ITC Reversal Traps: Are You Sitting on a Hidden GST Risk?

Table of Contents

ITC Reversal Traps: Are You Sitting on a Hidden GST Risk?

What is ITC Reversal?

ITC reversal means nullifying previously claimed input tax credit due to certain conditions not being met. The reversed amount is added back to the output tax liability, and interest may apply depending on the timing. Key Scenarios for ITC Reversal

| Rule/Section | Trigger for Reversal | When to Reverse |

| Rule 37 | Buyer doesn’t pay supplier within 180 days | After 180 days from invoice date |

| Rule 37A | Supplier doesn’t file GSTR-3B by 30th Sept of next FY | By 30th Nov of next FY |

| Rule 38 | Banks/financial institutions (50% ITC rule) | During regular return filing |

| Rule 42 | Inputs used for exempt/personal/non-business use | Monthly/yearly via formula |

| Rule 43 | Capital goods used for exempt/personal/non-business use | Monthly/yearly via formula |

| Rule 44 | GST registration cancelled or composition scheme opted | At time of REG-16 or ITC-03 filing |

| Rule 44A | Gold dore ITC reversal | At time of supply |

| Section 16(3) | Depreciation claimed on GST portion | At year-end book closure |

| Section 17(5) | Blocked credits availed | During regular returns till annual return |

| Section 17(5)(h) | Inputs lost/destroyed/stolen/free samples | In return for the relevant month |

| Section 17(5)(i) | Tax paid under fraud-related demand | In return for the relevant month |

Rule 42 & 43: ITC Reversal Calculation

Rule 42 – Inputs/Input Services

- Segregate Specific Credits:

- T1: Non-business use

- T2: Exempt supplies

- T3: Blocked credits

- Calculate Common Credit:

- C1 = T – (T1 + T2 + T3)

- T4: Taxable supply-specific credit

- C2 = C1 – T4

- Reversal Amounts:

- D1 = (E ÷ F) × C2 → Exempt supply portion

- D2 = 5% of C2 → Non-business use

- C3 = C2 – (D1 + D2) → Eligible ITC

Rule 43 – Capital Goods : Similar logic but applied to capital goods using useful life (60 months) and monthly apportionment.

Rule 44 – Cancellation/Composition Scheme

- Inputs/Semi-finished/Finished Goods: Reverse ITC based on invoice proportion.

- Capital Goods: Reverse ITC for remaining useful life (months left out of 60).

Rule 44A: Balance Transitional ITC to be Reversed on 1st July 2017 for Gold Dore Bars

This rule deals with the transitional provisions under the CGST Act for CENVAT credit carried forward from the earlier indirect tax regime. Specifically, it applies to additional duty of customs (levied under Section 3(1) of the Customs Tariff Act, 1975) paid on the importation of gold dore bars.

Where the stock of gold dore bars (raw material) or gold jewellery (finished goods) was lying with a registered person as on 1st July 2017, the ITC allowed was restricted to 1/6th of the total credit availed on such gold dore bars. Accordingly, 5/6th of the credit availed must be reversed at the time of supply of the gold dore bar, or the gold/gold jewellery manufactured from it.

This transitional rule ensured a smooth migration from the old tax regime by phasing out credit related to precious metals that had already enjoyed excise/CVD benefits before GST implementation.

Reporting of ITC Reversal in GSTR-3B

Taxpayers are required to calculate and self-report ITC reversal in Table 4(B) of Form GSTR-3B. There are two key reporting categories:

As per Rules 42 & 43 of CGST/SGST Rules → ITC attributable to exempt or non-business supplies must be manually calculated using the prescribed formula and reported here.

(Note: This field is not auto-populated.)

Others : → ITC reversals due to other reasons, such as Rule 37 (non-payment within 180 days), Rule 44 (cancellation of registration), or transitional adjustments under Rule 44A, should be reported under this head.

Reporting of ITC Reversal in GSTR-9

In the annual return (Form GSTR-9), taxpayers must disclose ITC reversals made during the year.

- Table 7 of GSTR-9 contains details of ITC reversed and ineligible ITC.

- Wherever possible, these figures are auto-populated based on data from monthly GSTR-3B filings.

- However, taxpayers may manually adjust or correct data to ensure full-year accuracy before submission.

How Compliance Platforms Can Help :

The process of computing and reporting ITC reversals—especially under Rules 42, 43, and 44A—can be complex and time-consuming. Cloud-based compliance platforms such as Clear Finance Cloud simplify this process by:

- Auto-downloading data from GSTN for the full year

- Reconciling GSTR-1, GSTR-3B, and books of accounts

- Automatically computing and suggesting ITC reversal amounts

- Identifying mismatches and helping fix them before return filing

This ensures accurate annual filings and minimizes the risk of GST notices or penalties.

ITC Reversal Traps: Are You Sitting on a Hidden GST Risk?

Yes, ITC reversal traps can pose serious hidden GST risks for businesses, especially in sectors like pharma, FMCG, and services. Here’s a breakdown of the most common traps and how they can silently impact your compliance and cash flow:

Top ITC Reversal Traps to Watch Out For

- Vendor Non-Compliance (Rule 37A)

- Trap: You claim ITC, but your vendor fails to file GSTR-3B by 30th November of the following FY.

- Risk: You must reverse ITC with 18% interest, even if you paid the vendor.

- Non-Payment to Supplier Within 180 Days (Rule 37)

- Trap: You delay payment beyond 180 days.

- Risk: Mandatory ITC reversal + interest. Reclaim only after actual payment.

- Claiming ITC on Cancelled GSTINs

- Trap: Supplier’s GSTIN is cancelled at the time of transaction.

- Risk: ITC is ineligible, and you may face scrutiny or denial.

- Ignoring GSTR-2B Reconciliation

- Trap: Claiming ITC not reflected in GSTR-2B.

- Risk: Auto-scrutiny tools flag mismatches, triggering notices under Rule 88D.

- Failure to Reverse ITC on Exempt Supplies (Rule 42/43)

- Trap: Common ITC not apportioned correctly between taxable and exempt supplies.

- Risk: Interest + penalties during audits. Especially relevant post GST rate restructuring.

- Blocked Credits Claimed (Section 17(5))

- Trap: ITC claimed on motor vehicles, club memberships, or employee perks.

- Risk: Entire ITC must be reversed.

- Advances Not Reported

- Trap: GST not paid on advances received for services.

- Risk: Mismatch with financials and GSTR-1/3B.

- Inventory Not Audited Before Exemption Change

- Trap: Goods become exempt (e.g., post 22 Sept 2025), but ITC on unsold stock not reversed.

- Risk: Reversal required on unsold inventory + capital goods used.

Hidden Risks of ITC Reversal Traps

- Cash Flow Crunch: Sudden reversal increases output tax liability.

- Interest Liability: 18% interest applies in most cases.

- Audit Exposure: Automated scrutiny tools flag mismatches instantly.

- Reputational Damage: Non-compliance can affect vendor ratings and business credibility.

- Legal Disputes: Incorrect ITC claims can lead to litigation under Section 74.

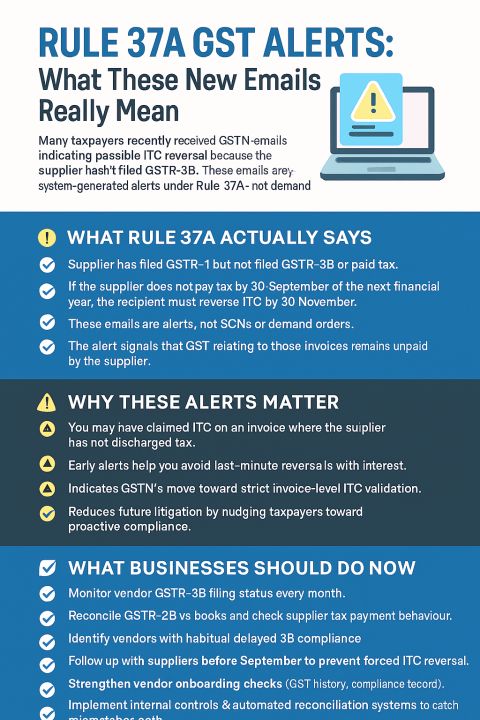

Rule 37A GST Alerts: Is Your ITC at Risk? What These New GSTN Emails Really Mean

Over the past few weeks, many taxpayers have received GSTN emails warning that certain ITC may be at risk because suppliers haven’t filed GSTR-3B. These alerts are causing confusion but here’s the clarity. These are system-generated alerts under Rule 37A, NOT demand notices or SCNs.

Rule 37A : Rule 37A was introduced to tighten ITC compliance and ensure suppliers actually pay the tax. It applies when:

- Supplier has filed GSTR-1 but NOT filed GSTR-3B or paid tax- This means the invoice appears in your GSTR-2B, but the tax hasn’t reached the government.

- If the supplier does NOT pay tax by 30 September of the following FY- Then you, the recipient, must reverse the ITC by 30 November.

- The email is just an alert- It is not a notice, assessment order, DRC-01A, or demand.

- The alert indicates unpaid GST on invoices you claimed ITC for- In short: the system is flagging high-risk ITC.

Why These Rule 37A GST Alerts Alerts Matter :

These alerts are part of GSTN’s movement toward invoice-level ITC validation and improved tax discipline. They help taxpayer

- Identify suppliers who haven’t paid GST

- Avoid sudden November reversals with interest

- Reduce future disputes and litigation

- Improve your vendor compliance ecosystem

What You Should Do Now – To protect GST taxpayer Input Tax Credit:

- Monitor supplier GSTR-3B filing status monthly -Even if GSTR-1 is filed, 3B non-filing is a red flag.

- Match GSTR-2B with books regularly- Identify at-risk invoices early.

- Flag habitual defaulters- Block or review vendors who routinely delay filings.

- Follow up before September each year – Ensure suppliers pay GST to prevent mandatory ITC reversal.

- Strengthen vendor onboarding checks – Include GST compliance history, return score, and default patterns.

- Use automated reconciliation tools- Helps detect mismatches and non-filers instantly.

Rule 37A represents a stricter, compliance-first GST regime. To safeguard GST taxpayer ITC – Proactive vendor monitoring + monthly reconciliation = ZERO ITC shock in November.

Most businesses focus on claiming Input Tax Credit (ITC) : but forget the real danger lies in when it must be reversed. The GST law is clear: wrong or ineligible ITC = reversal + 18% interest + penalty. Here are common ITC reversal triggers you can’t afford to ignore:

- Non-payment to supplier within 180 days → Reverse ITC with interest (Sec 16).

- Exempt or personal use → Proportionate reversal required (Rule 42/43).

- Credit notes issued by supplier → Reverse ITC immediately.

- Job work goods not returned in time → Reverse after 1/3 years as applicable.

- Blocked credits → Motor vehicles, club memberships, personal expenses, etc. (Sec 17(5)).

Practical Tip for Pharma & FMCG Sectors : Due to new exemptions post-GST restructuring, businesses must Reassess ITC eligibility, Apply Rule 42/43 for common credits & Maintain accurate turnover and exempt supply data for correct reversal. How to Stay Safe

- Regularly reconcile GSTR-2B with purchase records.

- Track vendor compliance (GSTR-3B filing status).

- Conduct monthly ITC audits, especially for common credits.

- Use GST APIs or software to monitor supplier GSTIN status.

- Prepare for rate restructuring by auditing inventory and capital goods.

- Don’t wait for a GST notice : conduct a monthly ITC reconciliation and reversal review to avoid future shocks. Are businesses really prepared to detect and manage these hidden ITC reversal risks?

- ITC reversal remains one of the most scrutinized areas during GST audits and departmental reviews. Businesses must regularly monitor their input credits and reconcile them against outward supplies, usage, and vendor compliance.

- A monthly ITC review not only ensures accurate reporting but also protects against interest, penalties, and notices for wrongful credit claims.

Frequently Asked Questions on ITC reversal

What is ITC reversal?

Reversal of ITC means adding back previously claimed input tax credit to the output tax liability when certain conditions for availing ITC are no longer met.

How to do ITC reversal?

Compute the reversal amount under the applicable rule (e.g., 37, 42, 43, or 44A) and report it in Table 4B of GSTR-3B or, if missed, via Form DRC-03 with applicable interest.

What are CGST Rules 42 & 43?

They prescribe methods for calculating and reversing ITC on inputs, input services, and capital goods used partly for taxable and partly for exempt or personal purposes.

Can DRC-03 be used for ITC reversal?

Yes, voluntary reversals (e.g., identified after return filing) can be reported through Form DRC-03 with payment of applicable interest.

When is ITC reversal required?

When:

- Supplier not paid within 180 days (Rule 37)

- Exempt or personal use (Rules 42/43)

- Registration cancelled or switching to composition (Rule 44)

- Transitional gold dore stock (Rule 44A)

- ITC wrongly claimed on blocked credits or lost goods (Sec. 17(5))

How is ITC reversal calculated?

As per formulas defined in the relevant rules. For example, under Rule 42, ITC reversal = (Exempt turnover ÷ Total turnover) × Common credit.

What is ITC reversal on damaged goods?

ITC on inputs used in goods that are lost, destroyed, stolen, or written off must be reversed under Section 17(5)(h).

Are there exceptions to ITC reversal?

If ITC was never claimed or if goods/services were used exclusively for taxable supplies, reversal is not required.

What documents are required for ITC reversal?

Supporting invoices, reconciliation statements, computation workings, and records of reversals reported in GSTR-3B/DRC-03.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.