Key Provisions under the SARFAESI Act, 2002

Table of Contents

Key Provisions under the SARFAESI Act, 2002

Introduction

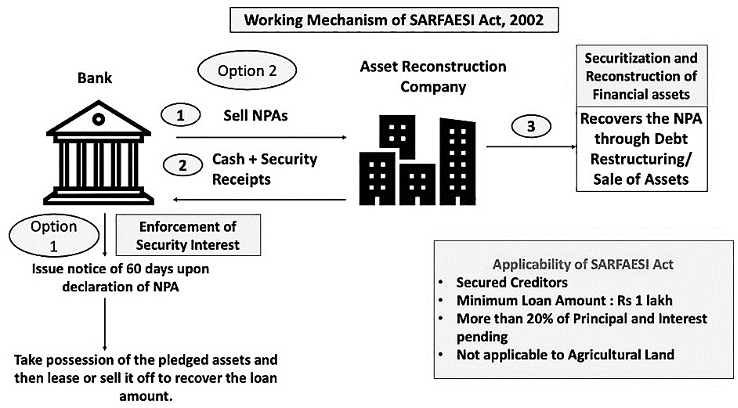

SARFAESI gives banks/ARCs the power to enforce security interest and recover dues without court intervention, with appeals going to DRT/DRAT and oversight by RBI. The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act) is a landmark statute designed to strengthen the Indian financial system by empowering banks and financial institutions to recover loans efficiently from defaulting borrowers. Enacted in the backdrop of rising Non-Performing Assets (NPAs), the Act aims to enable faster recovery, improve creditor confidence, and ensure stability in the credit ecosystem. Key provisions under the SARFAESI Act, 2002 are mentioned here under :

Securitisation of Financial Assets

The Act allows banks and financial institutions to securitize their loan portfolios. Securitization involves converting illiquid loan assets into marketable securities, which are then sold to investors. following are benefits that come SARFAESI Act: Reduces NPAs on bank balance sheets, enhances liquidity, Releases capital for further lending, Facilitates a more efficient credit market.

Enforcement of Security Interest (Section 13)

- This is the heart of SARFAESI. A secured creditor may enforce a security interest without court intervention. & Borrower must be a wilful defaulter / non-performing asset (NPA). A 60-day notice (Section 13(2)) must be issued demanding repayment.

- If the borrower does not comply, the secured creditor may take measures under Section 13(4), such as Taking possession of secured assets, Taking over management of borrower (13(4)(b)), Appointing a manager, Selling or leasing the secured assets, Recovering money from third parties who owe amounts to the borrower

Asset Reconstruction Companies (ARCs)

- SARFAESI provides a framework for the establishment and operation of Asset Reconstruction Companies, which specialize in acquiring and managing stressed assets. Key Functions of ARCs like Acquisition of NPAs from banks, Restructuring and rehabilitation of stressed assets, Recovery of overdue amounts through restructuring or enforcement, Improving the value of distressed businesses, By transferring NPAs to ARCs, banks can clean their balance sheets, reduce provisioning burdens, and focus on core lending.

Securitisation & Reconstruction of Financial Assets (Sections 5–12)

- These provisions regulate Asset Reconstruction Companies (ARCs): Powers of ARCs to acquire financial assets from banks, Methods of asset reconstruction Change of management; Rescheduling debts; Enforcement of security interest; Settlement of dues; Conversion to equity. ARC must register with RBI (Sec. 3).

Enforcement of Security Interest

- The most powerful feature of the SARFAESI Act is that it enables secured creditors to enforce their security interests without court intervention. Major Enforcement Powers under Section 13(4) After issuing a 60-day demand notice, creditors may Take possession of secured assets, Take over the management of the borrower’s business, Appoint a manager to control the secured asset, Sell, lease, or assign the secured asset to recover dues This eliminates lengthy civil litigation and accelerates debt recovery.

Protection of Borrowers

- Although the Act empowers lenders, it also preserves borrower rights, ensuring fairness and transparency. Borrower Safeguards like Right to receive 60 days’ notice before asset seizure, Right to object or make representations, Right to approach the DRT (Debt Recovery Tribunal) under Section 17, Protection against unfair or arbitrary actions by creditors. The Act aims to establish a balanced framework where creditor powers do not override borrower rights.

Measures for Asset Reconstruction (Section 9)

- ARCs can adopt the following measures Taking over management, Selling or leasing business, Restructuring the business, Rescheduling payment, Enforcing security interest, Settling dues, Converting debt into equity.

Taking Possession via Magistrate (Section 14)

- A secured creditor may approach the Chief Metropolitan Magistrate (CMM) or District Magistrate (DM) for assistance to take possession of secured assets. Time limits: 30 days, extendable up to 60 days, for passing orders.

Appeal to DRT (Section 17) :

- Borrower can challenge the creditor’s action under Section 13(4) Must file within 45 days. DRT must dispose the application within 60 days, extendable up to a maximum of 4 months.

Appeal to DRAT (Section 18) :

- A person aggrieved by the DRT order may appeal to DRAT. Pre-deposit of 50% of the debt due (reducible to 25%).

Central Registry (CERSAI) – Sections 20–23

- Establishment of Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI). Registration of charges on properties.Satisfaction, modification, or assignment of security interest must be registered. Non-registration may affect enforceability.

Offences & Penalties (Sections 27–30A)

-

Contravention punishable with imprisonment up to 1 year and/or fine. Penalty for failure to comply with RBI directions: up to ₹1 crore or twice the amount involved. Penalty to be paid within 30 days (Sec. 30A).

RBI Oversight & Powers (Section 12)

-

RBI may issue directions to ARCs. RBI may inspect ARCs. May cancel ARC registration.

Exemptions (Section 31)

- SARFAESI does not apply to Liens, Pledge of movables, Aircraft or vessels, Conditional sale, hire purchase (without security interest), Farm equipment, Residential property with loan ≤ ₹1 lakh, Unpaid seller’s rights

Economic Impact of the SARFAESI Act

- Strengthening the Financial System : The Act has significantly contributed to improving the asset quality of banks by reducing NPAs and enabling the efficient disposal or restructuring of stressed assets. This enhances the overall financial stability of the banking sector.

- Enhancing Credit Flow : A strong and efficient recovery mechanism improves credit confidence. Lenders are more willing to provide loans, knowing they have statutory backing to recover dues in case of default.

- Protecting Creditor Interests : The Act protects the financial interests of banks and financial institutions by Reducing delays in recovery, Minimising legal costs, Ensuring timely resolution of distressed assets. This reinforces financial discipline and supports sustainable lending.

- Promoting Financial Discipline : The possibility of swift enforcement under SARFAESI encourages borrowers to repay loans on time, reducing the incidence of strategic defaults. This has improved overall repayment behaviour in the lending ecosystem.

Challenges in Implementation in SARFAESI Act, 2002

- Judicial Delays : Despite the intention of speedy recovery, matters often get delayed due to Heavy burden on DRTs/DRATs, Frequent adjournments, Appeals and interim orders, These delays undermine the effectiveness of the Act.

- Resistance from Borrowers : Borrowers may Challenge actions in courts, Dispute valuation of assets, Use procedural loopholes to delay enforcement. This resistance often results in prolonged litigation.

- Ethical and Practical Concerns : Aggressive recovery measures can raise concerns, especially in cases of Genuine financial distress, Small borrowers, Improper valuation or unfair procedure. it Ensuring fairness, transparency, and humane recovery practices is essential.

SARFAESI Act, 2002 – Quick Reference Table

| S. No. | Topic / Question | Correct Provision / Answer |

| 1 | Which committees recommended SARFAESI? | Narasimham Committee I & II and Andhyarujina Committee |

| 2 | Applicability | Whole of India |

| 3 | Net Owned Funds requirement of ARC | Not less than INR 2 crore |

| 4 | Time for ARC to apply to RBI for registration | Within 6 months from commencement of the ARC |

| 5 | Sponsor requirement | Holding not less than 10% of paid-up capital of ARC |

| 6 | Appeal by ARC (against RBI order) | Within 30 days |

| 7 | Joint financing – action under SARFAESI can be taken when | Creditor(s) holding 60% of outstanding amount agree |

| 8 | If dues not fully satisfied from sale of secured assets | Secured creditor may apply to DRT for balance recovery |

| 9 | Time limit for CMM/DM to pass order after receiving affidavit | Within 30 days, extendable up to 60 days max |

| 10 | Taking over management of borrower by ARC | Section 9(a) |

| 11 | Taking over management by Secured Creditor | Section 13(4)(b) |

| 12 | Appeal to DRT by aggrieved borrower (against 13(4) action) | Within 45 days |

| 13 | Disposal of Sec. 17 application by DRT | Within 60 days, extendable (reasons recorded) but not more than 4 months |

| 14 | If borrower resides in J&K | Appeal lies before District Judge (pre-2019 provisions) |

| 15 | Appellate Tribunal for borrower in J&K | High Court |

| 16 | Validity period of Notice of Caveat | 90 days from date of lodgement |

| 17 | Central Government may delegate power for establishing Central Registry to | RBI |

| 18 | Central Registry shall NOT record particulars relating to | Extinguishment of security interest |

| 19 | Responsibility to furnish information on modification / satisfaction of security interest | ARC or Secured Creditor |

| 20 | Time to intimate Central Registrar about satisfaction of charge | Within 30 days |

| 21 | Punishment for contravention / abetment of contravention | Imprisonment up to 1 year, or fine, or both |

| 22 | Appeal against penalty order | Within 30 days |

| 23 | Appeal by ARC for cancellation of Registration Certificate | Within 30 days to Central Government (Ministry of Finance) |

| 24 | Authority empowered to cancel ARC Registration | RBI |

| 25 | ARC works as | Agent, Manager & Receiver |

| 26 | Full form of CERSAI | Central Registry of Securitisation Asset Reconstruction and Security Interest |

| 27 | Change in Management / Takeover permitted when | Outstanding amount exceeds INR 25 crore |

| 28 | Punishment for contravention of SARFAESI Act | Imprisonment up to 1 year and Fine |

| 29 | Penalty for failure by ARC/person to comply with RBI directions | Up to INR 1 crore OR twice the amount involved, whichever is higher |

| 30 | Time to pay penalty imposed under Section 30A | 30 days |

| 31 | If ARC fails to comply with RBI directions (specific penalty) | INR 5 lakh |

Conclusion

The SARFAESI Act, 2002 is a cornerstone legislation for India’s financial sector. It has helped reduce NPAs, strengthened creditor rights, enhanced liquidity, and improved credit discipline. However, the Act’s full potential can be realized only when judicial processes are strengthened, borrower resistance is addressed, and enforcement practices uphold fairness and ethics. A balanced, transparent, and efficient recovery ecosystem is crucial for safeguarding both creditor interests and borrower rights—ultimately supporting a stable and resilient financial system.

You may also review the other article

- Four Pillars of the Insolvency & Bankruptcy Code

- Category: Insolvency and Bankruptcy Code

- checklist of compliance requirements for RPs under IBC

- Overview on Initiation of Liquidation under the IBC

- Penalty Insolvency Professional under IBC regulations.

- Overview on Mandatory Requirement of AFA under IBC Code

- Do’s & Don’ts for IPs During Moratorium under IBC

- IBC Regulation

- IBC Help Homebuyers

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.