New Deadline of TRA from 30th Sept 2025 to 31st Oct 2025

New Deadline of Tax Audit from 30th September 2025 to 31st October 2025

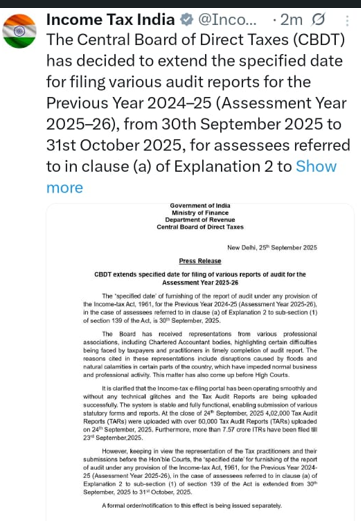

The Central Board of Direct Taxes has extended the due date for filing Tax Audit Reports under the Income Tax Act, 1961, for the Assessment Year 2025-26.

-

Previous Due Date: 30th September 2025

-

Revised Due Date: 31st October 2025

The due date for filing various audit reports for the Previous Year 2024-25 (Assessment Year 2025-26) has been extended from 30th September 2025 to 31st October 2025. This applies to assessees referred to in clause (a) of Explanation 2.

Why the Tax Audit Reports Extension :

This extension provides relief to taxpayers and practitioners affected by floods and other natural calamities, allowing additional time for accurate and compliant filings. Due date for filing Tax Audit Reports (TAR) for FY 2024-25 has been extended to 31st October 2025. The extension has been granted in view of the following factors:

-

Delayed release of e-filing utilities and frequent portal issues

-

Enhanced disclosure requirements (MSME, settlements, reconciliations, etc.)

-

Overlapping statutory compliance timelines

Based on representations from stakeholders. Taxpayers and professionals faced challenges in timely completion of audit reports. The extension aims to facilitate better compliance. Now Taxpayer ensure timely finalisation and error-free filing well within the extended timeline. We encourage all taxpayers and auditors to make the most of this extended timeline and ensure timely submission of audit reports.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.