Mandatory GST Invoice Details in eBRC (w.e.f. 13.01.2026)

Table of Contents

What is an Electronic Bank Realization Certificate (eBRC)?

An Electronic Bank Realisation Certificate (eBRC) is a digitally generated document issued by an authorized dealer bank to confirm that an exporter has received foreign exchange against an export of goods or services. It is the core proof of realization of export proceeds, replacing the old physical BRC. Only authorized Dealer Category‑I Banks (banks allowed to deal in forex by RBI) can issue eBRCs. Examples: SBI, HDFC, ICICI, Axis, Bank of Baroda, etc.

eBRC is mandatory because it is the only acceptable proof for

- DGFT Applications: MEIS / SEIS / RoDTEP / ROSCTL claims, EPCG / Advance Authorisation closure & Status House Certificate (Export House, Star Export House)

- FEMA Compliance : Confirms receipt of foreign remittance within RBI-prescribed timelines.

- Statutory Audit & Certifications : Export turnover verification & Banker certificates for export incentives

An eBRC generally contains:

| Particular | Details |

|---|---|

| IEC | Exporter’s Import Export Code |

| Bank AD Code | The bank branch’s AD Code |

| Shipping Bill No. & Date | Export document reference |

| Invoice No. & Date | Commercial invoice |

| Realised Amount | Amount received in foreign currency |

| INR Equivalent | Converted value |

| FIRC No. | Reference of foreign inward remittance |

| Purpose Code | RBI FEMA purpose code |

| Realisation Date | Date foreign exchange credited |

What is the difference between FIRC and eBRC?

| Particular | FIRC | eBRC |

|---|---|---|

| Issued by | Bank branch | Bank uploaded on DGFT portal |

| Purpose | Proof of receipt of foreign remittance | Proof of export proceeds realisation |

| Acceptability | Limited | Mandatory for DGFT/GST/Customs |

| Linkage | Not linked to shipping bill | Linked to shipping bill & IEC |

Mandatory GST Invoice Details in eBRC (w.e.f. 13.01.2026)

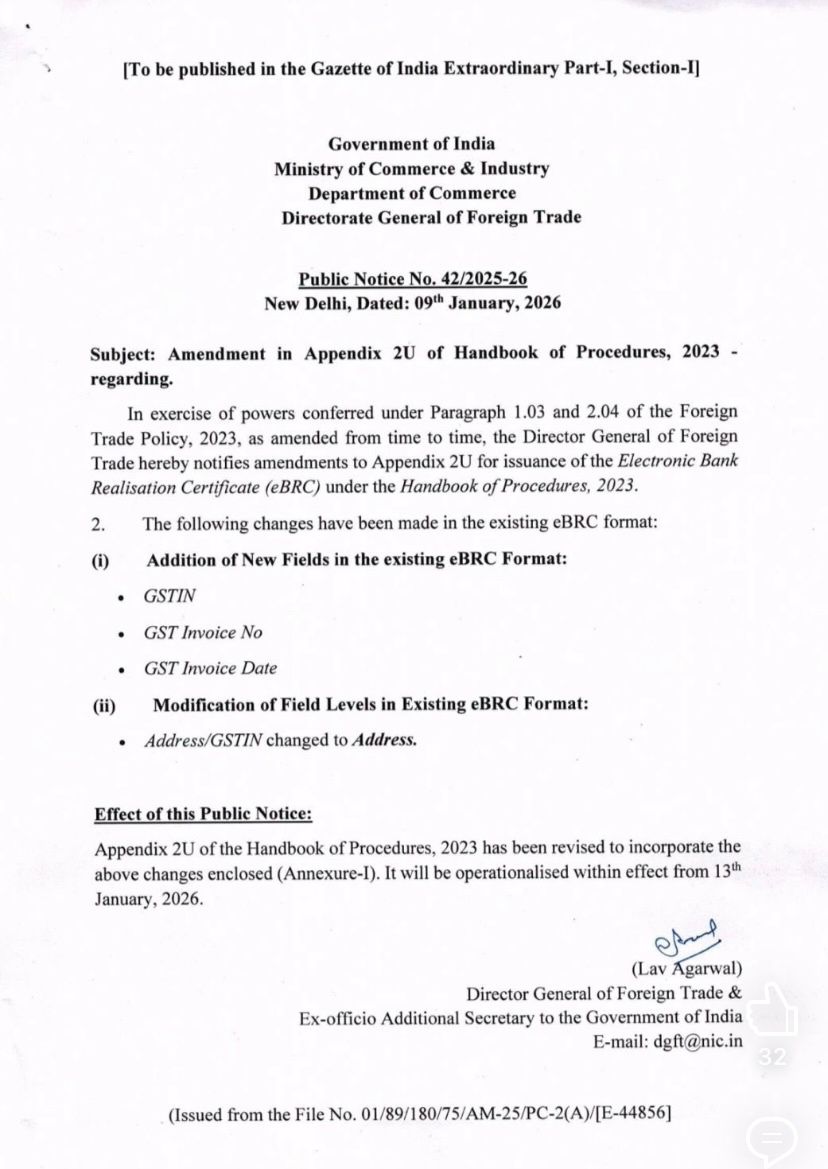

The Directorate General of Foreign Trade has introduced mandatory GST-level reporting in the Electronic Bank Realization Certificate (eBRC) to strengthen the linkage between exports, GST invoices, and foreign exchange realization, effective from 13 January 2026 via issue Public Notice No. 42 dated 09.01.2026.

what are the mandatory Details in eBRC (w.e.f. 13.01.2026)?

Banks will now be required to capture the following invoice-wise GST particulars while generating Electronic Bank Realization Certificates (eBRCs):

-

GSTIN of the exporter

-

GST Invoice Number

-

GST Invoice Date

Banks directly transmit Inward/Outward Remittance Messages/ORM (Inward/Outward Remittance Messages) to the Directorate General of Foreign Trade. Exporters self-certify and generate eBRCs on the Directorate General of Foreign Trade portal based on bank-uploaded Inward/Outward Remittance Messages (IRMs). The system supports invoice-level and remittance-level mapping, partial realizations, and bulk operations.

What are the changes in the Electronic Bank Realization Certificate (eBRC) format?

| Earlier Position | Revised Requirement |

|---|---|

| GSTIN embedded in address/IEC branch | Separate dedicated GSTIN field |

| Invoice details optional / reference-based | Invoice No. & Date mandatory |

| One eBRC per Shipping Bill (generally) | Invoice-linked eBRCs likely |

Practical & Industry Implications related to eBRC

- Multiple Invoices under One Shipping Bill : Common in cases where one customer order is dispatched through multiple vehicles & exports are consolidated from multiple suppliers, which impacts that Electronic Bank Realization Certificate generation may shift from shipping bill-wise to invoice-wise. Shift from shipping bill–centric to invoice-centric compliance.

- Export ensures accurate invoice data (GSTIN, Invoice No., Date) is shared with banks. Tracking partial realizations carefully may result in multiple eBRCs per invoice. Strengthen reconciliation controls across GST invoices, shipping bills, IRMs, and eBRCs. Exporters must note that it is essential for GST refunds, RoDTEP, drawback, MEIS-linked legacy claims, and Directorate General of Foreign Trade incentives.

Partial Realisations of Export Proceeds

- Where payments are received as advance, part payment, or final payment. which impacts the multiple electronic bank realization certificates against a single GST invoice & Each eBRC must reference the same GST invoice details

Increased Compliance & Reconciliation Effort

- Exporters will need Invoice-level mapping between GST invoices, Shipping Bills, Foreign inward remittances, and strong coordination with Banks, Customs brokers, ERP/accounting teams

Compliance Action Points for Exporters

- The exporter must ensure GST invoice numbers and dates are correctly communicated to banks & maintain invoice-wise realization tracking; also review ERP capability for Invoice-level export reconciliation along with Partial payment tracking; sensitize banks on correct GSTIN tagging & Prepare for higher scrutiny in RoDTEP, Duty Drawback, GST refunds, DGFT incentive claims

- System Readiness (Expected) : DGFT is expected to update the Directorate General of Foreign Trade portal, modify bulk upload templates, and enable invoice-wise eBRC mapping to ease compliance under the revised framework.

- Strategic Objective Behind the Change to Plug gaps between GST exports & FEMA realization, which Improve data integrity across GST–Customs–DGFT Banking systems & reduce misuse of export incentives and refund claims

- The Electronic Bank Realisation Certificate is no longer just a foreign exchange document—it is now a GST-linked compliance instrument. Exporters must move from shipping bill–centric tracking to invoice-centric tracking.

- eBRC has evolved from a mere realization proof to a core data-validation document linking GST, Customs, FEMA, and Directorate General of Foreign Trade systems. Robust invoice-level controls and bank coordination are now non-negotiable.

Services Available Under the eBRC Module

- Inward/Outward Remittance Messages/ORM Repository: Search & view inward and outward remittances uploaded by banks (PAN-wise) & outward remittances auto-linked to corresponding inward remittances.

- Generate eBRC (Self-Certification) : Generate eBRC against one or multiple IRMs as per self-certification rules.

- Bulk Generate eBRC : Invoice/remittance-wise bulk self-certification to reduce manual effort.

- View/Cancel eBRC: View issued eBRCs & cancel unutilized eBRCs (critical for avoiding double benefits).

- Inward/Outward Remittance Messages Utilization Report: Download detailed utilization linking IRM ↔ Shipping Bill/Invoice ↔ eBRC

- View Any eBRC: View eBRC details using IEC + eBRC number.

- Bulk Download : Bulk download inward/outward remittance messages/ORM/eBRC data for audit & reconciliation.

- Respond to Bank/Agency: Online response to flags raised by banks or government agencies.

DGFT – Enhanced Self-Certification Framework Legal Reference

-

Para 1.07 of the Foreign Trade Policy (FTP)—Commitment to efficient, transparent, and accountable trade facilitation.

-

Trade Notice No. 33/2023-24 dated 10.11.2023 – Roll-out of the enhanced eBRC system based on electronic remittance data from banks.

-

Trade Notice No. 02/2025-26 – Introduction of mandatory “Mode of Export of Services” field for service exports.

-

Public Notice No. 42 dated 09.01.2026 – Mandatory GST invoice details in eBRC w.e.f. 13.01.2026

About IFCCL

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.