Tax Benefits available to super senior citizen & senior citizen

Table of Contents

Tax Advantage available to super senior citizen & senior citizen.

Who is classify as super senior citizen & senior citizen?

Ans :. Income Tax definition of super senior citizen & senior citizen: Individual resident who is of the age of Sixty years or above, but less than 80 years is a Senior Citizen. An individual resident who is of the age of eighty years or above is a Super Senior Citizen.

What are the Income Tax Basic exemption limits for super senior citizen & senior citizen?

Ans :. Income Tax Basic exemption limits: For Senior Citizens the basic exemption limit is fixed at a figure of INR 3,00,000/-. For Super Senior Citizens, the basic exemption limit is fixed at INR 5,00,000/-.

What are the Advance Tax benefit available for super senior citizen & senior citizen?

Ans :. Advance Tax Advantage: A resident super senior citizen & senior citizen need not pay any advance tax, provided he does not have any income under the head PGBP.

What are the other benefit available for super senior citizen & senior citizen?

Ans :. Following are the Basic Benefit available for super senior citizen & senior citizen:

- Interest income: A super senior citizen & senior citizen can claim a deduction upto INR 50,000/- u/s 8OTTB in respect of savings bank accounts interest income, bank deposits interest income earned, or any deposit interest income with the co-operative banks or post office.

- Advantage of Income Tax u/s 80D: Deduction u/s 80D in respect of payment made for health insurance premium in respect of a super senior citizen & senior citizen has been permissible at INR 50k.

- No needed to submit Income Tax Returns: Below class of Senior Citizens are not required to submit their Income Tax Returns: — Resident Senior Citizens, Seventy five years or above & having only interest income & pension income only from account with a Indian bank in which they receive pension & interest income.

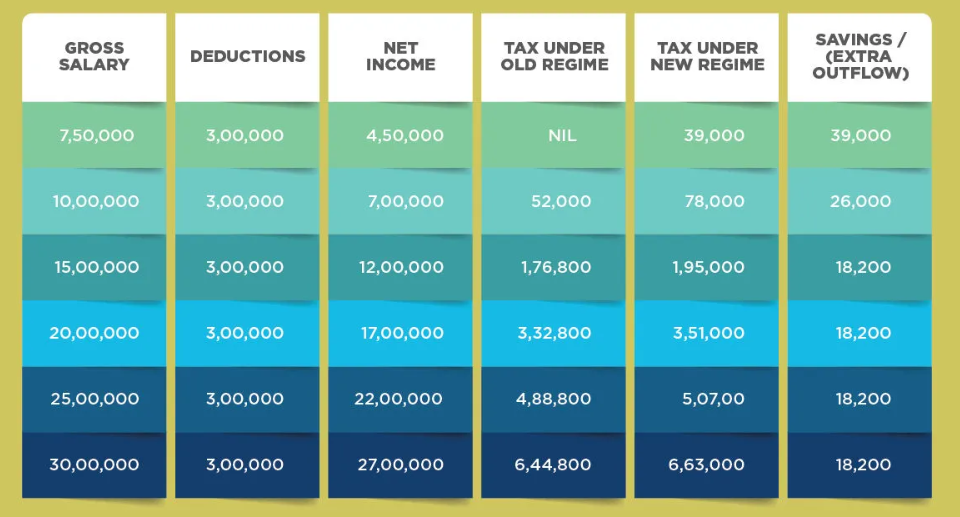

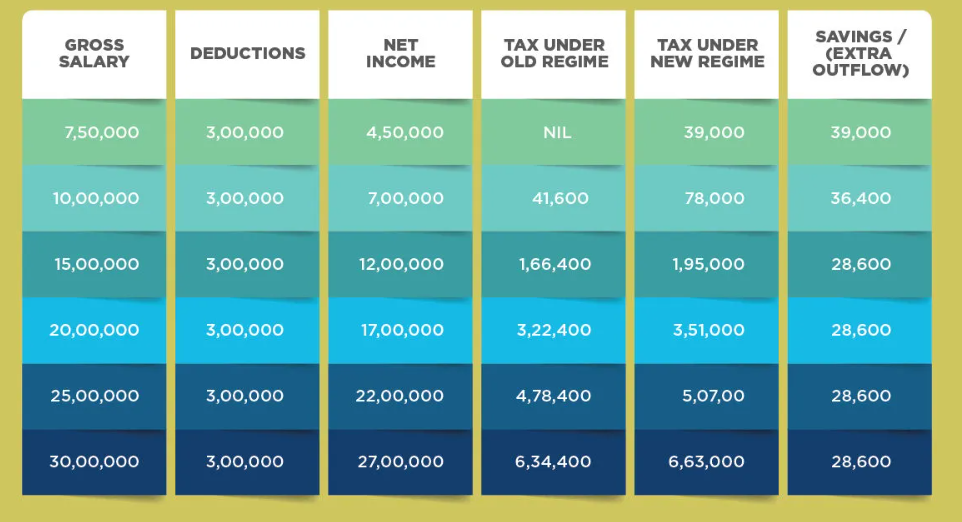

Tax calculated for Senior Citizens:

The Tax calculated for Very Senior Citizens:

- Income Tax Returns: A super senior citizen aged eighty years or above filing his return of income in SUGAM (ITR-4) or Form SAHAJ (ITR-1) & having Gross total income of more than INR 5,00,000/- or having a Income Tax refund claim, can submit ITR in hard copy or paper mode rather than online mode.

- Income Tax Form 15H: A super senior citizen & senior citizen may file Income Tax form no.15H to the deductor for non-deduction of Tax deduction Source on few class of incomes referred to in that section, if the tax on taxpayer estimated total income for the respective year comes at NIL.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.