GST Payment & Late filling Fees under the GST

Table of Contents

Payment under GST for Taxpayers

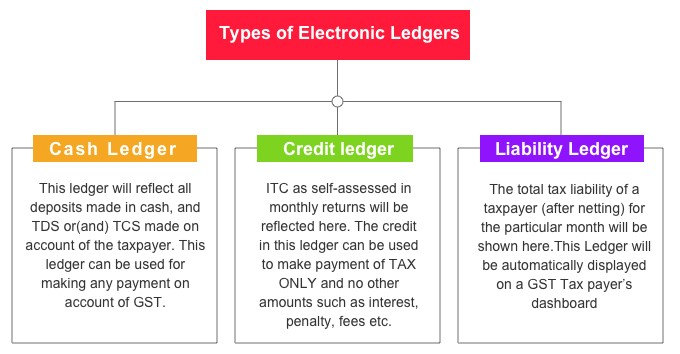

- The Normal GST Taxpayer must pay their taxes each month by the 20th of the next month. When making a payment in the monthly returns, the tax payer must first deposit cash payments in the Cash Ledger. He or she must then debit the ledger and include the appropriate debit entry number in his or her GST Return.

- GST Taxpayers may initiate a payment by creating an electronic challan using form GST PMT-06, which is good for 15 days. Then, GST payment may be made using any of the following methods: (Only authorised banks) Internet banking Card of credit or debit (only from authorised banks)

- Payments in relation to Form GST PMT-06 form required to be made through challan valid for fifteen days only. The GST taxpayer receives a CIN after a GST payment is made successfully.

- Payment of challans lower than INR 10000/- can be made physically through cheques, demand drafts, or currency, via approved banks only. GST Payments more than INR 10000/- have to be made compulsorily E payment mode.

- The GST taxpayer’s electronic cash ledger is shown as credited when electronic payments are made (credit card, NEFT, internet banking or RTGS) for GST tax, GST penalty, interest or fees as applicable as per law. The balance will be used for paying unpaid GST interests, liabilities or fees as applicable.

- E payment fees will be transferred the next day to account of the GST taxpayer after 8 PM. No physical challans are approved for making GST payments. All challans have to be generated only through E payment mode the main GST e portal.

Reduction under the Latest GST Amendments- Late filling Fees

| Form applicable under GST | Deadline in which GST Returns t be filed | Time Taxation period | Penal Late filing Fee Applicable |

| Taxpayers with Annual Aggregate Turnover upto Rs. 1.5 Crores – Form GSTR-3B

|

GST Prospective Taxation period | Previous year | · Maximum Capped of INR 2000 (INR 1000 each under State Goods and Services Tax & Central Goods and Services Tax) |

| GST Form GSTR-3B | GST Taxation period Between 1 June 2021 & 31 August 2021 | July 2017 to April 2021 | · A Maximum Capped to INR 500 (INR 250 under CGST and INR 250 under State Goods and Services Tax ) per return for taxpayers without any tax liability during the said tax period.

· Maximum Capped to INR 1000 (INR 500 each under State Goods and Services Tax & Central Goods and Services Tax ) per return for other taxpayers |

| Form GSTR-3B (Taxpayers with Annual Aggregate Turnover between Rs. 1.5 Crores and Rs. 5 Crores) | Prospective Taxation period | Previous year | · A Maximum Capped of INR 5000 (INR 2500 each under State Goods and Services Tax & Central Goods and Services Tax) |

| GSTR-3B (Taxpayers with Annual Aggregate Turnover more than Rs. 5 Crores) | GST Prospective Taxation period | Previous year | · Capped to a maximum of INR 10000 (INR 5000 each under State Goods and Services Tax & Central Goods and Services Tax) |

| Form GSTR-7 | Prospective Taxation period | Previous year | · Reduced to Rs. 50 per day (Rs. 25 State Goods and Services Tax and Rs. Central Goods and Services Tax) and capped to a maximum of Rs. 2000 (Rs. 1000 each under Central Goods and Services Tax and State Goods and Services Tax ) per return |

| GST For Composite Taxpayers – Form GSTR-4

|

GST Prospective Taxation period | Previous year |

|

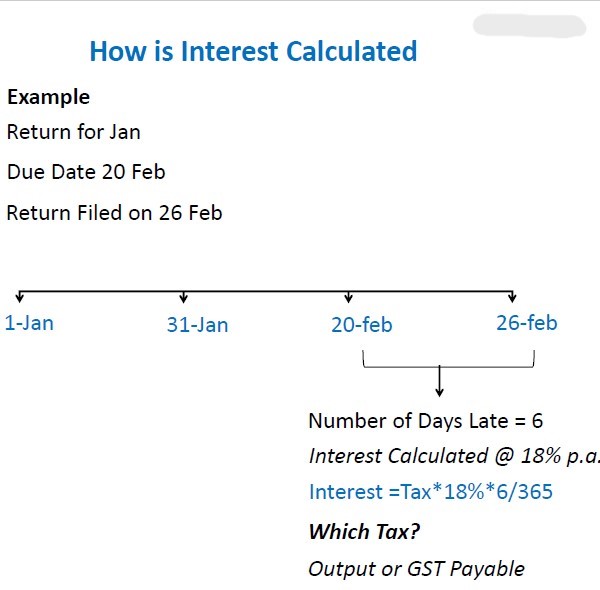

Interest rate on Late GST Payment

- GST payments that are made after the designated due date are assessed interest. In the following situations, taxpayers typically pay interest:

- If you pay your GST beyond the due date, you will be charged interest at the rate of 18 percent per year beginning on the day following the due date.

- 24 % annual interest charge is made when the GST taxpayer claims an excess input tax credit or reduces an excess output tax liability.

- Further relaxations have been given to taxpayers for interest on GST late payments, in addition to the recent relief measures provided to taxpayers on GST late fees. Here is a table summarizing the reinstated interest on late GST payments for the months of March and April 2021.

|

GST Taxpayer & Kind of GST Return |

Applicable Tax Period |

GST Taxpayer Class based on Annual Aggregate Turnover |

Filing Due Date |

Decrease Interest Rate applicable |

Waiver of Fee till |

||

|

First 15 days from Due Date |

Next 15 days |

From 31st day |

|||||

|

Regular GST taxpayers submission monthly GST returns in GSTR 3B Form |

Period ended March 2021 |

Upto INR 5 Cr. |

20 April 2021 |

Zero |

9 percent |

18 percent |

20 May 2021 |

|

Above INR 5 Cr. |

20 April 2021 |

9 percent |

18 percent |

18 percent |

5 May 2021 |

||

|

Period ended April 2021 |

Upto INR 5 Cr. |

20 May 2021 |

Zero |

9 percent |

18 percent |

19 June 2021 |

|

|

Above INR 5 Cr. |

20 May 2021 |

9 percentage |

18 percent |

18 percent |

4 June 2021 |

||

|

Taxpayers under QRMP scheme filing quarterly returns |

Period ended March 2021 |

Quarterly GSTR-3B |

22/24 April 2021 |

Zero |

9 percent |

18 percent |

22/24 May 2021 |

|

Period ended April 2021 |

GST PM-06 Challan |

25 May 2021 |

Zero |

9 percentage |

18 percentage |

N. A |

|

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.