SC Allows NFRA to continue proceeding against CA/Audit firm

Table of Contents

SC Allowing NFRA to continue its proceedings against CAs and audit firms

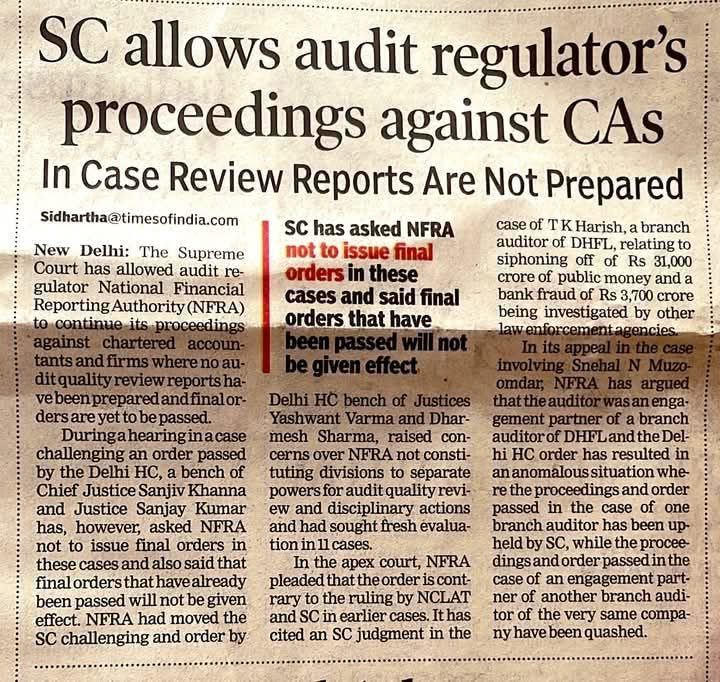

The Honorable Supreme Court’s decision allowing NFRA to continue its proceedings against chartered accountants and audit firms while halting the issuance and enforcement of final orders has significant regulatory and legal implications. Supreme Court (SC) decision allowing the National Financial Reporting Authority (NFRA) to proceed with actions against CAs and audit firms where audit quality review reports have not yet been prepared and final orders are pending. However, the SC has directed NFRA not to issue final orders in these cases and stated that any final orders already passed will not be given effect.

- The Delhi High Court has concerns about NFRA’s structure, particularly its failure to establish divisions to separate audit quality reviews and disciplinary actions.

- A specific case involving Snehal N Muzoomdar, where National Financial Reporting Authority argued that the auditor was engaged with DHFL, and the Delhi HC’s order led to an anomaly in regulatory treatment.

- The involvement of auditors in major financial fraud cases, such as the DHFL case involving the siphoning of INR 31,000 crore and a bank fraud of INR 3,700 crore.

Analysis of Honorable SC Decision on proceedings against CAs & Audit firms

- NFRA’s Authority to Investigate Continues: The ruling allows NFRA to proceed with inquiries and investigations where audit quality review reports have not been prepared, ensuring continued oversight of audit practices.

- Restriction on Final Orders: The SC’s directive not to issue final orders and to suspend the effect of already issued ones ensures that regulatory actions remain under judicial scrutiny.

- Concerns Over NFRA’s Structural Process: The Delhi HC raised concerns regarding National Financial Reporting Authority failure to establish separate divisions for audit quality reviews and disciplinary proceedings. This indicates a need for clearer procedural bifurcation in National Financial Reporting Authority s framework.

- Precedents and Legal Consistency: The NFRA referenced the T K Harish case (DHFL fraud involving ₹31,000 crore siphoning and ₹3,700 crore bank fraud), which was upheld by Honorable Supreme Court’s to argue for uniform treatment of similar cases.

- The Snehal N Muzoomdar case presents an anomaly—while one branch auditor’s proceedings were upheld, those against an engagement partner of another branch auditor were quashed.

Regulatory & Legal Implications on proceedings against CAs & Audit firms

- Strengthening Audit Oversight: The decision reinforces NFRA’s mandate to oversee auditors of large public interest entities, ensuring accountability in financial reporting.

- Judicial Oversight of National Financial Reporting Authority’s Actions: The Honorable Supreme Court’s intervention suggests that while NFRA’s authority is intact, procedural fairness and structural reforms may be required for its actions to be legally sustainable.

- Impact on Chartered Accountants & Firms: Chartered Accountants & audit firms under National Financial Reporting Authority Scrutiny may continue facing inquiries, but immediate enforcement actions remain stalled, providing temporary relief.

- Potential for Future Litigation: Given the inconsistency in past rulings, further legal challenges regarding NFRA’s jurisdiction, procedural fairness, and disciplinary powers are likely.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.