Overview MSME Form 1 Due Dates and filling Procedure

Table of Contents

Overview MSME Form 1 Due Dates and filling Procedure

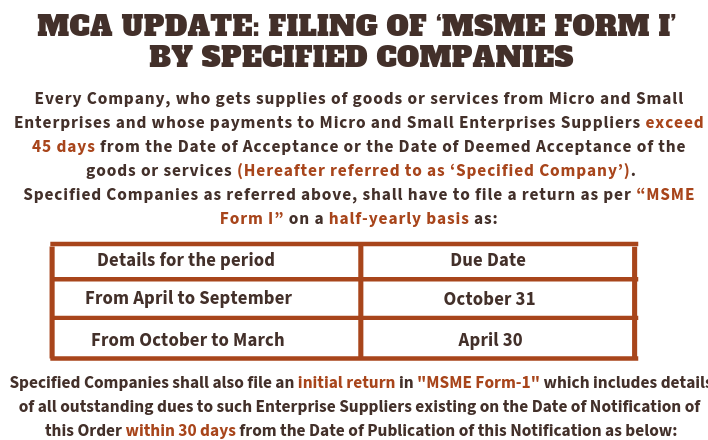

MCA throght MCA notification No S.O. 5622(E), 2.11.2018 has directed that Every Company, whether private/ public / OPC who gets supplies of goods or services from micro and small enterprises and whose payments to MSEs Suppliers more than 45 days from the Date of Acceptance* or the Date of Deemed Acceptance of the goods or services shall submit a half-yearly return to the MCA in “MSME Form I” stating the following:

- Amount of payment due; and

- Reasons for the delay;

What is MSME Form 1 (MCA)?

MSME Form I is a half-yearly return that must be filed with the Ministry of Corporate Affairs (MCA) by Specified Companies whose payments to Micro or Small Enterprises (MSEs) exceed 45 days from the date of acceptance (or deemed acceptance) of goods/services. This form was mandated under the:

-

Specified Companies (Furnishing of information about payment to micro and small enterprise suppliers) Order, 2019

-

Issued under Section 405 of the Companies Act, 2013

Applicability of MSME Form I

MSME Form 1 was introduced by the MCA to ensure timely payment to Micro and Small Enterprises. It mandates specified companies to file a half-yearly return detailing outstanding payments due to MSME suppliers beyond 45 days, along with reasons for the delay. Filing of MSME Form I is mandatory if your company: Has received goods or services from MSMEs, and payment is outstanding for more than 45 days from the date of acceptance or deemed acceptance of such goods/services. A company is required to file MSME Form I if both of the following conditions are met:

-

The company has received goods or services from Micro or Small Enterprises, and

-

Payment is due for more than 45 days from the date of acceptance/deemed acceptance of the goods/services.

The date of deemed acceptance refers to when there is no written objection within 15 days from the delivery of goods/services.

Definition of Micro and Small Enterprises (as per MSMED Act, 2006)

Manufacturing Sector

| Type | Investment in Plant & Machinery |

|---|---|

| Micro | ≤ ₹25 lakhs |

| Small | > ₹25 lakhs ≤ ₹5 crore |

Service Sector

| Type | Investment in Equipment |

|---|---|

| Micro | ≤ ₹10 lakhs |

| Small | > ₹10 lakhs ≤ ₹2 crore |

(Note: Revised classification limits notified in 2020 may apply for new registrations but for compliance with this order, original criteria are still considered relevant.)

What details need to be furnished in MSME Form 1?

Details Required in MSME Form I : Companies must report the following information:

-

Name of the MSME supplier

-

PAN of the supplier

-

Date from which the amount is due

-

CIN, PAN, Registered Address

-

Outstanding dues to MSEs

-

Amount payable

- Digital signature of Director/Authorized Signatory

-

Amount outstanding

-

Reasons for the delay in payment

MSME Form 1 Due Dates (Half-Yearly Returns)

| Period Covered | Due Date to File |

|---|---|

| April – September 2024 | 31st October 2024 |

| October – March 2025 | 30th April 2025 |

Who Are “Specified Companies”?

Any public or private company that meets both of the following:

-

Has acquired goods/services from an MSE.

-

Payment to MSE exceeds 45 days from acceptance/deemed acceptance.

Reminder for Filing MSME Form I for the Period October 1, 2024 to March 31, 2025

The company has outstanding payments to MSE suppliers which are due for more than 45 days from the date of acceptance or the deemed date of acceptance of goods or services. This is to inform you that MSME Form I is due for filing for the half-year period from 1st October 2024 to 31st March 2025. The due date for filing the form with the Ministry of Corporate Affairs (MCA) is 30th April 2025.

Action Required: Identify MSME vendors from whom goods or services were procured during the above period. Check if any payments were outstanding for more than 45 days as on 31st March 2025. Ensure timely filing to avoid penalties and ensure compliance with Section 405 of the Companies Act, 2013 and related MCA notifications. Prepare and file MSME Form I on the MCA portal within the prescribed deadline.

Steps to file the initial return (MSME Form I):

-

Identify MSME vendors with outstanding dues > 45 days as on 22nd January 2019.

-

Obtain MSME Registration Certificates from such vendors to confirm their MSME status.

-

Settle dues with such suppliers if possible to avoid the requirement of filing MSME Form 1.

-

If dues remain unpaid for > 45 days, file MSME Form I accordingly.

Penalty for Non-Compliance of Filing MSME Form I

Under Section 405(4) of the Companies Act:

-

Company: Fine up to ₹25,000

-

Directors/Officers: Fine from ₹25,000 to ₹3,00,000 or imprisonment up to 6 months, or both

Exemptions for Filing MSME Form I

Companies are not required to file MSME Form 1 if:

- No MSE suppliers exist

- Payment to MSEs is made within 45 days

- Supplier declares in writing that they do not fall under MSE category

It is advisable to obtain a declaration from every supplier confirming their MSME status)

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.