SWOT Analysis- is tool of self-assessment framework for CFOs

Table of Contents

SWOT Analysis- is tool of self-assessment framework for CFOs

The “SWOT Analysis” focuses on a structured self-assessment framework for CFOs, enabling them to evaluate personal and professional challenges, strengths, weaknesses, opportunities, and threats. Executive Summary & Main part of SWOT analysis:

-

CFOs face challenges including:

- Balancing strategic and operational demands: Managing long-term strategies while ensuring operational efficiency.

- Adapting to technological changes: Navigating digital transformation and technology integration.

- Managing stakeholder expectations: Balancing diverse needs from investors, Boards, teams, and auditors.

- Mitigating financial and regulatory risks: Ensuring compliance amidst evolving regulations.

- The SWOT analysis is proposed as a tool to reflect on these challenges and chart a course for improvement.

- Closing Thoughts : Completing a SWOT analysis sets the stage for professional growth and leadership excellence. The document encourages translating insights into a concrete roadmap aligned with personal aspirations.

Main areas of SWOT analysis

- Strengths: Identifying unique skills, certifications, and advantages. & Assessing feedback from peers and leveraging personal networks.

- Weaknesses: Highlighting areas needing improvement, such as undesirable habits or missed opportunities for growth. Recognizing behaviors that hinder progress.

- Opportunities: Leveraging industry trends, technological advancements, and personal branding. Building strategic relationships and using networks effectively.

- Threats: Evaluating workplace changes, obstacles, and risks posed by neglected relationships or evolving roles. And Identifying key threats that require immediate attention.

Actionable Steps of SWOT analysis

- Prioritize areas of strength and growth.

- Develop actionable goals and plans to address weaknesses.

- Leverage feedback and mentorship to gain insights.

- Regularly track progress and refine strategies.

- Balance efforts to maintain mental well-being and focus on strengths.

Excel Guide for Accountants

Essential Excel Functions for Accounting

| Function | Description | Example |

|---|---|---|

SUM() |

Adds values | =SUM(B2:B10) |

AVERAGE() |

Finds average | =AVERAGE(C2:C10) |

IF() |

Logical test | =IF(D2>10000,"High","Low") |

VLOOKUP() |

Searches for a value | =VLOOKUP(A2,Sheet2!A:B,2,FALSE) |

HLOOKUP() |

Horizontal lookup | =HLOOKUP(A1,Sheet2!A1:D2,2,FALSE) |

INDEX() + MATCH() |

More flexible lookup combo | =INDEX(C2:C10,MATCH(5000,B2:B10,0)) |

TEXT() |

Formats numbers/dates | =TEXT(A2,"dd-mm-yyyy") |

ROUND(), ROUNDUP(), ROUNDDOWN() |

Rounding values | =ROUND(B2,2) |

NOW(), TODAY() |

Inserts current time/date | =TODAY() |

EOMONTH() |

End of month calculation | =EOMONTH(A1,0) |

Excel Tools Accountants Must Know

| Tool | Use |

|---|---|

| Pivot Tables | Summarize large data sets, ideal for ledger analysis, trial balance, etc. |

| Data Validation | Create dropdowns, prevent invalid entries |

| Conditional Formatting | Highlight duplicates, flag overdue payments, aging analysis |

| Filters & Advanced Filters | Slice data quickly, useful for monthly reconciliation |

| Named Ranges | Assign names to cell ranges for clarity in formulas |

| Text to Columns | Split combined data (e.g., Names, Codes) |

| Remove Duplicates | Quickly clean master ledgers and lists |

| Group/Ungroup & Subtotal | Collapse and summarize data |

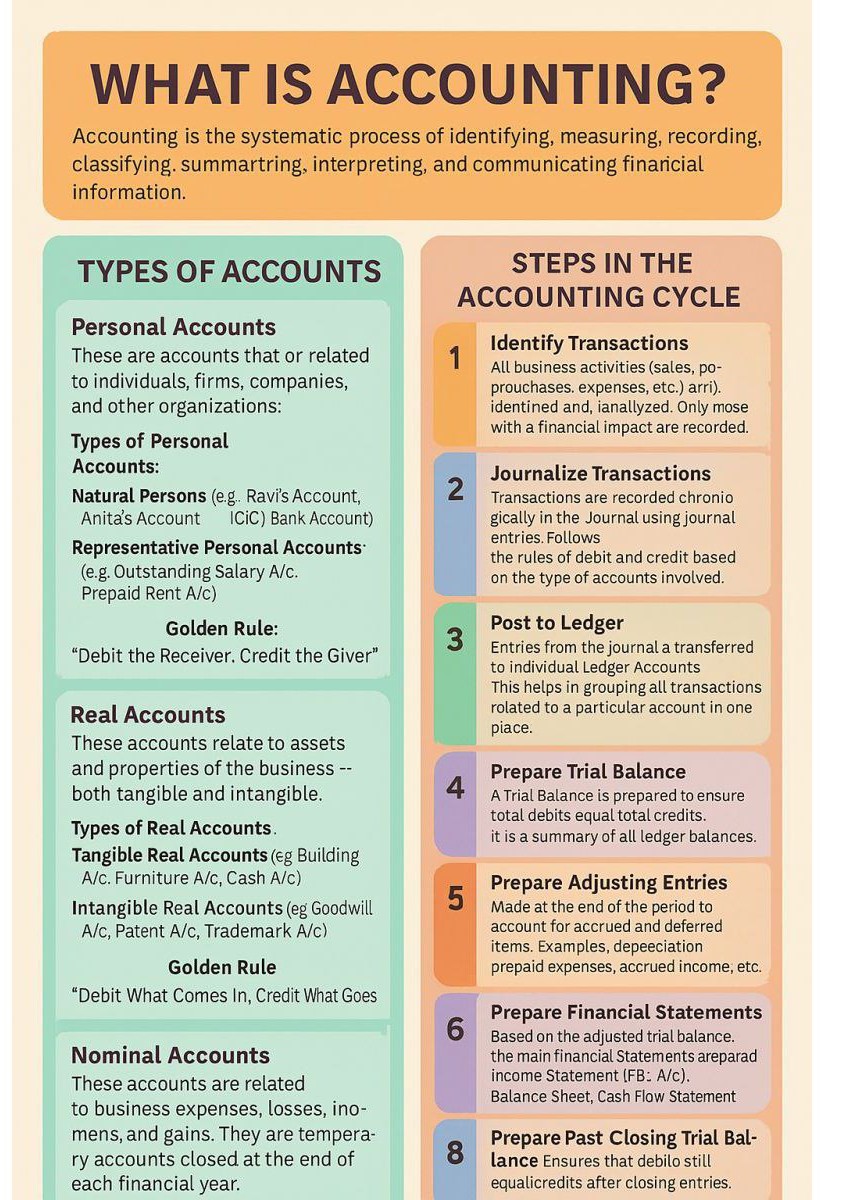

WHAT IS ACCOUNTING?

Financial Modeling & Accounting Templates

-

Cash Flow Statement

-

Profit & Loss (P&L) Account

-

Balance Sheet

-

Budget vs Actual Analysis

-

Bank Reconciliation Statement (BRS)

-

Depreciation Calculator (SLM/WDV)

-

GST Computation Sheet

-

TDS Tracker

IFCCL, emphasizes CFOs’ strategic roles in financial management and technological adoption. His insights are backed by decades of experience across various industries.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.