New Wage Code : Impact & Immediate Action Required (Dec2025)

Table of Contents

New Wage Codes – Impact & Immediate Actions Required

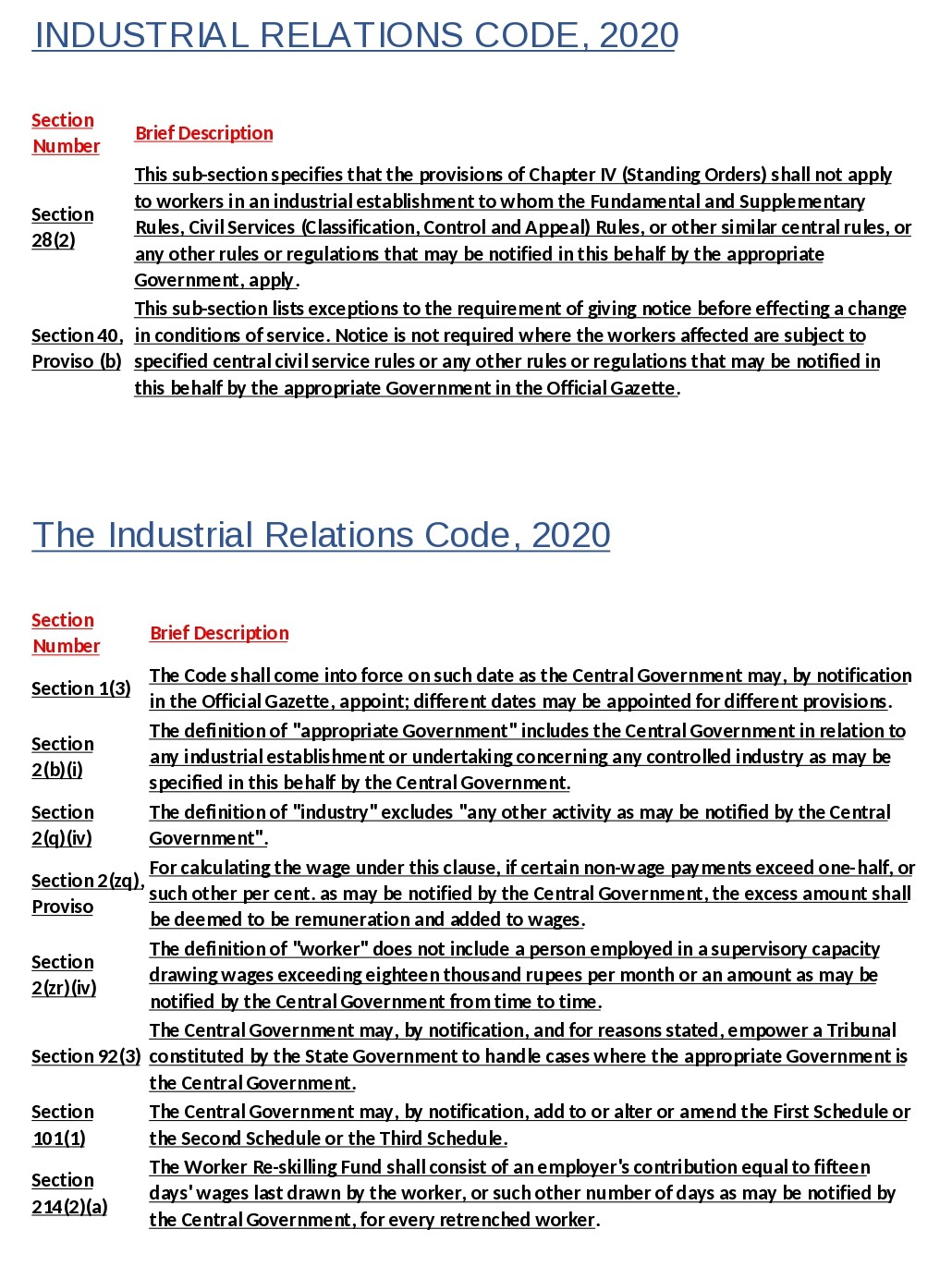

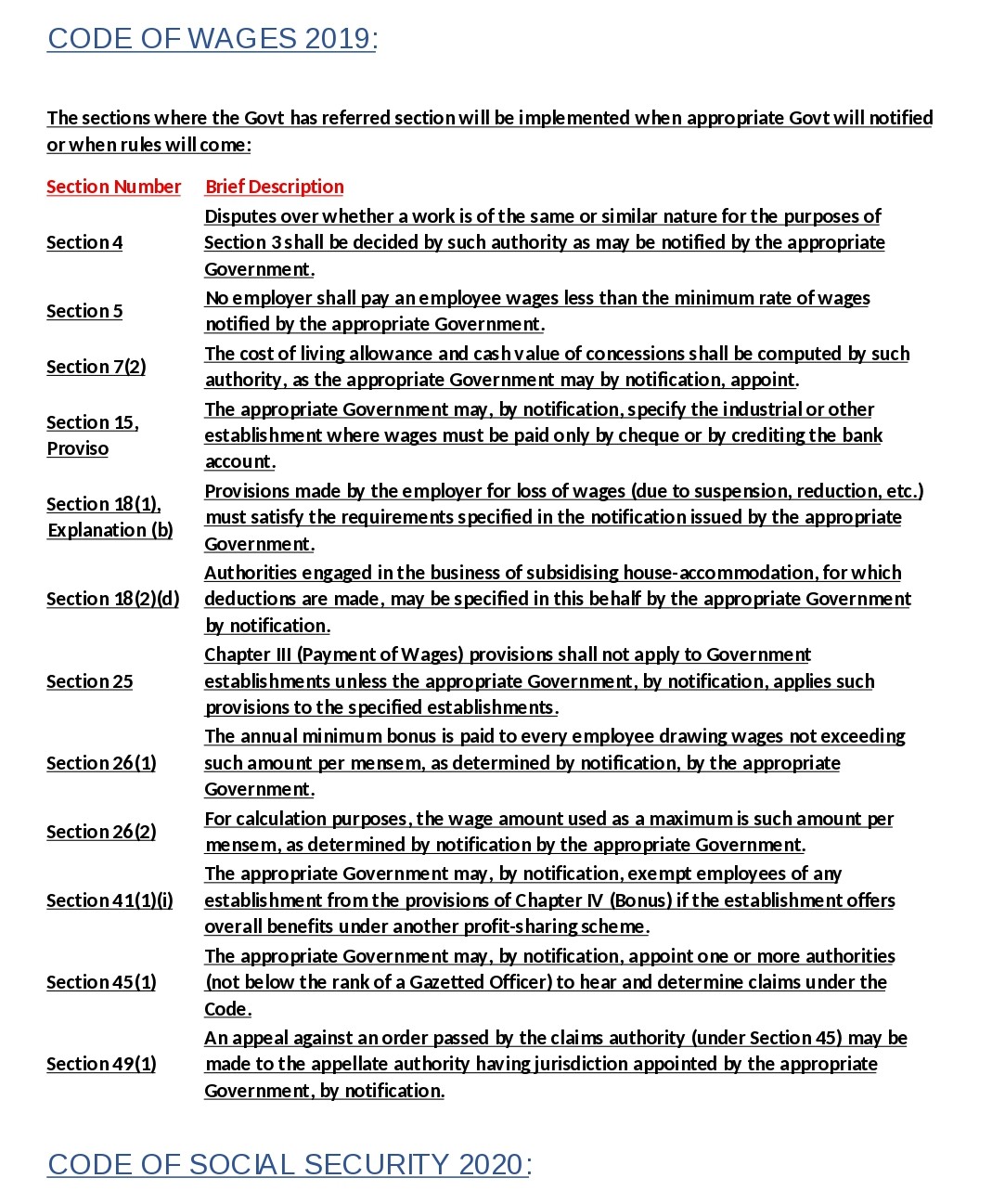

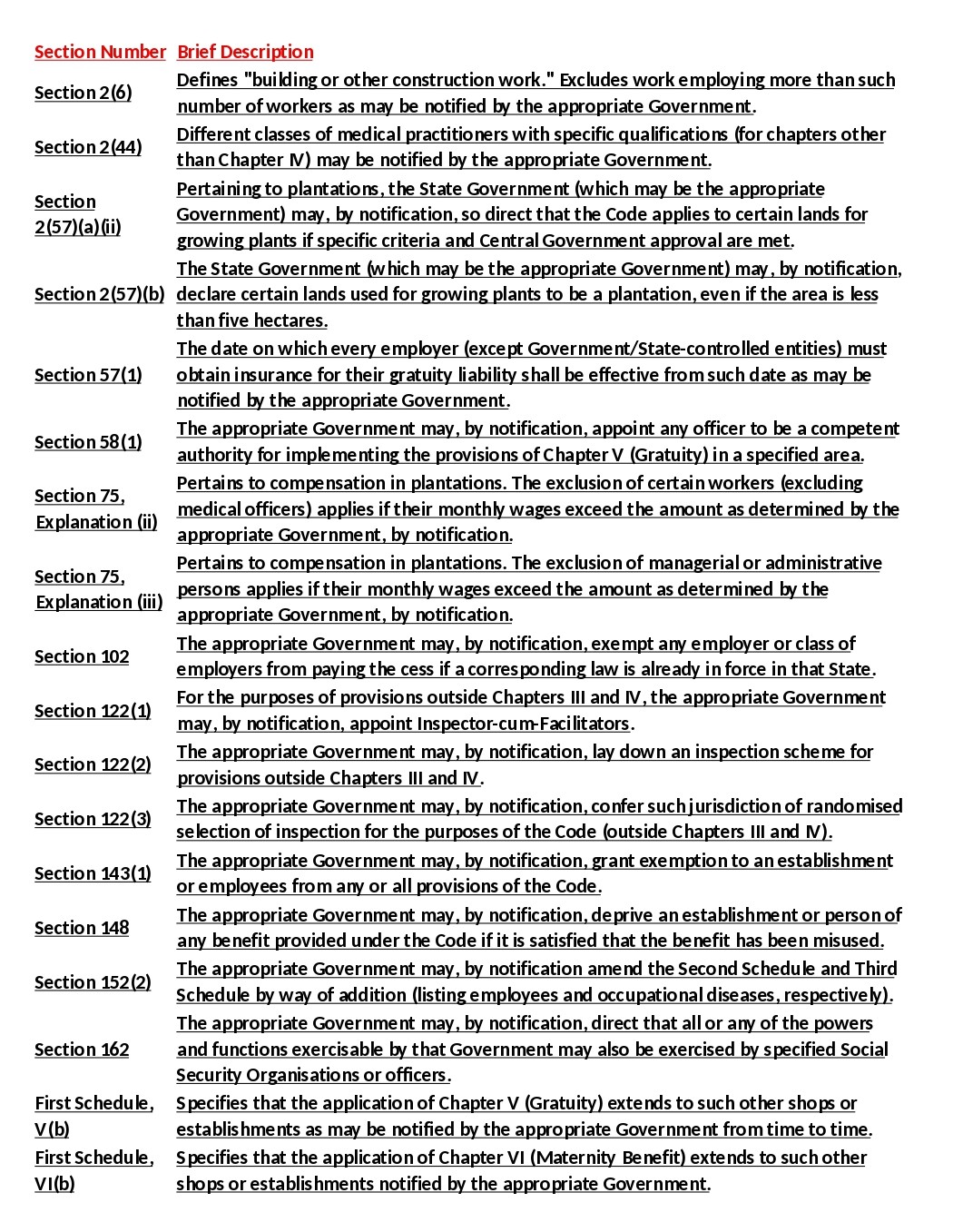

- India’s four Labour Codes—Code on Wages, 2019, Industrial Relations Code, 2020, Code on Social Security, 2020, and Occupational Safety, Health and Working Conditions Code, 2020—usher in unified definitions and streamlined compliance rules that reshape how organizations design compensation, compute statutory benefits, and run payroll.

- Effective from 21 November 2025, these Codes replace 29 erstwhile labour laws and require immediate recalibration of payroll structures. While some procedural/operational provisions await specific notifications by States, the Codes themselves are in force, and employers should prepare their December 2025 payroll accordingly.

Why the New Codes Matter Now

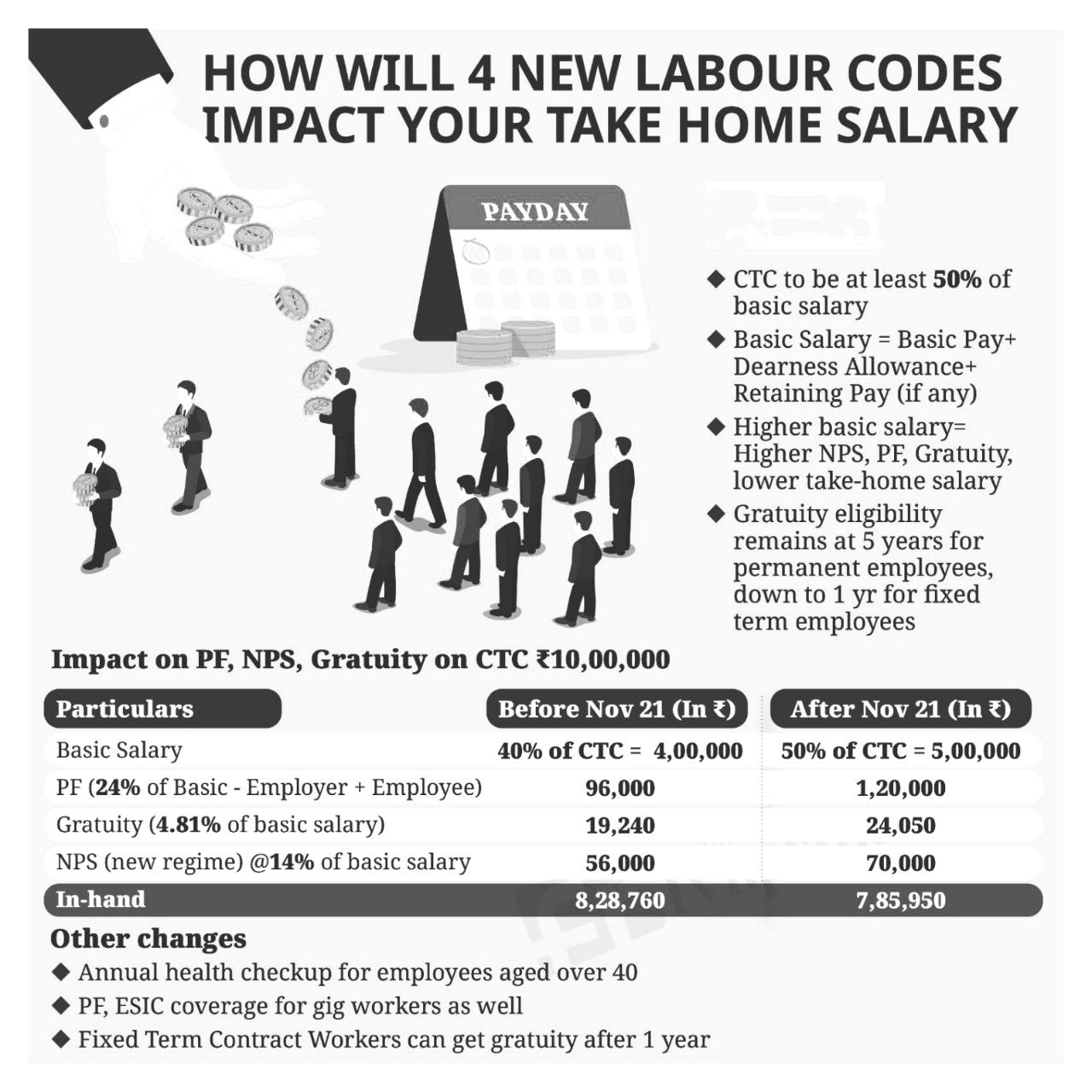

- Unified “wages” definition ties statutory benefits (PF, ESI, gratuity, bonus, retrenchment pay) to a minimum 50% of total remuneration.

- Social security coverage expands, including gig/platform workers via notified schemes.

- Employer obligations increase—especially for contract labour, safety, and leave encashment—impacting cost, cash flow, and payroll controls.

- Non‑compliance can trigger penalties, interest, and reputational risks.

Core Change: The 50% Wage Floor

Under the new regime, Basic + DA (and other components classified within “wages”) must form at least 50% of total remuneration/CTC. If allowances exceed 50%, the excess is added back to the wage base for statutory computations. This single rule:

- Raises the base for PF, ESI, gratuity, bonus, retrenchment, and other payouts.

- Potentially increases employer social‑security costs unless overall CTC is rebalanced.

- Reduces take‑home pay in some structures if CTC is unchanged and contributions rise.

- Demands payroll system updates to track inclusions/exclusions and enforce the floor.

- Practical guidance: Treat 50% of gross/CTC as the statutory wage base for benefit calculations. Ensure your payroll engine caps total exclusions (e.g., HRA, conveyance, special allowances) so they do not exceed 50%; any excess auto‑reclassifies to wages.

Code‑Wise Impact Overview

1) The Code on Wages, 2019

Basic wages must now constitute at least 50% of total remuneration, with any excess allowances added back to the wage base. This expands the base for PF, ESI, gratuity, and bonus calculations, potentially increasing employer costs while reducing take-home pay unless CTC adjusts. Payroll systems need updates to enforce this floor and track exclusions like HRA or transport up to 50%.

- Wages ≥ 50% of total remuneration (post allowance cap).

- Bonus & minimum wage linkages computed on the revised wage definition.

- Payroll enforcement: Configure rules to monitor allowance ceilings and automate add‑backs when the 50% threshold is breached.

2) Industrial Relations Code, 2020

Adopts the same 50% wage definition, raising bases for retrenchment compensation, notice pay, and lay-off payouts. Firms with under 300 workers gain flexibility in retrenchments without prior approval, indirectly easing payroll for terminations. Fixed-term employment ensures pro-rata benefits, standardizing payroll for such contracts.

Definition of Wages (Section 2(y), Code on Wages, 2019)

· Wages must be at least 50% of Gross / CTC

· Typically includes: Basic + DA

· Allowances exceeding 50% of total remuneration will be added back to wages

· PF, ESI, Gratuity and other statutory benefits will now be computed on this revised wage base

· Adopts the same “wages” definition for separation payouts: Retrenchment compensation, notice pay, and lay‑off benefits are calculated on higher bases.

· Managerial flexibility: Establishments with < 300 workers gain greater flexibility in retrenchment (subject to Code conditions), easing operational decision‑making.

· Fixed‑term employment: Mandates pro‑rata statutory benefits, standardizing payroll for FTC contracts.

3) Code on Social Security, 2020

Universalizes social security with expanded PF/ESI coverage, including gig workers via notified schemes, based on the broader wage definition. Principal employers bear full employer PF contributions for contract workers, with no deductions from employee wages. Thresholds persist for mandatory benefits (e.g., 10-20 employees), but voluntary extensions apply beyond wage ceilings like INR 15,000.

- PF/ESI computations now reference the broader wage base.

- Gig/platform workers: Coverage via notified schemes.

- Contract labour: Principal employer must ensure full employer PF contributions—no deductions from employee wages to fund the employer share.

- Thresholds: Existing coverage thresholds persist (e.g., ESI wage cap, PF wage ceiling), but employers may extend benefits voluntarily beyond wage ceilings (e.g., INR 15,000 for PF).

4) Occupational Safety, Health and Working Conditions (OSH) Code, 2020

Principal employers must pay contract workers’ wages if contractors default, adding payroll liability safeguards. Enables annual leave encashment, impacting year-end payroll adjustments. Registration applies to establishments with 10+ employees, with welfare facilities tied to payroll compliance.

Principal employer wage liability: If contractors default, principal employers must pay workers’ wages, necessitating escrow/controls.

- Annual leave encashment: Impacts year‑end payroll and provisions.

- Registration threshold: Establishments with 10+ employees must register and comply with welfare facilities linked to payroll.

- Immediate December 2025 Payroll Actions

A. Compensation Structure & CTC

- Re‑design salary structures so Basic + DA ≥ 50% of CTC/gross.

- Cap exclusions (HRA, conveyance, special allowances) to ≤ 50%; configure auto add‑back if exceeded.

- Reissue salary annexures/offer letters reflecting the revised break‑up and statutory notes.

- Understanding Salary Components (for Wage Calculation) Includes, Basic Pay, Dearness Allowance (DA), Allowances, Bonus, Employer’s PF/ESI contribution, HRA, Overtime, Commission, incentives, etc.

B. Social Security: PF & ESI

PF

- Apply PF on statutory wages (up to notified PF wage ceiling). Statutory ceiling:INR 15,000 (as of now), PF is mandatory if wages ≤INR 15,000

- For minimum wage employees (only Basic + DA), PF will apply on full wages, not on an artificially reduced basic

- In case employees paid minimum wages (Basic + DA only), PF applies on whole wages if within the ceiling.

- Contract employees: budget for employer PF; prevent any employee‑funded employer share.

ESI: ESI Applicability

- If statutory wages ≤ ESI cap, compute ESI on the revised wage base (usually Basic + DA post 50% rule).

- Update deductions & employer liability and communicate net‑pay impact transparently.

- Coverage threshold: Wages up to INR 21,000,

C. Gratuity & Separation Payouts

- Gratuity: Gratuity cannot be calculated on wages below 50% of Gross, Eligibility updated:

- Fixed-term employees: Eligible after 1 year

- Regular employees: Eligible after 5 years

- Higher wage base = higher gratuity liability

- Calculate on ≥ 50% wage base; do not compute gratuity on a reduced base.

- Fixed‑term: 1 year service suffices for gratuity eligibility; regular employees: 5 years (as per the Code).

- Retrenchment/Notice/Lay‑off: Recompute using the new wages definition.

- Update policies and HRIS workflows for approvals and documentation.

D. Contract Labour & Principal Employer Controls

- Wage assurance: Build controls to verify contractor payrolls; set escrow/retention to fund shortfalls.

- Register & maintain compliance under OSH Code; track welfare facilities linked to headcount.

E. Systems, Policy & Documentation

Payroll engine changes:

- Rule: Basic + DA floor at 50%, allowance cap, auto add‑backs.

- Recalculate PF/ESI bases, gratuity accruals, bonus eligibility.

- HR policy updates: Offer letters, FTC templates, separation policies, leave encashment rules.

- Employee communication: Explain statutory changes, net‑pay variances, and benefits clearly to avoid grievances.

Illustrative Examples

Example 1:

Mid‑Income Employee (CTC INR 6,00,000/year)

- Old split: Basic INR 20,000, DA INR 5,000, HRA INR 15,000, Other INR 10,000 (per month).

- Wage share (Basic+DA) = INR 25,000, total = INR 50,000 → 50% met

- PF base = INR 25,000 (subject to PF wage ceiling policy).

- ESI: Not applicable if statutory wages exceed ESI limit.

Example 2:

Allowance‑Heavy Structure (CTC INR 4,80,000/year)

- Old split per month: Basic INR 14,000, DA INR 3,000, HRA INR 12,000, Special INR 11,000 → Total INR 40,000.

- Wages = INR 17,000; < 50% of INR 40,000 → add‑back required.

- Adjust to Basic + DA ≥ INR 20,000; decrease special allowance/HRA accordingly.

Example 3:

- Fixed‑Term Employee (12 months)

- Eligible for gratuity pro‑rata after 1 year service; compute on 50% wage base.

Frequently Asked Questions- India’s four Labour Codes—Code on Wages, 2019

Q1.: Are the Codes applicable even if my State hasn’t notified all rules?

A. Yes. The Codes are already effective. Pending State notifications largely affect procedural/operational sections, not the core applicability. Proceed with payroll alignment.

Q2.: Will my payroll costs rise?

A. Typically yes, if your structures were allowance heavily. The 50% wage floor increases the base for PF/ESI/gratuity/bonus unless you rebalance CTC.

Q3.: What if we keep PF limited to INR 15,000?

A. You may cap PF wages at the notified PF ceiling (e.g., INR 15,000) per policy, but ensure it’s consistently applied and disclosed. Note: minimum‑wage cases and specific coverage rules can require applying PF on actual wages.

Q4.: Do fixed‑term employees get gratuity?

A. Yes, after 1 year, computed on the revised wage base. Regular employees: 5 years.

Q5.: How do we handle contractor non‑payment?

A. Under OSH, principal employers must ensure wages are paid; set strong payment controls, audits, indemnities, and contingency provisioning.

Non-compliance can result in penalties, interest, and litigation exposure. Early alignment = smoother audits + cost certainly.

Risk Hotspots & How to Mitigate

- Excess allowances (>50%) → Auto add‑back into wages.

- Contractor defaults → Principal employer liable for wages → Vendor due‑diligence, payment controls, indemnities.

- Separation payouts under‑computed → Audit formulas in HRIS.

- Legacy payroll engines → Patch rules, regression‑test before December run.

- Communication gaps → Issue FAQs, helpdesk support for employees.

Smart Compliance Checklist (Ready to Use)

We must remember that Minimum 50% of CTC must qualify as “Wages” for statutory benefits. Following are Immediate Action Points for December 2025 Payroll

· Reconstruct salary structures to meet the 50% wage rule

· Recalculate PF, ESI & Gratuity liabilities

· Update payroll software and compliance frameworks

· Review cost implications and employment contracts

· Ensure documentation and disclosures are aligned with the new Codes

- Restructure salary: Basic + DA ≥ 50% of CTC/gross.

- Update PF/ESI bases and wage ceilings.

- Recompute gratuity, bonus, retrenchment, leave encashment.

- Refresh FTC templates to include pro‑rata benefits.

- Strengthen contractor payroll assurance and payment controls.

- Amend HR policies, letters, SOPs; align with Codes.

- Regression‑test payroll engine; validate December outputs.

- Communicate net‑pay impacts and benefits to employees.

- Keep a compliance file with workings, approvals, and proofs.

Conclusion

The new Labour Codes demand substantive payroll recalibration—not cosmetic tweaks. Align structures to the 50% wage floor, re‑engineer statutory computations, and strengthen controls around contract labour and separation payouts. Transparent communication and rigorous testing will make December 2025 payroll smooth and compliant. The Labour Codes mark a structural shift from allowance-heavy salary models to wage-centric compliance. Delayed alignment increases litigation risk, penalties, and cost uncertainty, while early compliance strengthens governance and employer credibility.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.