Know Your Rights & Duties when Goods Seized under GST

Table of Contents

Know Your Rights & Duties in case Goods Seized under GST Act

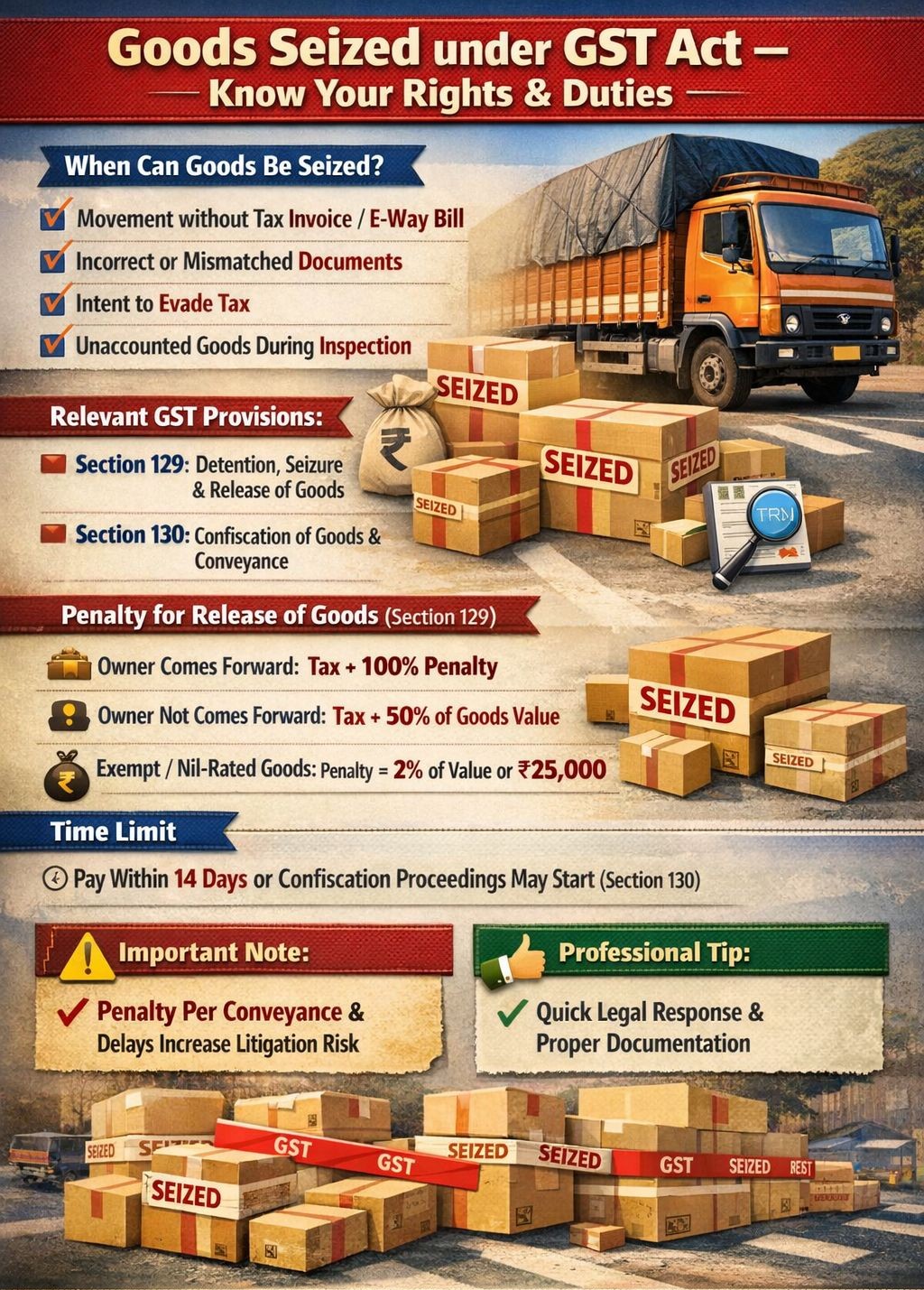

Under the GST law, goods and conveyance can be detained or seized during transit if prescribed conditions are violated. A clear understanding of these provisions can help businesses avoid penalties, delays, and litigation.

When Can Goods Be Detained or Seized?

Goods can be detained or seized in the following cases : Goods may be detained during movement in cases such as:

- Movement without a valid tax invoice or e-way bill

- Incorrect, incomplete, or mismatched details in documents

- Intent to evade tax

- Unaccounted goods found during inspection

Goods to be detained or seized under the relevant GST provisions

Section 129 – Detention, seizure & release of goods and conveyance in transit: Section 129 of the CGST Act, 2017, empowers GST authorities to detain or seize goods and the conveyance carrying such goods when they are transported in contravention of GST provisions. When Section 129 applies, detention or seizure may be initiated if goods are moved:

- Without a valid tax invoice/bill of supply

- When without or with an invalid e-way bill

- With incorrect or mismatched documents

- When a taxpayer has the intent to evade tax

Section 130 of the CGST Act, 2017—Confiscation of goods & conveyance (for serious or repeated violations)

Section 130 of the CGST Act, 2017, deals with confiscation of goods and conveyance in cases involving serious, deliberate, or repeated violations of GST law. It is a penal provision and is invoked only when there is a clear intent to evade tax. .

When Can Confiscation Be Ordered? :

Goods and conveyance are liable for confiscation if a taxable person:

- Supplies or receives goods in contravention of GST provisions

- Does not account for goods on which tax is payable

- Supplies taxable goods without registration

- Uses conveyance for transport of goods with intent to evade tax

- Fails to pay tax after detention under Section 129 of the CGST Act, 2017

- Commits repeated violations of GST law

Relationship with Section 129

- Section 129 of the CGST Act, 2017 : Temporary detention during transit (procedural lapses)

- under Section 130 of the CGST Act, 2017: permanent confiscation for grave offenses; Section 130 of the CGST Act, 2017 cannot be invoked mechanically for minor errors

- However, Confiscation usually follows non-payment of tax & penalty u/s 129 within 14 days

Consequences of Confiscation:

If confiscation is ordered, goods may be confiscated and sold by the GST department. Conveyance may also be confiscated (unless the owner proves lack of knowledge), and the GST taxpayer must pay the tax payable, a penalty of up to 100% of the tax, and a redemption fine in lieu of confiscation. Following Right to Be Heard is available with GST taxpayer

- Confiscation can be ordered only after issuing a Show Cause Notice

- Taxpayers have the right to reply and be heard

- Orders passed without due process are legally challengeable

Intent on evading tax is mandatory and Minor clerical or technical errors do not justify confiscation; in that case, Section 130 should not be used as an extension of Section 129

In Section 130 of the CGST Act, 2017 cases:

GST taxpayers respond promptly and legally to the SCN and establish absence of intent to evade tax. Then seek professional handling to prevent irreversible loss of goods or vehicle. A prompt legal reply, accurate documentation, and professional handling can Ensure faster release of goods, Reduce penalty exposure, and Minimise future litigation risk

Detention and confiscation of goods under GST are often confused. Section 129 and Section 130 operate in different fields, and knowing the distinction is critical to protect taxpayer rights and avoid excessive penalties.

Comparison between Section 129 & 130 of the CGST Act, 2017

| Particulars | Section 129 Goods Be Detained | Section 130- Goods Be Seized |

|---|---|---|

| Nature of provision | Procedural / temporary | Penal/permanent |

| Applicability | Goods & conveyance in transit | Serious or repeated violations |

| Intent to evade tax | Not mandatory | Mandatory |

| Typical cases | Missing / invalid e-way bill, document mismatch | Tax evasion, unaccounted goods, non-payment after detention |

| Objective | Ensure compliance during movement | Punish deliberate tax evasion |

| Action taken | Detention & seizure | Confiscation of goods & conveyance |

| Release of goods | On payment of tax & penalty or furnishing security | Only after redemption fine + tax + penalty |

| Time limit | 14 days to pay penalty | Initiated after failure under Sec 129 or direct evasion |

| SCN required | Yes (MOV-07) | Mandatory SCN & personal hearing |

| Use for minor errors | Yes (procedural lapses) | No |

| Finality | Temporary | Severe & irreversible |

Rights of GST Taxpayer when Goods Seized under of the CGST Act, 2017

- Right to receive a proper detention order and SCN

- The taxpayer has right to be heard before confiscation

- Right to provisional release on payment or security (Sec 129)

- GST taxpayer has right to challenge mechanical invocation of Section 130

- Right to prove absence of intent to evade tax

Duties of Taxpayer/Transporter when Goods Seized under the CGST Act, 2017

- GST taxpayer must carry valid tax invoice/bill of supply

- The taxpayer accurate and active e-way bill

- GST taxpayer must Match vehicle number, quantity, value & HSN

- All the GST Notices and SCN must respond promptly and correctly to GST notices

- Taxpayer must avoid delay beyond 14 days under Section 129

Penalty for Release of Goods – Section 129 of the CGST Act, 2017

- Where the owner of the goods comes forward: Tax payable + Penalty equal to 100% of tax payable

- In case the owner of the goods does NOT come forward: Tax payable + Penalty equal to 50% of value of goods (less tax paid)

- When GST payers have exempt/Nil-rated goods, the penalty is 2% of value of goods or ₹25,000, whichever is less

- Time Limit to Act: If penalty is not paid within 14 days,

Confiscation proceedings under Section 130 may be initiated.

- The penalty is per conveyance, not per invoice

- In case GST taxpayer has made incorrect replies or delayed responses, it can escalate matters

- During the confiscation proceedings, only Proper documentation is the first line of defense and a timely response to the SCN is needed to find out the solution

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.