Basic Tax advantage to Borrowers on taking Personal Loan

Table of Contents

What are the Basic Tax advantage to Borrowers on taking Personal Loan ?

- Over the past ten years, fintech has allowed the present-day financial industry to grow and change in many ways. The process of applying for a loan, having it approved, and receiving the funds in your bank account is simpler and faster than before. Maybe this explains why personal loans are becoming more and more common among self-employed and paid people.

- A large number of people, however, downplay the significance of borrowing’s tax ramifications. In India, personal loans do not provide borrowers with direct tax benefits; nevertheless, there are numerous indirect benefits that can be obtained. A crucial element in ascertaining favourable tax consequences is the utilisation of money acquired via a personal loan.

- Unlike some other types of loans, personal loans do not typically offer specific tax advantages to borrowers in most countries. However, there are a few potential indirect financial benefits to consider. The purpose of this blog is to enumerate crucial elements that borrowers must take into account in order to comprehend the tax effect on personal loans in India.

Interest Deductions

- If you use a personal loan for intended purposes, you may be eligible for tax benefits. In India, you are eligible to claim tax deductions on interest paid under section 24 if you took out a personal loan and utilised the money for the purchase, construction, or repair of your home (b). However, you can only file this claim within the allotted parameters. In case the dwelling property is occupied by the owner, they can claim the total interest paid on the loan up to INR 200,000. Additionally, you ought to be able to provide solid evidence that the funds from the loan amount were used for this kind of expenditure.

- Second, you may deduct the whole loan interest amount from your taxable rental income if you used the personal loan amount for a rental property. This deduction is additionally subject to a cap of two lakhs on the number of losses that can be written off against other income for the year under the residential property category for all properties considered together. Over 2 lakhs in unabsorbed loss can be carried forward for eight years against the income from the residential property.

Loan Purpose

Your personal loan could come with a few tax advantages depending on its intended use in India. The interest paid on the personal loan can be deducted from taxes, even though the original amount of the loan cannot be used to offset any deductions. You can deduct interest from your taxes if you have used the loan money for business expenses and have invested it in your company. The following is a list of additional circumstances in which you can use your personal loan to benefit taxes:

-

- Financing a down payment on home renovations or a home purchase

- Investing the amount in your business

- Purchase of assets such as shares, commercial property, jeweller, or any other commercial endeavour wherein the interest expense increases the cost of acquisition to reduce capital gains tax on the sale.

- Renovating or purchasing or constructing self-occupied property

Reporting Requirements

- If you have taken out and paid back a personal loan, or are in the midst of doing so, there are no prescribed requirements to report that you must disclose when filing your taxes. You must have all the necessary documentation to disclose the borrowing and the use/purpose of the loan funds if you want to receive tax benefits on your personal loan. If you use the loan amount to build a home, you must report it similarly to property taxes; if you use it to finance your business, you must report it similarly to sales tax. If a personal loan is cancelled, the borrower is required to include the information in their tax returns. Here, the discharged debt regulations would be applicable.

Tax Credits

- A personal loan often does not qualify for tax credits or deductions. However, you are eligible for tax benefits on a personal loan if the following categories apply to the loan purpose.

Personal Loan for Business

- The interest paid on a personal loan deducted from taxable net profit is a business expense if the loan amount is invested in your business. The tax-deductible obligations of a business are not restricted by the Income Tax Act in India. This implies that the business’s tax obligations can be decreased by using the whole interest paid on the personal loan.

- Personal loans can take benefit of several advantages from personal loans, such as affordability, ease of use, and quick funding. If you properly document your loan and your loan purpose fits into the desired category, you can receive considerable tax savings on the interest paid, even though they might not be very significant. Remember the things mentioned above, and before taking out a loan, always think about how it will affect your taxes. Furthermore, even though personal loans provide financial freedom, it’s important to use them responsibly and refrain from accruing more debt than you can afford.

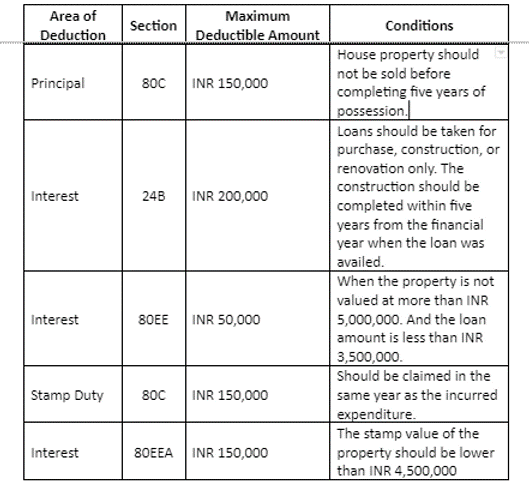

Personal Loan for Construction or Purchase Renovation of Residential House Property

- According to Section 24 of the Income Tax Act of India, a borrower’s net taxable income may be reduced by the interest paid on a personal loan used to buy, build, or renovate residential property. The borrower must provide the required paperwork to support the use of funds in order to accomplish this. Deductions for a self-occupied residential property are allowed up to INR 200,000/-

Personal Loan for Purchasing Assets

- In case borrower is not eligible for tax reduction at the time of purchase if they utilise the money from a personal loan to buy assets like shares, jewellery, or commercial real estate. But, the cost of the purchase may include the interest paid on the personal loan. Moreover, you can deduct interest exp which is paid while selling this asset as capital gains. So you may decrease your taxable profit. Here you may check the tax credits related to this category:

Documentation and Record Keeping

- It should come as no surprise that loans have thorough documentation. Documentation clarifies the goals and expectations of both parties, whether the loan is obtained from a private or bank institution. It provides evidence of the loan amount and offers advantages to both the borrower and the lender. Accounting, taxation, collection, and loan enforcement all require documentation. In order to be eligible for tax benefits on your personal loan, you must finish all the paperwork. Additionally, for the duration of the loan, you should keep all the records and paperwork required to demonstrate the purpose of your loan.

- For people with complicated income and tax situations, it is best to talk with a tax expert. Self-employed people with erratic incomes and several loans are a few examples. It could be challenging to determine your own income and tax liability. You may make sure that your annual tax file and declaration are proper by hiring a qualified tax professional. A qualified tax adviser can also assist you in understanding the tax benefits associated with your loan, if you are not fully aware of them now.

Other Advantage above

- Simplicity: Personal loans are straightforward. You receive a lump sum, and you repay it over a fixed period with a fixed interest rate. This simplicity can make budgeting and financial planning more manageable.

- No Collateral: Personal loans are typically unsecured, meaning you don’t need to put up collateral (such as a house or a car) to secure the loan. This reduces the risk of losing assets in case of default.

- Faster Approval: Personal loans often have a quicker approval process compared to other types of loans, which can be advantageous in situations where you need funds urgently.

- Debt Consolidation: You can use personal loans to consolidate high-interest debts, such as credit card debt. By paying off higher-interest debt with a personal loan, you may effectively reduce the overall interest you pay.

- Credit Score Impact: Successfully repaying a personal loan can positively impact your credit score, which can lead to more favorable terms on future loans or credit.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.