Whether supply attracts Reverse Charge (Yes/No)

- Nature of Supply – Description of goods/services

- Eligible ITC – Amount of ITC that can be claimed

- Books of Accounts Recording – Month in which invoice is recorded in accounts

- GSTR-2B Reflection – Month in which invoice appears in GSTR-2B

- Vendor Payment – Date of payment made to vendor (for 180-day rule compliance)

Having all this information consolidated in one place makes it easier to periodically reconcile ITC as per books of accounts with ITC claimed in GSTR-3B, ensuring accuracy and compliance.

Special Cases of Input Tax Credit under GST

The GST law prescribes special rules for claiming Input Tax Credit in scenarios involving capital goods, job work, Input Service Distributors, business transfers, and financial institutions. Understanding these provisions is essential to ensure compliance and avoid ineligible claims.

Input Tax Credit on Capital Goods

- Input Tax Credit is available on capital goods used for business purposes.

- The Input Tax Credit not available if capital goods are Used exclusively for making exempt supplies & Used exclusively for personal/non-business purposes

- If depreciation has been claimed on the tax component of capital goods under the Income Tax Act, Input Tax Credit on such tax component cannot be claimed.

Input Tax Credit on Job Work

The law permits a principal manufacturer to send inputs or capital goods to a job worker for processing without losing Input Tax Credit eligibility.

- Input Tax Credit is allowed in both cases:

- Goods sent from the principal’s place of business, or

- If Goods sent directly from the supplier to the job worker.

- GST Return timelines for goods sent on job work:

- Inputs: Must be received back within 1 year

- Capital goods: Must be received back within 3 years

Failure to bring goods back within the prescribed time results in the transaction being treated as a deemed supply, and GST becomes payable.

Input Tax Credit via Input Service Distributor

An Input Service Distributor is usually the head office or registered office of a business that receives invoices for input services and then distributes the ITC to various branches/units.

- The Input Service Distributor must distribute credit separately under the respective heads – CGST, SGST/UTGST, IGST, or Cess.

- Distribution is done in proportion to the turnover of each recipient unit.

- This mechanism ensures credit flows correctly to the branch/unit where the input service is utilized.

Input Tax Credit on Transfer of Business

In cases of amalgamation, merger, demerger, or transfer of business, the transferor’s unutilized Input Tax Credit is passed on to the transferee.

Such Transfer of Business must be specifically declared in Form GST ITC-02. And Conditions are here under Business transfer must include transfer of liabilities. & Transferee must be registered under GST.

Input Tax Credit for Banks and Financial Institutions

Banks and financial institutions deal in both taxable supplies (e.g., processing fees, advisory) and exempt supplies (e.g., interest on loans, deposits). To simplify Input Tax Credit claims, GST law provides a special option

- They can avail 50% of total Input Tax Credit on inputs, input services, and capital goods.

- The remaining 50% Input Tax Credit is permanently lapsed.

- This is an optional facility – once opted, it must be followed consistently across all branches.

Above special Input Tax Credit provisions are designed to address unique business models under GST. Businesses should Track goods sent for job work within timelines, Ensure ISD distribution is accurate and documented, Record business transfer Input Tax Credit properly via ITC-02, For banks/financial institutions, evaluate whether the 50% Input Tax Credit option or regular apportionment is more beneficial.

Reversal of Input Tax Credit under GST

Input Tax Credit can be claimed only on goods and services used in the course or furtherance of business. If goods/services are used for non-business purposes, or for making exempt supplies, Input Tax Credit is either not available or needs to be reversed. In addition to above, there are specific circumstances under GST where already claimed Input Tax Credit must be reversed. Following Situations Requiring Reversal of Input Tax Credit are mention here under:

- Non-Payment of Invoice within 180 Days: If the recipient fails to pay the value of supply plus GST to the supplier within 180 days from the date of invoice, the ITC claimed must be reversed. ITC can be reclaimed later once the payment is made.

- Credit Note Issued to ISD by Supplier : If a supplier issues a credit note to the head office, the Input Tax Credit distributed earlier gets reduced. The ISD must reverse the proportionate ITC distributed to its branches.

- Inputs Used for Both Business and Personal/Exempt Purposes : When inputs (goods/services) are used partly for business purposes and partly for personal use or exempt supplies, Input Tax Credit attributable to non-business or exempt purposes must be reversed proportionately.

- Capital Goods Used Partly for Business and Partly for Exempt/Personal Purposes : Similar to inputs, Input Tax Credit on capital goods used partly for exempt/non-business purposes needs to be reversed proportionately over the useful life (prescribed as 60 months under GST).

- Short Reversal Identified at Year-End : After filing the annual return, if it is found that the ITC reversed during the year is less than required, the differential Input Tax Credit must be added to the output tax liability. Interest will also apply on the short-reversed portion.

Blocked ITC under GST – Know What You Can’t Claim!

Tips to Avoid GSTR-3B Errors : Incorrect ITC claims may attract interest @18%, penalties, and notices under Section 73/74. Ensure accurate classification and timely reversals to maintain clean GST records. Cross-check GSTR-2B entries before claiming ITC, Identify and segregate blocked ITC each month, Reverse ITC for ineligible expenses in Table 4(B)(1) of GSTR-3B, Maintain documentary evidence for all ITC reversals.

Under Section 17(5) of the CGST Act, certain business expenses are ineligible for Input Tax Credit (ITC) — even when incurred in the course of business. Even if such expenses appear in GSTR-2B, their ITC must be reversed, thereby increasing your output tax liability. Commonly Blocked ITC Includes

- Motor Vehicles used for personal or non-eligible purposes

- Food & Catering Services, outdoor catering, and beverages

- Construction-related Expenses (for immovable property)

- Health Insurance, Club Memberships, Leisure Facilities, etc.

- Employee Benefits not mandated by law

Legal Exceptions of Blocked ITC under GST :

ITC may be allowed only if used for further supply of the same category of service or when statutorily required (e.g., employee insurance under labour laws). Practical Examples

-

ITC on company guesthouse renovation : Blocked

-

ITC on director’s car purchase : Blocked

-

ITC on catering provided by a catering company to its clients : Allowed

-

ITC on insurance required under Factories Act : Allowed

Key GST Judgments – Important Judicial Developments

Courts increasingly favour substance over form. Mechanical enforcement actions are being discouraged ITC remains a constitutional and business-critical right, subject to reasonable compliance & Taxpayers should maintain robust documentation and timely reconciliations

1. Bharti Airtel Ltd. v. Union of India (2021)

Issue: Revision of GSTR-3B

Ruling: The Supreme Court held that GSTR-3B cannot be revised beyond statutory timelines. Supreme Court ruled that GSTR-3B returns cannot be revised beyond statutory deadlines, impacting Input Tax Credit (ITC) planning and emphasizing timely reconciliation.

Impact: Reinforces the need for timely reconciliation between GSTR-2A/2B and GSTR-3B. Errors left uncorrected within prescribed limits may result in permanent ITC loss.

2. VKC Footsteps India Pvt. Ltd. v. Union of India (2021)

Issue: Refund under inverted duty structure

Ruling: Supreme Court upheld Rule 89(5), disallowing refund of input services. Court upheld Rule 89(5), restricting refund of input services under the inverted duty structure, affecting industries like textiles and footwear.

Impact: Adversely affects sectors like textiles, footwear, and manufacturing, where input services form a major cost component.

3. Safari Retreats Pvt. Ltd. v. Chief Commissioner of CGST (2019)

Issue: ITC on construction of commercial immovable property

Ruling: Orissa High Court allowed ITC where property is constructed for commercial letting. Orissa High Court allowed ITC on construction of immovable property intended for commercial letting, challenging restrictions under Section 17(5)(d).

Impact: Challenges the blanket restriction under Section 17(5)(d) and supports the principle of business-use-based credit eligibility.

4. Mohit Minerals Pvt. Ltd. v. Union of India (2022)

Issue: IGST on ocean freight (CIF contracts)

Ruling: Supreme Court struck down levy as unconstitutional, citing double taxation. Supreme Court struck down IGST on ocean freight in CIF contracts as unconstitutional, preventing double taxation.

Impact: Landmark ruling limiting excessive delegated legislation and protecting importers.

5. Canon India Pvt. Ltd. v. Commissioner of Customs (2021)

Issue: Jurisdiction of DRI officers

Ruling: Supreme Court held that DRI officers lack authority to issue show cause notices. Court ruled that DRI officers lack jurisdiction to issue show cause notices, prompting similar challenges under GST.

Impact: Triggered similar jurisdictional challenges under GST, especially in enforcement actions.

6. Radha Krishan Industries v. State of Himachal Pradesh (2021)

Issue: Provisional attachment under Section 83

Ruling: Supreme Court cautioned against mechanical attachment of bank accounts. Court cautioned against mechanical use of provisional attachment under Section 83, stressing natural justice.

Impact: Reinforces natural justice and proportionality in GST recovery proceedings.

7. Suncraft Energy Pvt. Ltd. v. Assistant Commissioner (2023)

Issue: ITC denial due to supplier default

Ruling: Calcutta High Court held that buyers cannot be penalized if they have complied with GST provisions. Calcutta High Court protected buyers from ITC denial due to supplier default, if compliance was met

Impact: Strengthens taxpayer protection against supplier-side non-compliance.

8. B. Braun Medical India Pvt. Ltd. v. Union of India (2025)

- Issue: ITC denial due to minor invoice discrepancies

- Ruling: Delhi High Court allowed ITC, holding that substantive rights cannot be denied for procedural lapses. Delhi High Court allowed ITC despite minor invoice discrepancies, reinforcing that substantive rights override procedural lapses.

- Impact: Reaffirms the principle that GST is a value-added tax, not a penalty-driven regime.

In Conclusion

In short Many taxpayers tend to rely only on invoices appearing in GSTR-2B without verifying other conditions or maintaining supporting documentation. This often leads to disputes, reversal of ITC, and imposition of interest and penalties. To strengthen & maximize ITC benefits and remain GST-compliant on Input Tax Credit claim:

- Ensure supplier compliance (invoices filed in GSTR-1 and taxes paid).

- Maintain complete and compliant documentation.

- Ensure vendors have uploaded invoices in GSTR-1 and paid taxes.

- Regularly reconcile purchase data with GSTR-2B- Reconcile ITC in books vs. GSTR-2B every month.

- Claim ITC only within the prescribed timelines

- Maintain complete invoice-level documentation for audits and annual return filings

- ITC once availed is not absolute – it remains subject to conditions of payment, usage, and reconciliation.

- Businesses must maintain clear records of input allocation (business vs. exempt/personal) to support ITC claims and reversals.

- File GSTR-3B accurately and on time : Annual return filing acts as a final checkpoint for ITC accuracy – any shortfall in reversal at that stage leads to additional tax liability plus interest.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.