New Frontier of AI‑Enabled Tax Enforcement in India

Table of Contents

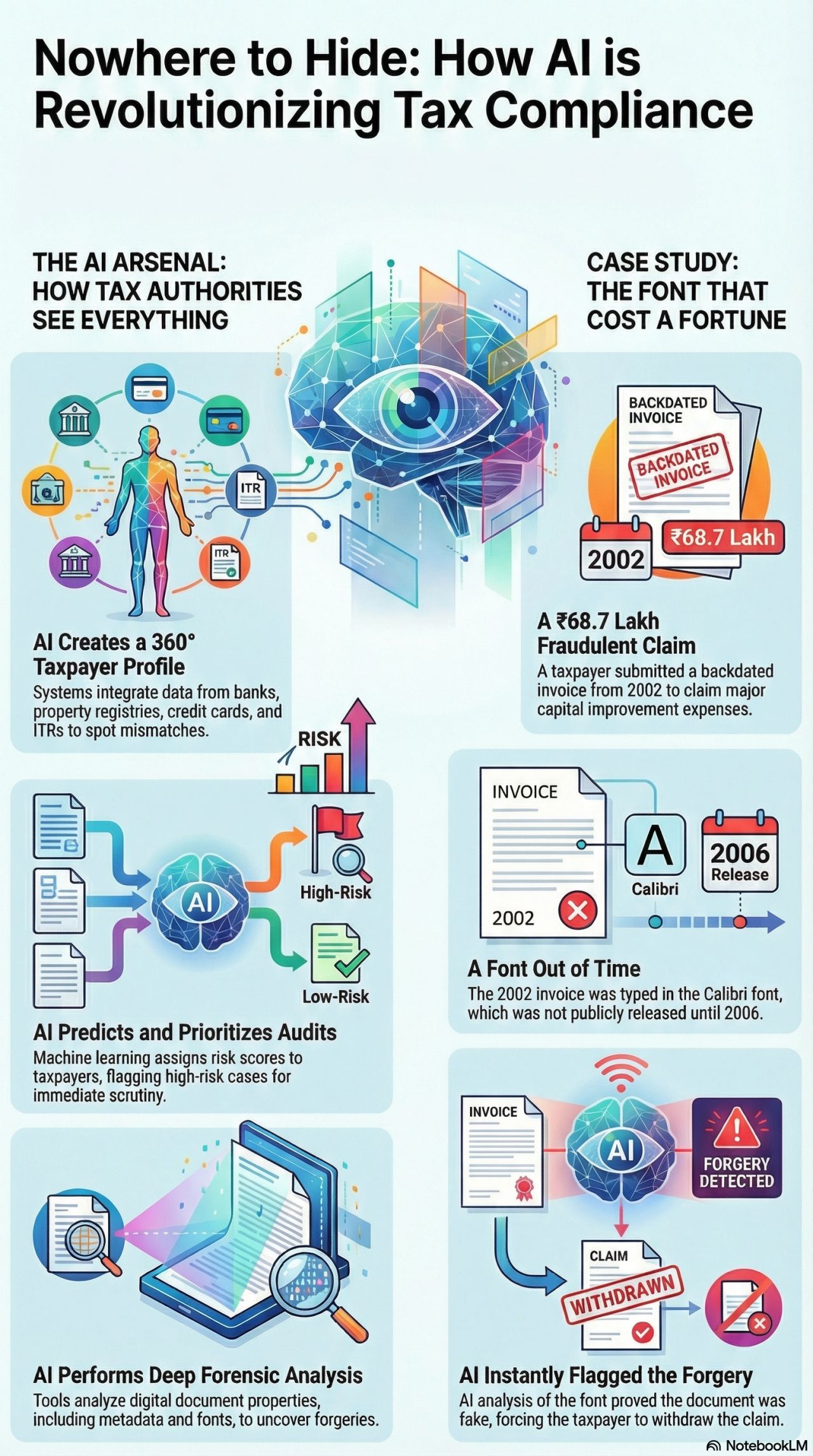

When a Font Exposed a INR 68.7 L Long-term capital gain Tax Fraud

Are your taxation-related documents AI-ready?

A INR 68.7 lakh long-term capital gain claim collapsed because the font told the truth. In the artificial general intelligence era, authenticity is as important as arithmetic. In a landmark example of digital forensics at work, the Hyderabad Income Tax Department dismantled a INR 68.7 lakh unauthorised Long-term capital gain claim not via a raid, but through artificial general intelligence AI‑assisted document forensics.

What happened in this case study ?

A taxpayer sold an immovable property for INR 1.4 crore and slashed the reported long-term capital gain by claiming a large indexed Cost of improvement. A key supporting invoice was dated” 6 July 2002 with INR 7.68 lakh of improvement expenses. During the investigation it is observed that. AI flagged a fatal inconsistency and found that the invoice used Calibri (Body) a font not publicly released until 2006 and only later becoming the default in MS Office 2007. The 2002 date was therefore chronologically impossible. The final outcome in this case is taxpayer withdrew the INR 68.7 lakh claim, filed a revised ITR, and paid the correct taxes.

How AI Turned the Tables

Modern tax tech isn’t just reconciling numbers, but it’s validating authenticity:

- Metadata analysis: Hidden timestamps, authorship, and version trails that contradict declared dates.

- Font/era consistency: artificial general intelligence maps fonts, file formats, and printer drivers to their release timelines.

- Pattern & anomaly detection: Models flag subtle irregularities across docs, filings, SFTs, registries, and bank trails that humans may miss.

🇮🇳 The Indian Taxation context: From Reactive to Predictive

- Project Insight fuses multi‑source data (banks, SFTs, property registries, GST, TDS/TCS, AIS/26AS) to build 360° taxpayer profiles and trigger risk‑based actions.

- artificial general intelligence enabled e‑verification is scaling—fewer manual selections, more algorithmic targeting.

- CBDT direction of travel: data‑driven compliance, reduced friction for honest taxpayers, and faster exception handling.

Why This Matters to Professionals & Taxpayers

- Compliance now includes digital integrity. Fonts, metadata, timestamps, and even print artifacts can be audited.

- Photocopies won’t save you. Weak scans are becoming forensic evidence—not protection.

- Documentation ≠ just storage. It must be verifiable, traceable, and time‑consistent.

Quick Checklist & Practical Guidance for Taxpayers

- Keep original, native files (not just PDFs/scans).

- Preserve creation & modification history (don’t scrub metadata).

- Verify font/version timelines for legacy documents.

- Match invoices to bank credits, eBRC/FIRC, and shipping/property records.

- Reconcile ITR ↔ AIS ↔ 26AS ↔ SFT ↔ GST before filing.

- If reconstructing old records, disclose re-creations and attach affirmations/corroborations.

Mini‑SOP: Document Forensic Readiness (For Firms)

- Intake: Accept native formats (DOCX, XLSX, image EXIF); avoid only‑PDF pipelines.

- Automated pre‑screen:

- Extract metadata (created/modified dates, author, app versions)

- Flag post‑dated fonts/templates for pre‑2007 docs

- Linkage: Tie each expense to bank entries, work orders, contractors, permits, and photos with EXIF.

- Version vault: Store originals with hash; generate a read‑only evidence pack.

- Disclosure policy: If re‑typed invoices are used (e.g., lost originals), append declaration + corroboratives (affidavits, bank proofs, vendor confirmations).

Risk Map: Where artificial general intelligence Will Look Next

- Works contracts & property improvements (inflated/retrospective bills)

- Related‑party paper trails (shared templates, identical font defects)

- Back‑dated service agreements (inconsistent styles/headers/footers)

- Export incentives (eBRC mapping, purpose codes, split remittances)

- High‑value cash cycle (ATM velocity anomalies, cash‑bank round‑trips)

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.