Jio Finance’s INR 24 ITR filing plan vs Tax e-filing portal

Table of Contents

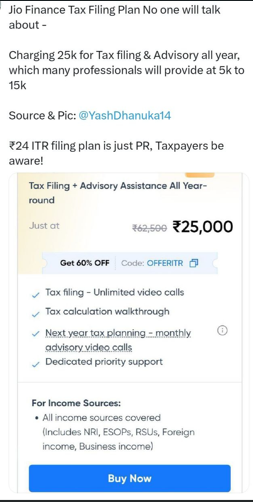

Jio Finance Tax Filing + Advisory Plan (INR 25,000)

What’s Included in Jio Finance Tax Filing + Advisory Plan

- Unlimited video calls for tax filing assistance

- Tax calculation walkthroughs

- Next year tax planning with monthly advisory video calls

- Dedicated priority support

- That plan Covers NRI income, ESOPs & RSUs, Foreign income & Business income

Pricing Original: INR 62,500 & Discounted: INR 25,000 (with code OFFERIT)

Comparison of Jio Finance’s INR 24 ITR filing plan vs the free Income Tax e-filing portal

ITR Filing: Jio Finance App vs Income Tax Portal

| Parameter | Jio Finance App (INR 24 Plan) | Income Tax Portal (Free) |

| Cost | INR 24 (cheapest among fintech platforms) | Free for all taxpayers |

| Best For | Nil ITR, ITR-1 filers with simple income | Simple income sources; salaried individuals; pre-filled data |

| Ease of Use | User-friendly UI, refund tracking, tax planner tools | Requires some navigation effort; no need to upload Form 16 |

| Expert Support | No CA support in INR 24 plan; INR 999 for assisted filing | No CA support; designed for self-filing |

| Data Safety | Processed by TaxBuddy (registered ERI); Jio claims no data storage | Managed by CBDT; secure government platform |

- Jio Finance INR 24 Plan is ideal for First-time filers, Salaried individuals with no additional income & Those who want a guided experience but don’t need expert help.

- Income Tax Portal is best if You’re comfortable navigating government portals, You want full control and zero cost, You prefer not to share data with third-party platforms

- Things to Watch Out For Jio’s INR 24 plan is not suitable for complex cases like Capital gains, Foreign income, Business/professional income. Concerns around data usage exist, though Jio claims compliance with the Digital Personal Data Protection Act 2023.

- Many professionals offer similar services for INR 5,000–INR 15,000. The INR 24 ITR filing plan promoted earlier is seen as PR bait, not a full-service offering. CA & Income tax expert and others professional are cautioning taxpayers to look beyond the marketing and assess the actual value.

Jio Finance INR 24 Plan : Should You Consider It? If Taxpayer

- Have complex income sources (NRI, ESOPs, foreign income), Want year-round advisory support, Prefer video-based consultations. it might be worth exploring. But if your tax situation is straightforward, you may find more affordable options with similar quality.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.