Required documents before the start of the Secretarial Audit

Required documents before the start of the Secretarial Audit

Following List of first set of required documents from the client before the start of the Secretarial Audit :-

- Latest Annual Report and Memorandum of Association & Articles of Association.

- Notice of all the Meetings with email Copy send to the Directors of the Company.

- Minutes of the Board Meetings.

- Minutes of the Audit Committee Meetings.

- Minutes of the Stakeholder Relationship Committee.

- Minutes of the Nomination and Remuneration Committee Meetings.

- Minutes of Corporate Social Responsibility Committee.

- Minutes of all other Committee Meetings, if any.

- Minutes of Annual General Meeting as well as Extra Ordinary General Meetings.

- Notice and Minutes of Resolutions passed through postal ballot process.

- Notice and Resolutions passed through circulations.

- All the Statutory Registers.

- Any Disclosure Received from Directors in terms of section 184 of the Companies Act, 2013. (Form MBP 1 of all directors)

- Auditors Consent for Appointment/Re-appointment.

- Letters under section 164(2) read with Rule 14(1) from the Directors(DIR 8)

- Copies of Form CHG 4 (Satisfaction of Charge) and CHG 5(Memorandum of Satisfaction of Charge)

- Correspondence file with the Registrar of Companies and Stock Exchange.

- Correspondence file with the Stock Exchanges.

- Correspondence file with the Directors of the Company.

- Annual General Meeting File if any.

- Details of Complaints received from shareholders (Dividend File)

- Compliance of Clause 16, 17, 20, 35,35B, 41 and 49 of the Listing Agreement.

- Statement of Account of Remuneration paid to the Directors.

- Any Remuneration paid to any relative of Director as per Section 188 of the Companies Act, 2013.

- Statement of Account of Sitting Fees paid to the Directors.

- Statement of Account of Loans and Advances given.

- Statement of Account of Investment made.

- Investments made/ Fixed Assets Purchased are they in Company’s name?

- Statement of Account of Loans and Advances taken, whether secured or unsecured.

- Details of Public Deposit Accepted.

- Details of surety or guarantee provided.

- Details of Amounts transferred to Investor and Education Protection Fund(IEPF).

- Statements of Dividend Reconciliation.

- Any Show Cause Notice received from ROC / Stock Exchanges / SEBI.

- Details of Compliance of Code of Conduct in terms of the Insider Trading Including Closing of Trading windows(Copy of Code of Conduct)

- Details of Compliance of Take Over code in terms of SAST Provisions.

- Whether any Loan or guarantee given to foreign subsidiary or Joint venture company.

- Details of Stock option given to the employees of the Company.

- Details of Stock option Converted into equity shares of the Company.

- Any issue of Capital (Right issue, Preferential Issue, Bonus Issue, IPO/FPO), Details of it.

- List of Other Laws applicable specifically to the Company and Compliance Mechanism of the same.

- Agreement between the Company and Registrar and share Transfer Agent.

- Lastly, The details of Compliance Mechanism of Labour Laws i.e. for examining and reporting whether the adequate systems and processes are in place to monitor and ensure compliance with general laws like Labour laws, Competition law, Environmental laws.

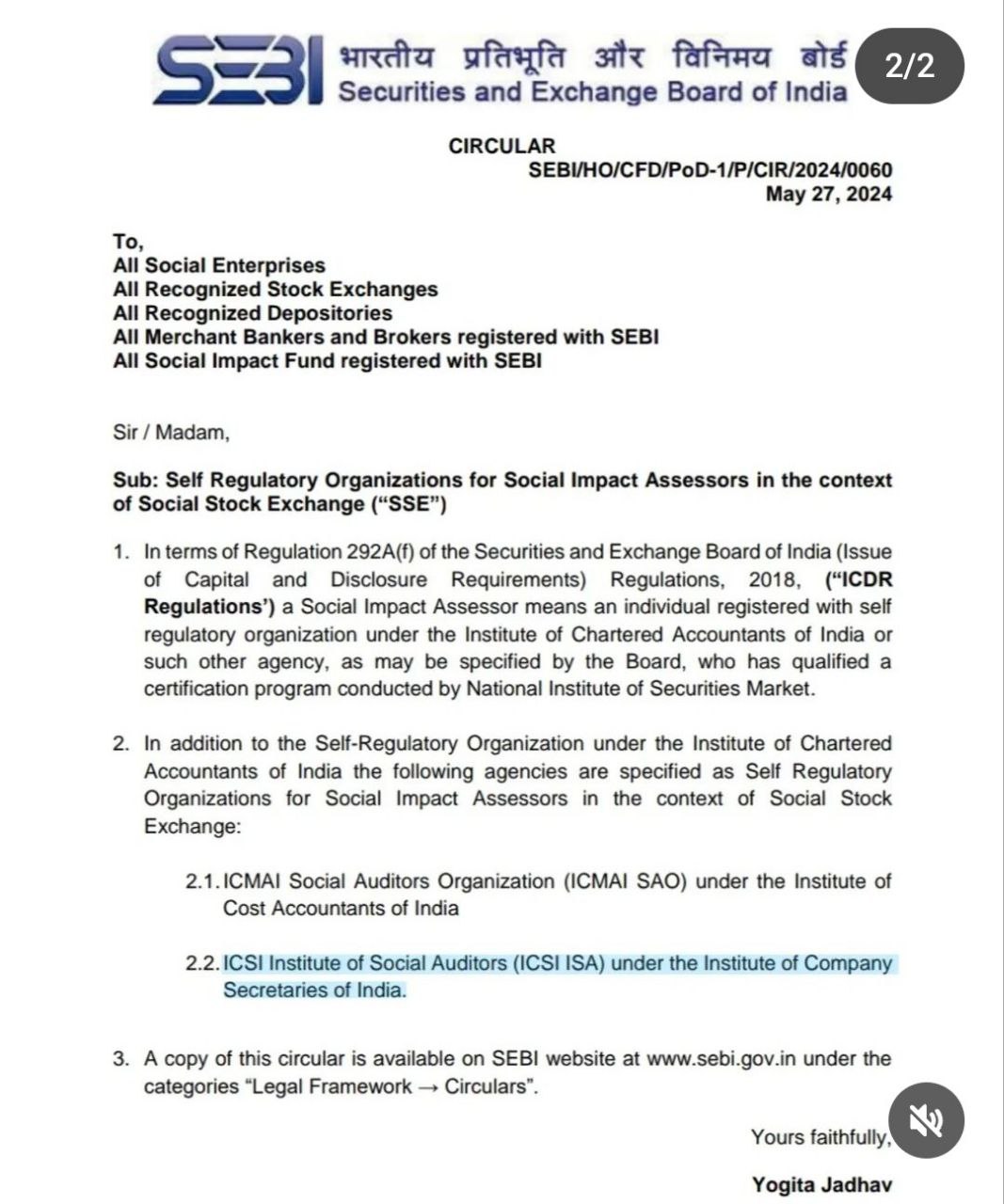

New opportunities in the field of Social Audits

Hope the information will assist you in your Professional endeavors. For query or help, contact: singh@carajput.com or call at 011-43520194.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.