Provision of Presumptive Taxation Scheme in India

Table of Contents

All about the Provision of Presumptive Taxation Scheme in India

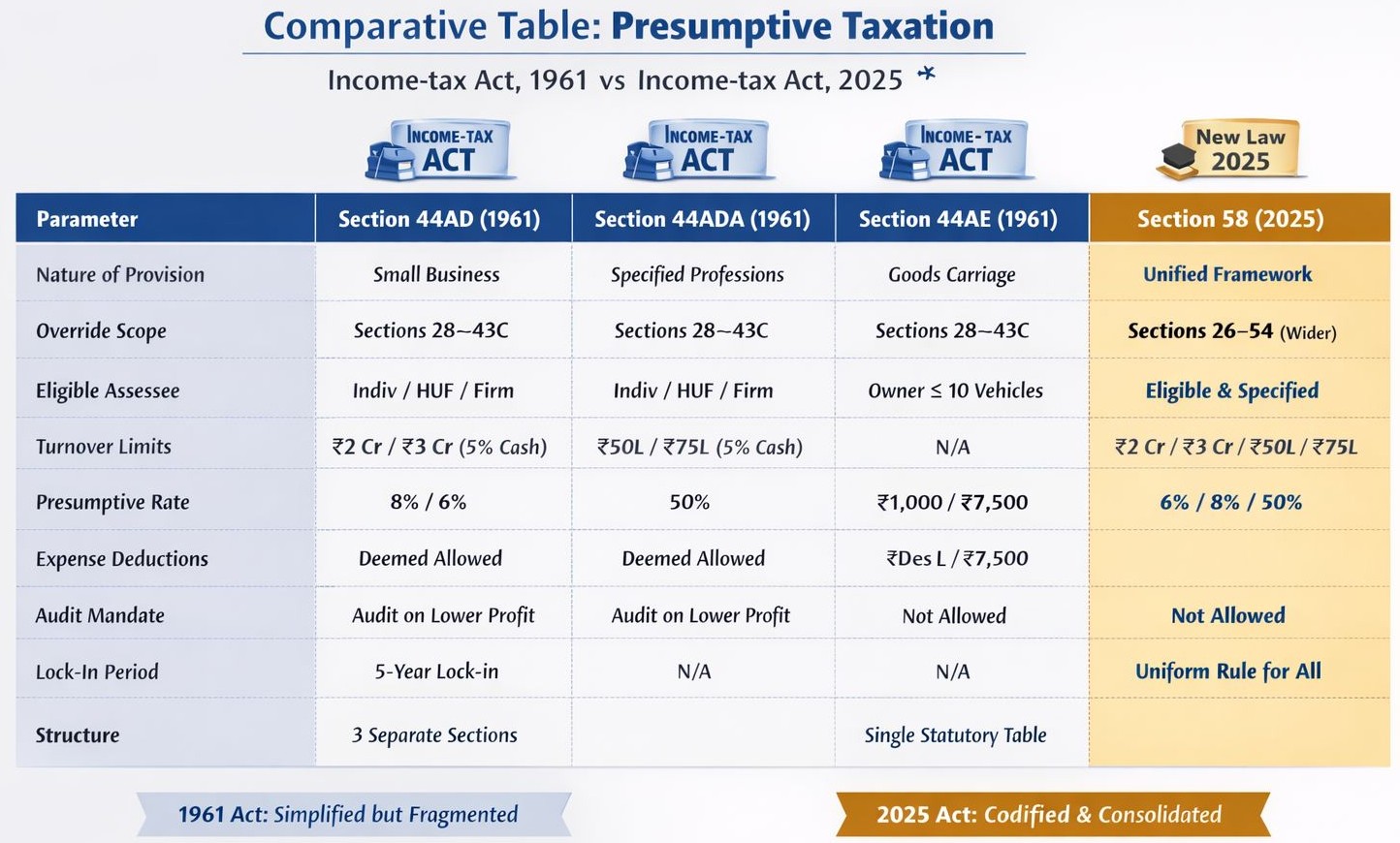

Presumptive taxation allows small taxpayers to declare income at a prescribed rate without the burden of maintaining detailed books of accounts and undergoing audits. This scheme simplifies tax compliance for eligible businesses and professionals under sections 44AD, 44AE, and 44ADA of the Income Tax Act. These scheme enabling them to declare income at a prescribed rate without maintaining detailed books of accounts. However, it is essential to understand the conditions and thresholds under sections 44AD, 44AE, and 44ADA to ensure compliance and avoid penalties.

According to Income tax Small taxpayers can pick presumptive taxation schemes in India :

- Presumptive Income Tax u/s 44AD – For Business Income

- The Presumptive Income Tax u/s 44AE- For Select Businesses

- Presumptive Income Tax u/s 44ADA- For Professional Income

Following Change Come in In the Budget 2023 Updates related to sections 44AD, 44AE & 44ADA

- Section 44AD: Threshold limit increased from Rs. 2 crores to Rs. 3 crores if cash receipts do not exceed 5% of total receipts.

- Sec 44ADA: Threshold limit increased from Rs. 50 lakhs to Rs. 75 lakhs if cash receipts do not exceed 5% of total receipts.

Presumptive Taxation under Section 44AD

- Resident individuals, resident HUFs, resident partnership firms (excluding LLPs) who have not claimed deductions under sections 10A, 10AA, 10B, 10BA, and sections 80HH to 80RRB.

- Eligible Business: Any business except: Businesses covered under Section 44AE. Agency business. Business of commission or brokerage.

- Total turnover or gross receipts not exceeding Rs. 2 crores (increased to Rs. 3 crores as per Budget 2023 if cash receipts do not exceed 5% of total receipts).

- Prescribed Income:

- 6% of total turnover or gross receipts received by account payee cheque/bank draft, ECS through a bank account.

- 8% of total turnover or gross receipts in all other cases.

- Additional Provisions: No other deductions for business expenses. Written down value of assets computed as if depreciation is claimed. Higher income can always be declared. Advance tax payable by March 15th; interest levied for non-compliance.

Presumptive Taxation Under Section 44AE

- Eligible Taxpayer: Any taxpayer owning not more than 10 goods carriages at any time during the tax year (ownership includes goods carriages taken on hire or installment). Eligible Business: Business of plying, hiring, or leasing goods carriages.

- Prescribed Income: Rs. 1,000 per ton per goods carriage for heavy vehicles per month or part thereof. Rs. 7,500 per goods carriage for other vehicles per month or part thereof. Calculation based on the period the goods carriage is owned.

- Additional Provisions: Salary and interest paid to partners deductible if the taxpayer is a partnership firm. Advance tax paid in four installments as per standard provisions.

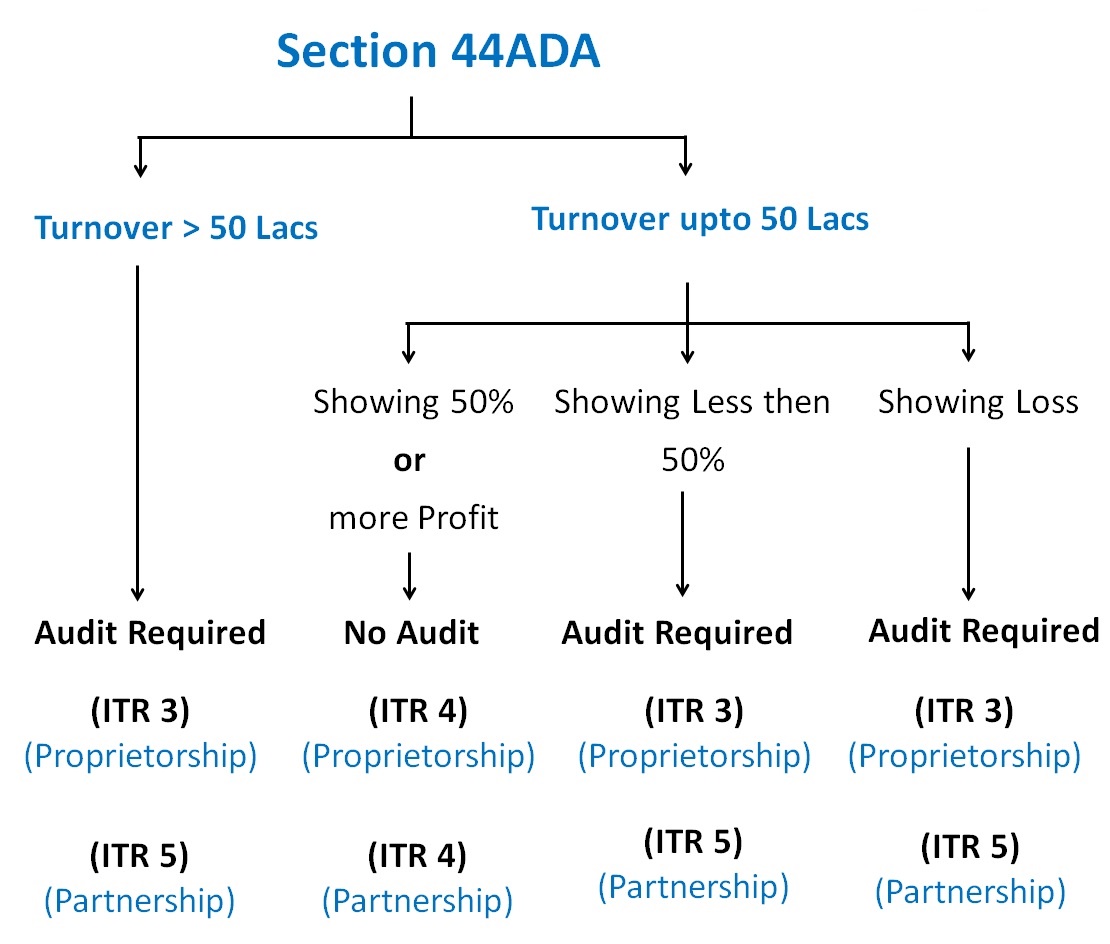

Presumptive Taxation Under Section 44ADA:

- Resident individuals or resident partnership firms (excluding LLPs) engaged in professions such as legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration, or other notified professions.

- Total gross receipts not exceeding Rs. 50 lakhs (increased to Rs. 75 lakhs as per Budget 2023 if cash receipts do not exceed 5% of total receipts).

- Prescribed Income: 50% of total gross receipts.

- Additional Provisions: No other deductions for business expenses. Written down value of assets computed as if depreciation is claimed. Higher income can always be declared. Advance tax payable by March 15th; interest levied for non-compliance.

What is the consequences of claiming lower profit under sections 44AD, 44AE & 44ADA?

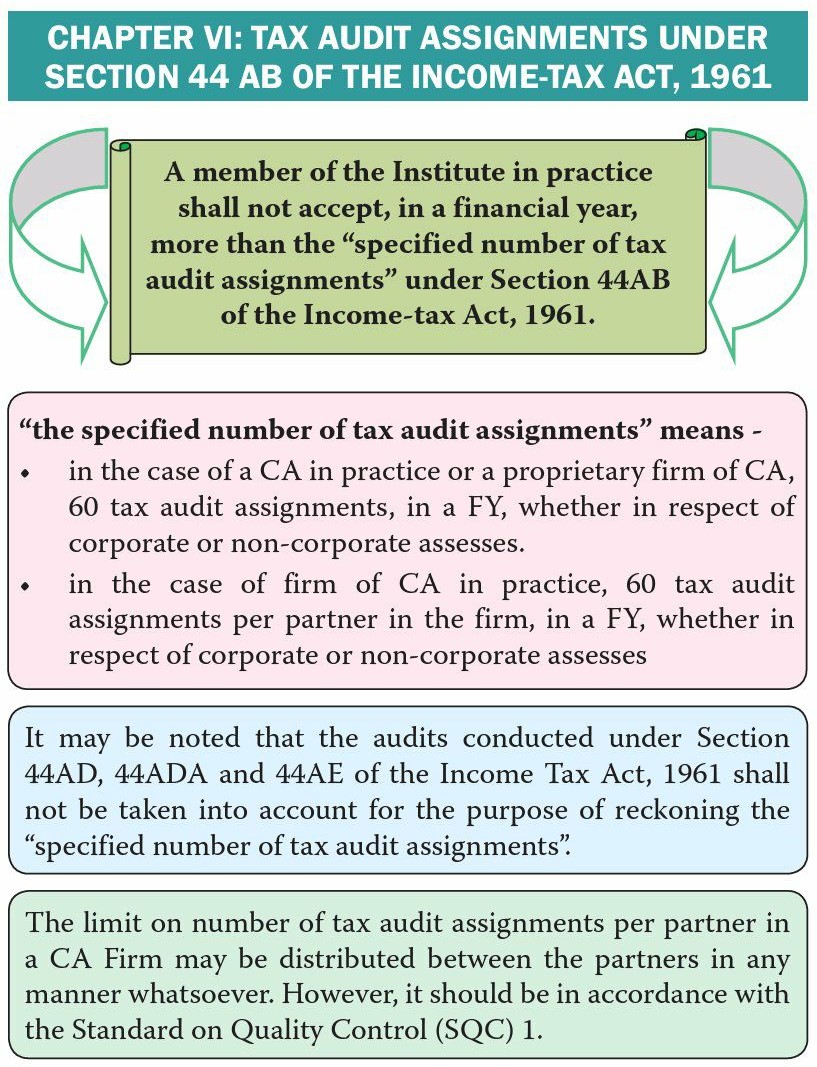

- In case claiming lower profit under Section 44AD: If income is claimed lower than the prescribed rate, regular books of accounts must be maintained and audited if income exceeds the basic exemption limit. Failure to continue with the scheme for 5 years after opting in requires maintaining regular books and audit if the total income exceeds the exemption limit.

- In case of claiming lower profit under Section 44AE & 44ADA: If income is claimed lower than the prescribed rate, regular books of accounts must be maintained and audited if income exceeds the basic exemption limit.

Frequently Asked Questions related to u/s 44AD, 44AE & 44ADA

- Can I opt for benefit under Section 44AE without owning a goods carriage?

No, you must own at least one goods carriage.

- Can I opt for both Section 44AD & 44ADA?

Yes, if you have income from business and specified professions.

- Will I be allowed deductions under Sections 80C and 80D if I opt for presumptive taxation?

Yes, deductions under Sections 80C and 80D are allowed.

- Is it compulsory to opt for Section 44AE if I own 6 goods carriages?

No, it is optional. Opting out requires maintaining books and possibly an audit.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.