Make Payment of Excise/Service Tax in case of Appeal filing

How to make payment of Excise/ Service Tax in case of Appeal filing

Step-1 : initially we needed to Go to https://cbic-gst.gov.in/index.html

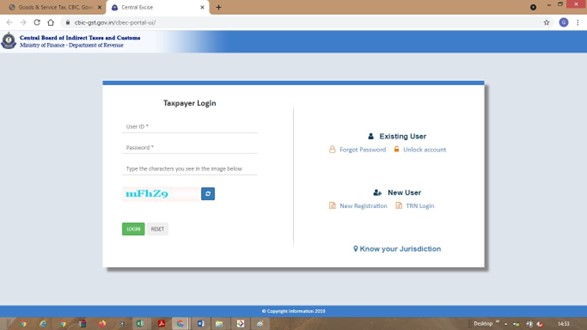

Step-2 : Click on ACES( CE&ST)——– à ACES( CE&ST)Login

Step-3 : Enter old credentials of Service Tax/ Excise for Login

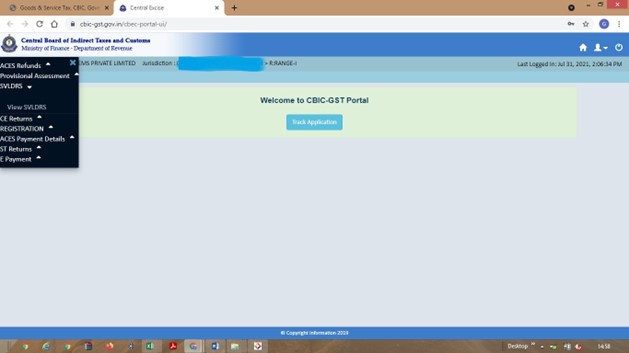

Step 4 : Go to E payment option in Menu Tab

Step-5: Click on generate Challan

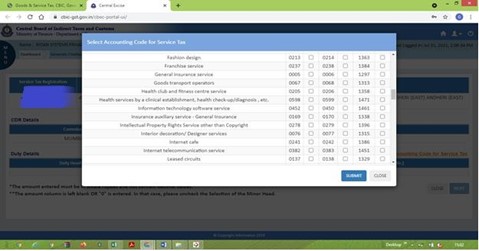

Step-6: Select relevant accounting codes under which payment is required to be made

Step 7: Input amount to be paid and then click on generate challan

Step-8 : Challan Generated successfully message will displayed on screen

Step-9 : Click on Make payment and input relevant details such as STN, Type of Duty, Jurisdiction code,

Step-10: Once all details are submitted, National Electronic Funds Transfer (NEFT) mandate form is generated

Step-11 : Make National Electronic Funds Transfer (NEFT) with Nationalized Bank

Step-12: CIN will be generated after 1 day which can be seen from challan status in Menu Tab

Step-13: Take relevant screen shot for the purpose appeal submission

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.